Need help finding what you are looking for?

Contact Us

PUBLISHER: TrendForce | PRODUCT CODE: 1850613

PUBLISHER: TrendForce | PRODUCT CODE: 1850613

2026 NAND Flash: AI & HDD Shortage Ignite Price Surge

PUBLISHED:

PAGES: 6 Pages

DELIVERY TIME: 1-2 business days

SELECT AN OPTION

'2026 NAND Flash: AI' drives explosive enterprise SSD demand, offsetting weak consumer markets. HDD shortages compel a shift to high-capacity QLC SSDs. Despite bit growth, supply for these remains structurally tight, ensuring sustained price increases and a significant market pivot.

Key Highlights:

- Weak Consumer Demand: Global economic headwinds and inflation limit consumer electronics upgrades, offering minimal NAND Flash growth.

- Explosive Enterprise Demand: AI's rapid advancement fuels surging data center computing and storage needs, becoming the primary NAND Flash driver.

- Severe HDD Supply Shortage: Nearline HDD supply critically lags demand, with extended lead times creating a substantial storage gap.

- Enterprise SSDs as Replacement: Data centers and CSPs are compelled to adopt high-capacity QLC enterprise SSDs to substitute for HDDs.

- Structural Supply Tightness: NAND Flash capacity expansion is limited; while process upgrades boost bit output, high-capacity SSDs face yield and validation challenges, constraining supply.

- Undersupplied Market Outlook: Overall, 2026 NAND Flash faces undersupply, ensuring sustained price increases and marking a significant structural industry transformation.

SAMPLE VIEW

Product Code: TRi-0094

Table of Contents

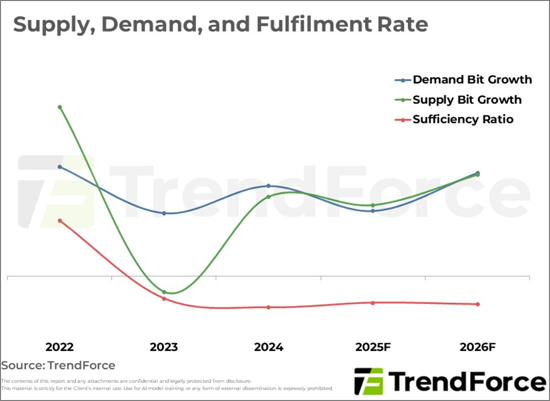

- 1. Supply-Demand Dynamics and Structural Pricing Challenges in the NAND Flash Market in 2026

- 2. Server Storage Breakdown

- 3. Supply-Side Analysis: NAND Flash Bit Growth Will Be Modest in 2026 as Suppliers Limit Capacity Expansions and Instead Concentrate on Process Upgrades

- 4. NAND Flash Suppliers' Respective Supply Bit Growth Rates

- 5. Supercycle Introduced for NAND Flash Industry as Shortages Related to AI and Storage Actuate Explosive Growth in Demand

- 6. Supply, Demand, and Fulfilment Rate

- 7. Prices to Continue Rising in 2026 under Short Supply

- 8. Quarterly Blended Prices for 2026

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.