Need help finding what you are looking for?

Contact Us

PUBLISHER: TrendForce | PRODUCT CODE: 1873714

PUBLISHER: TrendForce | PRODUCT CODE: 1873714

DDR5 Supply Shortfall Drives Prices Higher; 2026 Profits Will Surpass HBM3e

PUBLISHED:

PAGES: 5 Pages

DELIVERY TIME: 1-2 business days

SELECT AN OPTION

Tariffs and policy changes kept early demand cautious, but cloud expansion and AI investment have lifted memory demand and pricing, tightening DRAM supply. The DDR5 uptrend is established, with profitability likely to surpass HBM3e; vendors' capacity allocation and pricing strategies will reshape the market landscape.

Sample preview

Key Highlights:

- Early on, tariffs and policy shifts prompted buyers to pull in orders while end demand stayed cautious; as cloud expansion and AI investment accelerated, memory demand strengthened, supply tightened, and DRAM pricing moved higher.

- Server shipments and per-system memory density are rising in tandem, driving significant bit-demand growth and extending the supply-demand gap across calendar years.

- Recent contract price increases have been markedly revised upward, with some products facing acute shortages and outsized price gains.

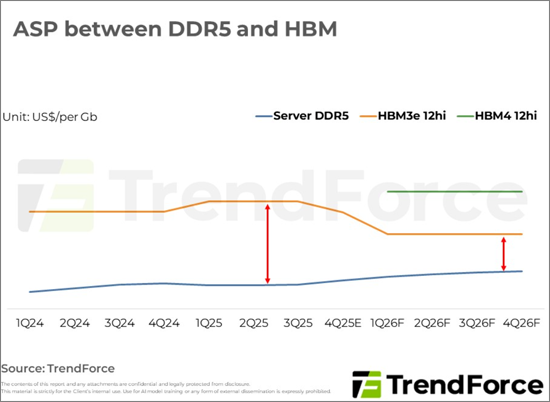

- DDR5's rally is continuing with strengthening profit momentum; HBM3e is weakening under competitive dynamics and inventory pressure, narrowing the price gap. DDR5 profitability is poised to overtake, prompting adjustments in capacity allocation and pricing strategies.

Product Code: TRi-0097

Table of Contents

1. Due to CSPs' Strong Pull-In Momentum, Server DRAM Demand Is Expected to Grow by Over 20% in 2026, Thus Reinforcing Shortage

- Projected DRAM Contract Prices for 4Q25 (Before and After Update)

2. Price Hike for DDR5 Established at US$0.65/Gb; Profitability to Surpass HBM3e in 2026

- ASP between DDR5 and HBM

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.