Need help finding what you are looking for?

Contact Us

PUBLISHER: TrendForce | PRODUCT CODE: 1873720

PUBLISHER: TrendForce | PRODUCT CODE: 1873720

Server DRAM Price Surge: Long-Term Strategy & Capacity Race - From Q4 2025

PUBLISHED:

PAGES: 6 Pages

DELIVERY TIME: 1-2 business days

SELECT AN OPTION

Server DRAM prices are projected to surge due driven by tight supply and robust cloud service provider demand. To secure supply, clients are aggressively negotiating long-term agreements, incentivizing manufacturers to expand capacity. Manufacturers are shifting production focus to high-margin DDR5. Market anticipates persistent undersupply, with substantial new capacity taking years to come online, while process upgrades accelerate short-term. PC DRAM also rises, but less significantly.

Sample preview

Key Highlights:

- Significant Server DRAM Price Increases:

- Strong cloud service provider demand and tight manufacturer supply are driving a substantial increase in server DRAM prices, significantly surpassing PC DRAM.

- Manufacturers' limited ability to meet customer needs contributes to continuous price escalation.

- Long-Term Supply Agreements:

- Cloud service providers are actively negotiating long-term purchasing agreements extending into future years to secure supply and incentivize manufacturers to expand capacity investment.

- Client acceptance of price hikes reflects confidence in cloud service opportunities and willingness to stimulate manufacturer expansion.

- Manufacturer Strategic Shift:

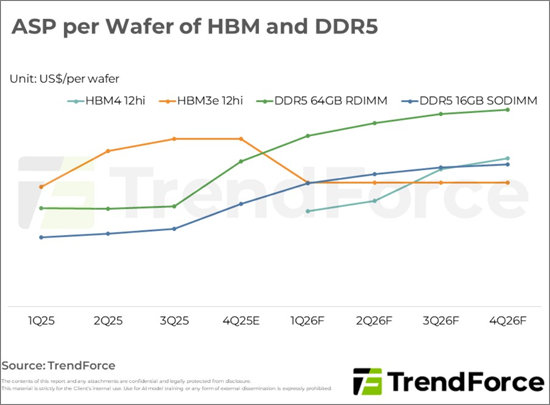

- To boost profitability, manufacturers are shifting production focus towards high-value DDR5 products, with their average selling price per wafer projected to exceed HBM.

- Some manufacturers have begun reallocating capacity from HBM to DDR5.

- Capacity Expansion Challenges:

- New cleanroom construction requires several years for large-scale production, creating a supply bottleneck.

- In the short term, manufacturers will accelerate process upgrades or slightly advance cleanroom construction to boost bit supply growth.

- Market Outlook:

- Data center investment visibility remains high, with increasing server shipments and DRAM content per server.

- The overall market is expected to remain seller-dominated with persistent undersupply.

Product Code: TRi-0103

Table of Contents

1. Formal Quotes for Server DRAM Contracts Emerge, and Significant Increases in Projected QoQ Hikes for Transaction Prices Encourage Suppliers to Expand Production

2. Following Samsung's Aggressive Quotes, 4Q25 Server DRAM Contract Negotiations Will Conclude; Latest Revised Projection Puts Server DRAM's Price Hike at 43-48%, Greatly Surpassing PC DRAM's Price Hike

- Projected QoQ Changes in Server DRAM and PC DRAM Prices

3. Suppliers Now Prioritizing on Expansions as Negotiations for Demand of CSPs Extended to 2027

4. Value of Wafers Set as Pricing Anchor for Suppliers' Products under Restricted Capacity

- ASP per Wafer of HBM and DDR5

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.