PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1323309

PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1323309

Managed Print Services for Label Printing

INSIDE THIS REPORT:

VDC's ‘Managed Print Services for Label Printing report’ seeks to better understand the opportunity for outsourcing management and replenishment of label media and supplies, along with label printer hardware procurement, management, and servicing to third-party service partners with an aim to lower overall costs of investment and operation, along with fleet optimization. VDC's definition of managed print services (MPS) includes management of printers, consumables (including ink, printhead, ribbons), and related media (including paper and label stock) through external service providers, to improve organizations' printing environments. The provider also tracks usage statistics and permissions to ensure minimal downtime and offers periodic updates/upgrades to the printer hardware and software.

In support of this research study, VDC interviewed label printer hardware OEMs and their channel partner organizations to assess the potential for MPS solutions in the label printing market. In addition, VDC fielded a survey among North American label printing technology investment decision makers to understand their support challenges with their label printer fleets and opportunity for MPS solutions.

WHAT QUESTIONS ARE ADDRESSED?

- What are the primary capabilities of MPS offerings for label printing solutions?

- Which labeling hardware vendors are leading the MPS conversation?

- What are the leading adoption barriers for MPS solutions for label printing?

- Who are the leading channel providers offering labeling-specific MPS solutions?

- What are the similarities between office printing and label printing MPS solutions and is there an opportunity for established office printing MPS solution providers to expand their capabilities into label printing?

- What are the technological shifts to printer architecture that are most impacting the opportunity for MPS for label printing?

- Which organizations will be the most successful in positioning MPS offerings within the labeling market?

WHO SHOULD READ THIS REPORT?

VDC has designed this research program for senior decision-makers at organizations developing and selling label printing infrastructure as well as their partners and customers, including those individuals with the following roles:

- CEO and other C-level positions

- Corporate development and M&A

- Marketing

- Business development and sales

- Product development, management, and strategy

- Channel development, management, and strategy

VENDORS LISTED IN THIS REPORT:

|

|

EXECUTIVE SUMMARY:

Label printing solutions are critical to business operations. There are inherent challenges to companies looking to improve print efficiencies, minimize downtime, and reduce paper waste. Without proper oversight and management, businesses often don't recognize the need for consumables replenishment until it is too late, resulting in decreased efficiency. Companies need to use critical resources and time to maintain their print fleet. Maximizing uptime and minimizing downtime and consequent workflow disruptions can offer massive benefits. This makes it critical for organizations to shift from traditional reactionary approaches to managing their label printing fleets to one that's more proactive and provides a dashboard to indicate printer hardware performance metrics, downtime alerts, and labeling analytics; usage statistics for automatic replenishment of label printer consumables and supplies; and alerts to update security certificates and firmware, among others. A centralized approach to label printer fleet management could improve print security and reduce paper waste. In-depth analytics and visibility are critical to lowering operational downtime.

To address print management-related issues, several businesses look to one solution: managed print services (MPS). The concept of MPS stems from businesses looking to exercise control over the printer management function, offloading management responsibilities to dedicated third-parties. It offers solutions to track printing data so that businesses can ensure they never run out of stock and maximize efficiency by automating the entire printing process and offloading related operational challenges to streamline label printing. While the details of each MPS offering may vary by business and solution provider, it has been well-established that MPS offers benefits for all organizations looking to reduce paper waste and improve label printing operational efficiency. Managed print services-related investments have been integral to office environments for several years. Some of the early entrants developing this segment were companies like HP, Lexmark, and Xerox, who achieved significant success by helping their customers tackle escalating print costs while also enhancing business efficiency. Since then, many of the largest office printing hardware and supplies vendors in the market have developed MPS solutions, including Brother, Canon, and Ricoh. Some of these vendors - such as Brother - also offer thermal label printers in addition to their office printers and are evaluating the potential of extending their MPS solutions to also support label printers more commonly used in industrial supply chain environments.

MPS offers the support needed to optimize printer usage and management, and to enhance operational productivity. VDC defines managed print services (MPS) for labeling as the management of label printer hardware, consumables (including printhead, ribbons, and other accessories), and related media (like paper and label stock) through external service providers, to improve organizations' label printing workflows. The service provider tracks usage statistics and permissions to ensure minimal downtime and operational disruption, while also offering periodic updates and upgrades to the labeling hardware and software. With all the benefits that office printing MPS offers businesses, it would stand to reason that label printing solutions could benefit similarly. In addition, label printers being sold/adopted today are more "intelligent" and are designed to be networked and managed remotely. However, MPS has barely taken off in the label printing market. VDC's survey shows that the significant investments required for building new platforms, designing services, and developing recurring billing processes are a barrier to MPS adoption. In addition, label printing consumables investments tends to be highly decentralized and locally by the BU, further complicating commercialization. However, with many organizations upgrading their printer fleets to adopt more modern printers capable of being managed remotely, the door is potentially opening to introduce MPS solutions.

KEY FINDINGS:

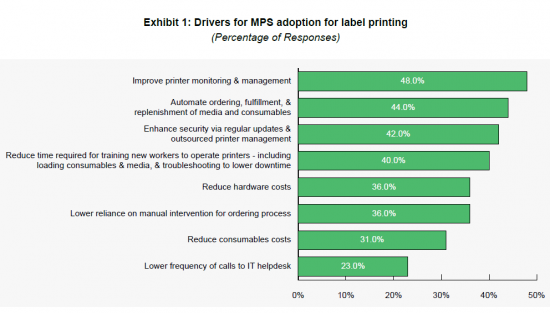

Drivers for MPS adoption - Survey respondents indicated the following as the leading drivers for MPS adoption - improve printer monitoring and management (55%); automate ordering, fulfillment, and replenishment of media and consumables (50%); and, enhanced security via regular updates and outsourced printer management (49%). As costs associated with on-site service and reactive maintenance increase, VDC expects to see investments in IoT hardware that will help minimize costly downtimes through proactive monitoring and management, and realtime insights into usage statistics. Channel organizations will also offer more such services because of larger deal sizes, in addition to the possibility to generate consistent recurring revenues.

Barriers to MPS adoption - Survey respondents indicated the following as the leading barriers to MPS adoption - significant investments required for building new platforms, designing services, and developing recurring billing processes (39%); requires significant upgrades to existing infrastructure (38%); and budget constraints (34%). Costs associated with MPS program implementation are especially concerning for businesses. Low labeling volumes can also be an investment deterrent. However, VDC expects vendors and partners to increasingly communicate how the benefits outweigh the costs with real-world examples, thereby highlighting the viability of investments in such programs.

Ongoing digitization and migration to cloud-enabled printing will positively impact MPS investments - 7 out of 10 organizations expect to be able to remotely manage at least some of their label printer hardware in three years' time. VDC predicts that this will lead to a rise in demand for 3rd-party device management and support services, like SOTI Connect, which will enable remote monitoring and management, and offer usage statistics and detailed analytics. Such investments will enable organizations to seamlessly manage their multibranded device infrastructure, including for label printers.

Variations in vendors' approach to MPS opportunity - VDC expects to see different go-to-market strategies being adopted by MPS market participants. For instance, while Zebra has chosen to enter this space primarily through its partner network by enabling them to optimize the use of Link-OS and Print DNA, Toshiba TEC will adopt a direct-to-customer model and leverage its cloud-based Encompass Managed Print as a Service (MPaaS) subscription program. That said, several label printer hardware vendors are also taking a waitand- see approach to MPS investments. Some measure of financial success - including pace of new printer adoption, increased share of consumables and media as a part of overall sales - will likely encourage others to participate. All printer OEMs, however, are keenly interested in harnessing printer use data to better understand use characteristics and demand patterns and are looking at MPS as a potential opportunity to collect that data.

Security concerns continue to limit adoption; however, awareness levels are increasing - Zero-trust security is a critical consideration for organizations looking to invest in MPS programs. Device integration, management, and remote authentication are now standard requirements laid out by corporates. This makes setting up of enterprise-wide security permissions and controlled access to labeling data strategic measures for data protection. For instance, Zebra's partner, EO Johnson, eases its customers' security configuration by pushing security updates and launching diagnostic processes as required. VDC's research shows that 60% of respondents consider enhanced security through encrypted connections and access control to be the leading advantage to investing in label printing hardware that can be remotely managed and monitored.

Accelerated hardware refreshes a distinct possibility - With the label printing market being relatively mature, large greenfield opportunities are hard to come by. VDC believes that MPS gives vendors and their solution partners the opportunity to encourage its customer network to accelerate the pace at which they replace older printers, particularly those that have limited remote management capabilities, if at all. Awareness around MPS solutions is increasing, which can give label printer solution providers an edge when customizing their MPS program for customers. While the printer hardware sale has historically been purely transactional (and continues to be so for a majority of customers), the creation of highly customizable investment options that can be tweaked based on any organization's unique labeling requirements will become more appealing as tangible benefits are identified. As organizations invest to upgrade their printers to the more modern, secure devices available, there is a growing opportunity to introduce MPS.

ABOUT THE AUTHORS:

Richa Gupta

Richa is a Consultant working for VDC's AutoID & Data Capture practice. She has been tracking the markets for a range of AIDC technologies at VDC since 2010, including, but not limited to, barcode scanners and printers, labeling solutions, machine vision solutions, and robotics automation. Over the years, she has undertaken market opportunity sizing and forecasting, competitive landscape analysis, and offered strategic marketing assistance, while also providing valuable thought leadership for this technology segment. Richa holds a degree in Computer Engineering and an MBA from India.

David Krebs

David has more than ten years experience covering the markets for enterprise and government mobility solutions, wireless data communication technologies and automatic data-capture research and consulting. David focuses on identifying the key drivers and enablers in the adoption of mobile and wireless solutions among mobile workers in the extended enterprise. David's consulting and strategic advisory experience is far reaching and includes technology and market opportunity assessments, technology penetration and adoption enablers, partner profiling and development, new product development and M&A due diligence support. David has extensive primary market research management and execution experience to support market sizing and forecasting, total cost of ownership (TCO), comparative product performance evaluation, competitive benchmarking and end user requirements analysis. David is a graduate of Boston University (BSBA).

Table of Contents

Executive Summary

- Key Findings

Managed Print Services Research Overview

- Creating a circular economy through MPS investments

- Alleviating security-related concerns with MPS for labeling

MPS Route-to-Market

MPS Profiles

- Distribution Management

- Honeywell

- Lowry Solutions

- Ricoh

- Scantron Technology Solutions

- Toshiba TEC

- Zebra Technologies

Select Printer Management Solutions

- ECI Software Solutions

- EO Johnson

- SOTI

About VDC Research

Report Exhibits

- Exhibit 1: Drivers for MPS adoption for label printing

- Exhibit 2: Frequency of operational disruption due to label printer-related issues

- Exhibit 3: Organization's approach to MPS adoption and investments for office printing

- Exhibit 4: Spend on label printing-related services and hardware equipment

- Exhibit 5: What should be included in the MPS dashboard for label printing

- Exhibit 6: Top 3 reasons for label printer fail rates

- Exhibit 7: Primary method of replenishing labeling supplies

- Exhibit 8: Organization's philosophy around MPS investments for labeling

- Exhibit 9: Advantages to investing in label printer hardware that can be remotely managed and monitored

- Exhibit 10: Barriers to MPS adoption for label printing

- Exhibit 11: Primary security components of organizations' current or planned MPS solution investments for label printing

- Exhibit 12: Frequency of support tickets raised for each label printer per month

- Exhibit 13: Organization's current/planned approach to MPS adoption and investments for office printing

- Exhibit 14: Primary consideration for MPS investments for label printing