PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1575711

PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1575711

Validation, Prototyping & XiL Solutions for Virtual ECUs

Inside this Report:

The automotive industry is undergoing an unprecedented shift toward the software-defined vehicle (SDV) concept that is fundamentally changing the design, validation, production, and support of the vehicle through its lifecycle. This report defines and examines the market for virtual electronic control units (vECUs), and development tools, quantifying, and qualifying market dynamics through an in-depth discussion of recent events, engineering trends, and vendor strategies. As part of VDC's continued efforts to engage with the technology markets we research, this report includes end user insights from VDC's "Voice of the Engineer" survey.

INFOGRAPHICS

What Questions are Addressed?

- Global revenue for automotive validation, prototyping, & XiL solutions will grow with a double-digit CAGR from 2023 through 2028.

- How will vendors adapt to the virtualization of hardware, including ECUs and silicon (vMCU, vGPU and vSoC)?

- What barriers are challenging more widespread use of vECUs?

- Which areas of vECU development will experience the most growth?

- Who are the leading suppliers in the industry, and what initiatives are they taking to ensure their future as the industry pivots to the software-defined vehicle?

- What are the regional differences in vECU development?

Who Should Read this Report?

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Organizations Listed in this Report:

|

|

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Global Market Overview

- Recent Market Developments

- Where do Virtual ECUs Fit in the Transition to the SDV?

- How can a Virtual ECU Help Navigate the Transition to the SDV?

- Virtual ECU Abstraction Layers

- Automotive Software Factory and Virtual ECUs

- Virtual ECUs and SBOM Management

- Hurdles to vECU Adoption

- Standards and Regulations

Comparative Forecasts by Region

- Americas

- Government Initiatives Drive Domestic Semiconductor, Software, and Hardware Development

- Europe, Middle East, Africa (EMEA)

- Automaker Direct Sourcing of Semiconductors Fuels Growth

- Asia-Pacific (APAC)

- Chinese OEMs Rapid Vehicle Development Timelines Spur Demand

Vendor Landscape

- Automotive Tool Vendors are Key to Enabling Virtual ECU Solutions

Vendor Profiles

- EDA/Simulation Vendors

- Automotive Tool Suppliers

- Silicon Providers

End User Insights

- Key Decision Characteristics for Selecting Virtual Prototyping Solutions

- Virtual Prototyping Driven by E/E System Software Tasks

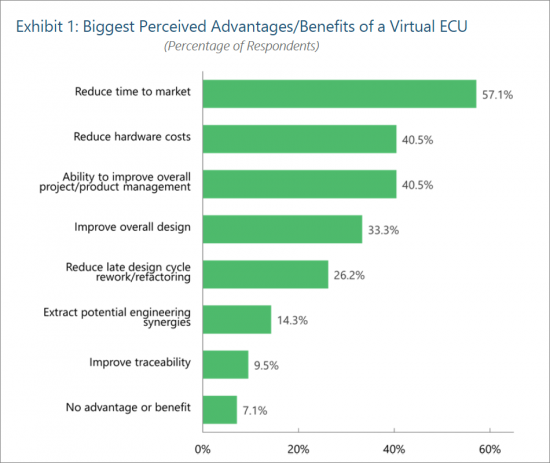

- Reducing Time to Market Drives Virtual ECU Adoption

- The Transition to SDVs is Building Virtual ECU Consideration

About the Authors

About VDC Research

List of Exhibits

- Exhibit 1: Global Revenue of Automotive Validation, Prototyping, & XiL Solutions Exhibit 2: Consideration of Key Trends: Software-defined Functionality

- Exhibit 3: Biggest Obstacle to the Development and Growth of the Connected/Software-Defined Vehicle Industry Exhibit 4: Global Revenue by Level of ECU Virtualization

- Exhibit 5: Global Revenue of Validation, Prototyping, & XiL Solutions by Geographic Region 2023 to 2028 Exhibit 6: Revenue of Automotive Validation, Prototyping, & XiL Solutions, Americas

- Exhibit 7: Revenue of Automotive Validation, Prototyping, & XiL Solutions, EMEA Exhibit 8: Revenue of Automotive Validation, Prototyping, & XiL Solutions, APAC

- Exhibit 9: Validation, Prototyping, & XiL Solution Market, Segmented by Leading Vendor Exhibit 10 Global Revenue of Validation, Prototyping, & XiL Solutions by Vendor Type

- Exhibit 11: Community/Tool Type Perceived to be the Most Successful in Enabling/Facilitating Virtual ECU Solutions Exhibit 12: Most Important Characteristics When Selecting Virtual Prototyping Solution

- Exhibit 13: Type of Tasks in Which Virtual Prototyping Solutions are Used Exhibit 14: Biggest Perceived Advantages/Benefits of a Virtual ECU

- Exhibit 15: Current Use or Consideration of Virtual ECUs