PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1872362

PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1872362

2025 Handheld Barcode Scanner Market Report

Inside this Report

This report continues VDC's analysis of the key strategic issues, trends and drivers for handheld barcode scanners, including 2D imagers, linear imagers (CCD scanners) and laser scanners. The research presents multiple market analyses: 2024 through 2029 by geographies, imaging/scanning technologies, industries, channels and more, with detailed five-year forecasts. Our analyst research and commentary address global and regional market forces, technology trends, growth opportunities and in-depth intelligence on leading vendors of handheld barcode scanners.

What Questions are Addressed?

- After turbulent years for the scanner market, what do we expect going forward, and why?

- What are the product portfolios and strategies of the leading vendors?

- How will handheld scanner vendors respond to data capture requirements beyond line-of-sight barcode scanning and leverage advances in AI and image processing to differentiate their solutions?

- How do Incumbent vendors respond to competition from low-cost/entry class solutions?

- How will traditional vertical markets and geographical regions perform in the near- and long-term for handheld barcode offerings?

Who Should Read this Report?

This annual research has been carefully designed for senior managers and executives at barcode technology and solution provider companies, especially individuals in the following roles:

- CEOs and supporting C-level management

- Corporate development and M&A professionals

- Product Management and Marketing professionals

- Strategic Directors and Marketing Communications managers

- Business development and sales

- Channel developers and managers

- Senior management of leading retailers

Organizations Listed in this Report:

|

|

|

Executive Summary

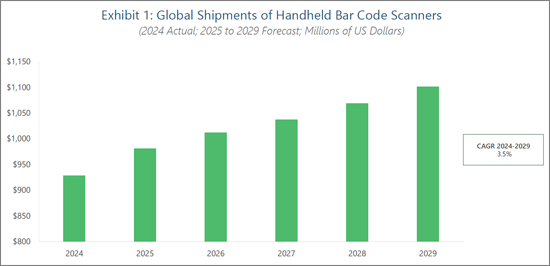

Global 2024 handheld barcode scanner revenues were the lowest in the last 13 years. The recent market contraction points primarily to a post-COVID market correction as the channel worked through excess inventory and over-capacity was adjusted. While the use case for handheld scanners for established applications remains - be it POS scanning, pick and pack in logistics or medication administration in healthcare - the market is fundamentally changing. Competition from new (wearable) form factors for scan-intensive workflows, viability of entry-class products from emerging market vendors, growing utility of SW-based computer vision tools and alternative form of data capture are all challenging the status quo.

Key market forces impacting a return to growth include the continued migration to 2D scanners from laser and linear imager solutions, upgrades to an aging installed base and support for new data capture workflows. 2D imager investments are being driven by vendors' active focus on expanding their camera-based solution portfolio at the expense of 1D options, as end users are increasingly availing benefits such as ability to read different barcode symbologies / types, omnidirectional data capture, damaged code readability, and support of advanced applications like compliance labeling, serialization, and traceability.

INFOGRAPHICS

For product development, leading competitors focus on the function and form of their designs, aligning them with the unique workflow requirements of each target vertical market and use case. Leading vendors have advanced their AI to deliver better aiming, illumination and reading of damaged codes and are designing advanced devices with color imagers and/or RAIN RFID reading to support more diverse item identification requirements. The five largest vendors (Zebra, Honeywell, Datalogic, Newland AIDC and Code Corporation) collectively garnered market share in 2024, compared toin 2023.

Key Findings:

- Demand for linear imager and laser scanning technology is declining: VDC has long tracked the decline of laser technology, which is now rapid as it is eclipsed by 2D imaging. Sales of handhelds using linear imaging technology are falling almost as fast.

- Integration of RFID reading continued to scale: Zebra initiated this pairing with its DS9908R and sold it to apparel retailers such as Lululemon, which have implemented RFID for inventory management and now to the POS. Zebra also modified its design to produce a healthcare version for traceability of expensive items such as surgical instruments and select supplies and drugs. Meanwhile, Datalogic launched the PowerScan 9600 RFID for loss prevention. Datalogic's design is ruggedized and cordless, and captures images in addition to barcodes and RFID. The PowerScan 9600 RFID is optimized to prevent barcode switching, a major source of shrink for DIY retailers. Dual readers offer additional use cases: inventory management, rapid stock counting, returns management, and more. Multiple additional vendors are developing or exploring handheld barcode scanners with integrated RFID.

- AI-enhanced handheld scanners emerging: Handheld barcode scanners have employed AI for decades to decode symbologies, and vendors routinely refine these algorithms to improve speed, reading of damaged codes, multiple codes, finding correct codes when many are presented. With the general price sensitivity of handheld barcode scanners, design of devices with higher-end components that may support more advanced AI applications is limited. However, applications that require more advanced image processing are areas where AI could play a greater role in handheld scanner applications is emerging..

- Vendors showing agility in responding to threat of tariffs and impact on product pricing: The volatility behind tariff decisions has presented the greatest challenge for vendors to navigate. However, following the post-COVID supply chain disruption, vendor approach to product and component sourcing and location of manufacturing decisions is significantly more resilient. As a result, vendors are better positioned to respond to market factors without significantly impacting customers.

Table of Contents

List of Exhibits

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Global Market Overview

- Regional Market Analysis

- Americas

- EMEA

- Asia-Pacific

Product and Technology Trends

- RFID

- 2D versus Linear Imager and Laser Technologies

- Software Platforms

Vertical Markets

- Retail

- Manufacturing

- Healthcare

- Transportation and Logistics

Competitive Landscape and Vendor Profiles

- CipherLab

- Code Corporation

- Cognex

- Datalogic

- Honeywell

- Newland AIDC

- Socket Mobile

- Unitech

- Zebra

About the Authors

About VDC Research

List of Exhibits

Report Exhibits

- Exhibit 1: Global Shipments of Handheld Barcode Scanners

- Exhibit 2: Forecasted Global Shipments of Handheld Barcode Scanners, Segmented by Product Type, Dollars

- Exhibit 3: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Product Type, Units

- Exhibit 4: Forecasted Americas Shipments of Handheld Barcode Scanners Segmented by Product Type

- Exhibit 5: Forecasted EMEA Shipments of Handheld Barcode Scanners Segmented by Product Type

- Exhibit 6: Forecasted Asia-Pacific Shipments of Handheld Barcode Scanners Segmented by Product Type

- Exhibit 7: 2D Imager, Linear Imager and Laser: Ten Year Trends by Technology

- Exhibit 8: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Economic Sector

- Exhibit 9: Global Vendor Shares of Handheld Barcode Scanners

Excel Dataset Exhibits

Market Analysis - Global

- Exhibit 1: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 2: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 3: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Product Type (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 4: Forecasted Global Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Millions of Dollars)

- Exhibit 5: Forecasted Global Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Thousands of Units)

- Exhibit 6: Forecasted Global Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 7: Forecasted Global Shipments of Handheld 2D Imager Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 8: Forecasted Global Shipments of Handheld Linear Imager Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 9: Forecasted Global Shipments of Handheld Laser Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 10: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Connectivity (Millions of Dollars)

- Exhibit 11: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 12: Forecasted Global Shipments of 2D Imager Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 13: Forecasted Global Shipments of Linear Imager Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 14: Forecasted Global Shipments of Laser Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 15: Forecasted Global Shipments of Handheld Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 16: Forecasted Global Shipments of 2D Imager Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 17: Forecasted Global Shipments of Linear Imager Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 18: Forecasted Global Shipments of Laser Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 19: Forecasted Global Shipments of Handheld Barcode Scanners by Country Market (Millions of Dollars)

Market Analysis - Americas

- Exhibit 1: Forecasted Americas Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 2: Forecasted Americas Shipments of Handheld Barcode Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 3: Forecasted Americas Shipments of Handheld Barcode Scanners Segmented by Product Type (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 4: Forecasted North American Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 5: Forecasted North American Shipments of Handheld Barcode Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 6: Forecasted North American Shipments of Handheld Barcode Scanners Segmented by Product Type (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 7: Forecasted Latin American Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 8: Forecasted Latin American Shipments of Handheld Barcode Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 9: Forecasted Latin American of Handheld Barcode Scanners Segmented by Product Type (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 10: Forecasted Americas Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Millions of Dollars)

- Exhibit 11: Forecasted Americas Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Thousands of Units)

- Exhibit 12: Forecasted Americas Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 13: Forecasted Americas Shipments of Handheld 2D Imager Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 14: Forecasted Americas Shipments of Handheld Linear Imager Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 15: Forecasted Americas Shipments of Handheld Laser Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 16: Forecasted Americas Shipments of Handheld Barcode Scanners Segmented by Connectivity (Millions of Dollars)

- Exhibit 17: Forecasted Americas Shipments of Handheld Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 18: Forecasted North American Shipments of Handheld Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 19: Forecasted Latin American Shipments of Handheld Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 20: Forecasted Americas Shipments of 2D Imager Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 21: Forecasted Americas Shipments of Linear Imager Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 22: Forecasted Americas Shipments of Laser Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 23: Forecasted Americas Shipments of Handheld Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 24: Forecasted North American Shipments of Handheld Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 25: Forecasted Latin American Shipments of Handheld Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 26: Forecasted Americas Shipments of 2D Imager Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 27: Forecasted Americas Shipments of Linear Imager Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 28: Forecasted Americas Shipments of Laser Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 29: Forecasted Americas Shipments of Handheld Barcode Scanners by Country Market (Millions of Dollars)

Market Analysis - EMEA

- Exhibit 1: Forecasted EMEA Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 2: Forecasted EMEA Shipments of Handheld Barcode Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 3: Forecasted EMEA Shipments of Handheld Barcode Scanners Segmented by Product Type (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 4: Forecasted European Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 5: Forecasted European Shipments of Handheld Barcode Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 6: Forecasted European Shipments of Handheld Barcode Scanners Segmented by Product Type (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 7: Forecasted Middle East & Africa Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 8: Forecasted Middle East & Africa Shipments of Handheld Barcode Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 9: Forecasted Middle East & Africa of Handheld Barcode Scanners Segmented by Product Type (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 10: Forecasted EMEA Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Millions of Dollars)

- Exhibit 11: Forecasted EMEA Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Thousands of Units)

- Exhibit 12: Forecasted EMEA Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 13: Forecasted EMEA Shipments of Handheld 2D Imager Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 14: Forecasted EMEA Shipments of Handheld Linear Imager Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 15: Forecasted EMEA Shipments of Handheld Laser Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 16: Forecasted EMEA Shipments of Handheld Barcode Scanners Segmented by Connectivity (Millions of Dollars)

- Exhibit 17: Forecasted EMEA Shipments of Handheld Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 18: Forecasted European Shipments of Handheld Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 19: Forecasted Middle East & Africa Shipments of Handheld Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 20: Forecasted EMEA Shipments of 2D Imager Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 21: Forecasted EMEA Shipments of Linear Imager Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 22: Forecasted EMEA Shipments of Laser Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 23: Forecasted EMEA Shipments of Handheld Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 24: Forecasted European Shipments of Handheld Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 25: Forecasted Middle East & Africa Shipments of Handheld Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 26: Forecasted EMEA Shipments of 2D Imager Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 27: Forecasted EMEA Shipments of Linear Imager Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 28: Forecasted EMEA Shipments of Laser Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 29: Forecasted European Shipments of Handheld Barcode Scanners by Country Market (Millions of Dollars)

- Exhibit 30: Forecasted Middle East & Africa Shipments of Handheld Barcode Scanners by Country Market (Millions of Dollars)

Market Analysis - Asia-Pacific

- Exhibit 1: Forecasted Asia-Pacific Shipments of Handheld Barcode Scanners Segmented by Product Type (Millions of Dollars)

- Exhibit 2: Forecasted Asia-Pacific Shipments of Handheld Barcode Scanners Segmented by Product Type (Thousands of Units)

- Exhibit 3: Forecasted Asia-Pacific Shipments of Handheld Barcode Scanners Segmented by Product Type (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 4: Forecasted Asia-Pacific Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Millions of Dollars)

- Exhibit 5: Forecasted Asia-Pacific Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Thousands of Units)

- Exhibit 6: Forecasted Asia-Pacific Shipments of Handheld Laser Barcode Scanners Segmented by Scanning Technology (Average Factory Selling Price (AFSP) - Dollars)

- Exhibit 7: Forecasted Asia-Pacific Shipments of Handheld 2D Imager Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 8: Forecasted Asia-Pacific Shipments of Handheld Linear Imager Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 9: Forecasted Asia-Pacific Shipments of Handheld Laser Barcode Scanners Segmented by Ruggedization (Millions of Dollars)

- Exhibit 10: Forecasted Asia-Pacific Shipments of Handheld Barcode Scanners Segmented by Connectivity (Millions of Dollars)

- Exhibit 11: Forecasted Asia-Pacific Shipments of Handheld Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 12: Forecasted Asia-Pacific Shipments of 2D Imager Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 13: Forecasted Asia-Pacific Shipments of Linear Imager Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 14: Forecasted Asia-Pacific Shipments of Laser Barcode Scanners Segmented by Economic Sector (Millions of Dollars)

- Exhibit 15: Forecasted Asia-Pacific Shipments of Handheld Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 16: Forecasted Asia-Pacific Shipments of 2D Imager Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 17: Forecasted Asia-Pacific Shipments of Linear Imager Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 18: Forecasted Asia-Pacific Shipments of Laser Barcode Scanners Segmented by Distribution Channel (Millions of Dollars)

- Exhibit 19: Forecasted Asia-Pacific Shipments of Handheld Barcode Scanners by Country Market (Millions of Dollars)

Competitive Analysis - Global

- Exhibit 1: Global Shipments of Handheld Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 2: Global Shipments of Handheld 2D Imager Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 3: Global Shipments of Handheld Linear Imager Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 4: Global Shipments of Laser Handheld Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

Competitive Analysis - Americas

- Exhibit 1: Americas Shipments of Handheld Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 2: North American Shipments of Handheld Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 3: Latin American Shipments of Handheld Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 4: Americas Shipments of Handheld 2D Imager Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 5: Americas Shipments of Handheld Linear Imager Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 6: Americas Shipments of Laser Handheld Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

Competitive Analysis - EMEA

- Exhibit 1: EMEA Shipments of Handheld Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 2: EMEA Shipments of Handheld 2D Imager Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 3: EMEA Shipments of Handheld Linear Imager Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 4: EMEA Shipments of Laser Handheld Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

Competitive Analysis - Asia-Pacific

- Exhibit 1: APAC Shipments of Handheld Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 2: APAC Shipments of Handheld 2D Imager Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 3: APAC Shipments of Handheld Linear Imager Barcode Scanners Segmented by Vendor Share (Percent of Dollars)

- Exhibit 4: APAC Shipments of Laser Handheld Barcode Scanners Segmented by Vendor Share (Percent of Dollars)