PUBLISHER: WinterGreen Research, Inc. | PRODUCT CODE: 1333992

PUBLISHER: WinterGreen Research, Inc. | PRODUCT CODE: 1333992

FinTech Virtual Money: Market Shares, Market Strategies and Market Forecasts, 2023 to 2029

FinTech Virtual Money Leverages AI as an Implementation Mechanism

Fintech implements digital banking, currencies, and payments. Specialized software and computer and smartphone algorithms implement integration of digital technology into financial services offerings. Companies seek to improve their use and delivery to consumers. Fintech works by unbundling offerings with apps. Firms use fintech to achieve efficiency, they create new markets. The largest fintech companies are Visa, Mastercard, and Tencent.

The worldwide fintech industry compound annual growth rate (CAGR) for revenue is 33.3%. Expected investment in the sector at $310 billion 2022 is expected to reach $3.7 trillion by 2029.

Fintech helps implement digital transactions, credit cards, bank by smartphone, digital checking with images, processes used to better manage financial operations, and living without so much pressure.

SAMPLE VIEWS

Executive Summary

Fintech Supports Access To Differentiated Data

Fintech is an extremely disruptive technology. 98% of banking and payment services face business disruption from fintech models. 88% of companies in the insurance, asset, and wealth management sector will face disruption due to fintech business models. Fintech supports access to differentiated data, robust linking capabilities, and flexible delivery. Through digital finance, virtual money is empowering finance companies to grow. During the coming period of unprecedented disruption, there is an opportunity to simplify operations & enhance customer experiences. Fintech provides financial data APIs. Fintech makes it easy for users to connect their bank accounts to any app using specially implemented APIs.

Figure 1. Fintech Functions

- Supports access to differentiated data

- Supports robust linking capabilities

- Provides flexible delivery

- Implements virtual currency

- Speeds transactions

- Makes banking cheaper and more available

Source: Winter Green Research, Inc.

The fintech sector, currently holding 2% share of global financial services revenue, is estimated to reach $3.7 trillion in annual revenue by 2029, constituting 15% of banking valuations worldwide as the electric vehicle industry drives massive new wealth. The auto industry is the engine of the economy. Fintech helps implement digital transactions, credit cards, bank by smartphone, digital checking with images, processes used to better manage financial operations, and living without so much pressure.

Because the processing from the FinTech is automatic, not directly initiated by someone, it appears to the user to be more a part of the blockchain or distributed ledger than of the storage mechanism. Data on a server can be accessed using a link location. A FinTech simply runs in the background. A FinTech on a blockchain is useful to automate workflows, moving in successive step as needed.

In the blockchain-based FinTech, an input triggers action. The FinTech connects the blockchain to real-world events. It allows inputs and outputs from the real world to execute decision making and implement action. Because blockchain fails to scale in most cases, we use distributed ledgers that do scale to implement blockchain.

There are several types of FinTech Virtual Money. An RFID sensor on a food shipment sends data to a FinTech that then releases payment to the supplier. An IoT device can capture a wide range of useful data that an artificial intelligence system manages. The AI system then uses the data to activate FinTech processes automatically.

Useful in government, farming, healthcare, banking, insurance, business, and for central bank digital currencies (CBDC), FinTech revolutionize transactions and process. Processes implemented with AI through FinTech are more efficient. FinTech support faster and cheaper automated ordering, purchasing, shipments, and payments. With government use of FinTech for CBDC, settlements process moves from two days to several seconds, creating less costly, more efficient settlements processes.

Figure 2. FinTech Electronically Linked Transfer Of Goods,

Services, Or Funds: Market Segments

- Budgeting

- Money management

- Crowdfunding

- Crypto

- Insurance

- Lending

- Payment

- Robo-advising

Source: Winter Green Research, Inc.

Figure 3. FinTech Functional Areas

- Government

- Farming

- Healthcare

- Banking

- Insurance

- Business

- Central bank digital currencies (CBDC)

- Electric Batteries

- Electric Vehicles

Source: Winter Green Research, Inc.

Figure 4. FinTech Functional Methods

- Subscription

- Advertising

- Leveraging Data

- Integration with third parties to offer additional value

- Partnering

- Robo-advisors

- Fees

Source: Winter Green Research, Inc.

FinTech implemented on blockchain and distributed ledgers leverage trust to develop a rapidly growing business. With the appropriate guards in place, digital assets and decentralized finance are transformed by FinTech.

FinTech implements digital finances, changing how businesses and people deal with each other. FinTech automates business transactions and processes in new ways. “FinTech Virtual Money Market Shares, Market Forecasts, Market Analysis, 2023-2029” describes how impactful will be the move to digital contracting. The 2023 study has 188 pages, 54 tables and figures. AI and FinTech are set to deliver more efficient business processes in every area.

Table of Contents

FinTech: Executive Summary

- The study is designed to give a comprehensive overview of the Fintech market segment. Research represents a selection from the mountains of data available of the most relevant and cogent market materials, with selections made by the most senior analysts. Commentary on every aspect of the market from independent analysts creates an independent perspective in the evaluation of the market. In this manner the study presents a comprehensive overview of what is going on in this market, assisting managers with designing market strategies likely to succeed.

Fintech: Introduction

Fintech Executive Summary

- Fintech Supports Access To Differentiated Data

1. Fintech Market Description and Market Dynamics

- 1.1. Payments Lead to the Coming Fintech Era

- 1.2. FinTech Businesses in the Developed World

- 1.3. FinTech in Emerging Economies

- 1.4. Proactive Regulators

2. FinTech Market Shares, Market Forecasts, Regional Analysis, and Market Segments

- 2.1. FinTech Market Growth Factors

- 2.2. FinTech Market Shares

- 2.3. FinTech Market Forecasts

- 2.4. FinTech Market Segments

- 3.1.1. Subscriptions/Fee

- 3.1.2. Robo-Advisors

- 3.1.3. Third parties

- 3.1.4. Advertising

- 3.1.5. Data

- 3.1.6. APIs

- 3.1.7. Open Banking

- 3.1.8. Wealth Management

- 3.1.9. Digital Assets

- 3.1.10. CNBC Fintech Company Segment Analysis

- 2.5. FinTech Regional Analysis

- 2.5.1. FinTech Regional Market Segments

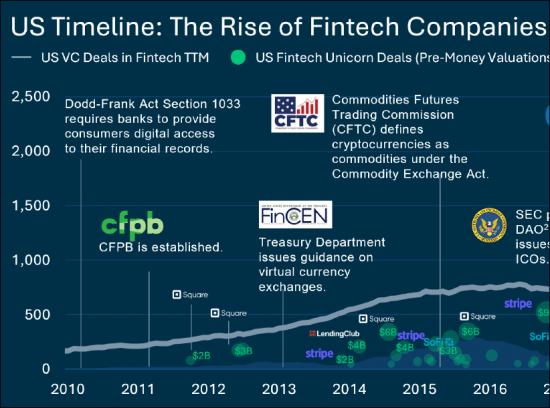

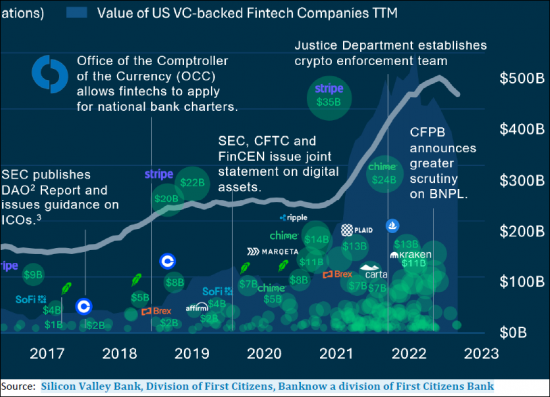

- 2.5.2. US and Americas

- 2.5.3. Europe

- 2.5.4. Lithuania.

- 2.5.5. China

- 2.5.6. APAC

3. Fintech Investors, Technology, and Regulation

- 3.2. FinTech AI Technology

- 3.2.1. Open Banking

- 3.2.2. Copied / Cashflow Underwriting

- 3.2.3. CopiedOpen Banking (US) and AI

- 3.3. Investors / Consumer FinTech Apps

- 3.4. Late-Stage FinTech

- 3.5. FinTech Regulation

- 3.6. AI Tax Collection

- 3.6.1. AI Applications Penetrate The Spectrum Of Financial Industry Operations, Across Front, Middle, And Back Offices

- 3.7. DTL / Blockchain Disrupts Established Financial Protocols

- 3.8. Financial Services Cloud Computing

- 3.8.1. Public Cloud, Hybrid Cloud, And Private Cloud

4. FinTech Positioning

- 4.1. FinTech Financial Sectors

- 4.2. Open source, SaaS and Serverless Lower Barriers To Entry

- 4.3. No-code and Low-Code Will Redefine Application Development

5. Selected FinTech Company Descriptions

- 5.1. Visa

- 5.1.1. Visa Fintech Case Studies

- 5.1.1. Visa Community Banking

- 5.1.2. Authorize.Net Subsidiary of Visa

- 5.1.3. Visa Fintech Revenue

- 5.1.4. Visa Loses Acquisition of Plaid, Acquires Tink

- 5.1.5. Visa Buys Swedish Fintech Tink For $2.1 Billion

- 5.2. Mastercard

- 5.2.1. Mastercard Fintech Tools

- 5.2.2. Mastercard Fintech Connecting Third Party Sellers And Consumers Through Their Online Platforms

- 5.2.3. Mastercard Revenue

- 5.3. Tencent

- 5.3.1. Tenpay Global and Tenpay Global Remittances

- 5.3.2. China Fintech Regulation

- 5.3.3. Tencent Machine Learning Algorithms

- 5.3.4. TenCent Homomorphic Encryption Protects Data Privacy

- 5.3.5. TenPay

- 5.3.6. Tencent Fintech Revenue

- 5.4. Alibaba / Ant Group / Alipay

- 5.4.1. Alipay Revenue

- 5.5. Adyen

- 5.5.1. Adyen Partnership with Shopify

- 5.5.2. Adyen Fintech

- 5.5.3. Adyen Fintech Revenue

- 5.6. Moeda Seeds

- 5.7. Lendio

- 5.8. LISNR Transforming Commerce With Audio

- 5.9. Binance

- 5.10. BitMart

- 5.11. Coinbase

- 5.12. Block

- 5.13. Bump

- 5.14. Cash App

- 5.15. Circle

- 5.16. Codat

- 5.17. Chinapay

- 5.18. Creative Juice

- 5.19. Chipper Cash

- 5.20. iCapital

- 5.20.1. iCapital

- 5.20.2. iCapital Network Revenue

- 5.21. Ekata

- 5.22. Fiserv

- 5.22.1. Fiserv Revenue

- 5.23. Government Blockchain Association GBA

- 5.24. Goldman Sacks

- 5.25. JPMorgan Chase

- 5.26. Klarna

- 5.26.1. Klarna Revenue

- 5.26.2. Klarna Funding Round Led by SoftBank

- 5.27. Knot API

- 5.28. Mayfair

- 5.29. NU Holdings

- 5.29.1. NU a Warren Buffett Stock

- 5.29.2. Nu Fintech Revenue

- 5.30. OpenSea

- 5.30.1. OpenSea Revenue

- 5.31. PayPal

- 5.31.1. Braintree

- 5.31.2. Paypal / Venmo Revenue

- 5.32. Plaid

- 5.32.1. Plaid Fintech Fraud Report Sharing

- 5.32.2. Plaid Fintech Revenue

- 5.33. Opto Investments

- 5.34. Pinwheel

- 5.35. Pontera

- 5.36. Revolut

- 5.37. Rho

- 5.37.1. Rho Revenue

- 5.38. Robinhood

- 5.38.1. Robinhood Revenue

- 5.39. Stripe

- 5.39.1. Stripe Revenue

- 5.40. Tegus

- 5.41. Visible Alpha

- 5.42. Teampay

- 5.43. Brigit

- 5.44. OTR Fintech Solutions

- 5.45. Macquarie Group

- 5.46. Apex Fintech Solutions

- 5.47. TransUnion

- 5.48. Even Financial

- 5.49. Halo Investing

- 5.50. Geode Capital Management

- 5.51. Galatea Associates

- 5.52. Levelset

- 5.53. OpenFin

- 5.54. Method Financial

- 5.55. Millennium Trust Company

- 5.56. Neighborhood Trust Financial Partners

- 5.57. Nibble Health

- 5.58. NinjaTrader

- 5.59. Capitalize

- 5.60. CAIS

- 5.61. Check

- 5.62. Mojito

- 5.63. Northwestern Mutual

- 5.64. BlackLine

- 5.65. Belvedere Trading

- 5.66. Flex

- 5.67. Enova

- 5.68. Turnstile

- 5.69. Pennymac

- 5.70. Northern Trust

- 5.71. Earnest

- 5.72. Western Union

- 5.73. Unanet

- 5.74. Array

- 5.75. Argyle

- 5.76. Above Lending

- 5.77. Flywire

- 5.78. MANTL

- 5.79. Remitly

- 5.80. Hudson River Trading

- 5.81. Riskified

- 5.82. Chime

- 5.83. TrueML

- 5.84. Coinbase

- 5.85. PitchBook

- 5.86. Optiver

- 5.87. Forward Financing

- 5.88. Morningstar

- 5.89. OppFi

- 5.90. Verifi

- 5.91. Addepar

- 5.92. SoFi

- 5.93. Avant

- 5.94. Wealthfront

- 5.95. Enfusion

- 5.96. WISE

- 5.97. Billtrust

- 5.98. Carta

- 5.99. Current

- 5.100. Square

- 5.101. CrowdStreet

- 5.102. The D. E. Shaw Group

- 5.103. Blend

- 5.104. Fundrise

- 5.105. Achieve

- 5.106. Arcesium

- 5.107. Asset Class

- 5.108. Trillium Labs

- 5.109. MoneyLion

- 5.110. Cledara

- 5.111. DriveWealth

- 5.112. SIMON from iCapital

- 5.113. EquityBee

- 5.114. Flourish

- 5.115. Kinly

- 5.116. Lendflow

- 5.117. Lev

- 5.118. MainStreet

- 5.119. Chipper

- 5.120. RevenueCat

- 5.121. Cloudvirga

- 5.122. Wintrust Financial Corporation

- 5.123. Advyzon

- 5.124. Clyde

- 5.125. Wefunder

- 5.126. ActBlue

- 5.127. Spring Labs

- 5.128. Affirm

- 5.129. LendingClub

- 5.130. Tala

- 5.131. Suplari

- 5.132. BLX Group

- 5.133. Gravity Payments

- 5.134. Venmo

- 5.135. Morty

- 5.136. Acorns

- 5.137. Digit

- 5.138. Guaranteed Rate

- 5.139. Commonbond

- 5.140. GreenSky

- 5.141. NerdWallet

- 5.142. Netspend

- 5.143. Yapstone

- 5.144. InvestCloud, Inc.

- 5.145. SumUp

- 5.146. Ethic

- 5.147. T-REX

- 5.148. Valon

- 5.149. Thought Machine

- 5.150. Varo

- 5.150.1. Varo Bank

- 5.151. 9fin

- 5.151.1. 9fin Revenue

- 5.152. MarketAxess

- 5.153. Zeta

- 5.154. Selected List of Fintech Companies

LIST OF FIGURES

- Figure 1. Fintech Functions

- Figure 2. FinTech Factors that Make Banking Services More Accessible

- Figure 3. Fintech Payments Sector Growth Factors

- Figure 4. FinTech Market Growth Factors

- Figure 5. Fintech Market Shares, Revenue, Dollars, Worldwide, 2022

- Figure 6. Fintech Market Shares, Revenue, Dollars, Worldwide, 2022

- Figure 7. Fintech Company Descriptions

- Figure 8. Fintech Company Descriptions (Continued)

- Figure 9. Fintech Company Descriptions (Continued)

- Figure 10. Fintech Market Forecasts

- Figure 11. FinTech Market Forecasts

- Figure 12. FinTech Market Segments, Dollars, Worldwide, 2023 to 2029

- Figure 13. FinTech Market Segments, Percent, Worldwide, 2023 to 2029

- Figure 14. Fintech Neobanking Segment Forecast, MM$, 2023 to 2029

- Figure 15. Fintech Market Segments

- Figure 16. Fintech Revenue Categories

- Figure 17. Fintech Regional Market Segments, Dollars, Worldwide, 2022

- Figure 18. Fintech Regional Market Segments, Dollars, Worldwide, 2022

- Figure 19. Invest Lithuania

- Figure 20. NER Can Take The Relevant Information From Blob Of Text And Organize It:

- Figure 21. Data-Driven Transformation With AWS

- Figure 22. AI Customer-Facing Applications

- Figure 23. AI Fintech Middle-and-Back Office Applications

- Figure 24. Fintech AI Technologies

- Figure 25. Fintech Innovations

- Figure 26. WalletPasses - Passbook Wallet - Apps on Google Play

- Figure 27. Selected Blockchain Applications:

- Figure 28. Fintech Cloud Functions

- Figure 29. Top Fintech Stats

- Figure 30. Fintech Cloud Platforms that Incorporate Container As A Service (CaaS)

- Figure 31. Visa B to B Cross Border Payments Multi Currency Solution

- Figure 32. Community Bank Fintech Partner Solutions

- Figure 33. Authorize.Net Payment Types

- Figure 34. Authorize.Net Payment Accepted Card Types

- Figure 35. Mastercard Fintech Programs to Help Partners Scale

- Figure 36. Mastercard Network of Partners Brings Innovation

- Figure 37. Mastercard Fintech Products Offered to Network of Partners

- Figure 38. Mastercard Fintech Tools

- Figure 39. Mastercard Fintech Solutions along the Marketplaces Value Chain:

- Figure 40. Mastercard Fintech Partner Available Services

- Figure 41. Mastercard Revenue

- Figure 42. Tencent Low-code Development Platform

- Figure 43. Tencent Low Process Automation

- Figure 44. TenCent Homomorphic Encryption Protects Data Privacy

- Figure 45. Circle 2022, 2021 Revenue

- Figure 46. GBA Blockchain Democracy Standard

- Figure 47. Klarna Metrics

- Figure 48. Klarna First Quarter Results 2023

- Figure 49. Plaid Fintech Features

- Figure 50. How Plaid Works

- Figure 51. Plaid FinTech Pricing

- Figure 52. Stripe Fintech App

- Figure 53. List of Selected FinTech Companies

- Figure 54. More Selected FinTech Companies