PUBLISHER: Zhar Research | PRODUCT CODE: 1812616

PUBLISHER: Zhar Research | PRODUCT CODE: 1812616

6G Communications Winning Materials, Hardware, Systems: Markets, Technology Opportunities 2026-2046

Summary

This 339-page, commercially-oriented report from Zhar Research gives a grand overview of 6G materials and hardware opportunities emerging at launch in 2030 and later stages. See closely-allied topics of systems and signal processing. Learn how emerging materials such as ionomers, metamaterials, energy harvesters, transparent materials and structural electronics can assist. The primary 6G materials and hardware opportunities lie in these overlapping topics:

- a) Base stations as they partly evolve into such things as Tower in the Sky (aerospace) and building fabric.

- b) Equipment enhancing the propagation path, notably Reconfigurable Intelligent Surfaces RIS, but also reflect-arrays, a more primitive product.

- c) Customer premises equipment.

- d) Client devices.

20-year forecasts and roadmaps 2026-2046

The report assists all in the value chain from investors to added-value materials companies, product and system integrators, mobile network operators, academics, regulators and others. Discover potential partners, acquisitions, winning approaches, best practice, lessons of failure. The new PhD level analysis is presented as 12 SWOT appraisals, 17 key conclusions, many new comparison charts, infograms, assessments by company, 6-line roadmaps to 2046, 48 forecast lines to 2046 and many sections marked "Zhar Research Comment".

Appraisal of research advances through 2025 is essential

Vitally, there is deep coverage of the flood of new research and company activity through 2025 because 6G capabilities and objectives are changing. Old information and analysis can be very misleading.

Lucid analysis not rambling text

The Executive Summary and Conclusions (65 pages) is rapidly readable by those with limited time, presenting mostly graphics, graphs with tables of all forecasts, SWOT appraisals and bullet-point key conclusions.

The Introduction explains why two very-different phases of 6G are now inevitable. Expect incremental 6G launch then a disruptive, very difficult second phase. See how the physical layer will be influenced by advances and requirements in higher layers. Here is the frequency spectrum for 6G phases in context of current general use of spectrum with a SWOT appraisal. Initially, many of the traditional telcos will economise by upgrading existing infrastructure and adding minimal new hardware. However, the mismatch of planned and researched 6G frequencies shown here and other radical advances will invite usurpers, better serving the more heroic ambitions of companies such as Meta. Understand the situation with primary 6G infrastructure and client devices by type set against radical advances in 6G materials in general and the surge in importance of optical technologies for 6G phase two- optical wireless communication, optical tuning, deep fiber optic intermediary. Grasp the strong 6G trend from components-in-a-box to smart materials and metasurfaces, self-healing, long life and self-cleaning materials for 6G with SWOT.

Grasp electrically-functionalised transparent glass, sophisticated thermal materials and semiconductor advances demanded for 6G. See how the conjunction of 6G and other disruptive hardware may enable genuine Internet of Things IOT rather than renaming of what we had already. Like every other chapter, there is a close look at the important inventions and changes of direction through 2025.

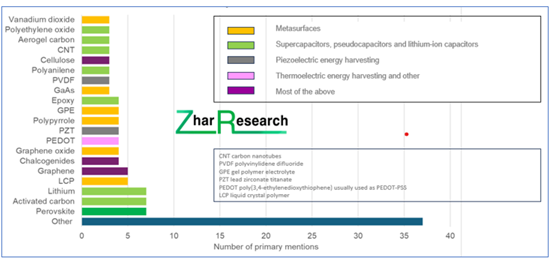

Chapter 3. "Analysis revealing best 6G component and material opportunities" (46 pages) presents data from the many Zhar Research drill down reports measuring which research and company materials development is winning for which 6G applications. Enjoy maturity curves by year, detailed comparison tables, research analysis pie charts for all those candidate materials and components. For example, for the essential progress beyond 5G bands, the much higher frequencies will increasingly use tuning materials rather than components in the metasurfaces. Here, two chalcogenides are losing out to vanadium dioxide, liquid crystal and plasmonic graphene. See other materials added for optical communication.

Chapter 4. "Base stations and Non-Terrestrial Network NTN 6G: UM-MIMO, Tower in the Sky HAPS, other UAV" (26 pages) clarifies the vital importance of these for 6G to have much better coverage than 5G. However, it requires collaboration with other companies that own these types of infrastructure such as the NEO satellites and the newly- important solar drones loitering in the stratosphere, potentially for years. 6G can both benefit from and assist unmanned aerial vehicles.

Chapter 5. Reconfigurable intelligent surfaces RIS and metamaterial reflect-arrays enhancing propagation path and base stations (53 pages) is extensive because it is one of the few new forms of hardware essential for 6G to launch with more than fixing a few 5G problems. RIS can increase range, security, reach around obstructions, and add many business cases and paybacks for 6G. It is little-used in 5G but essential for 6G as it starts largely at GHz and making mmWave performance more widely available then progresses to much tougher frequencies for stellar performance. See many new infograms, SWOT appraisals, dramatic advances through 2025.

Self-powering must come center-stage for 6G because so much will be inaccessible and too numerous to visit to charge or repair - from tens of billions of 6G IoT nodes to the base station as "Tower in the Sky". Chapter 6 dives into this. Called, "Zero energy devices ZED and battery elimination in 6G infrastructure and client devices" it employs 46 close-packed pages of infograms, SWOTs, tables of options. Yes, even unpowered and very low power client devices are likely for later 6G and you have excellent opportunities for your added-value materials. Learn which ones.

The report closes with 48 pages of Chapter 7. "36 companies involved in 6G materials and hardware: products, plans, patents, Zhar Research appraisals: 2025-6. Here the focus is on what these companies are targeting and achieving for new 6G hardware, RIS being one priority.

The Zhar Research report, "6G Communications Winning Materials, Hardware, Systems: Markets, Technology Opportunities 2026-2046" is your essential reading and there are drill-down reports with even more on specifics.

CAPTION: The most successful materials in recent research relevant to battery-free and self-powered 6G infrastructure and client devices. Source: Zhar Research report, "6G Communications Winning Materials, Hardware, Systems: Markets, Technology Opportunities 2026-2046".

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose and context of this report and background

- 1.2. Methodology and focus of this analysis

- 1.3. 16 conclusions for 6G Communications systems and hardware with 22 infograms, 10 SWOT appraisals

- 1.4. 6G systems, materials and standards roadmaps in four lines 2026-2046

- 1.5. Market forecasts for 6G materials and hardware 2026- 2046 lines, graphs,explanation

- 1.5.1. Overview

- 1.5.2. 6G hardware by four global regions, four locations (client, CPE, RIS, BS) 2026-2046

- 1.5.3. Smartphone and successor billion units sold globally 2024-2046 in two scenarios

- 1.5.4. Market for 6G vs 5G base stations units millions yearly 2025-2046

- 1.5.5. 6G base stations market value $bn if 6G successful 2029-2046

- 1.5.6. 6G fully passive metamaterial reflect-array market $ billion 2029-2046

- 1.5.7. 6G RIS value market 2027-2046 $ billion with explanation

- 1.5.8. 6G RIS area sales yearly billion square meters 2027-2046 with explanation

- 1.5.9. Average 6G RIS price $/ square m. ex-factory including electronics 2028-2046 with explanation

- 1.5.10. 6G RIS value market $ billion: active vs four semi-passive categories by frequency 2026-2046 with explanation

- 1.5.11. 6G RIS market $ billion: active vs four semi-passive frequency bands 2026-2046

- 1.5.12. 6G RIS area sales vs average panel area, panels sales number, total panels deployed cumulatively 2027-2046 with explanation

- 1.5.13. 6G RIS value market for base station vs propagation path $ billion 2027-2046

- 1.5.14. Market for semi-passive vs active RIS 0.1-1THz vs non-6G THz electronics 2027-2046

- 1.5.15. Thermal management material and structure for 6G infrastructure and client devices $ billion 2026-2046

- 1.5.16. Thermal interface material market 5G vs 6G $ billion 2025-2046

- 1.6. Background forecasts 2026-2046

- 1.6.1. Cooling module global market by seven technologies $ billion 2025-2046

- 1.6.2. Cooling module global market by seven technologies $ billion 2025-2046

- 1.6.3. Terrestrial radiative cooling performance in commercial products W/sq. m 2025-2046

- 1.6.4. Solid state cooling: best reported/ potential temperature drop by four technologies 2000-2046

- 1.6.5. Location of primary 6G material and component activity worldwide 2026-2046

2. Introduction

- 2.1. Overview

- 2.2. Two phases of 6G are inevitable

- 2.2.1. Reasoning with infograms

- 2.2.2. Incremental 6G launch then a disruptive, very difficult second phase

- 2.3. How physical layer will be influenced by advances and requirements in higher layers

- 2.4. Spectrum for 6G phases in context of current general use of spectrum with SWOT

- 2.4.1. Spectrum choices

- 2.4.2. Mismatch of planned and researched 6G frequencies may invite usurpers

- 2.4.3. Primary wireless transmission tools of 6G compared by frequency

- 2.4.4. SWOT appraisal of Visible Light Communications

- 2.5. Situation with primary 6G infrastructure and client devices by type

- 2.6. Radical advances in 6G materials in general

- 2.6.1. Strong 6G trend from components-in-a-box to smart materials and metasurfaces

- 2.6.2. Self-healing, long life and self-cleaning materials for 6G with SWOT

- 2.6.3. Electrically-functionalised transparent glass for 6G OTA, T-RIS

- 2.6.4. The place of metamaterials in 6G

- 2.6.5. More sophisticated thermal materials demanded for 6G and semiconductor issues

- 2.7. Conjunction of 6G and other disruptive hardware advances may enable genuine Internet of Things

- 2.8. Ten key conclusions concerning 6G Communications generally

- 2.9. Further reading - academic research examples through 2025 and new market research

3. Analysis revealing best 6G component and material opportunities

- 3.1. Overview

- 3.2. Overall 6G materials analysis

- 3.3. Ranking of most successful 6G ZED compounds and carbon allotropes in research

- 3.4. Thermal cooling and thermal conductor materials and hardware prioritised for 6G

- 3.5. Thermal metamaterials for 6G

- 3.6. Ionogels for 6G including electrically conductive thermal insulation

- 3.7. Advanced heat shielding, thermal insulation analysis for 6G

- 3.8. Inorganic, organic and composite thermal insulation materials prioritised for 6G

- 3.9. Prevalence of low loss and thermal materials in 6G research by formulation

- 3.10. Low-loss dielectrics prioritised for 6G

- 3.11. Optical and sub-THz 6G materials prioritised for 6G 0.1-1THz, NearIR and visible light

- 3.12. Materials for metamaterial-based 6G RIS analysed including tuning materials and components prioritised

- 3.12.1. RIS materials prioritised by 2024/5 research success

- 3.12.1. Tuning materials and devices prioritised by frequency GHz to optical: graph and two pie charts

4. Base stations and Non-Terrestrial Network NTN 6G: UM-MIMO, Tower in the Sky HAPS, other UAV

- 4.1. Overlapping subjects: 6G base stations and non-terrestrial networks

- 4.2. Progress to UM-MIMO and vanishing base stations

- 4.2.1. Sequence

- 4.2.2. RIS-enabled, self-powered 6G UM-MIMO base station design

- 4.2.3. The escalating base station power and cooling problem

- 4.2.4. Semiconductors needed

- 4.2.5. Base station and MIMO technology advances through 2025

- 4.3. Satellites and drones aid and sometimes benefit from 6G, Internet of Drones: advances through 2025

- 4.4. Internet of Drones

- 4.5. Large stratospheric HAPS as part of 6G

5. Reconfigurable intelligent surfaces RIS and metamaterial reflect-arrays enhancing propagation path and base stations

- 5.1. Definitions, multiple 6G uses, surging interest, manic terminology

- 5.2. Dreams of 6G RIS everywhere: infograms

- 5.3. Many types of RIS needed for 6G

- 5.4. 25 takeaways concerning 6G RIS opportunities

- 5.5. Advanced client devices to RIS: SWIPT, STIIPT, AmBC, CD-ZED

- 5.6. Seven aspects of materials and component opportunities in 6G RIS and more

- 5.7. 6G RIS cost issues and potential reduction

- 5.8. 6G RIS and reflect-array manufacturing technology

- 5.9. Five SWOT appraisals

- 5.9.1. 6G RIS SWOT appraisal

- 5.9.2. SWOT appraisal of 6G adding sub-THz, THz, near infrared and visible frequencies

- 5.9.3. SWOT appraisal of BD-RIS for 6G

- 5.9.4. STAR-RIS SWOT appraisal

- 5.9.5. SWOT appraisal of 6G RIS for Optical Wireless Communications OWC

- 5.10. Further reading

6. Zero energy devices ZED and battery elimination in 6G infrastructure and client devices

- 6.1. Overview

- 6.1.1. Scope

- 6.1.2. Key enabling technologies and quest for battery-less ZED in heterogenous cellular networks

- 6.2. Context of ZED

- 6.2.1. Overlapping and adjacent technologies and examples of long-life energy independence

- 6.2.2. Reasons for the trend to ZED and battery-free

- 6.2.3. Electrical autonomy examples that last for the life of their host equipment

- 6.2.4. Examples of ZED successes 1980-2035

- 6.3. 6G becoming zero-energy, often battery-free

- 6.3.1. Situation with primary 6G infrastructure and client devices

- 6.3.2. Eight options that can be combined for 6G ZED

- 6.3.3. Increasing electricity consumption of electronics and 6G ZED harvesting strategies

- 6.3.4. The place of ZED in 6G investment focus

- 6.4. Primary candidate enabling technologies for battery-free 6G ZED

- 6.4.1. 13 on-board harvesting technologies compared and prioritised for 6G ZED

- 6.4.2. Infogram: Maturity of primary ZED enabling technologies in 2025

- 6.5. Analysis of specific 6G ZED design approaches and SWOT appraisal

- 6.5.1. Targets and prioritisation

- 6.5.2. Device architecture

- 6.5.3. Energy harvesting system improvement strategies

- 6.5.4. Device battery-free storage: supercapacitors, LIC, massless energy

- 6.5.5. Example: IOT ZED enabled by LIC hybrid supercapacitor

- 6.5.6. "Massless energy" for ZED: structural supercapacitors without increase in size or weight

- 6.5.7. SWOT appraisal of battery-less storage technologies for ZED

- 6.6. Ambient backscatter communications AmBC, crowd detectable CD-ZED, SWIPT

- 6.7. SWOT appraisal of circuits and infrastructure that eliminate storage

- 6.8. Further research through 2025

7. 36 companies involved in 6G materials and hardware: products, plans, patents, Zhar Research appraisals: 2025-6

- 7.1. Overview: Likely 6G hardware landscape with examples of manufacturers and patenting trends

- 7.1.1. Rapidly changing situation 2025-6

- 7.1.2. Examples of material patenting and literature trends

- 7.2. AGC Japan

- 7.3. Alcan Systems Germany

- 7.4. Alibaba China

- 7.5. Alphacore USA

- 7.6. China Telecom China Mobile, China Unicom, Huawei, ZTE, Lenovo, CICT China collaboration

- 7.7. Ericsson Sweden

- 7.8. Fractal Antenna Systems USA

- 7.9. Greenerwave France

- 7.10. Huawei China

- 7.11. ITOCHU Japan

- 7.12. Kymeta Corp. USA

- 7.13. Kyocera Japan

- 7.14. Metacept Systems USA

- 7.15. Metawave USA

- 7.16. NEC Japan

- 7.17. Nokia Finland with LG Uplus South Korea

- 7.18. NTT DoCoMo and NTTJapan

- 7.19. Orange France

- 7.20. Panasonic Japan

- 7.21. Pivotal Commware USA

- 7.22. Qualcomm USA

- 7.23. Samsung Electronic South Korea

- 7.24. Sekisui Japan

- 7.25. SensorMetrix USA

- 7.26. SK Telecom South Korea

- 7.27. Sony Japan

- 7.28. Teraview USA

- 7.29. Vivo Mobile Communications China

- 7.30. VTT Finland

- 7.31. ZTE China