PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408241

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408241

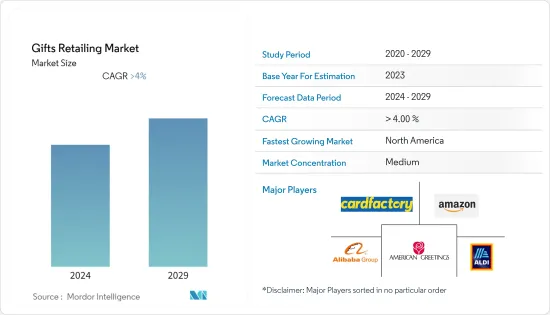

Gifts Retailing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

Gifts Retailing Market has generated a revenue of USD 14 billion in the current year and is poised to register a CAGR of 4% for the forecast period. The gifts retailing market is a significant segment of the global retail industry. The market size can vary depending on the region and economic conditions, but it generally experiences steady growth due to the demand for gifts for various occasions throughout the year. Special occasions like birthdays, weddings, anniversaries, Valentine's Day, Christmas, and other holidays drive the demand for gifts. The rise of e-commerce has significantly impacted the gifts retailing market. Online shopping platforms offer a wide range of gifts, convenient delivery options, and the ability to send gifts directly to recipients, even across borders. This has expanded the market's reach and accessibility.

There is a growing trend towards eco-friendly and sustainable gifts. Consumers are interested in gifts from recycled materials, organic products, and ethically sourced items. In addition to physical products, experiential gifts such as spa vouchers, travel packages, and event tickets are gaining popularity. These gifts focus on creating memorable experiences for recipients. Corporate gifting is an important segment within the gifts retailing market. Businesses purchase gifts for clients, employees, and partners to express appreciation and strengthen professional relationships.

The COVID-19 pandemic had a significant impact on the gift retailing market. As the virus spread globally and led to lockdowns, social distancing measures, and economic disruptions, the gifts retailing industry faced challenges and opportunities. With physical retail stores temporarily closed or operating with limited capacity, consumers turned to online shopping to purchase gifts. E-commerce platforms experienced a surge in demand as people sought to buy gifts and have them delivered directly to recipients' homes. This shift accelerated the already growing trend of online gift retailing. Supply chain disruptions caused by factory closures, transportation restrictions, and labor shortages impacted the availability of certain gift items. This led to delivery delays and limited product choices for consumers and retailers alike.

Gifts Retailing Market Trends

Impact of Valentine's Day Gifts Purchasing in Gift Retailing Market

Valentine's Day gift purchasing in the United States significantly impacts the gift retailing market. Valentine's Day celebrated on February 14th, is a popular holiday dedicated to expressing love and affection to romantic partners, friends, and family members. As a major gift-giving occasion, it drives a surge in consumer spending on various items, impacting the overall gifts retailing industry. Valentine's Day gifts often involve an element of personalization, such as customized jewelry, engraved items, or personalized greeting cards. Gift retailers that offer personalized options see increased demand during this time as consumers seek to make their gifts more meaningful and special. Valentine's Day can provide small and local gift retailers with a valuable opportunity to attract customers and boost sales. Many consumers prefer to support small businesses during this holiday, contributing to the growth of local economies.

Increasing Sales of Gift, Novelty, and Souvenir Stores in United States

Gift, novelty, and souvenir stores are specialized retail establishments that offer a wide range of products suitable for gift-giving and commemorating special events or travel experiences. An increase in gift, novelty, and souvenir store sales indicates growing demand for gift items in the United States. This expansion suggests that consumers actively seek gifts and souvenirs for various occasions, leading to potential market growth for the overall gift retail industry. The sales patterns of gift, novelty, and souvenir stores during specific seasons and holidays can offer insights into consumer preferences and trends, which may impact how other gift retailers strategize their seasonal sales and promotions. As gift, novelty, and souvenir stores cater to specific interests and themes, they may offer personalized and customizable gift options. The increasing popularity of personalized gifts in these stores may influence other gift retailers to offer similar services.

Gifts Retailing Industry Overview

The gifts retailing market is highly competitive, with players continuously innovating and adapting to changing consumer preferences and trends. Retailers differentiate themselves by offering unique product selections, excellent customer service, personalized options, and competitive pricing. Building brand loyalty and maintaining a strong online presence are essential strategies in this competitive landscape. The market includes traditional brick-and-mortar retailers and online platforms, each having a share of consumer spending on gift items. Following is the list of Top players in the Market: Card Factory, Aldi Stores Ltd, Alibaba Group Holding Ltd, Amazon.com Inc, and American Greetings Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Seasonal Occasions and Celebrations

- 4.2.2 E-commerce and Online Shopping

- 4.3 Market Restraints

- 4.3.1 Intense Competition

- 4.3.2 Changing Consumer Preferences and Trends

- 4.4 Insights on Consumer Behavior Analysis

- 4.5 Insights on Impact of technology in the Market

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Souvenirs and novelty items

- 5.1.2 Seasonal decorations

- 5.1.3 Greeting cards

- 5.1.4 Giftware

- 5.1.5 Other Gift items

- 5.2 By Distribution channel

- 5.2.1 Offline

- 5.2.2 Online

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 UK

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Netherlands

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Indonesia

- 5.3.3.6 Malaysia

- 5.3.3.7 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 UAE

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 Israel

- 5.3.4.4 South Africa

- 5.3.4.5 Rest of Middle East and Africa

- 5.3.5 Latin America

- 5.3.5.1 Argentina

- 5.3.5.2 Brazil

- 5.3.5.3 Mexico

- 5.3.5.4 Rest of Latin America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Card Factory

- 6.2.2 Aldi Stores Ltd.

- 6.2.3 Alibaba Group Holding Ltd.

- 6.2.4 Amazon.com Inc.

- 6.2.5 American Greetings Corp.

- 6.2.6 Spencer Gifts LLC

- 6.2.7 The Walt Disney Co

- 6.2.8 Hallmark Cards Inc

- 6.2.9 My Pet Gift Box Ltd

- 6.2.10 Shutterfly Inc

- 6.2.11 Macys Inc*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US