PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431246

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431246

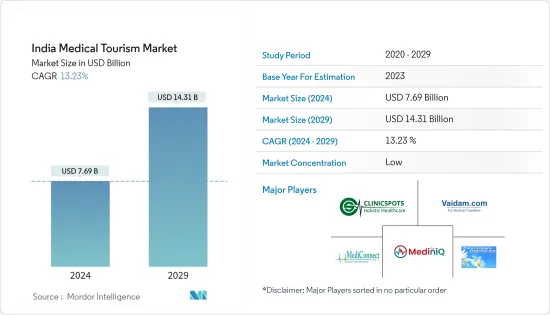

India Medical Tourism - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The India Medical Tourism Market size is estimated at USD 7.69 billion in 2024, and is expected to reach USD 14.31 billion by 2029, growing at a CAGR of 13.23% during the forecast period (2024-2029).

The Covid-19 pandemic outbreak significantly impacted the India Medical Tourism Market, like the global healthcare industry. The pandemic led to widespread travel restrictions and lockdowns, severely limiting patients' ability to travel for medical treatment and resulting in a decline in medical tourism. The India Medical Tourism Market was also affected by decreased demand for non-essential medical procedures, as patients prioritized their safety and avoided unnecessary travel. Many medical facilities were also repurposed to treat Covid-19 patients, limiting the availability of medical services for foreign patients.

India became a popular destination for medical tourism due to its advanced healthcare facilities, skilled healthcare professionals, and lower costs of medical treatments compared to developed countries. The India Medical Tourism Market offers various medical services, including cardiac surgery, organ transplantation, cosmetic surgery, dental care, and traditional medicine. The Indian government implemented various policies and initiatives to promote medical tourism, such as streamlined visa processes and developing specialized medical tourism zones. In addition, India includes a large pool of English-speaking doctors and nurses, which makes it easier for patients from English-speaking countries to communicate with their healthcare providers.

India Medical Tourism Market Trends

Increase in the Number of Medical Tourists in India is Driving the Market

India saw a significant increase in medical tourists over the past few years. One of the primary reasons is the country's advanced medical facilities, which offer world-class treatments and procedures at a fraction cost of comparable treatments in other countries. This cost-effectiveness made India an attractive destination for patients seeking affordable healthcare. The country includes a large pool of highly trained medical professionals like doctors, surgeons, and nurses skilled in the latest medical procedures and techniques. This expertise and the country's advanced medical facilities made India a popular destination for specialized treatments such as organ transplants, cardiac surgeries, and orthopedic surgeries.

One of the most critical factors is low-cost treatment by esteemed hospitals in India. People usually look for similar treatment in nations that can provide it cheaper. Apart from that, in some countries, obtaining a visa requires a lengthy process. Due to the low-cost treatments available in India, it ranks at number 7 amongst the 20 wellness tourism markets, with over 560 lacs trips made to India for medical value tourism generating USD 16.3 billion in revenue. It also ranks at number 3 in wellness-focused countries in the Asia-Pacific.

Expansion of Healthcare Infrastructure in India is Driving the Marekt

India saw a significant expansion in its healthcare infrastructure over the past few years. This expansion is driven by public and private investment in healthcare and government initiatives to improve healthcare access and quality across the country. One of the key areas of expansion in healthcare infrastructure in India is the construction of new hospitals and healthcare facilities. Many new hospitals and healthcare centers were built nationwide, particularly in urban areas, to meet the growing healthcare service demand. These facilities are equipped with the latest medical equipment and technologies and staffed by highly trained medical professionals.

In addition to new hospitals, India saw an expansion in its healthcare workforce. The government launched several initiatives to increase the number of healthcare professionals in the country, including training programs for doctors, nurses, and other healthcare workers.

Another expansion area in India's healthcare infrastructure is the development of telemedicine and other digital health technologies. These technologies allow patients in remote areas to access healthcare services and consultations from doctors and specialists elsewhere in the country. It helped improve healthcare access and quality in underserved areas and made healthcare services more convenient and accessible for patients.

Overall, expanding healthcare infrastructure in India helped improve healthcare access and quality nationwide, making it easier for patients to access the necessary treatments and services. With continued investment and government support, India's healthcare infrastructure is poised for further growth in the coming years, which will help to improve healthcare outcomes for patients across the country.

India Medical Tourism Industry Overview

The Indian Medical Tourism Market is fragmented. Each country includes unique attractions and tourism offerings, resulting in diverse travel options for visitors. India's top medical tourism destinations are Mumbai, Chennai, New Delhi, Ahmedabad, and Bangalore. The major players in this market are Clinicspots, Vaidam, MediConnect India, Forerunners Healthcare, and Mediniq.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Key Trends and Recent Developments in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Treatment Type

- 5.1.1 Dental Treatment

- 5.1.2 Cosmetic Treatment

- 5.1.3 Cardiovascular Treatment

- 5.1.4 Orthopedic Treatment

- 5.1.5 Neurological Treatment

- 5.1.6 Cancer Treatment

- 5.1.7 Fertility Treatment

- 5.1.8 Others

- 5.2 By Service Provider

- 5.2.1 Public

- 5.2.2 Private

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Clinicspots

- 6.2.2 Vaidam

- 6.2.3 MediConnect India

- 6.2.4 Forerunners Healthcare

- 6.2.5 Mediniq

- 6.2.6 Global Treatment Services

- 6.2.7 Health Opinion

- 6.2.8 ANAVARA

- 6.2.9 Tour2India4Health

- 6.2.10 Apollo Hospital*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US