PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709976

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709976

Global Aerospace and tooling Market 2025-2035

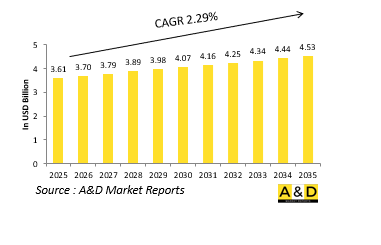

The Global Aerospace and Tooling Market is estimated at USD 3.61 billion in 2025, projected to grow to USD 4.53 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 2.29% over the forecast period 2025-2035.

Introduction to Aerospace and Tooling Market:

The global defense aerospace and tooling market represents a critical foundation for producing, assembling, and maintaining sophisticated military aircraft and related systems. Tooling in this context encompasses an extensive array of precision equipment, jigs, fixtures, molds, and custom-built instruments used throughout the lifecycle of airframes, engines, and onboard systems. As the defense aerospace sector advances, driven by stealth technology, high-performance materials, and digitally integrated systems, the complexity of tooling processes has expanded accordingly. These tools ensure dimensional accuracy, structural integrity, and repeatability in manufacturing, all of which are essential to meet strict military standards. Whether it's the assembly of fifth-generation fighter jets, heavy-lift transport aircraft, or unmanned aerial systems, customized tooling solutions are indispensable. Additionally, tooling plays a key role in modifications and overhauls, enabling rapid retrofitting of platforms with new avionics or mission systems. With defense aviation programs often spanning decades, the need for durable, adaptive, and scalable tooling has become a long-term strategic priority. This market operates not only at the level of major airframe manufacturers but also within a complex web of suppliers and maintenance providers, making it a vital and interconnected segment of the broader defense industrial base.

Technology Impact in Aerospace and Tooling Market:

Technology is transforming the defense aerospace and tooling market by enabling higher precision, flexibility, and efficiency in both production and maintenance operations. Advanced digital manufacturing tools, such as computer-aided design and computer-aided manufacturing, have streamlined the development of complex geometries and optimized part tolerances. Additive manufacturing, or 3D printing, is now being used to produce lightweight, custom tooling and even some structural components, reducing lead times and material waste. Robotics and automated guided systems are increasingly being integrated into tooling workflows, especially in repetitive tasks like drilling, fastening, and surface treatment, improving consistency and worker safety. Sensor-equipped tools and real-time feedback systems allow for smarter quality control, detecting deviations early in the process and minimizing rework. Virtual reality and augmented reality applications are beginning to influence tool alignment and technician training, enhancing accuracy during assembly and inspection procedures. Tooling databases are being digitized and connected to broader aerospace platforms, making traceability and configuration management more effective across global operations. These technological developments are aligning with broader goals in defense: faster delivery schedules, enhanced platform readiness, and the ability to support increasingly complex aircraft systems with minimal error and maximum consistency.

Key Drivers in Aerospace and Tooling Market:

Several powerful trends are fueling sustained growth in the defense aerospace and tooling market. One major factor is the increased global demand for modern military aircraft and unmanned systems, which require sophisticated tooling from the outset of development through to sustainment. As nations pursue air dominance and multi-domain operations, tooling becomes essential to ensure that aircraft systems meet stringent performance and durability requirements. Lifecycle sustainment and mid-life upgrades also drive tooling investments, especially when older platforms are being modernized with digital avionics or new structural components. Additionally, the growing emphasis on rapid prototyping and short-turnaround development cycles demands agile and reconfigurable tooling that can keep up with shifting design requirements. Global supply chain strategies are also influencing procurement decisions, as defense manufacturers seek more localized and resilient tooling support to reduce dependency on vulnerable trade routes. Sustainability is emerging as a new consideration, with eco-friendly materials and energy-efficient manufacturing practices gaining traction. Above all, national security imperatives require that tooling systems deliver maximum reliability and repeatability under pressure, whether on the production line or during in-field repairs. These drivers collectively underscore tooling's strategic importance in supporting defense aerospace capabilities at scale and speed.

Regional Trends in Aerospace and Tooling Market:

The global defense aerospace and tooling market exhibits distinct regional dynamics shaped by national defense priorities, industrial capacity, and investment in advanced manufacturing. North America, particularly the United States, maintains a strong lead due to its expansive aircraft production programs and mature defense manufacturing ecosystem. The region is marked by deep integration between military contractors, tooling specialists, and research institutions, fostering continuous innovation. In Europe, collaborative defense initiatives are prompting standardization of tooling systems across allied nations, especially in support of joint aircraft development and maintenance programs. Countries like Germany, France, and the UK are investing in high-precision tooling infrastructure to support both indigenous platforms and transatlantic projects. Asia-Pacific is emerging rapidly, with countries such as India, South Korea, and Japan focusing on indigenous aerospace capabilities. These nations are not only producing their own combat aircraft but are also establishing tooling facilities to reduce reliance on foreign supply chains. In the Middle East, industrialization efforts are being tied to defense offsets, encouraging domestic production and localized tooling capabilities. Latin America and parts of Africa are slower to develop in this sector but are showing interest in collaborative manufacturing hubs. Each region reflects a unique balance of innovation, capability-building, and strategic autonomy in tooling development.

Key Aerospace and Tooling Program:

Under research and development contracts with DARPA, Boeing and Lockheed Martin each developed an X-plane to support risk reduction efforts for the Next Generation Air Dominance (NGAD) platform. These experimental aircraft completed their first flights in 2019 and 2022, respectively, and have since accumulated several hundred flight hours each.

Table of Contents

Global Aerospace and tooling market - Table of Contents

Global Aerospace and tooling market Report Definition

Global Aerospace and tooling market Segmentation

By Material

By Manufacturing Process

By Application

By Region

Global Aerospace and tooling market Analysis for next 10 Years

The 10-year Global Aerospace and tooling market analysis would give a detailed overview of Global Aerospace and tooling market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Aerospace and tooling market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Aerospace and tooling market Forecast

The 10-year Global Aerospace and tooling market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Aerospace and tooling market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Aerospace and tooling market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Aerospace and tooling market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Aerospace and tooling market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Material, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Application, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Manufacturing Process, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Material, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Application, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Manufacturing Process, 2022-2032

List of Figures

- Figure 1: Global Aerospace and Tooling Forecast, 2022-2032

- Figure 2: Global Aerospace and Tooling Forecast, By Region, 2022-2032

- Figure 3: Global Aerospace and Tooling Forecast, By Material, 2022-2032

- Figure 4: Global Aerospace and Tooling Forecast, By Application, 2022-2032

- Figure 5: Global Aerospace and Tooling Forecast, By Manufacturing Process, 2022-2032

- Figure 6: North America, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 7: Europe, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 8: Middle East, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 9: APAC, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 10: South America, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 11: United States, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 12: United States, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 13: Canada, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 14: Canada, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 15: Italy, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 16: Italy, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 17: France, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 18: France, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 19: Germany, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 20: Germany, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 21: Netherlands, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 23: Belgium, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 24: Belgium, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 25: Spain, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 26: Spain, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 27: Sweden, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 28: Sweden, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 29: Brazil, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 30: Brazil, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 31: Australia, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 32: Australia, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 33: India, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 34: India, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 35: China, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 36: China, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 39: South Korea, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 40: South Korea, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 41: Japan, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 42: Japan, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 43: Malaysia, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 45: Singapore, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 46: Singapore, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Aerospace and Tooling, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Aerospace and Tooling, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Aerospace and Tooling, By Material (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Aerospace and Tooling, By Material (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Aerospace and Tooling, By Application (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Aerospace and Tooling, By Application (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Aerospace and Tooling, By Manufacturing Process (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Aerospace and Tooling, By Manufacturing Process (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Aerospace and Tooling, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Aerospace and Tooling, Global Market, 2022-2032

- Figure 59: Scenario 1, Aerospace and Tooling, Total Market, 2022-2032

- Figure 60: Scenario 1, Aerospace and Tooling, By Region, 2022-2032

- Figure 61: Scenario 1, Aerospace and Tooling, By Material, 2022-2032

- Figure 62: Scenario 1, Aerospace and Tooling, By Application, 2022-2032

- Figure 63: Scenario 1, Aerospace and Tooling, By Manufacturing Process, 2022-2032

- Figure 64: Scenario 2, Aerospace and Tooling, Total Market, 2022-2032

- Figure 65: Scenario 2, Aerospace and Tooling, By Region, 2022-2032

- Figure 66: Scenario 2, Aerospace and Tooling, By Material, 2022-2032

- Figure 67: Scenario 2, Aerospace and Tooling, By Application, 2022-2032

- Figure 68: Scenario 2, Aerospace and Tooling, By Manufacturing Process, 2022-2032

- Figure 69: Company Benchmark, Aerospace and Tooling, 2022-2032