PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709979

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709979

Global Tube launched AUV and UAV Market 2025-2035

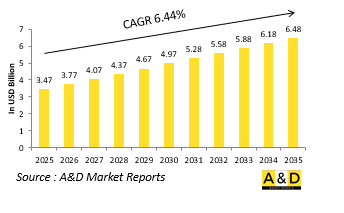

The Global Tube launched AUV and UAV market is estimated at USD 3.47 billion in 2025, projected to grow to USD 6.48 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 6.44% over the forecast period 2025-2035.

Introduction to Tube launched AUV and UAV Market:

The global defense market for tube-launched AUVs and UAVs is gaining traction as armed forces seek compact, deployable, and multi-domain solutions to enhance surveillance, reconnaissance, and strike capabilities. These systems are engineered to be launched from confined or mobile platforms, such as submarines, armored vehicles, aircraft, or naval vessels, offering operational flexibility in contested environments. The tube-launched design enables stealth deployment, especially in maritime and littoral zones where detection risks are high. For underwater operations, AUVs can be released covertly to conduct intelligence missions, mine countermeasures, or undersea mapping. On the aerial side, tube-launched UAVs are ideal for rapid tactical ISR support, enabling forces to quickly gain visual and signal intelligence in forward zones without large launch systems. These compact systems are increasingly used to bridge the gap between large, centralized assets and on-the-ground tactical units. Their modularity allows mission customization while reducing the logistical footprint. This market is also responding to the rising need for rapid deployment capabilities in remote or denied areas. As operational theaters become more unpredictable and dispersed, the ability to discreetly deploy autonomous systems from any platform is becoming essential, positioning tube-launched systems as a critical innovation in modern warfare.

Technology Impact in Tube launched AUV and UAV Market:

Technological advances are significantly reshaping the capabilities and deployment potential of tube-launched AUVs and UAVs. Miniaturization of electronics and propulsion systems has made it possible to pack powerful sensors, secure communication suites, and adaptive navigation systems into these compact platforms. Innovations in autonomous navigation algorithms allow these vehicles to operate with minimal input, navigating complex terrain or underwater topography while avoiding obstacles and threats. For tube-launched UAVs, vertical takeoff adaptations and electric propulsion enable near-silent operation and rapid ascent, enhancing stealth and mission success in contested airspace. Underwater, developments in energy-dense battery systems are increasing operational range and endurance, allowing AUVs to undertake longer and more data-intensive missions. Launching mechanisms themselves have evolved, now integrated with multi-platform compatibility features that allow rapid deployment from torpedo tubes, canisters, or mobile launchers. Artificial intelligence integration is also advancing real-time decision-making, object recognition, and mission adaptability. This allows these systems to shift objectives mid-mission based on incoming data. Secure, low-latency communications-often through encrypted, burst-transmission links-ensure operational security without sacrificing performance. These technological leaps are reinforcing the strategic value of tube-launched platforms by making them smarter, quieter, and more versatile in the increasingly complex domains of modern conflict.

Key Drivers in Tube launched AUV and UAV Market:

Multiple strategic and tactical demands are propelling the rise of tube-launched AUV and UAV systems in defense planning. A key driver is the need for discreet, flexible, and rapidly deployable systems that can be launched from existing military platforms without significant modifications. This makes them highly attractive for forces seeking to extend operational capabilities without investing in entirely new infrastructure. In underwater domains, growing concerns over naval mines, submarine detection, and undersea cables are encouraging the use of AUVs for low-profile reconnaissance and surveillance. On land and in air, tactical UAVs launched from vehicles or portable canisters provide an immediate intelligence advantage in time-sensitive or high-risk environments. The increasing importance of unmanned systems in reducing human exposure to danger also supports adoption, especially in areas like urban warfare or contested littorals. Additionally, the rise of hybrid and multi-domain warfare has made seamless integration of assets across air, land, and sea a necessity. Tube-launched systems can support joint operations by acting as a connective layer between units and domains. The need for cost-effective, reusable, and mission-configurable platforms is another compelling factor, particularly as militaries worldwide strive to maintain agility in the face of evolving threats and constrained defense budgets.

Regional Trends in Tube launched AUV and UAV Market:

Regional developments in the tube-launched AUV and UAV market reflect diverse security priorities, geographic challenges, and defense modernization strategies. In North America, emphasis is placed on integrating these systems into submarine and special operations frameworks, reflecting a need for stealthy, forward-deployable tools in contested regions. U.S. programs often focus on interoperability, autonomy, and swarming capabilities, aiming to enable coordinated multi-domain operations with minimal human oversight. Europe is increasingly adopting tube-launched UAVs and AUVs to bolster border protection, naval presence, and rapid-response forces. Nations along the Mediterranean and Baltic coasts are particularly active in deploying maritime-capable platforms suited to shallow water and archipelagic environments. In the Asia-Pacific region, nations like Australia, Japan, and South Korea are investing in these systems as part of wider efforts to monitor vast maritime zones and respond swiftly to regional tensions. China's growing interest in autonomous warfare is also evident through its domestic development of launch systems and small, agile drones capable of operating in swarms. The Middle East, driven by both territorial defense and urban security challenges, is exploring tube-launched UAVs as part of counter-insurgency and surveillance operations. Each region's investment is shaped by local threat landscapes, operational needs, and the desire for strategic flexibility.

Key Tube launched AUV and UAV Program:

It has recently come to light that the U.S. Navy's Ohio-class guided missile submarine, USS Michigan, made significant use of uncrewed underwater vehicles (UUVs) during operations conducted between October 2022 and January 2024. Over this period, the submarine and its crew carried out at least three highly classified "national security" missions, along with operations involving special forces in hostile and demanding environments. As previously detailed by The War Zone, Ohio-class guided missile submarines (SSGNs) are among the Navy's most versatile and sought-after assets. These platforms are capable of executing a wide array of missions, including covert intelligence gathering, clandestine special operations, and the launch of large volumes of Tomahawk cruise missiles, making them critical to U.S. strategic capabilities.

Table of Contents

Global tube launched AUV and UAV market- Table of Contents

Global tube launched AUV and UAV market Report Definition

Global tube launched AUV and UAV market Segmentation

By Type

By Platform

By Application

By Region

Global tube launched AUV and UAV market Analysis for next 10 Years

The 10-year Global tube launched AUV and UAV market analysis would give a detailed overview of Global tube launched AUV and UAV market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global tube launched AUV and UAV market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global tube launched AUV and UAV market Forecast

The 10-year Global tube launched AUV and UAV market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global tube launched AUV and UAV market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global tube launched AUV and UAV market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global tube launched AUV and UAV market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global tube launched AUV and UAV market

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Application, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Type, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Application, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Type, 2022-2032

List of Figures

- Figure 1: Global Tube Launched AUV & UAV Market Forecast, 2022-2032

- Figure 2: Global Tube Launched AUV & UAV Market Forecast, By Region, 2022-2032

- Figure 3: Global Tube Launched AUV & UAV Market Forecast, By Platform, 2022-2032

- Figure 4: Global Tube Launched AUV & UAV Market Forecast, By Application, 2022-2032

- Figure 5: Global Tube Launched AUV & UAV Market Forecast, By Type, 2022-2032

- Figure 6: North America, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 7: Europe, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 8: Middle East, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 9: APAC, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 10: South America, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 11: United States, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 12: United States, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 13: Canada, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 14: Canada, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 15: Italy, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 16: Italy, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 17: France, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 18: France, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 19: Germany, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 20: Germany, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 21: Netherlands, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 23: Belgium, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 24: Belgium, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 25: Spain, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 26: Spain, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 27: Sweden, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 28: Sweden, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 29: Brazil, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 30: Brazil, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 31: Australia, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 32: Australia, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 33: India, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 34: India, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 35: China, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 36: China, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 39: South Korea, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 40: South Korea, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 41: Japan, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 42: Japan, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 43: Malaysia, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 45: Singapore, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 46: Singapore, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Tube Launched AUV & UAV Market, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Tube Launched AUV & UAV Market, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Tube Launched AUV & UAV Market, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Tube Launched AUV & UAV Market, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Tube Launched AUV & UAV Market, By Application (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Tube Launched AUV & UAV Market, By Application (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Tube Launched AUV & UAV Market, By Platform (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Tube Launched AUV & UAV Market, By Platform (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Tube Launched AUV & UAV Market, By Type (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Tube Launched AUV & UAV Market, By Type (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Tube Launched AUV & UAV Market, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Tube Launched AUV & UAV Market, Global Market, 2022-2032

- Figure 59: Scenario 1, Tube Launched AUV & UAV Market, Total Market, 2022-2032

- Figure 60: Scenario 1, Tube Launched AUV & UAV Market, By Region, 2022-2032

- Figure 61: Scenario 1, Tube Launched AUV & UAV Market, By Platform, 2022-2032

- Figure 62: Scenario 1, Tube Launched AUV & UAV Market, By Application, 2022-2032

- Figure 63: Scenario 1, Tube Launched AUV & UAV Market, By Type, 2022-2032

- Figure 64: Scenario 2, Tube Launched AUV & UAV Market, Total Market, 2022-2032

- Figure 65: Scenario 2, Tube Launched AUV & UAV Market, By Region, 2022-2032

- Figure 66: Scenario 2, Tube Launched AUV & UAV Market, By Platform, 2022-2032

- Figure 67: Scenario 2, Tube Launched AUV & UAV Market, By Application, 2022-2032

- Figure 68: Scenario 2, Tube Launched AUV & UAV Market, By Type, 2022-2032

- Figure 69: Company Benchmark, Tube Launched AUV & UAV Market, 2022-2032