PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1744378

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1744378

Global Underwater Launchable UAVs market 2025-2035

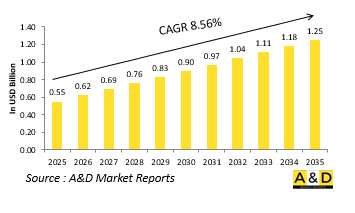

The Global Underwater launchable UAVs market is estimated at USD 0.55 billion in 2025, projected to grow to USD 1.25 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.56% over the forecast period 2025-2035.

Introduction to Underwater launchable UAVs Market

Underwater launchable unmanned aerial vehicles (UAVs) represent a cutting-edge convergence of maritime and aerial technologies, designed to extend reconnaissance, surveillance, and strike capabilities from beneath the ocean's surface. These innovative platforms are deployed from submarines or underwater drones, enabling covert insertion into contested or denied environments. Once launched, these UAVs transition from submerged deployment to aerial operations, providing real-time intelligence, target acquisition, or electronic warfare support. This capability bridges the gap between undersea stealth and surface-level situational awareness, enhancing force projection and operational flexibility. Defense forces worldwide are exploring these systems to address challenges such as littoral surveillance, mine detection, and rapid battlefield assessment without compromising the stealth of their underwater platforms. The ability to launch UAVs underwater also reduces vulnerability to detection and attack during deployment. As naval operations grow increasingly complex and multi-domain in nature, underwater launchable UAVs offer unique strategic advantages by combining the stealth and persistence of submarines with the agility and reach of aerial assets. Their development signals a significant shift toward integrated, layered maritime surveillance and combat networks, enhancing maritime situational awareness and rapid response in contested waters.

Technology Impact in Underwater launchable UAVs Market:

Technological innovation is central to the evolution of underwater launchable UAVs, enabling seamless transition from submerged environments to air operations. Advances in compact propulsion systems and pressure-resistant housings allow UAVs to withstand underwater deployment stresses and rapidly break the surface for flight. Breakthroughs in hydrodynamics and materials engineering optimize the UAV's ability to operate efficiently in both water and air. Sophisticated navigation technologies, including inertial sensors and GPS, ensure precise trajectory control during launch, transit, and mission execution. Communication systems capable of switching from underwater acoustic links to radio frequency or satellite networks are critical for maintaining command and data exchange across mediums. Autonomous control algorithms enhance operational independence, allowing UAVs to adapt mission parameters in real time based on environmental inputs and tactical needs. Energy storage improvements, such as high-density batteries and hybrid power sources, extend mission endurance and range. The integration of miniature sensors, cameras, and electronic warfare payloads further increases operational versatility. These technological strides collectively transform underwater launchable UAVs into multi-domain force multipliers, capable of delivering timely intelligence and tactical support while maintaining stealth and survivability in complex maritime theaters.

Key Drivers in Underwater launchable UAVs Market:

Several strategic and operational imperatives drive the development of underwater launchable UAVs. The increasing need for stealthy surveillance and intelligence gathering in contested maritime environments makes covert deployment from submerged platforms highly attractive. Naval forces face growing challenges in maintaining situational awareness in littoral zones and denied areas, where traditional airborne or surface assets risk early detection or interdiction. Underwater launchable UAVs offer a discreet alternative, minimizing the footprint of reconnaissance missions while maximizing coverage. The rise of asymmetric threats, including swarming small boats, underwater mines, and hostile submarines, underscores the demand for rapid, precise, and persistent observation capabilities. Additionally, the push for networked multi-domain operations encourages platforms that can seamlessly integrate underwater, surface, and aerial intelligence streams. Budget constraints and operational efficiency also favor reusable, remotely operated systems over manned sorties, lowering risk to personnel. Furthermore, geopolitical competition in strategically vital waterways has intensified interest in advanced technologies that enhance naval dominance and deterrence. These drivers converge to make underwater launchable UAVs a key component in future naval doctrine, offering a strategic edge by enabling stealthy, flexible, and persistent maritime operations.

Regional Trends in Underwater launchable UAVs Market:

Regional security dynamics and technological capabilities heavily influence the adoption and development of underwater launchable UAVs. In the Indo-Pacific, growing maritime disputes and the expansion of submarine fleets have spurred investments in stealthy reconnaissance systems that can operate in both deep ocean and congested littoral waters. Nations in this region are actively pursuing indigenous programs while partnering with international developers to advance UAV deployment from underwater platforms. Europe's emphasis on integrated maritime security and NATO interoperability has encouraged collaborative efforts to standardize underwater UAV systems that support collective surveillance and defense missions. In the Middle East, protection of critical maritime chokepoints and offshore infrastructure has led to growing interest in versatile UAVs capable of monitoring both surface and subsurface threats. North America, with its technological edge, focuses on pushing the boundaries of autonomy, endurance, and multi-domain integration for underwater-launched UAVs, often aligning development with broader naval modernization efforts. Emerging naval powers in South America and Southeast Asia are gradually exploring these technologies to enhance coastal defense and maritime domain awareness, often through technology transfer and regional cooperation. Across regions, the trend is clear: underwater launchable UAVs are becoming vital assets tailored to meet specific operational needs shaped by geographic, political, and threat landscapes.

Key Underwater launchable UAVs Program:

In a move to enhance India's underwater military capabilities, the Defence Research and Development Organisation (DRDO) has initiated the development of the country's first underwater-launched unmanned aerial vehicles (ULUAVs), designed to be deployed from submarines. The project is being carried out in collaboration with Pune-based defence startup Sagar Defence Engineering Pvt Ltd. The technology development contract was awarded to Sagar Defence under DRDO's Technology Development Fund (TDF) after a competitive selection process involving 17 firms. DRDO's Defence Research & Development Laboratory (DRDL), which previously worked with the startup on a maritime spotter drone for the Indian Navy, will provide technical support for the ULUAV project. These ULUAVs will be capable of launching autonomously from moving submarines, offering high endurance and extended range. Their discreet deployment will provide a significant strategic advantage by enabling covert surveillance missions without compromising the submarine's position. The contract was signed in the presence of DRDL Director Dr. G.A.S. Murthy and officials from the Indian Navy.

Table of Contents

Underwater Launchable UAVS Market Report Definition

Underwater Launchable UAVS Market Segmentation

By Region

By Type

By Propulsion

Underwater Launchable UAVS Market Analysis for next 10 Years

The 10-year underwater launchable UAVS market analysis would give a detailed overview of missile and smart kits guidance market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Underwater Launchable UAVS Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Underwater Launchable UAVS Market Forecast

The 10-year underwater launchable UAVS market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Underwater Launchable UAVS Market Trends & Forecast

The regional underwater launchable UAVS market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Underwater Launchable UAVS Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Underwater Launchable UAVS Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Underwater Launchable UAVS Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Underwater Launchable UAVS Market Forecast, 2025-2035

- Figure 2: Global Underwater Launchable UAVS Market Forecast, By Region, 2025-2035

- Figure 3: Global Underwater Launchable UAVS Market Forecast, By Platform, 2025-2035

- Figure 4: Global Underwater Launchable UAVS Market Forecast, By Type, 2025-2035

- Figure 5: North America, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 6: Europe, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 8: APAC, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 9: South America, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 10: United States, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 11: United States, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 12: Canada, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 14: Italy, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 16: France, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 17: France, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 18: Germany, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 24: Spain, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 30: Australia, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 32: India, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 33: India, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 34: China, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 35: China, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 40: Japan, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Underwater Launchable UAVS Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Underwater Launchable UAVS Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Underwater Launchable UAVS Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Underwater Launchable UAVS Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Underwater Launchable UAVS Market, By Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Underwater Launchable UAVS Market, By Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Underwater Launchable UAVS Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Underwater Launchable UAVS Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Underwater Launchable UAVS Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Underwater Launchable UAVS Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Underwater Launchable UAVS Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Underwater Launchable UAVS Market, By Region, 2025-2035

- Figure 58: Scenario 1, Underwater Launchable UAVS Market, By Platform, 2025-2035

- Figure 59: Scenario 1, Underwater Launchable UAVS Market, By Type, 2025-2035

- Figure 60: Scenario 2, Underwater Launchable UAVS Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Underwater Launchable UAVS Market, By Region, 2025-2035

- Figure 62: Scenario 2, Underwater Launchable UAVS Market, By Platform, 2025-2035

- Figure 63: Scenario 2, Underwater Launchable UAVS Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Underwater Launchable UAVS Market, 2025-2035