PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1714093

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1714093

Global Aerospace & Defense ER&D Market 2025-2035

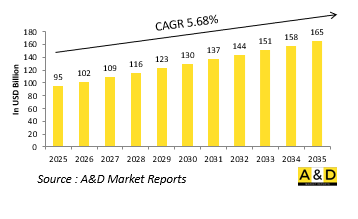

The global Aerospace & Defense ER&D market is estimated at USD 95 billion in 2025, projected to grow o USD 165 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.68% over the forecast period 2025-2035.

Introduction to Global Aerospace & Defense ER&D market:

The global aerospace and defense ER&D sector is evolving rapidly as industry stakeholders adapt to new strategic imperatives and technological frontiers. As the boundaries between traditional aerospace domains and emerging verticals like cyber defense, autonomous systems, and low-earth orbit operations blur, ER&D is being redefined to support cross-domain functionality and integrated mission capabilities. No longer confined to in-house development by defense contractors and national space agencies, ER&D now includes agile contributions from startups, private space companies, and academic think tanks. These collaborative ecosystems aim to accelerate innovation while maintaining rigorous compliance with security and safety protocols. Moreover, with space becoming an increasingly contested and commercialized domain, ER&D programs are broadening in scope to include satellite resilience, reusable space vehicles, and space situational awareness technologies. As global tensions rise and commercial aviation markets diversify, ER&D is positioned not just as a support function, but as a strategic lever that enables nations and corporations to stay ahead in an era of multipolar competition.

Technology Impact in Aerospace & Defense ER&D Market:

Modern aerospace and defense ER&D is being reshaped by a wave of interconnected technologies that are changing both the capabilities of systems and the methods used to develop them. Advanced simulation and modeling platforms now allow engineers to evaluate system performance in virtual combat and environmental scenarios long before a prototype is built. This shift from physical to digital validation accelerates design cycles and reduces development risk. Sensor fusion-combining data from infrared, radar, acoustic, and other sources-is enabling superior situational awareness and target recognition in defense applications. In the aerospace sector, onboard health monitoring systems powered by real-time analytics are revolutionizing aircraft reliability and maintenance planning. Furthermore, swarm intelligence-used in coordinating autonomous drones and unmanned underwater vehicles-introduces new operational paradigms for surveillance and combat operations. Human-machine teaming, another area of intense research, is driving the development of cockpits and command interfaces that dynamically adapt to human behavior, stress levels, and mission context. The convergence of these technologies is elevating aerospace and defense ER&D to a level where systems can anticipate, learn, and adapt in real time, aligning with future needs for autonomy and resilience.

Key Drivers in Aerospace & Defense ER&D Market:

A number of strategic, operational, and market-driven forces are shaping the trajectory of aerospace and defense ER&D worldwide. One of the most critical drivers is the imperative for resilience in an increasingly contested global security environment. Adversaries' advancements in anti-access/area denial (A2/AD) technologies are pushing defense organizations to rethink system survivability, redundancy, and mission continuity. This is leading to a surge in R&D for distributed platforms, stealth technologies, and resilient space architectures. Another influential driver is the growing demand for real-time intelligence and global reach, necessitating highly networked systems that can operate across multiple domains-land, air, sea, cyber, and space. Meanwhile, in the commercial aerospace realm, evolving passenger expectations, urban mobility trends, and sustainability goals are spurring ER&D into developing supersonic travel, noise-reduction technologies, and hybrid-electric propulsion systems. Additionally, defense procurement models are increasingly favoring modular and open-architecture designs, enabling rapid upgrades and technology refresh cycles. These shifts are encouraging more iterative and collaborative engineering models, which is transforming ER&D into a continuous, data-driven innovation process rather than a linear development cycle.

Regional Trends in Aerospace & Defense ER&D Market:

The global distribution of aerospace and defense ER&D efforts reveals how different regions prioritize and approach innovation based on their strategic needs, industrial base, and geopolitical outlook. In North America, particularly the United States, ER&D remains focused on maintaining a technological edge in multi-domain operations, with heavy investment in hypersonics, counter-space capabilities, and digital engineering environments. Canada complements this with initiatives in aerospace sustainability and dual-use technologies. In Europe, innovation is being shaped by increased emphasis on sovereignty and collective defense, particularly through frameworks such as the European Defence Fund. Programs like the Tempest fighter jet in the UK and the joint Franco-German FCAS demonstrate Europe's growing ambition in developing indigenous platforms supported by robust ER&D ecosystems. In Asia-Pacific, regional dynamics vary significantly-China prioritizes self-reliance in military technologies and space dominance, while India expands its indigenous programs like the Gaganyaan mission and the Tejas fighter. Japan and South Korea, meanwhile, are increasing their R&D investments in space security and next-gen surveillance systems to keep pace with regional threats. In the Middle East, nations like the UAE and Saudi Arabia are shifting from being customers to co-developers of defense systems, establishing R&D centers and forming technology transfer partnerships to build homegrown capabilities. This growing regional diversification in ER&D efforts is contributing to a more fragmented but highly competitive global landscape.

Key Aerospace & Defense ER&D Program:

The British Army recently conducted its largest-ever trial of a UK-developed radiofrequency directed energy weapon (RF DEW) system, successfully testing it against drone swarms. Held at a weapons range in West Wales, the trial saw UK troops use the system to bring down two drone swarms in a single engagement. In total, the system tracked, engaged, and neutralized over 100 drones throughout the series of tests. The project was spearheaded by Team Hersa, a collaboration between Defence Equipment & Support and the Defence Science and Technology Laboratory, with Thales UK developing the system under a £40 million ($50 million) government investment.

Table of Contents

Global aerospace and defense engineering and R&D (ER&D) Market - Table of Contents

Global aerospace and defense engineering and R&D (ER&D) market Report Definition

Global aerospace and defense engineering and R&D (ER&D) market Segmentation

By Region

By Type

By Platform

By Application

Global aerospace and defense engineering and R&D (ER&D) market Analysis for next 10 Years

The 10-year Globalaerospace and defense engineering and R&D (ER&D) market analysis would give a detailed overview of Globalaerospace and defense engineering and R&D (ER&D) market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global aerospace and defense engineering and R&D (ER&D)

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global aerospace and defense engineering and R&D (ER&D) market Forecast

The 10-year Globalaerospace and defense engineering and R&D (ER&D) market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional aerospace and defense engineering and R&D (ER&D) market Trends & Forecast

The regional Globalaerospace and defense engineering and R&D (ER&D) market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global aerospace and defense engineering and R&D (ER&D) market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global aerospace and defense engineering and R&D (ER&D) market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Technology Focus, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Domain, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Technology Focus, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Domain, 2025-2035

List of Figures

- Figure 1: Global Aerospace and Defense R&D Forecast, 2025-2035

- Figure 2: Global Aerospace and Defense R&D Forecast, By Region, 2025-2035

- Figure 3: Global Aerospace and Defense R&D Forecast, By Technology Focus, 2025-2035

- Figure 4: Global Aerospace and Defense R&D Forecast, By Application, 2025-2035

- Figure 5: Global Aerospace and Defense R&D Forecast, By Domain, 2025-2035

- Figure 6: North America, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 7: Europe, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 8: Middle East, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 9: APAC, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 10: South America, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 11: United States, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 12: United States, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 13: Canada, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 14: Canada, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 15: Italy, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 16: Italy, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 17: France, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 18: France, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 19: Germany, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 20: Germany, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 21: Netherlands, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 23: Belgium, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 24: Belgium, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 25: Spain, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 26: Spain, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 27: Sweden, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 28: Sweden, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 29: Brazil, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 30: Brazil, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 31: Australia, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 32: Australia, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 33: India, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 34: India, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 35: China, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 36: China, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 39: South Korea, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 40: South Korea, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 41: Japan, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 42: Japan, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 43: Malaysia, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 45: Singapore, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 46: Singapore, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Aerospace and Defense R&D, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Aerospace and Defense R&D, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Aerospace and Defense R&D, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Aerospace and Defense R&D, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Aerospace and Defense R&D, By Technology Focus (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Aerospace and Defense R&D, By Technology Focus (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Aerospace and Defense R&D, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Aerospace and Defense R&D, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Aerospace and Defense R&D, By Domain (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Aerospace and Defense R&D, By Domain (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Aerospace and Defense R&D, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Aerospace and Defense R&D, Global Market, 2025-2035

- Figure 59: Scenario 1, Aerospace and Defense R&D, Total Market, 2025-2035

- Figure 60: Scenario 1, Aerospace and Defense R&D, By Region, 2025-2035

- Figure 61: Scenario 1, Aerospace and Defense R&D, By Technology Focus, 2025-2035

- Figure 62: Scenario 1, Aerospace and Defense R&D, By Application, 2025-2035

- Figure 63: Scenario 1, Aerospace and Defense R&D, By Domain, 2025-2035

- Figure 64: Scenario 2, Aerospace and Defense R&D, Total Market, 2025-2035

- Figure 65: Scenario 2, Aerospace and Defense R&D, By Region, 2025-2035

- Figure 66: Scenario 2, Aerospace and Defense R&D, By Technology Focus, 2025-2035

- Figure 67: Scenario 2, Aerospace and Defense R&D, By Application, 2025-2035

- Figure 68: Scenario 2, Aerospace and Defense R&D, By Domain, 2025-2035

- Figure 69: Company Benchmark, Aerospace and Defense R&D, 2025-2035