PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1719518

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1719518

Global Transport Aircraft Simulation Market 2025-2035

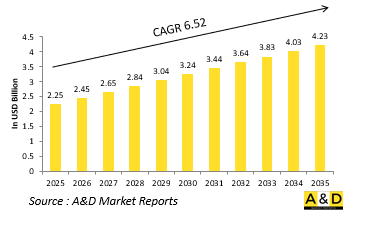

The Global Transport Aircraft Simulation market is estimated at USD 2.25 billion in 2025, projected to grow to USD 4.23 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 6.52% over the forecast period 2025-2035.

Introduction to Transport Aircraft Simulation Market:

Transport aircraft simulation has emerged as an essential component in modern military and humanitarian aviation operations. These aircraft serve a vital role in supporting logistics, troop movement, disaster response, medical evacuation, and aerial resupply across vast and often hostile environments. The increasing complexity of missions involving transport fleets demands precise coordination, high situational awareness, and consistent crew proficiency. Simulation offers a cost-effective, controlled environment to train flight crews, loadmasters, and mission planners in a range of scenarios-many of which would be difficult, dangerous, or resource-intensive to replicate in live operations. By recreating both routine and emergency procedures, simulators allow teams to rehearse cargo loading under time constraints, low-visibility landings, fuel management during extended flights, and coordinated aerial drops in contested zones. Globally, armed forces and government agencies are investing in transport aircraft simulation to ensure mission continuity under pressure, enhance multinational coordination, and reduce training time for increasingly complex aircraft systems. These simulation platforms are tailored not only for basic flight operations but also for comprehensive mission rehearsal, supporting both peacetime logistics and critical operations in conflict or crisis zones. As global demands on airlift capabilities increase, simulation plays a central role in sustaining readiness, safety, and operational excellence.

Technology Impact in Transport Aircraft Simulation Market:

Technological advancements have significantly elevated the realism and training value of transport aircraft simulation. Modern simulators incorporate precise flight dynamics, realistic cockpit environments, and advanced sensory feedback systems that mirror real-world operations. High-definition visual displays replicate diverse terrain, weather conditions, and air traffic scenarios to challenge flight crews in a wide range of operational settings. The integration of immersive technologies, including virtual and mixed reality, allows users to interact with simulated environments in ways that enhance spatial awareness and procedural memory. Motion systems add physical authenticity to cockpit behavior during takeoffs, landings, turbulence, and emergencies. Beyond basic flight simulation, these systems now model mission-specific elements such as cargo shifts, weight balancing, in-flight refueling alignment, and coordination with ground units during joint operations. Artificial intelligence enhances the adaptability of training scenarios by introducing variable outcomes, unexpected system failures, and dynamic mission changes. Networking capabilities also allow multiple simulators to operate together, enabling joint-force training with real-time communication and coordination. These technological improvements ensure that training remains relevant, flexible, and closely aligned with the demands of real-world transport missions, all while reducing operational risk and maintaining aircrew readiness.

Key Drivers in Transport Aircraft Simulation Market:

Several strategic factors are accelerating the adoption of simulation in the training and preparation of transport aircraft crews. One of the key drivers is the growing operational tempo of both military and humanitarian missions, which demands consistent and efficient airlift capacity across unpredictable environments. Simulation enables personnel to train under conditions that mirror the urgency and complexity of real missions, such as rapid evacuations, precision air drops, and supply runs into underdeveloped or contested regions. The increasing technical sophistication of transport aircraft, with complex avionics, automated systems, and digital flight controls, necessitates thorough crew training without over-relying on costly flight hours. Simulation provides a platform for practicing normal and emergency procedures without exposing personnel or equipment to risk. Additionally, the emphasis on global interoperability requires standardized training protocols and familiarization with allied operational procedures, which simulation platforms can replicate across various user bases. Environmental and cost considerations also make simulation an attractive alternative, reducing fuel consumption and maintenance wear during training. Finally, readiness for disaster relief, pandemic response, and other non-combat operations reinforces the need for flexible, scenario-driven simulation systems that prepare crews to respond to evolving global demands swiftly and effectively.

Regional Trends in Transport Aircraft Simulation Market:

Transport aircraft simulation exhibits distinct regional trends, reflecting varying defense priorities, logistics needs, and operational doctrines. In North America, simulation programs are deeply integrated into strategic airlift training, supporting both domestic and expeditionary missions. Emphasis is placed on complex coordination exercises, including formation flying, rapid response, and integration with joint task forces. European nations are focused on multinational interoperability, using simulation to enhance collaboration within coalition frameworks, humanitarian efforts, and air mobility operations across diverse terrains and airspaces. These programs often involve cross-training initiatives to standardize procedures among partner nations. In the Asia-Pacific region, a mix of military modernization and increased disaster preparedness is driving investment in simulation for large aircraft operations, particularly in island nations and countries with expansive inland territories. Regional forces are using simulation to bolster their capabilities in troop movement, supply chain logistics, and contingency planning. In the Middle East, strategic lift is vital for rapid deployment, and simulation supports both defense planning and regional stability missions. Meanwhile, in Latin America and Africa, emerging transport capabilities are being supported through simulation partnerships and international training programs, enabling gradual but steady improvement in operational efficiency and aircrew self-sufficiency.

Key Transport Aircraft Simulation Program:

Airbus, Embraer, and Lockheed Martin are closely watching the Indian Air Force's (IAF) upcoming Medium Transport Aircraft (MTA) competition, which is expected to result in a substantial procurement of up to 80 aircraft. While an official timeline for the final decision has yet to be announced, IAF sources speaking to IDRW have indicated that the C-390 Millennium is currently seen as the leading contender, ahead of the C-130J and A400M turboprops. The Brazilian-made tactical transport jet stands out due to its versatility and potential for adaptation to multiple mission roles, including Airborne Early Warning (AEW), maritime patrol (MPA), aerial refueling, and Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR) operations.

Table of Contents

Global Transport Aircraft Simulation Market - Table of Contents

Global Transport Aircraft Simulation market Report Definition

Global Transport Aircraft Simulation market Segmentation

By Region

By Type

By Component

By Technology

Global Transport Aircraft Simulation market Analysis for next 10 Years

The 10-year Global Transport Aircraft Simulation market analysis would give a detailed overview of Global Transport Aircraft Simulation market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Transport Aircraft Simulation

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Transport Aircraft Simulation market Forecast

The 10-year Global Transport Aircraft Simulation market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Transport Aircraft Simulation market Trends & Forecast

The regional Global Transport Aircraft Simulation market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Transport Aircraft Simulation market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Transport Aircraft Simulation market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Component, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Component, 2025-2035

List of Figures

- Figure 1: Global Transport Aircraft Simulation Market Forecast, 2025-2035

- Figure 2: Global Transport Aircraft Simulation Market Forecast, By Region, 2025-2035

- Figure 3: Global Transport Aircraft Simulation Market Forecast, By Technology, 2025-2035

- Figure 4: Global Transport Aircraft Simulation Market Forecast, By Type, 2025-2035

- Figure 5: Global Transport Aircraft Simulation Market Forecast, By Component, 2025-2035

- Figure 6: North America, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 7: Europe, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 9: APAC, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 10: South America, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 11: United States, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 12: United States, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 13: Canada, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 15: Italy, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 17: France, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 18: France, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 19: Germany, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 25: Spain, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 31: Australia, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 33: India, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 34: India, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 35: China, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 36: China, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 41: Japan, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Transport Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Transport Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Transport Aircraft Simulation Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Transport Aircraft Simulation Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Transport Aircraft Simulation Market, By Technology (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Transport Aircraft Simulation Market, By Technology (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Transport Aircraft Simulation Market, By Type (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Transport Aircraft Simulation Market, By Type (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Transport Aircraft Simulation Market, By Component (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Transport Aircraft Simulation Market, By Component (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Transport Aircraft Simulation Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Transport Aircraft Simulation Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Transport Aircraft Simulation Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Transport Aircraft Simulation Market, By Region, 2025-2035

- Figure 61: Scenario 1, Transport Aircraft Simulation Market, By Technology, 2025-2035

- Figure 62: Scenario 1, Transport Aircraft Simulation Market, By Type, 2025-2035

- Figure 63: Scenario 1, Transport Aircraft Simulation Market, By Component, 2025-2035

- Figure 64: Scenario 2, Transport Aircraft Simulation Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Transport Aircraft Simulation Market, By Region, 2025-2035

- Figure 66: Scenario 2, Transport Aircraft Simulation Market, By Technology, 2025-2035

- Figure 67: Scenario 2, Transport Aircraft Simulation Market, By Type, 2025-2035

- Figure 68: Scenario 2, Transport Aircraft Simulation Market, By Component, 2025-2035

- Figure 69: Company Benchmark, Transport Aircraft Simulation Market, 2025-2035