PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1727194

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1727194

Global Fighter Aircraft Simulation Market 2025-2035

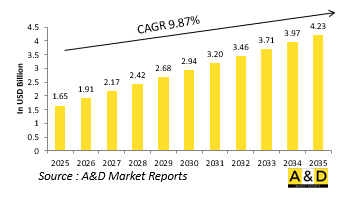

The Global Fighter Aircraft Simulation market is estimated at USD 1.65 billion in 2025, projected to grow to USD 4.23 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 9.87% over the forecast period 2025-2035.

Introduction to Fighter Aircraft Simulation Market:

Fighter aircraft simulation has become an essential element in the training and operational readiness of modern air forces. These systems replicate real-world flying environments, combat scenarios, and mission complexities, allowing pilots to develop and refine skills without the risks and costs of actual flight. Simulation supports a wide spectrum of training needs-from basic flight instruction to advanced combat maneuvers, electronic warfare, and joint-force coordination. These tools enable aircrews to repeatedly practice high-risk missions in a controlled setting, improving performance while preserving equipment and ensuring safety. Additionally, simulators contribute to decision-making and tactical planning by allowing teams to rehearse various scenarios under different threat conditions. With increasing sophistication, they can now mimic specific enemy tactics, airspace configurations, and environmental challenges. This realism not only enhances pilot competence but also supports strategic thinking and mission rehearsal across all levels of command. Fighter aircraft simulation is a critical component of force preparedness, bridging the gap between theoretical knowledge and live operational experience. As modern air combat grows more technologically advanced and unpredictable, simulation continues to be a key resource for cultivating skilled, adaptive, and mission-ready aircrews worldwide.

Technology Impact in Fighter Aircraft Simulation Market:

Technological advancement has dramatically expanded the capabilities of fighter aircraft simulation, turning it into a high-fidelity training and operational planning tool. Enhanced visual systems now provide ultra-realistic 3D environments, accurately representing landscapes, weather, and aerial threats. Motion platforms replicate the physical sensations of flight, while high-resolution cockpit displays and tactile controls provide immersion that closely mirrors real-world conditions. Artificial intelligence has further improved simulations by generating realistic adversary behaviors, challenging trainees with dynamic, responsive scenarios. Integration with digital twin models enables the replication of specific aircraft systems for technical training and performance analysis. Furthermore, networked simulations now allow multiple pilots and units to train together in synchronized, large-scale combat scenarios, supporting joint and coalition exercises. Augmented and virtual reality applications are also gaining ground, enabling cost-effective, portable training options that retain high interactivity. As these systems become more connected, they are increasingly integrated with live flight data and mission debriefing tools, supporting continuous feedback and improvement. This convergence of digital technologies has transformed simulation from a supplemental tool into a core capability for modern air forces. It enhances mission rehearsal, reduces wear on aircraft, and fosters adaptability in complex, fast-changing combat environments.

Key Drivers in Fighter Aircraft Simulation Market:

A range of operational, strategic, and economic factors is driving the growing emphasis on fighter aircraft simulation across global defense forces. One of the most influential drivers is the need for cost-effective training solutions. Live flight training involves significant resource expenditure, including fuel, maintenance, and airspace coordination, whereas simulators offer repeated, scalable training without the same logistical burden. Safety is another compelling factor; simulation provides a secure space to practice emergency procedures, combat engagements, and complex maneuvers without exposing personnel or aircraft to actual risk. As modern air combat increasingly incorporates advanced systems-such as electronic warfare suites, beyond-visual-range missiles, and integrated sensors-simulation offers a vital platform for pilots to train in using these technologies cohesively. It also supports preparation for multi-domain operations by enabling joint exercises with other branches or allied forces. Additionally, the unpredictability of global threats necessitates regular training updates and scenario flexibility, something simulation can accommodate much faster than real-world exercises. Lastly, simulation plays a crucial role in onboarding and upskilling new pilots, bridging the gap between classroom learning and live flight. These combined pressures have elevated simulation to a strategic priority in sustaining operational readiness and technological competence in modern air forces.

Regional Trends in Fighter Aircraft Simulation Market:

Regional adoption and evolution of fighter aircraft simulation systems reflect each area's defense strategies, training philosophies, and technological infrastructure. In North America, particularly within the United States, simulation is deeply embedded in pilot development and mission rehearsal programs, with a focus on integrating live-virtual-constructive (LVC) training frameworks that allow seamless transition between real and simulated elements. European nations prioritize modular and interoperable systems to support coalition-based operations, especially among NATO members, fostering shared training environments and standardized mission protocols. In the Asia-Pacific region, growing airpower ambitions and regional tensions have led countries like India, Japan, and Australia to invest heavily in advanced simulators that replicate local airspace and threat scenarios. These systems are often aligned with broader defense modernization goals, including indigenous aircraft development. In the Middle East, simulation plays a key role in building and maintaining combat readiness despite challenging environments and limited airspace for live training. Adoption in Latin America and Africa is more selective, often tied to specific modernization programs or partnerships with foreign defense suppliers. Across all regions, there is a growing shift toward using simulation not just for training but also for operational planning, system testing, and integrating future capabilities into evolving combat doctrines.

Key Fighter Aircraft Simulation Program:

Japan is reportedly considering the export of its next-generation fighter aircraft-currently being co-developed with the UK and Italy under the Global Combat Air Programme (GCAP)-to Australia. Last month, Tokyo also extended an invitation to India to join the GCAP initiative. In March 2024, the Japanese cabinet eased the country's strict regulations on defense equipment exports, creating a pathway for the future export of next-gen fighter jets. The relaxation of these rules is based on the condition that such exports will be limited to nations that have existing defense equipment and technology transfer agreements with Japan. Additionally, each potential export will be assessed individually, with decisions made following internal consultations within the ruling coalition.

Table of Contents

Fighter Aircraft SIMULATION Market - Table of Contents

Fighter Aircraft SIMULATION market Report Definition

Fighter Aircraft SIMULATION market Segmentation

By Region

By Technology

By Application

By Type

Fighter Aircraft SIMULATION market Analysis for next 10 Years

The 10-year Fighter Aircraft SIMULATION market analysis would give a detailed overview of Fighter Aircraft SIMULATION market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Fighter Aircraft SIMULATION market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Fighter Aircraft SIMULATION market Forecast

The 10-year Fighter Aircraft SIMULATION market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Fighter Aircraft SIMULATION market Trends & Forecast

The regional Fighter Aircraft SIMULATION market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Fighter Aircraft SIMULATION market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Fighter Aircraft SIMULATION market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Fighter Aircraft Simulation Market Forecast, 2025-2035

- Figure 2: Global Fighter Aircraft Simulation Market Forecast, By Region, 2025-2035

- Figure 3: Global Fighter Aircraft Simulation Market Forecast, By Type, 2025-2035

- Figure 4: Global Fighter Aircraft Simulation Market Forecast, By Technology, 2025-2035

- Figure 5: Global Fighter Aircraft Simulation Market Forecast, By Application, 2025-2035

- Figure 6: North America, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 7: Europe, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 9: APAC, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 10: South America, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 11: United States, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 12: United States, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 13: Canada, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 15: Italy, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 17: France, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 18: France, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 19: Germany, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 25: Spain, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 31: Australia, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 33: India, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 34: India, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 35: China, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 36: China, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 41: Japan, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Fighter Aircraft Simulation Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Fighter Aircraft Simulation Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Fighter Aircraft Simulation Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Fighter Aircraft Simulation Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Fighter Aircraft Simulation Market, By Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Fighter Aircraft Simulation Market, By Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Fighter Aircraft Simulation Market, By Technology (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Fighter Aircraft Simulation Market, By Technology (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Fighter Aircraft Simulation Market, By Application (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Fighter Aircraft Simulation Market, By Application (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Fighter Aircraft Simulation Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Fighter Aircraft Simulation Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Fighter Aircraft Simulation Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Fighter Aircraft Simulation Market, By Region, 2025-2035

- Figure 61: Scenario 1, Fighter Aircraft Simulation Market, By Type, 2025-2035

- Figure 62: Scenario 1, Fighter Aircraft Simulation Market, By Technology, 2025-2035

- Figure 63: Scenario 1, Fighter Aircraft Simulation Market, By Application, 2025-2035

- Figure 64: Scenario 2, Fighter Aircraft Simulation Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Fighter Aircraft Simulation Market, By Region, 2025-2035

- Figure 66: Scenario 2, Fighter Aircraft Simulation Market, By Type, 2025-2035

- Figure 67: Scenario 2, Fighter Aircraft Simulation Market, By Technology, 2025-2035

- Figure 68: Scenario 2, Fighter Aircraft Simulation Market, By Application, 2025-2035

- Figure 69: Company Benchmark, Fighter Aircraft Simulation Market, 2025-2035