PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1727191

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1727191

Global Main Battle Tank Thermal Camera Market 2025-2035

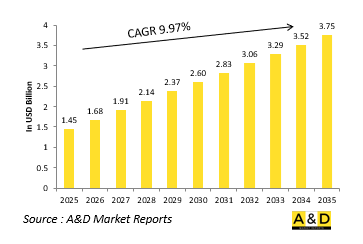

The Global Main Battle Tank Thermal Camera Market is estimated at USD 1.45 billion in 2025, projected to grow to USD 3.75 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 9.97% over the forecast period 2025-2035.

Introduction to Main Battle Tank Thermal Camera Market:

Thermal cameras are a critical part of the sensor suite onboard modern main battle tanks, offering unmatched capabilities for target detection, navigation, and threat engagement across diverse combat conditions. These cameras function by capturing infrared radiation emitted by objects, enabling tank crews to visualize the battlefield even in total darkness, through smoke, fog, or camouflage. Unlike conventional optics, thermal imaging reveals temperature differences, helping distinguish vehicles, personnel, and other heat sources regardless of visual concealment. For tank commanders, gunners, and drivers, thermal cameras provide enhanced battlefield awareness, enabling accurate firing solutions and movement coordination. Mounted typically in the gunner's sight, commander's panoramic viewers, and driver assistance systems, these devices play a pivotal role in high-intensity armored warfare. The introduction of thermal imaging has significantly elevated the effectiveness of MBTs, reducing reaction times and improving hit probability under adverse conditions. Their integration into fire control systems ensures faster and more reliable target acquisition. As armored units operate in increasingly unpredictable and complex operational environments, thermal imaging has become an essential tool for maintaining dominance in ground combat. Across global defense forces, the adoption of thermal systems reflects a broader push for greater precision, survivability, and operational readiness in mechanized warfare.

Technology Impact in Main Battle Tank Thermal Camera Market:

Technological innovation has transformed thermal cameras from basic imaging devices into advanced, networked battlefield sensors onboard main battle tanks. Today's systems offer far greater resolution, range, and reliability than earlier models, delivering crisp imagery that enables precise identification of targets at extended distances. Enhanced thermal sensitivity now allows for finer distinction between similar heat sources, aiding in friend-or-foe discrimination. Image stabilization and software-based enhancements ensure clear visibility even when the tank is moving rapidly or operating in rough terrain. Modern thermal systems are also increasingly integrated with digital fire control and situational awareness platforms, enabling automatic target tracking and improved ballistic solutions. Some tanks now feature multi-channel optics, combining thermal and day cameras into a single user interface, streamlining operations for the crew. Real-time sharing of thermal data with other vehicles or command units enables coordinated action and quicker responses in fluid combat situations. Miniaturization and ruggedization have also improved, making sensors more durable and easier to maintain in the field. With the growing use of AI, thermal imaging is being paired with algorithms capable of object classification and threat prioritization. These advancements significantly boost a tank's lethality, protection, and tactical value, reinforcing the role of thermal imaging as a cornerstone of armored warfare.

Key Drivers in Main Battle Tank Thermal Camera Market:

The growing complexity of land warfare and the evolving nature of threats are primary forces driving the adoption of thermal cameras in main battle tanks. These sensors enable forces to operate effectively in conditions that would otherwise compromise visual systems, such as night operations, adverse weather, or environments filled with smoke and debris. With the shift toward high-mobility, rapid-reaction ground forces, the ability to detect and engage targets accurately without relying on ambient light has become a tactical necessity. Enemy use of concealment tactics and terrain for cover further underscores the need for thermal imaging, which can identify hidden threats that traditional optics might miss. As modern tanks are expected to perform in a variety of roles-ranging from urban engagements to open-field warfare-thermal cameras provide the adaptability required to maintain combat effectiveness across these scenarios. Upgrades to older tank fleets also drive demand, as thermal systems are often part of broader modernization packages that extend vehicle relevance on the battlefield. In addition, advances in autonomous and semi-autonomous targeting platforms are increasing the importance of sensor systems, with thermal imaging playing a key role in feeding data to automated decision-support tools. These factors make thermal capability a standard, not a luxury, in modern armored doctrine.

Regional Trends in Main Battle Tank Thermal Camera Market:

Adoption and advancement of thermal cameras for main battle tanks vary widely across regions, reflecting differences in defense priorities, operational environments, and technological capabilities. In Western countries, particularly in North America and parts of Europe, thermal imaging is deeply integrated into MBT platforms as part of advanced digitization and networked warfare strategies. These nations focus on high-performance sensors that support long-range engagement and multi-crew coordination. Eastern European countries, responding to increasing security challenges, are accelerating the upgrade of legacy tanks with thermal systems to enhance survivability and targeting accuracy in potential frontline deployments. In the Asia-Pacific region, growing tensions and expanding armored forces have led to increased investment in domestic sensor development and integration. Nations such as South Korea and India are placing emphasis on indigenous solutions to support their strategic autonomy. In the Middle East, thermal technology is essential for effective combat in open, arid environments where visibility is often impaired by dust and heat. These systems also play a major role in countering unconventional threats in both rural and urban areas. Meanwhile, Latin America and Africa exhibit more limited adoption, often driven by international aid or selective procurement projects aimed at bolstering border security or internal stability missions.

Key Main Battle Tank Thermal Camera Program:

Hyundai Rotem, a prominent South Korean defense manufacturer, has formally registered a next-generation tank project with the South Korean patent office. The patent application, submitted on August 26, 2024, was approved on April 17, 2025, with the decision publicly disclosed on April 21, 2025. Informally referred to by some analysts as the "K3" - a likely successor to the K2 Black Panther - the new tank features a notably streamlined design compared to earlier concept renderings. Its turret modules appear robust, suggesting a heavily armored platform that incorporates advanced protection materials, including steel, ceramics, and composite armor.

Table of Contents

Main Battle Thermal Camera Market - Table of Contents

Main Battle Thermal Camera Market Report Definition

Main Battle Thermal Camera Market Segmentation

By Type

By Technology

By Region

Main Battle Thermal Camera Market Analysis for next 10 Years

The 10-year Main Battle thermal camera market analysis would give a detailed overview of Main Battle thermal camera market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Main Battle Thermal Camera Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Main Battle Thermal Camera Market Forecast

The 10-year Main Battle thermal camera market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Main Battle Thermal Camera Market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Main Battle Thermal Camera Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Main Battle Thermal Camera Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Main Battle Thermal Camera Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Component, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Component, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Main Battle Tank Thermal Camera Market Forecast, 2025-2035

- Figure 2: Global Main Battle Tank Thermal Camera Market Forecast, By Region, 2025-2035

- Figure 3: Global Main Battle Tank Thermal Camera Market Forecast, By Component, 2025-2035

- Figure 4: Global Main Battle Tank Thermal Camera Market Forecast, By Technology, 2025-2035

- Figure 5: Global Main Battle Tank Thermal Camera Market Forecast, By Application, 2025-2035

- Figure 6: North America, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 7: Europe, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 9: APAC, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 10: South America, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 11: United States, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 12: United States, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 13: Canada, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 15: Italy, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 17: France, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 18: France, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 19: Germany, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 25: Spain, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 31: Australia, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 33: India, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 34: India, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 35: China, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 36: China, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 41: Japan, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Component (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Component (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Technology (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Technology (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Application (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Application (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Main Battle Tank Thermal Camera Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Main Battle Tank Thermal Camera Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Main Battle Tank Thermal Camera Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Main Battle Tank Thermal Camera Market, By Region, 2025-2035

- Figure 61: Scenario 1, Main Battle Tank Thermal Camera Market, By Component, 2025-2035

- Figure 62: Scenario 1, Main Battle Tank Thermal Camera Market, By Technology, 2025-2035

- Figure 63: Scenario 1, Main Battle Tank Thermal Camera Market, By Application, 2025-2035

- Figure 64: Scenario 2, Main Battle Tank Thermal Camera Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Main Battle Tank Thermal Camera Market, By Region, 2025-2035

- Figure 66: Scenario 2, Main Battle Tank Thermal Camera Market, By Component, 2025-2035

- Figure 67: Scenario 2, Main Battle Tank Thermal Camera Market, By Technology, 2025-2035

- Figure 68: Scenario 2, Main Battle Tank Thermal Camera Market, By Application, 2025-2035

- Figure 69: Company Benchmark, Main Battle Tank Thermal Camera Market, 2025-2035