PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1838154

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1838154

Global Main Battle Tank Market 2025-2035

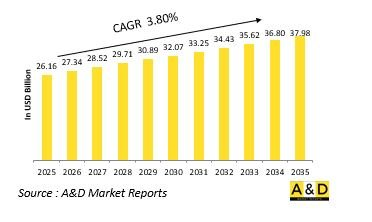

The Global Main Battle Tank market is estimated at USD 26.16 billion in 2025, projected to grow to USD 37.98 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 3.80% over the forecast period 2025-2035.

Introduction to Main Battle Tank Market:

The defense main battle tank market remains a cornerstone of modern land warfare, combining firepower, protection, and mobility to dominate in both conventional and asymmetric conflicts. Main battle tanks (MBTs) serve as the backbone of armored forces, providing decisive combat capability across varied terrains and operational theaters. The evolution of MBTs has been shaped by shifting military doctrines that emphasize multi-domain integration, survivability, and precision engagement. Modern tanks are no longer isolated battlefield platforms but networked systems capable of sharing data with reconnaissance units, drones, and command centers in real time. As threats evolve, the role of MBTs continues to expand beyond direct engagement. They serve as psychological deterrents, projecting strength and ensuring dominance during both offensive maneuvers and peacekeeping operations. The integration of advanced armor materials, digital fire-control systems, and active protection measures has elevated the combat readiness of these vehicles. Furthermore, the resurgence of territorial disputes and large-scale land conflicts has reaffirmed the strategic importance of armored formations. With modernization programs underway in multiple nations, MBTs are being redesigned for greater agility, modularity, and survivability, ensuring their continued relevance in an era of rapidly advancing defense technologies and changing combat dynamics.

Technology Impact in Main Battle Tank Market:

Technological innovation is redefining the capabilities of main battle tanks, transforming them into highly networked, adaptive, and resilient combat platforms. Advancements in armor technology, such as composite and reactive armor systems, are enhancing survivability against kinetic and chemical energy projectiles. Active protection systems now enable tanks to detect and neutralize incoming threats like anti-tank guided missiles before impact, significantly improving crew safety. At the same time, advancements in engine design and hybrid propulsion are improving mobility, fuel efficiency, and operational range without compromising power. Digitalization is another major transformation driver. Integrated battlefield management systems allow MBTs to share situational awareness data, synchronize with drones, and operate as part of network-centric warfare environments. Modern fire-control systems and advanced optics enhance targeting precision, even under adverse conditions, while automation and AI-assisted functions are simplifying operations and reducing crew workload. The emergence of unmanned or optionally manned tank concepts further illustrates the direction of technological progress, offering new tactical flexibility. Moreover, the use of additive manufacturing for spare parts and modular designs simplifies maintenance and upgrades. These innovations collectively ensure that main battle tanks continue to evolve as technologically sophisticated platforms capable of maintaining dominance in future combat scenarios.

Key Drivers in Main Battle Tank Market:

The demand for main battle tanks in the defense market is driven by a combination of evolving security challenges, modernization imperatives, and technological advancements. Increasing geopolitical tensions and the reemergence of high-intensity warfare have compelled militaries to strengthen their armored forces for deterrence and rapid response. MBTs are central to this strategy, offering unmatched firepower, protection, and shock effect in land-based combat operations. Modernization of aging fleets is a critical factor driving market growth. Many nations are upgrading legacy platforms with digital systems, advanced sensors, and improved armor configurations to meet modern warfare requirements. The push for interoperability with other battlefield assets, including unmanned systems and command networks, is also influencing procurement decisions. Additionally, the focus on urban warfare and hybrid conflict environments has led to the development of lighter, more agile MBTs capable of operating effectively in complex terrains. Defense industrial collaboration and indigenous production initiatives are also supporting demand, as countries seek self-reliance in armored vehicle manufacturing. Continuous innovation in propulsion, survivability, and weapon systems further sustains interest in MBT programs worldwide. Collectively, these factors underscore the enduring relevance of main battle tanks as essential assets in both deterrence and combat effectiveness.

Regional Trends in Main Battle Tank Market:

Regional trends in the main battle tank market are shaped by distinct strategic priorities, industrial capabilities, and threat perceptions. In technologically advanced defense regions, modernization programs focus on next-generation MBTs equipped with active protection systems, digital connectivity, and hybrid propulsion. These areas emphasize innovation, seeking to develop highly survivable and networked platforms capable of performing within multi-domain operations. The goal is to maintain armored superiority through integration of AI-based decision support, automation, and advanced situational awareness systems. In contrast, regions facing persistent territorial disputes and internal conflicts prioritize rapid acquisition and modernization of cost-effective tanks to ensure deterrence and operational readiness. These nations often pursue upgrade packages for existing fleets, balancing capability enhancement with budget constraints. Meanwhile, defense-industrial cooperation and joint development programs are fostering cross-border collaborations, enabling emerging economies to access advanced technologies while building domestic manufacturing expertise. Environmental and logistical considerations are also influencing regional strategies, with a growing emphasis on fuel efficiency and sustainability in armored vehicle design. Furthermore, the increasing focus on export-oriented production has expanded global competition, with countries positioning themselves as suppliers of advanced MBT solutions to allied and developing nations. These regional dynamics collectively shape the evolving landscape of the global main battle tank market.

Key Main Battle Tank Program:

The Indian Ministry of Defence has signed a $248-million contract with Rosoboronexport to supply advanced engines for the Indian Army's T-72 Ural main battle tanks. As part of the agreement, the Russian state-owned defense exporter will deliver 1,000-horsepower engines to replace the older 780-horsepower units currently installed on India's Soviet-era T-72 fleet. The army presently operates around 2,500 of these tanks, which have been in service since their production in the 1970s. The contract also includes a technology transfer arrangement that will enable India's state-run Armoured Vehicles Nigam Ltd. to locally manufacture the new engines under license, supporting domestic production and maintenance capabilities.

Table of Contents

Main Battle Tank Market - Table of Contents

Main Battle Tank Market Report Definition

Main Battle Tank Market Segmentation

By Region

By Type

Main Battle Tank Market Analysis for next 10 Years

The 10-year Main Battle Tank Market analysis would give a detailed overview of Main Battle Tank Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Main Battle Tank Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Main Battle Tank Market Forecast

The 10-year Main Battle Tank Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Main Battle Tank Market Trends & Forecast

The regional Main Battle Tank Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Main Battle Tank Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Main Battle Tank Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Main Battle Tank Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Process, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Process, 2025-2035

List of Figures

- Figure 1: Global Main Battle Tank Market Forecast, 2025-2035

- Figure 2: Global Main Battle Tank Market Forecast, By Region, 2025-2035

- Figure 3: Global Main Battle Tank Market Forecast, By Type, 2025-2035

- Figure 4: Global Main Battle Tank Market Forecast, By Process, 2025-2035

- Figure 5: North America, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 6: Europe, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 8: APAC, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 9: South America, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 10: United States, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 11: United States, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 12: Canada, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 14: Italy, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 16: France, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 17: France, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 18: Germany, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 24: Spain, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 30: Australia, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 32: India, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 33: India, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 34: China, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 35: China, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 40: Japan, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Main Battle Tank Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Main Battle Tank Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Main Battle Tank Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Main Battle Tank Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Main Battle Tank Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Main Battle Tank Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Main Battle Tank Market, By Process (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Main Battle Tank Market, By Process (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Main Battle Tank Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Main Battle Tank Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Main Battle Tank Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Main Battle Tank Market, By Region, 2025-2035

- Figure 58: Scenario 1, Main Battle Tank Market, By Type, 2025-2035

- Figure 59: Scenario 1, Main Battle Tank Market, By Process, 2025-2035

- Figure 60: Scenario 2, Main Battle Tank Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Main Battle Tank Market, By Region, 2025-2035

- Figure 62: Scenario 2, Main Battle Tank Market, By Type, 2025-2035

- Figure 63: Scenario 2, Main Battle Tank Market, By Process, 2025-2035

- Figure 64: Company Benchmark, Main Battle Tank Market, 2025-2035