PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1733885

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1733885

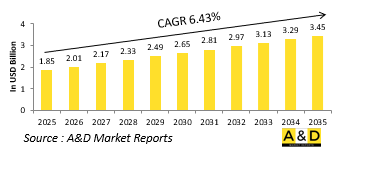

Global 12.7mm Market 2025-2035

The global 12.7mm market is estimated at USD 1.85 billion in 2025, projected to grow to USD 3.45 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 6.43% over the forecast period 2025-2035.

Introduction to Global 12.7mm market:

The 12.7mm caliber, often recognized as the .50 BMG (Browning Machine Gun), holds a pivotal role in both military and defense sectors globally. Originating as a heavy machine gun round, its usage has expanded into various platforms, including sniper rifles, anti-material weapons, and even some armored vehicles. The global demand for 12.7mm ammunition has been shaped by modern warfare dynamics, where long-range precision and armor-penetrating capabilities are crucial. Countries continue to invest in this caliber for its versatility, destructive potential, and ability to provide both offensive and defensive firepower. From NATO-aligned nations to non-aligned militaries, the 12.7mm round serves as a critical component of infantry and vehicle-mounted weapon systems. As geopolitical tensions persist and military modernization programs accelerate, the 12.7mm continues to gain relevance, underpinning its entrenched position in contemporary arsenals.

Technology Impact in 12.7mm Market:

Technological innovation has significantly transformed the capabilities of the 12.7mm caliber. Modern advancements have enhanced the performance of both the ammunition and the platforms that fire it. New propellant materials have increased range and consistency, while improved projectile designs have augmented penetration and accuracy. Integration with smart targeting systems and advanced optics has enabled users to engage targets more effectively at extended distances. Additionally, the development of lighter materials for weapons and mounts has made 12.7mm systems more deployable in diverse combat scenarios. The evolution of suppressors and recoil mitigation technologies has further refined the operational efficiency of this caliber. As digital warfare and precision engagement become more prominent, the 12.7mm is adapting with upgrades that align with networked battlefield strategies, ensuring it remains a relevant force multiplier in both conventional and asymmetric conflicts.

Key Drivers in 12.7mm Market:

Several key factors are propelling the continued use and development of the 12.7mm caliber across global defense markets. The rise in regional conflicts and border skirmishes necessitates versatile firepower, where 12.7mm weapons offer both deterrent and tactical advantages. Military modernization initiatives often prioritize interoperability and standardized calibers, making 12.7mm an attractive choice due to its wide adoption and combat-proven track record. Additionally, the shift toward asymmetric warfare has increased the demand for weapons capable of countering lightly armored threats, unmanned aerial vehicles, and fortified positions-roles well-suited to the 12.7mm. The commercial defense industry also plays a role, with continual R&D investments leading to more efficient and adaptable platforms. Moreover, partnerships between governments and private defense firms help sustain a robust supply chain and innovation ecosystem around the 12.7mm, ensuring its strategic importance continues to grow amid evolving operational needs.

Regional Trends in 12.7mm Market:

The deployment and development of 12.7mm systems vary across regions based on strategic priorities and defense capabilities. In North America, particularly the United States, the caliber is integral to ground forces and special operations, with substantial investments in next-generation weapon platforms and ammunition upgrades. Europe follows with a focus on NATO-standardization and integration into hybrid warfare doctrines. In the Asia-Pacific, nations such as India, China, and South Korea are enhancing their 12.7mm capabilities to address regional security concerns and assert military presence. The Middle East continues to be a significant consumer, driven by ongoing conflicts and the need for high-impact, mobile firepower. Meanwhile, African and Latin American countries show growing interest due to insurgency challenges and modernization efforts, albeit with more limited resources. Across these regions, the 12.7mm caliber remains a cornerstone of firepower strategy, reflecting diverse security imperatives and technological readiness levels.

Key 12.7mm Program:

Nammo has entered into a new contract with the Swedish Defence Materiel Administration (FMV), establishing the company as the exclusive supplier of 12.7mm ammunition through 2029. This seven-year agreement covers various types of 12.7mm ammunition, with deliveries sourced from Nammo's facilities in Palencia, Spain, and Raufoss, Norway. Nammo Sweden will act as the prime contractor for the contract. Under this contract, Nammo will serve as the primary provider of 12.7mm ammunition for the Swedish Armed Forces over the next seven years. The initial contract is valued at 120 million Swedish kronor, with the potential to increase to approximately 500 million Swedish kronor if all options are exercised.

Table of Contents

12.7mm Market - Table of Contents

12.7mm market Report Definition

12.7mm market Segmentation

By Region

By Type

By application

By Platform

12.7mm market Analysis for next 10 Years

The 10-year 12.7mm market analysis would give a detailed overview of 12.7mm market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of 12.7mm market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global 12.7mm market Forecast

The 10-year 12.7mm market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional 12.7mm market Trends & Forecast

The regional 12.7mm market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for 12.7mm market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on 12.7mm market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global 12.7mm Market Forecast, 2025-2035

- Figure 2: Global 12.7mm Market Forecast, By Region, 2025-2035

- Figure 3: Global 12.7mm Market Forecast, By Type, 2025-2035

- Figure 4: Global 12.7mm Market Forecast, By Platform, 2025-2035

- Figure 5: Global 12.7mm Market Forecast, By Application, 2025-2035

- Figure 6: North America, 12.7mm Market, Market Forecast, 2025-2035

- Figure 7: Europe, 12.7mm Market, Market Forecast, 2025-2035

- Figure 8: Middle East, 12.7mm Market, Market Forecast, 2025-2035

- Figure 9: APAC, 12.7mm Market, Market Forecast, 2025-2035

- Figure 10: South America, 12.7mm Market, Market Forecast, 2025-2035

- Figure 11: United States, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 12: United States, 12.7mm Market, Market Forecast, 2025-2035

- Figure 13: Canada, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 14: Canada, 12.7mm Market, Market Forecast, 2025-2035

- Figure 15: Italy, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 16: Italy, 12.7mm Market, Market Forecast, 2025-2035

- Figure 17: France, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 18: France, 12.7mm Market, Market Forecast, 2025-2035

- Figure 19: Germany, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 20: Germany, 12.7mm Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, 12.7mm Market, Market Forecast, 2025-2035

- Figure 23: Belgium, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, 12.7mm Market, Market Forecast, 2025-2035

- Figure 25: Spain, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 26: Spain, 12.7mm Market, Market Forecast, 2025-2035

- Figure 27: Sweden, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, 12.7mm Market, Market Forecast, 2025-2035

- Figure 29: Brazil, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, 12.7mm Market, Market Forecast, 2025-2035

- Figure 31: Australia, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 32: Australia, 12.7mm Market, Market Forecast, 2025-2035

- Figure 33: India, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 34: India, 12.7mm Market, Market Forecast, 2025-2035

- Figure 35: China, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 36: China, 12.7mm Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, 12.7mm Market, Market Forecast, 2025-2035

- Figure 39: South Korea, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, 12.7mm Market, Market Forecast, 2025-2035

- Figure 41: Japan, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 42: Japan, 12.7mm Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, 12.7mm Market, Market Forecast, 2025-2035

- Figure 45: Singapore, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, 12.7mm Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, 12.7mm Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, 12.7mm Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, 12.7mm Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, 12.7mm Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, 12.7mm Market, By Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, 12.7mm Market, By Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, 12.7mm Market, By Platform (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, 12.7mm Market, By Platform (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, 12.7mm Market, By Application (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, 12.7mm Market, By Application (CAGR), 2025-2035

- Figure 57: Scenario Analysis, 12.7mm Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, 12.7mm Market, Global Market, 2025-2035

- Figure 59: Scenario 1, 12.7mm Market, Total Market, 2025-2035

- Figure 60: Scenario 1, 12.7mm Market, By Region, 2025-2035

- Figure 61: Scenario 1, 12.7mm Market, By Type, 2025-2035

- Figure 62: Scenario 1, 12.7mm Market, By Platform, 2025-2035

- Figure 63: Scenario 1, 12.7mm Market, By Application, 2025-2035

- Figure 64: Scenario 2, 12.7mm Market, Total Market, 2025-2035

- Figure 65: Scenario 2, 12.7mm Market, By Region, 2025-2035

- Figure 66: Scenario 2, 12.7mm Market, By Type, 2025-2035

- Figure 67: Scenario 2, 12.7mm Market, By Platform, 2025-2035

- Figure 68: Scenario 2, 12.7mm Market, By Application, 2025-2035

- Figure 69: Company Benchmark, 12.7mm Market, 2025-2035