PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1735754

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1735754

Global Unmanned Naval Combat Market 2025-2035

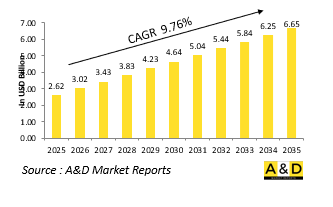

The Global Unmanned Naval Combat market is estimated at USD 2.62 billion in 2025, projected to grow to USD 6.65 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 9.76% over the forecast period 2025-2035.

Introduction to Unmanned Naval Combat Market:

Unmanned naval combat systems are transforming maritime warfare by introducing autonomy, precision, and persistent presence into naval operations without endangering human crews. These systems, which include surface and underwater vehicles, offer a range of strategic advantages-conducting surveillance, mine countermeasures, electronic warfare, and even offensive strikes. As naval domains become increasingly contested, defense forces are turning to unmanned platforms to extend operational reach, monitor vast maritime regions, and respond to threats more swiftly. Unlike traditional vessels, unmanned systems can operate for prolonged durations, often in environments too dangerous or remote for manned crews. They can also be deployed in swarms or coordinated units, offering layered and adaptive maritime defense. Global interest in these capabilities is expanding, with militaries seeking to modernize their fleets and adopt technologies that support multidomain operations. The development of these systems reflects a strategic shift in naval doctrine-prioritizing versatility, survivability, and real-time intelligence. As threats at sea become more complex, nations are investing in unmanned naval combat solutions to enhance deterrence, protect trade routes, and ensure maritime dominance. These platforms are no longer peripheral; they are becoming essential components of future naval warfare, seamlessly integrating with traditional assets and contributing to a more agile and resilient maritime force.

Technology Impact in Unmanned Naval Combat Market:

Technological innovation is driving unprecedented progress in the capabilities and effectiveness of unmanned naval combat systems. Modern advancements have enabled these platforms to operate autonomously, navigating complex maritime environments, avoiding obstacles, and executing missions without direct human control. Breakthroughs in sensor technologies have enhanced threat detection, target identification, and environmental awareness, allowing unmanned vessels to gather and relay critical data in real time. Communication systems have evolved to support secure, high-bandwidth links across vast ocean distances, facilitating remote coordination and data sharing with command centers and allied units. Artificial intelligence and machine learning algorithms are now embedded into these systems, enabling adaptive behaviors, predictive decision-making, and mission optimization. In addition, miniaturized electronics and efficient propulsion systems are extending operational range and endurance while reducing maintenance requirements. The integration of electronic warfare suites and modular payload bays allows these platforms to transition seamlessly between surveillance, offensive, and defensive roles. Importantly, these systems are being designed to collaborate with manned vessels, aircraft, and underwater platforms, creating a connected and cohesive combat environment. The technological impact is not only reshaping how naval forces conduct operations but also redefining strategic thinking about force deployment, threat engagement, and maritime situational dominance in the evolving theater of naval warfare.

Key Drivers in Unmanned Naval Combat Market:

The increasing complexity of maritime security challenges is fueling the adoption of unmanned naval combat systems across global defense communities. A major driver is the need to maintain persistent surveillance and deterrence across vast and often contested maritime regions without exposing personnel to high-risk environments. These systems offer the flexibility to operate in both peacetime patrols and active combat scenarios, making them highly adaptable to changing mission profiles. The desire to reduce the operational costs associated with traditional naval fleets also contributes to their appeal, as unmanned systems generally require fewer resources to deploy and sustain. Geopolitical tensions and competition over critical sea lanes, territorial waters, and undersea resources have underscored the importance of advanced maritime capabilities, prompting accelerated investment in unmanned platforms. The shift toward distributed maritime operations has further highlighted the need for networked, agile, and scalable systems that can respond swiftly to asymmetric threats. Additionally, evolving doctrines emphasize the importance of integrating unmanned systems into joint and coalition naval operations, enhancing interoperability and strategic reach. The ability to carry out reconnaissance, strike, and mine-clearing missions independently or in tandem with crewed assets has solidified these platforms as a cornerstone of future naval strategy, driven by the demand for versatility, survivability, and rapid response.

Regional Trends in Unmanned Naval Combat Market:

Global defense sectors are increasingly recognizing the strategic potential of unmanned naval combat systems, and regional trends reflect diverse priorities based on security concerns and maritime geography. In the Asia-Pacific region, coastal disputes and the need for maritime domain awareness are prompting significant investment in autonomous surface and underwater platforms. Nations with expansive coastlines and active shipping routes are focusing on surveillance and anti-submarine capabilities to ensure maritime control. In North America, particularly the United States, efforts are directed toward building integrated unmanned fleets that complement existing naval power, emphasizing long-range operations, intelligence gathering, and precision engagement. European countries are pursuing cooperative development programs, focusing on modular designs and interoperability to support both national and alliance-led missions. Their approach often includes combining surface and underwater systems to address a range of threats, from piracy to territorial incursion. In the Middle East, unmanned naval systems are being adopted to secure ports, monitor vital chokepoints, and conduct persistent patrols around key maritime infrastructure. African and Latin American regions are gradually exploring unmanned capabilities for coastal security and counter-smuggling operations, often in partnership with more established defense producers. Across all regions, the common thread is a growing emphasis on autonomy, adaptability, and integration into broader maritime defense architectures.

Key Unmanned Naval Combat Program:

HD Hyundai Heavy Industries (HD HHI), in collaboration with the Republic of Korea (ROK) Navy, is advancing the development of a naval combat unmanned surface vessel (USV), seen as a potential game-changer in future maritime operations. Designed to operate in frontline areas, the combat USV will undertake reconnaissance and close-combat missions, effectively reducing the need for manned vessels. It is expected to play a central role in future manned-unmanned teaming systems at sea. HD HHI plans to hold a kickoff meeting later this month and will spend the next eight months on concept design, aiming to complete this phase by December. The work will define the combat USV's performance requirements, key technologies, and procurement strategies. With this initiative, HD HHI intends to propose mission solutions tailored to future multi-domain warfare, while developing a USV that surpasses current manned platforms in reliability and cost-efficiency. The company has reaffirmed its commitment to leading the advancement of integrated manned-unmanned systems, starting with this project.

Table of Contents

Unmanned Naval Combat Market Report Definition

Unmanned Naval Combat Market Segmentation

By Guidance

By Type

By Region

Unmanned Naval Combat Market Analysis for next 10 Years

The 10-year Unmanned Naval Combat Market analysis would give a detailed overview of mortar ammunition market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Unmanned Naval Combat Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Unmanned Naval Combat Market Forecast

The 10-year Unmanned Naval Combat Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Unmanned Naval Combat Market Trends & Forecast

The regional Unmanned Naval Combat Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Unmanned Naval Combat Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Unmanned Naval Combat Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Power Unit, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Power Unit, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Unmanned Naval Combat Market Forecast, 2025-2035

- Figure 2: Global Unmanned Naval Combat Market Forecast, By Region, 2025-2035

- Figure 3: Global Unmanned Naval Combat Market Forecast, By Power Unit, 2025-2035

- Figure 4: Global Unmanned Naval Combat Market Forecast, By Application, 2025-2035

- Figure 5: North America, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 6: Europe, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 8: APAC, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 9: South America, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 10: United States, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 11: United States, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 12: Canada, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 14: Italy, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 16: France, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 17: France, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 18: Germany, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 24: Spain, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 30: Australia, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 32: India, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 33: India, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 34: China, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 35: China, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 40: Japan, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Unmanned Naval Combat Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Unmanned Naval Combat Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Unmanned Naval Combat Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Unmanned Naval Combat Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Unmanned Naval Combat Market, By Power Unit (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Unmanned Naval Combat Market, By Power Unit (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Unmanned Naval Combat Market, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Unmanned Naval Combat Market, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Unmanned Naval Combat Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Unmanned Naval Combat Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Unmanned Naval Combat Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Unmanned Naval Combat Market, By Region, 2025-2035

- Figure 58: Scenario 1, Unmanned Naval Combat Market, By Power Unit, 2025-2035

- Figure 59: Scenario 1, Unmanned Naval Combat Market, By Application, 2025-2035

- Figure 60: Scenario 2, Unmanned Naval Combat Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Unmanned Naval Combat Market, By Region, 2025-2035

- Figure 62: Scenario 2, Unmanned Naval Combat Market, By Power Unit, 2025-2035

- Figure 63: Scenario 2, Unmanned Naval Combat Market, By Application, 2025-2035

- Figure 64: Company Benchmark, Unmanned Naval Combat Market, 2025-2035