PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836478

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836478

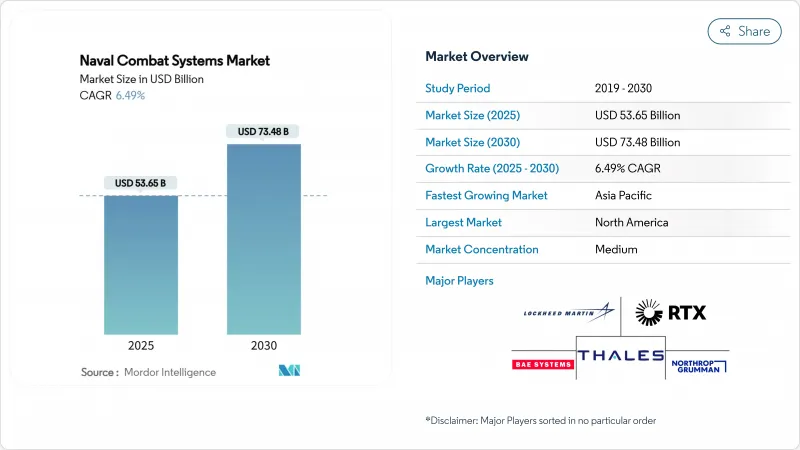

Naval Combat Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The naval combat systems market size is valued at USD 53.65 billion in 2025 and is projected to reach USD 73.48 billion in 2030, delivering a 6.49% CAGR.

The current expansion is propelled by simultaneous fleet-modernization programs, fast-maturing directed-energy technologies, and the rapid move toward distributed, unmanned naval architectures that reshape mission concepts and crew models. Growing investment in integrated combat-management suites, rising demand for electronic-warfare and C4ISR capabilities, and steady progress in DevSecOps pipelines all reinforce long-term spending momentum. Meanwhile, accelerated acquisition of unmanned surface and underwater vehicles redefines naval force structure, enabling persistent ISR and low-risk strike missions across contested seas. North American dominance is underpinned by the US Navy's large modernization budget. However, Asia-Pacific's growth outpaces all regions as China's third aircraft carrier and regional counter-moves from India, Japan, South Korea, and Australia spur parallel procurement cycles.

Global Naval Combat Systems Market Trends and Insights

Fleet-modernization programs in major navies

Global fleet-renewal initiatives are moving away from hull-replacement cycles and toward capability-centric buys that demand plug-and-play combat suites. Gray Flag 2024 validated joint software baselines that let allied warships share targeting data in minutes rather than hours. Australia's pledge to more than double its surface force by 2034 drives a pivot from frigate-heavy constructs to distributed formations requiring advanced sensor fusion. Germany's 2035 blueprint stresses modular mission packages, confirming that future hulls will outlive their first combat-system fit. Japan's co-development of next-generation frigates with Australia shows how partners pool R&D to speed entry into service. Together, these actions channel steady funding into the naval combat systems market and ensure multi-decade sustainment demand.

Rising Indo-Pacific Geopolitical Tensions

Beijing's deployment of the carrier Fujian has compressed acquisition lead times across Asia-Pacific, pushing navies to field hardware ahead of schedule. Multilateral patrols in the South China Sea illustrate how operational coalitions dictate real-time capability swaps rather than paper upgrades. Amphibious capacity is surging as regional states prepare for distributed operations, raising demand for integrated air-defence and strike packages. Japan's dual-carrier tasking during RIMPAC underscores an elevated sortie tempo that tests combat-system resilience in prolonged deployments. New bilateral forums on defence industrial cooperation institutionalise technology transfers that expand the naval combat systems market footprint.

Budget Caps Delaying Surface-Combatant Procurement

Tight ceilings have pushed the Constellation frigate two years right, rippling across allied co-production slots and stretching supplier cash-flow profiles. French planners face hard trade-offs between sustaining today's fleet and funding Horizon destroyer renewals. Canberra's massive shipbuilding plan must juggle domestic yard throughput with imported subsystems, risking schedule mismatch. When budgets lag, yards struggle to maintain skilled labor pipelines, raising cost per tonne and deferring combat-system buys that feed the naval combat systems market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of Integrated Combat-Management Suites

- Expansion of Naval Electronic-Warfare and C4ISR Demand

- Extended Weapon-Integration Certification Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Directed Energy Weapons claimed the fastest trajectory with a 9.63% CAGR forecast, supported by successful HELIOS proofs aboard Burke-class destroyers that validated beam-control stability at sea. Weapon Systems still hold a 45.65% slice of the naval combat systems market share for 2024, reflecting enduring demand for kinetic strike but acknowledging an inflection toward energy arms. Electronic-warfare suites secured multiyear funding upticks because electromagnetic denial dominates early-phase conflict. C4ISR packages ride the same wave, driven by a joint all-domain doctrine that links space, air, and surface sensors. Integrated combat software anchors every package, allowing navies to deploy updates between patrols and protecting the naval combat systems market size advantage for primes able to scale agile pipelines. Unmanned sea-system payload bays are being pre-wired for directed-energy turrets, ensuring backwards compatibility with future high-power modules. Training and simulation investments keep pace, as evidenced by the USD 563 million contract to J.F. Taylor, without which crews could not rehearse complex multi-domain kill chains.

The Naval Combat Systems Market Report is Segmented by Type (Weapon Systems, Electronic Warfare, C4ISR, Directed Energy Weapons, Integrated Combat Systems, Unmanned Sea Systems and More), Platform (Aircraft Carriers, Destroyers, Frigates, Corvettes, Submarines, Littoral Combat Ships, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.89% of 2024 revenue as the largest regional naval combat systems market contributor. The US Navy's FY25 topline preserved multi-billion funding lines for Aegis, Next Generation Jammer, and the long-range surface drone program that added 49 hulls in 2024. HII's USD 3 billion umbrella contract amplifies the region's pull-through effect on subsystem suppliers. At the same time, partnerships with South Korean yards hint at a blended production model that externalises capacity to allies. Canada's CSC frigate and Mexico's OPV modernization widen the customer base, though still modest in dollar terms. Across the region, primes prioritise secure DevSecOps pipelines to comply with zero-trust directives and protect an expansive naval combat systems market.

Asia-Pacific is the fastest-growing theatre at 6.71% CAGR to 2030. Fujian's sea trials triggered accelerated Japanese, Indian, and Korean fleet renewals; each now embeds open-architecture combat suites to guarantee allied plug-in during coalition missions. Australia's decision to double its surface fleet unleashes a USD 10 billion opportunity actively courted by Japanese yards offering the Mogami-class. The Hudson Institute reports that Japan could fill US capacity gaps by exporting turnkey combatants, a scenario that multiplies subsystem orders anchored in the naval combat systems market. India's adoption of KONGSBERG logistics suites for five ships widens Scandinavian supplier reach.

Europe shows steady, policy-driven growth. Berlin's 2035 naval plan funds modular combat suites for F126 frigates, prioritising software refresh over hull count. Paris co-finances Horizon destroyer upgrades with Rome, reinforcing Franco-Italian radar and missile chains. London's Type 83 concept champions a software-centric core but grapples with pacing against cyber-hardening targets. Madrid and Oslo upgrade legacy tonnage through competitively tendered CMS refits. While aggregated European budgets trail US outlays, pooled R&D and standardised interfaces sustain a robust, export-oriented Naval Combat Systems market.

- BAE Systems plc

- Lockheed Martin Corporation

- RTX Corporation

- Thales Group

- General Dynamics Mission Systems (General Dynamics Corporation)

- Saab AB

- L3Harris Technologies, Inc.

- Northrop Grumman Corporation

- Elbit Systems Ltd.

- Terma A/S

- Kongsberg Gruppen ASA

- Huntington Ingalls Industries, Inc.

- Leonardo S.p.A

- ATLAS ELEKTRONIK GmbH

- MBDA

- Naval Group

- Israel Aerospace Industries Ltd.

- Hanwha Systems Co., Ltd.

- Mitsubishi Electric Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptionsand Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Fleet-modernization programs in major navies

- 4.2.2 Rising Indo-Pacific geopolitical tensions

- 4.2.3 Rapid uptake of integrated combat-management suites

- 4.2.4 Expansion of naval electronic warfare (EW) and C4ISR demand

- 4.2.5 Shift to distributed unmanned surface/underwater fleets

- 4.2.6 DevSecOps-based "continuous upgrade" architectures

- 4.3 Market Restraints

- 4.3.1 Budget caps delaying surface-combatant procurement

- 4.3.2 Extended weapon-integration certification cycles

- 4.3.3 Cyber-vulnerability of network-centric warships

- 4.3.4 GaN radar-chip supply-chain bottlenecks

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Weapon Systems

- 5.1.2 Electronic Warfare (EW)

- 5.1.3 C4ISR

- 5.1.4 Directed Energy Weapons (DEW)

- 5.1.5 Integrated Combat Systems

- 5.1.6 Unmanned Sea Systems

- 5.1.7 Simulation and Training Systems

- 5.1.8 Combat-Management Software

- 5.2 By Platform

- 5.2.1 Aircraft Carriers

- 5.2.2 Destroyers

- 5.2.3 Frigates

- 5.2.4 Corvettes

- 5.2.5 Submarines

- 5.2.6 Littoral Combat Ships (LCS)

- 5.2.7 Unmanned Surface Vessels (USV)

- 5.2.8 Unmanned Underwater Vehicles (UUV)

- 5.2.9 Other Platforms

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Middle East

- 5.3.5.1.1 Saudi Arabia

- 5.3.5.1.2 Israel

- 5.3.5.1.3 Rest of Middle East

- 5.3.5.2 Africa

- 5.3.5.2.1 Egypt

- 5.3.5.2.2 South Africa

- 5.3.5.2.3 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BAE Systems plc

- 6.4.2 Lockheed Martin Corporation

- 6.4.3 RTX Corporation

- 6.4.4 Thales Group

- 6.4.5 General Dynamics Mission Systems (General Dynamics Corporation)

- 6.4.6 Saab AB

- 6.4.7 L3Harris Technologies, Inc.

- 6.4.8 Northrop Grumman Corporation

- 6.4.9 Elbit Systems Ltd.

- 6.4.10 Terma A/S

- 6.4.11 Kongsberg Gruppen ASA

- 6.4.12 Huntington Ingalls Industries, Inc.

- 6.4.13 Leonardo S.p.A

- 6.4.14 ATLAS ELEKTRONIK GmbH

- 6.4.15 MBDA

- 6.4.16 Naval Group

- 6.4.17 Israel Aerospace Industries Ltd.

- 6.4.18 Hanwha Systems Co., Ltd.

- 6.4.19 Mitsubishi Electric Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment