PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1744375

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1744375

Global Torpedo Market 2025-2035

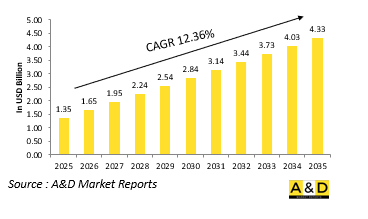

The Global Torpedo market is estimated at USD 1.35 billion in 2025, projected to grow to USD 4.33 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 12.36% over the forecast period 2025-2035.

Introduction to Torpedo Market:

Torpedoes are essential underwater weapons used primarily by submarines, surface ships, and aircraft to engage and neutralize naval threats. These self-propelled munitions are designed to track and destroy enemy submarines and surface vessels through direct impact or proximity detonation. Unlike naval mines or depth charges, torpedoes can actively seek out targets using onboard guidance systems, making them highly effective in both offensive and defensive maritime operations. Their relevance spans peacetime deterrence, wartime strike missions, and anti-access strategies. As maritime domains become more contested, torpedoes play a central role in undersea warfare by offering stealth, surprise, and lethality. Modern naval tactics increasingly depend on these weapons to maintain underwater superiority and strategic deterrence, especially in choke points and territorial waters. Equipped on a variety of platforms-from diesel-electric submarines to long-range patrol aircraft-torpedoes form a critical layer of naval capability. They are also instrumental in securing sea lines of communication and in deterring surface incursions by hostile navies. The global defense community continues to prioritize torpedo development, recognizing their enduring value in asymmetric and high-intensity conflict scenarios. Their continued evolution reflects a broader shift toward undersea dominance and integrated maritime combat readiness.

Technology Impact in Torpedo Market:

Technological advancements have profoundly reshaped the capabilities and roles of modern torpedoes in maritime defense. Innovations in propulsion systems have led to quieter and faster torpedoes, reducing detection risk while improving strike precision. Thermal engines, advanced electric motors, and improved hydrodynamics enable these weapons to operate over longer distances with greater stealth. In terms of guidance, newer models integrate advanced sonar, wake-homing sensors, and inertial navigation systems, allowing them to adapt to complex environments and outmaneuver countermeasures. Artificial intelligence and autonomous targeting algorithms are also emerging, enabling torpedoes to distinguish between decoys and legitimate threats with minimal operator input. Enhanced data-link capabilities provide mid-course updates, giving operators more control and flexibility after launch. Warhead design has evolved to deliver more focused and effective damage while maintaining compactness and safety. Additionally, modular architecture allows for rapid upgrades and mission-specific configurations. These technological gains are not only boosting lethality but also improving survivability against increasingly sophisticated anti-submarine warfare systems. Combined with integration into network-centric naval operations, modern torpedoes now serve as both strategic deterrents and precision tools in highly contested undersea environments, supporting mission success across both conventional and asymmetric maritime theaters.

Key Drivers in Torpedo Market:

Several critical factors are propelling the global development and deployment of torpedoes in contemporary naval strategies. The growing competition for dominance in undersea domains is a major influence, as nations seek to secure strategic waterways and maritime resources. Increased submarine activity-both for surveillance and deterrence-has underscored the need for effective underwater strike options. Evolving naval doctrines that prioritize layered defense and rapid-response capabilities reinforce the relevance of torpedoes in both offensive and defensive postures. The integration of unmanned platforms and the expansion of littoral operations require compact, efficient torpedoes capable of operating in shallow and confined waters. Concerns over anti-submarine threats in regional hotspots further drive investment in torpedoes designed to counter a variety of submersible and surface adversaries. Additionally, a focus on force projection in blue-water operations encourages the development of long-range and multi-role variants. Modern navies are also emphasizing self-reliance, prompting increased research into indigenous torpedo design and production. Operational readiness and flexible deployment options remain key goals, leading to enhancements in launch systems and storage capabilities. These drivers collectively reflect a strategic shift toward maintaining credible deterrence, improving tactical options at sea, and ensuring maritime superiority in an increasingly contested global security environment.

Regional Trends in Torpedo Market:

Torpedo development and deployment vary by region, shaped by distinct maritime strategies and threat perceptions. In the Indo-Pacific, heightened naval competition and territorial disputes have led to significant investments in advanced torpedo systems, particularly by nations aiming to expand their submarine fleets and assert undersea dominance. Coastal and archipelagic states are enhancing their anti-submarine capabilities, emphasizing agile torpedoes suited for shallow and congested waters. In Europe, the focus is on interoperability and modernization, with defense programs often aimed at upgrading legacy torpedoes to align with NATO standards. The region's emphasis on protecting sea lanes and responding to regional instability contributes to steady demand for both heavy and lightweight variants. The Middle East, with its strategic maritime chokepoints, relies on torpedoes as part of broader naval defense networks aimed at securing coastal installations and deterring surface incursions. North America continues to lead in terms of technological sophistication, emphasizing advanced guidance systems and integration with multi-domain platforms. Meanwhile, in South America and parts of Africa, torpedo capabilities are expanding gradually through modernization efforts and regional cooperation. Across these regions, the trajectory reflects a broader recognition that effective undersea weaponry is central to maritime deterrence, fleet defense, and long-term strategic security planning.

Key Torpedo Program:

India's Ministry of Defence has signed two major contracts aimed at significantly strengthening the country's submarine capabilities. One agreement, valued at ₹877 crore, was signed with France's Naval Group for the acquisition of advanced Electronic Heavy Weight Torpedoes (EHWT). The second and larger contract, worth approximately ₹1,990 crore, was signed with Mumbai-based Mazagon Dock Shipbuilders for the integration of a new Air Independent Propulsion (AIP) system. The AIP technology, developed indigenously by the Defence Research and Development Organisation (DRDO), is a major boost under the 'Atmanirbhar Bharat' (self-reliant India) initiative. Together, the contracts total ₹2,867 crore and mark a significant step forward in enhancing the endurance, lethality, and self-reliance of India's submarine fleet.

Table of Contents

Torpedo Market Report Definition

Torpedo Market Segmentation

By Region

By Launch Platform

By Type

Torpedo Market Analysis for next 10 Years

The 10-year torpedo market analysis would give a detailed overview of torpedo market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Torpedo Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Torpedo Market Forecast

The 10-year torpedo market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Torpedo Market Trends & Forecast

The regional torpedo market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Torpedo Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Torpedo Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Torpedo Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Launch Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Launch Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Torpedo Market Forecast, 2025-2035

- Figure 2: Global Torpedo Market Forecast, By Region, 2025-2035

- Figure 3: Global Torpedo Market Forecast, By Launch Platform, 2025-2035

- Figure 4: Global Torpedo Market Forecast, By Type, 2025-2035

- Figure 5: North America, Torpedo Market, Market Forecast, 2025-2035

- Figure 6: Europe, Torpedo Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Torpedo Market, Market Forecast, 2025-2035

- Figure 8: APAC, Torpedo Market, Market Forecast, 2025-2035

- Figure 9: South America, Torpedo Market, Market Forecast, 2025-2035

- Figure 10: United States, Torpedo Market, Technology Maturation, 2025-2035

- Figure 11: United States, Torpedo Market, Market Forecast, 2025-2035

- Figure 12: Canada, Torpedo Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Torpedo Market, Market Forecast, 2025-2035

- Figure 14: Italy, Torpedo Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Torpedo Market, Market Forecast, 2025-2035

- Figure 16: France, Torpedo Market, Technology Maturation, 2025-2035

- Figure 17: France, Torpedo Market, Market Forecast, 2025-2035

- Figure 18: Germany, Torpedo Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Torpedo Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Torpedo Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Torpedo Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Torpedo Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Torpedo Market, Market Forecast, 2025-2035

- Figure 24: Spain, Torpedo Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Torpedo Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Torpedo Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Torpedo Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Torpedo Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Torpedo Market, Market Forecast, 2025-2035

- Figure 30: Australia, Torpedo Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Torpedo Market, Market Forecast, 2025-2035

- Figure 32: India, Torpedo Market, Technology Maturation, 2025-2035

- Figure 33: India, Torpedo Market, Market Forecast, 2025-2035

- Figure 34: China, Torpedo Market, Technology Maturation, 2025-2035

- Figure 35: China, Torpedo Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Torpedo Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Torpedo Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Torpedo Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Torpedo Market, Market Forecast, 2025-2035

- Figure 40: Japan, Torpedo Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Torpedo Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Torpedo Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Torpedo Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Torpedo Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Torpedo Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Torpedo Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Torpedo Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Torpedo Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Torpedo Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Torpedo Market, By Launch Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Torpedo Market, By Launch Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Torpedo Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Torpedo Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Torpedo Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Torpedo Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Torpedo Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Torpedo Market, By Region, 2025-2035

- Figure 58: Scenario 1, Torpedo Market, By Launch Platform, 2025-2035

- Figure 59: Scenario 1, Torpedo Market, By Type, 2025-2035

- Figure 60: Scenario 2, Torpedo Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Torpedo Market, By Region, 2025-2035

- Figure 62: Scenario 2, Torpedo Market, By Launch Platform, 2025-2035

- Figure 63: Scenario 2, Torpedo Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Torpedo Market, 2025-2035