PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836714

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836714

Torpedo - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

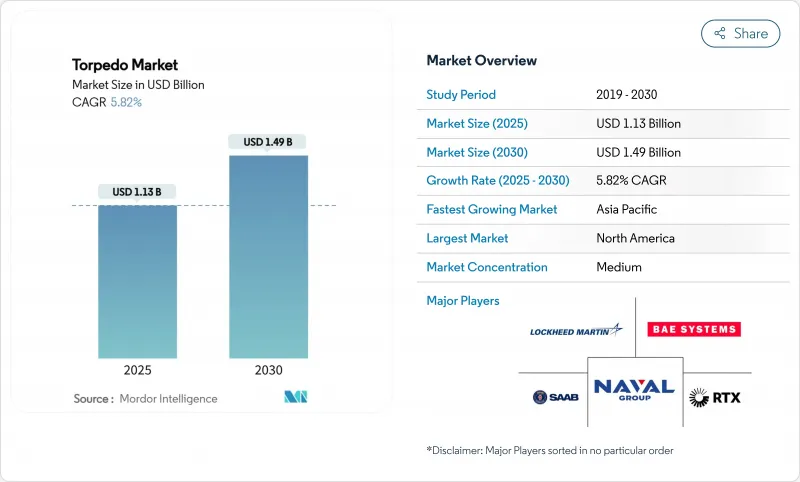

The torpedo market size is estimated at USD 1.13 billion in 2025, and is expected to reach USD 1.49 billion by 2030, reflecting a CAGR of 5.82% during the forecast period.

Escalating naval competition in the South China Sea, Baltic Sea, and other chokepoints is steering defense ministries toward submarine-centric force structures that rely on heavyweight and lightweight torpedoes for deterrence. Fleet recapitalization programs under AUKUS and similar alliances continue to enlarge backlogs for MK-48, F21, and other flagship models, while electric-propelled designs built around lithium-ion batteries are carving out a share by lowering acoustic signatures and lengthening patrol endurance. Demand is further buoyed by unmanned underwater vehicles (UUVs) and unmanned surface vessels (USVs) that now launch very-lightweight torpedoes, offering cost-effective area denial and mine-countermeasure options. Supply-chain exposure to silver and rare-earth elements remains a structural concern, yet governments are funding closed-loop recovery lines that can recycle those inputs and reduce import dependence.

Global Torpedo Market Trends and Insights

Accelerated induction of nuclear and diesel-electric submarines worldwide

Navies are fielding new attack and ballistic-missile submarines at a record pace, generating sustained demand for heavyweight torpedoes. Australia's March 2025 order for additional MK-48 Mod 7 rounds positions Collins-class boats for interim lethality ahead of nuclear-powered replacements. Brazil followed by commissioning Humaita in 2024, equipped with F21 weapons and an integrated combat suite. Greece's Type 214 upgrade to the SeaHake Mod 4 underscores how even mid-sized fleets modernize magazines with 50 km-range warheads. The pattern is clear: underwater deterrence outranks surface power in budget priority.

Ongoing naval fleet modernization across key maritime powers

Multi-domain doctrines emphasize layered defense; thus, torpedoes remain indispensable despite long-range missile proliferation. Japan's Type 12 missile expansion coexists with a nationwide Sting Ray refresh that keeps antisubmarine punch aboard P-1 aircraft and Mogami-class frigates. The UK allocated USD 75 million in 2025 for Sting Ray mid-life work, ensuring availability through 2040. Germany sourced the same lightweight round for its Poseidon fleet, illustrating how interoperability accelerates procurement cycles. These moves signal that navies view torpedoes as the only proven close-range kill solution once missiles exhaust or fail.

High unit costs of heavyweight torpedoes strain defense procurement budgets

A MK-48 Mod 7 round with a new guidance package can exceed USD 6 million, compressing buying power when naval budgets fund submarines and missiles. The US Navy's FY 2025 decision to accept only one Virginia-class hull instead of two highlights how expensive ammunition cascades into wider force-structure trade-offs. Though flush with funds, Saudi Arabia still awaits Congressional clearance before ordering MK-54s, signaling that even cash-rich customers weigh cost-to-benefit carefully.

Other drivers and restraints analyzed in the detailed report include:

- Increased utilization of lightweight torpedoes in airborne ASW platforms

- Rising strategic need for sub-surface deterrence in geopolitically contested waters

- Extended platform integration and qualification timelines delay deployment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Heavyweight models captured 53.78% of the torpedo market share in 2024, underlining their dominance in blue-water deterrence, where high-yield warheads and 50 km+ ranges remain decisive. Australia's USD 200 million restock and Brazil's Scorpene fitout confirm steady volume in the heavyweight class. Conversely, very-lightweight designs are on an 8.24% CAGR path to 2030, propelled by unmanned integration and coastal defense missions that favor compact rounds. Sweden's Torpedo 47 and the Pentagon-funded Skelmir concept show how micro-torpedoes weighing under 25 kg can neutralize mines and midget subs in littorals, often at one-tenth the cost of a traditional weapon.

Growth signals a bifurcating toolkit: navies procure fewer but smarter heavyweights for peer engagements while adopting swarms of light rounds for saturation coverage. This balanced portfolio lowers per-shot cost for routine patrol but retains strategic punch for contested deep-water engagements. The torpedo market, therefore, continues to diversify, with niche suppliers entering lighter niches as primes focus on heavyweight sustainment.

Sea-launched weapons still dominate at 62.33% in 2024, leveraging submarines' stealth to provide first-strike capacity against undersea and surface threats. Yet, unmanned-platform-launched systems are growing fastest at 8.80% CAGR as navies deploy UUVs such as Anduril's Dive-LD that can self-recover after 10-day missions. Air-launched usage is rising through high-altitude kits that allow fixed-wing aircraft to stand off from air-defense umbrellas, giving commanders wider engagement arcs without risking hulls.

The torpedo market size for unmanned platforms is projected to reach USD 0.22 billion by 2030, reflecting high sensor-to-shooter automation rates. As autonomy scales, traditional frigates may offload magazine weight to loyal-wingman surface drones, making torpedo salvos more distributed and survivable.

The Torpedo Market Report is Segmented by Weight (Heavy, Light, and Very Light), Launch Platform (Sea and Air), Propulsion Type (Electric and Conventional), Guidance System (Wire-Guided, Acoustic, and Optical), Application (Anti-Submarine Warfare and Anti-Surface Warfare), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 33.90% of 2024 sales, supported by the US Navy's Virginia-class construction queue and Canada's entry into AUKUS technology sharing. The SSN(X) concept, now in early design, is expected to carry next-generation electric torpedoes with modular payload bays, ensuring the region stays the largest buyer well into the 2030s. Budget ceilings, however, may compress annual buy quantities until new industrial capacity reduces unit costs.

Asia-Pacific is the fastest-growing territory at 7.21% CAGR. China's Indigenous Yu-10 development and India's DRDO pipeline exemplify the pivot toward self-sufficiency. At the same time, Japan's Mogami-class frigates integrate Type 97 torpedoes and improved sonar chains to counter a maturing PLAN submarine arm. South Korea's supercavitating prototype and Taiwan's expanding unmanned fleet signal a technology leap that could shift future volume away from Western primes toward local champions.

Europe, South America, and the Middle East and Africa regions show steady but varied trajectories. Europe's collaborative buys-such as Germany procuring UK Sting Ray stocks-optimize interoperability under NATO task force constructs. Brazil's ProSub yard is turning out the region's first nuclear attack submarine around 2029. Egypt and Saudi Arabia are evaluating Type 039A and MK-54 packages, respectively, indicating that the torpedo market is widening beyond traditional power blocks into littoral states seeking credible underwater deterrence.

- ATLAS ELEKTRONIK GmbH

- BAE Systems plc

- Bharat Dynamics Ltd.

- General Dynamics Mission Systems (General Dynamics Corporation)

- RTX Corporation

- Saab AB

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Naval Group

- Mitsubishi Heavy Industries, Ltd.

- ASELSAN A.S.

- LIG Nex1 Co., Ltd.

- Roketsan A.S.

- SAIC

- Fincantieri S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated induction of nuclear and diesel-electric submarines worldwide

- 4.2.2 Ongoing naval fleet modernization across key maritime powers

- 4.2.3 Increased utilization of lightweight torpedoes in airborne ASW platforms

- 4.2.4 Rising strategic need for sub-surface deterrence in geopolitically contested waters

- 4.2.5 Emerging demand for micro and ultra-lightweight torpedoes for unmanned maritime systems

- 4.2.6 Closed-loop manufacturing models enabled by high silver content recovery

- 4.3 Market Restraints

- 4.3.1 High unit costs of heavyweight torpedoes strain defense procurement budgets

- 4.3.2 Extended platform integration and qualification timelines delay deployment

- 4.3.3 Price instability and supply risks associated with critical minerals like silver and rare-earths

- 4.3.4 Increasing preference for long-range anti-ship missiles reduces demand for torpedoes in surface warfare

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Weight

- 5.1.1 Heavy

- 5.1.2 Light

- 5.1.3 Very Light

- 5.2 By Launch Platform

- 5.2.1 Sea

- 5.2.1.1 Surface Vessel

- 5.2.1.2 Submarine

- 5.2.1.3 Unmanned Underwater Vehicles (UUVs)

- 5.2.2 Air

- 5.2.2.1 Aircraft

- 5.2.2.2 Helicopters

- 5.2.2.3 Unmanned Aerial Vehicles (UAVs)

- 5.2.1 Sea

- 5.3 By Propulsion Type

- 5.3.1 Electric

- 5.3.2 Conventional

- 5.4 By Guidance System

- 5.4.1 Wire-Guided

- 5.4.2 Acoustic

- 5.4.3 Optical

- 5.5 By Application

- 5.5.1 Anti-Submarine Warfare (ASW)

- 5.5.2 Anti-Surface Warfare (ASuW)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ATLAS ELEKTRONIK GmbH

- 6.4.2 BAE Systems plc

- 6.4.3 Bharat Dynamics Ltd.

- 6.4.4 General Dynamics Mission Systems (General Dynamics Corporation)

- 6.4.5 RTX Corporation

- 6.4.6 Saab AB

- 6.4.7 Lockheed Martin Corporation

- 6.4.8 Northrop Grumman Corporation

- 6.4.9 Naval Group

- 6.4.10 Mitsubishi Heavy Industries, Ltd.

- 6.4.11 ASELSAN A.S.

- 6.4.12 LIG Nex1 Co., Ltd.

- 6.4.13 Roketsan A.S.

- 6.4.14 SAIC

- 6.4.15 Fincantieri S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment