PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1811815

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1811815

Global Submarine Market 2025 - 2035

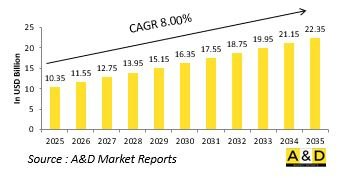

The Global Submarine market is estimated at USD 10.35 billion in 2025, projected to grow to USD 22.35 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.00% over the forecast period 2025-2035.

Introduction to Submarine Market:

The defense submarine market represents one of the most strategic areas within naval defense, as submarines provide nations with unmatched capabilities in stealth, deterrence, and force projection. Unlike surface fleets, submarines operate covertly, enabling them to conduct surveillance, intelligence gathering, and precision strike missions while remaining undetected. Their role in modern naval warfare extends beyond traditional combat; they are also crucial for protecting sea lanes, securing maritime borders, and serving as platforms for special operations. The market is shaped by the growing emphasis on undersea dominance in both regional and global theaters. Submarines serve as critical tools of deterrence, especially when equipped with advanced weapon systems and long-endurance designs. Their ability to remain hidden for extended periods gives naval forces a significant advantage, both in times of conflict and during peacetime patrols. The balance of power in many maritime regions is increasingly influenced by submarine capabilities, prompting nations to modernize fleets with advanced propulsion systems, acoustic quieting technologies, and enhanced survivability features. This makes the submarine market a central focus of naval procurement programs, reflecting the enduring importance of undersea platforms in safeguarding national security and projecting influence across contested waters.

Technology Impact in Submarine Market:

Technology has fundamentally redefined the design, performance, and strategic importance of submarines in defense operations. Innovations in propulsion systems, particularly air-independent propulsion and advancements in nuclear technology, have significantly extended the endurance and operational range of submarines. These developments allow vessels to remain submerged for longer durations, thereby enhancing stealth and reducing vulnerability to detection. Acoustic quieting technologies are another critical area of progress. Submarines are increasingly designed with hull coatings, noise-reducing propulsors, and vibration isolation systems that minimize their acoustic signature. This makes them more difficult for adversaries to track, bolstering their role as elusive assets in naval warfare. Alongside stealth, the integration of sophisticated sonar arrays and sensor suites has dramatically improved situational awareness, enabling submarines to detect threats at greater distances while remaining hidden themselves. Digitalization and network-enabled capabilities have also transformed submarine operations. Modern platforms can exchange real-time intelligence with surface ships, aircraft, and command centers, creating a connected undersea network. Additionally, advances in weapon systems, including long-range cruise missiles and torpedoes, have expanded the offensive potential of submarines. The adoption of unmanned underwater vehicles as complementary assets is further reshaping their operational scope, demonstrating how technology continues to elevate submarines as decisive instruments of naval power.

Key Drivers in Submarine Market:

The demand for submarines in the defense sector is propelled by a combination of strategic imperatives, security challenges, and technological opportunities. Nations view submarines as vital assets for ensuring maritime dominance and protecting economic interests tied to sea routes and offshore resources. Their ability to operate covertly makes them essential for deterrence, power projection, and intelligence gathering in an increasingly contested maritime environment. Geopolitical rivalries and territorial disputes over key waterways further accelerate demand. Submarines provide a strategic edge by allowing navies to monitor adversary activities, enforce maritime claims, and project force without the visibility of surface fleets. As tensions escalate in regions with contested sea lanes, investments in submarine capabilities become central to defense planning. The modernization of existing fleets is another significant driver. Many naval powers are phasing out older platforms and replacing them with submarines that incorporate advanced propulsion, stealth, and weapons technology. Additionally, the dual capability of submarines to conduct both conventional and nuclear deterrence roles enhances their value in national security strategies. Beyond conflict scenarios, submarines also contribute to non-combat missions such as surveillance, research, and undersea infrastructure protection, ensuring their continued relevance across multiple operational domains.

Regional Trends in Submarine Market:

Regional dynamics in the defense submarine market are shaped by geography, security environments, and strategic priorities. Maritime nations with expansive coastlines and access to vital sea lanes prioritize submarine fleets to secure territorial waters and project power far from their shores. Coastal defense, anti-access strategies, and deterrence against regional adversaries all drive submarine procurement in these areas. Advanced naval powers emphasize nuclear-powered submarines, investing in platforms capable of extended deployments and global reach. These vessels serve as cornerstones of strategic deterrence, supporting both conventional operations and second-strike nuclear capabilities. In contrast, regions with limited budgets often favor diesel-electric submarines equipped with modern propulsion and sensor technologies, balancing cost with operational effectiveness. Geopolitical hotspots such as contested straits and disputed maritime zones further amplify regional demand. Submarines are deployed to maintain a constant undersea presence, monitor adversary movements, and ensure control over vital waterways. Industrial capabilities also influence trends: some nations prioritize indigenous submarine construction to enhance self-reliance, while others pursue partnerships and joint ventures to acquire advanced platforms. This regional diversity ensures that while global interest in submarines is widespread, each market segment reflects localized priorities tied to geography, resources, and security challenges.

Key Submarine Program:

Mazagon Dock Shipbuilders has entered official contract discussions with Germany's ThyssenKrupp Marine Systems (TKMS) for a major submarine initiative. TKMS has formally opened negotiations with Indian procurement authorities, indicating an emerging Indo-German partnership in the naval sector. The company's order backlog reached EUR 18.50 billion as of June 30, with part of this attributed to the ongoing negotiations. Although detailed project specifics remain confidential, Mazagon Dock's active participation showcases its strategic importance within India's maritime defense industry. The agreement's outcome could substantially boost Mazagon Dock's order pipeline and enhance its contribution to the modernization of India's naval capabilities.

Table of Contents

Submarine Market Report Definition

Submarine Market Segmentation

By Type

By Application

By Region

Submarine Market Analysis for next 10 Years

The 10-year submarine market analysis would give a detailed overview of submarine market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Submarine Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Submarine Market Forecast

The 10-year submarine market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Submarine Market Trends & Forecast

The regional submarine market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Submarine Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Submarine Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Submarine Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Submarine Market Forecast, 2025-2035

- Figure 2: Global Submarine Market Forecast, By Region, 2025-2035

- Figure 3: Global Submarine Market Forecast, By Type, 2025-2035

- Figure 4: Global Submarine Market Forecast, By Application, 2025-2035

- Figure 5: North America, Submarine Market, Market Forecast, 2025-2035

- Figure 6: Europe, Submarine Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Submarine Market, Market Forecast, 2025-2035

- Figure 8: APAC, Submarine Market, Market Forecast, 2025-2035

- Figure 9: South America, Submarine Market, Market Forecast, 2025-2035

- Figure 10: United States, Submarine Market, Technology Maturation, 2025-2035

- Figure 11: United States, Submarine Market, Market Forecast, 2025-2035

- Figure 12: Canada, Submarine Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Submarine Market, Market Forecast, 2025-2035

- Figure 14: Italy, Submarine Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Submarine Market, Market Forecast, 2025-2035

- Figure 16: France, Submarine Market, Technology Maturation, 2025-2035

- Figure 17: France, Submarine Market, Market Forecast, 2025-2035

- Figure 18: Germany, Submarine Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Submarine Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Submarine Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Submarine Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Submarine Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Submarine Market, Market Forecast, 2025-2035

- Figure 24: Spain, Submarine Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Submarine Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Submarine Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Submarine Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Submarine Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Submarine Market, Market Forecast, 2025-2035

- Figure 30: Australia, Submarine Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Submarine Market, Market Forecast, 2025-2035

- Figure 32: India, Submarine Market, Technology Maturation, 2025-2035

- Figure 33: India, Submarine Market, Market Forecast, 2025-2035

- Figure 34: China, Submarine Market, Technology Maturation, 2025-2035

- Figure 35: China, Submarine Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Submarine Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Submarine Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Submarine Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Submarine Market, Market Forecast, 2025-2035

- Figure 40: Japan, Submarine Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Submarine Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Submarine Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Submarine Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Submarine Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Submarine Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Submarine Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Submarine Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Submarine Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Submarine Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Submarine Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Submarine Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Submarine Market, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Submarine Market, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Submarine Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Submarine Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Submarine Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Submarine Market, By Region, 2025-2035

- Figure 58: Scenario 1, Submarine Market, By Type, 2025-2035

- Figure 59: Scenario 1, Submarine Market, By Application, 2025-2035

- Figure 60: Scenario 2, Submarine Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Submarine Market, By Region, 2025-2035

- Figure 62: Scenario 2, Submarine Market, By Type, 2025-2035

- Figure 63: Scenario 2, Submarine Market, By Application, 2025-2035

- Figure 64: Company Benchmark, Submarine Market, 2025-2035