PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1811817

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1811817

Global Swarm Drones Market 2025 - 2035

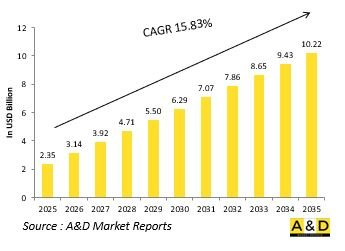

The Global Swarm Drones market is estimated at USD 2.35 billion in 2025, projected to grow to USD 10.22 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 15.83% over the forecast period 2025-2035.

Introduction to Swarm Drones Market

The defense swarm drones market represents a significant shift in how militaries approach aerial operations and tactical dominance. Unlike traditional unmanned systems that operate individually, swarm drones rely on collective behavior and autonomous coordination to execute complex missions. These systems can perform tasks such as surveillance, target acquisition, electronic jamming, and strike operations by leveraging group dynamics. Their ability to overwhelm defenses, adapt to changing battlefield conditions, and cover large areas with efficiency makes them a transformative tool for modern warfare. The appeal of swarm drones lies not only in their versatility but also in their resilience. A single drone may be vulnerable, but when deployed in swarms, the loss of individual units does not compromise the mission, ensuring continuity and effectiveness. Militaries view swarms as force multipliers capable of augmenting traditional aircraft, artillery, and ground forces. Furthermore, they are particularly suited for contested environments, where speed, agility, and distributed intelligence offer distinct advantages over conventional systems. As geopolitical competition intensifies, swarm drone capabilities are emerging as a focal point of investment and innovation, shaping the future of asymmetric strategies and redefining the dynamics of aerial combat and battlefield management.

Technology Impact in Swarm Drones Market:

Technological advances are driving the evolution of swarm drones from conceptual prototypes to operational assets within defense forces. Central to this transformation is the integration of artificial intelligence and machine learning, enabling drones to communicate, collaborate, and make decisions without direct human intervention. This autonomy allows swarms to adapt to dynamic battlefield environments, reassign roles within the group, and adjust tactics in real time when facing threats or obstacles. Advancements in secure communication networks and distributed computing architectures further enhance the effectiveness of swarms. These technologies ensure that each drone functions as part of a larger ecosystem, maintaining coordination even in environments where electronic warfare attempts to disrupt control signals. Sensor miniaturization and energy-efficient propulsion systems are also expanding mission capabilities, allowing swarms to operate longer and across varied terrains, from dense urban environments to open seas. Emerging technologies such as edge computing and bio-inspired algorithms are further pushing the boundaries of swarm autonomy. These developments not only improve the efficiency of drone operations but also strengthen their survivability and adaptability. Collectively, these innovations make swarm drones a decisive factor in future defense strategies, offering both offensive and defensive advantages in increasingly complex military theaters.

Key Drivers in Swarm Drones Market:

The rise of the defense swarm drones market is being propelled by the need for adaptable, cost-effective, and scalable solutions to modern security challenges. Militaries face adversaries employing advanced technologies and unconventional tactics, creating demand for tools that can respond with agility and resilience. Swarm drones provide exactly that, delivering distributed intelligence, rapid deployment, and multi-mission versatility without requiring large-scale infrastructure. Another critical driver is the growing importance of asymmetric warfare. Swarms offer smaller and medium-sized defense forces the ability to counter more technologically advanced adversaries by leveraging numerical superiority and coordinated maneuvers. Their ability to penetrate air defenses, disrupt communications, and execute synchronized attacks makes them ideal for neutralizing high-value targets. Budget efficiency also plays a role. While developing traditional defense platforms like fighter jets or ships involves substantial investment and long timelines, swarm drones can be produced and scaled at a relatively lower cost. This makes them attractive to both established and emerging defense powers. Additionally, the integration of swarms into combined operations-working alongside manned systems and cyber assets-ensures their role as indispensable force multipliers. These drivers collectively underline why swarm drone capabilities are gaining strategic momentum across global defense markets.

Regional Trends in Swarm Drones Market:

Regional developments in the defense swarm drones market reflect differing priorities, threat perceptions, and industrial capabilities. Nations with advanced defense industries focus on developing highly autonomous, AI-driven swarms capable of performing integrated missions alongside other advanced platforms. Their emphasis lies in maintaining technological superiority, ensuring that their swarms are not only effective but also resistant to electronic warfare and capable of countering stealthy or unconventional threats. In regions experiencing persistent security tensions, investment in swarm drones is driven by the need for rapid-response and force-multiplication capabilities. These countries often seek flexible solutions that can be adapted to varied terrains and operational contexts, from border defense to maritime surveillance. For them, swarm drones provide a cost-efficient way to enhance deterrence while maintaining operational readiness.

Emerging defense markets, meanwhile, are exploring partnerships and technology transfers to accelerate domestic capabilities in drone swarm production. Their focus is on indigenization, ensuring long-term sustainability and reducing reliance on external suppliers. Regional alliances and joint exercises also shape adoption patterns, as interoperability in drone swarm operations becomes increasingly important in multinational missions. Together, these trends highlight how swarm drones are transitioning from experimental systems into mainstream defense assets across the global security landscape.

Key Swarm Drones Program:

The IAF and New Delhi-based startup Veda Aeronautical Pvt Ltd signed a landmark ₹300 crore deal to manufacture 200 long-range swarm drones for the Indian Air Force, a result of the IAF's Mehar Baba Swarm Drone competition. These loitering munitions, often described as kamikaze drones, are intended to be released in small groups and then autonomously converge on or defend designated targets once airborne. The order underscores the IAF's strong support for the domestic drone startup ecosystem and is expected to see the weapon system ready for operational deployment by the end of this year.

Table of Contents

Swarm Drones Market Report Definition

Swarm Drones Market Segmentation

By Region

By Type

By Operation

Swarm Drones Market Analysis for next 10 Years

The 10-year swarm drones market analysis would give a detailed overview of swarm drones market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Swarm Drones Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Swarm Drones Market Forecast

The 10-year swarm drones market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Swarm Drones Market Trends & Forecast

The regional swarm drones market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Underwater Warfare Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Underwater Warfare Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Swarm Drones Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Operation, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Operation, 2025-2035

List of Figures

- Figure 1: Global Swarm Drones Market Forecast, 2025-2035

- Figure 2: Global Swarm Drones Market Forecast, By Region, 2025-2035

- Figure 3: Global Swarm Drones Market Forecast, By Type, 2025-2035

- Figure 4: Global Swarm Drones Market Forecast, By Operation, 2025-2035

- Figure 5: North America, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 6: Europe, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 8: APAC, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 9: South America, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 10: United States, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 11: United States, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 12: Canada, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 14: Italy, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 16: France, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 17: France, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 18: Germany, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 24: Spain, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 30: Australia, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 32: India, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 33: India, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 34: China, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 35: China, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 40: Japan, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Swarm Drones Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Swarm Drones Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Swarm Drones Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Swarm Drones Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Swarm Drones Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Swarm Drones Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Swarm Drones Market, By Operation (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Swarm Drones Market, By Operation (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Swarm Drones Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Swarm Drones Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Swarm Drones Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Swarm Drones Market, By Region, 2025-2035

- Figure 58: Scenario 1, Swarm Drones Market, By Type, 2025-2035

- Figure 59: Scenario 1, Swarm Drones Market, By Operation, 2025-2035

- Figure 60: Scenario 2, Swarm Drones Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Swarm Drones Market, By Region, 2025-2035

- Figure 62: Scenario 2, Swarm Drones Market, By Type, 2025-2035

- Figure 63: Scenario 2, Swarm Drones Market, By Operation, 2025-2035

- Figure 64: Company Benchmark, Swarm Drones Market, 2025-2035