PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851839

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851839

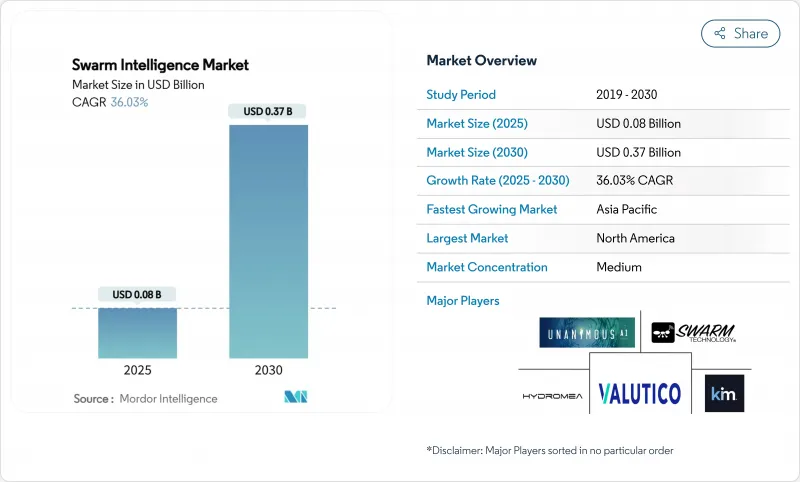

Swarm Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The swarm intelligence market size stands at USD 0.08 billion in 2025 and is forecast to reach USD 0.37 billion by 2030, expanding at a 36.03% CAGR.

Real-time coordination enabled by neuromorphic edge chips, the convergence of bio-inspired algorithms with low-latency computing, and rising demand for distributed decision-making architectures underpin this growth. Transportation and logistics automation, defense UAV swarms, and smart-city pilot projects headline early commercial traction, while sustained venture funding for bio-inspired processors lowers adoption barriers. Competitive differentiation shifts toward flexible platforms that can support multiple algorithm families, accommodate heterogeneous robotic fleets, and meet stringent data-sovereignty requirements. Intensifying hardware constraints in the silicon supply chain and shortages of cross-disciplinary talent temper the otherwise strong outlook for the swarm intelligence market.

Global Swarm Intelligence Market Trends and Insights

Rising adoption of swarm robotics in logistics and warehouse automation

Warehouse operators gain up to 40% cost savings versus single-agent systems when multi-robot swarms handle dynamic routing. Experiments at MIT achieved 4 X faster task completion and cut operator workload by 50.9%, confirming throughput gains that mitigate acute labour shortages.Germany-based Cellumation's Celluveyor moves 5,200 parcels per hour with self-organising hexagonal cells, validating modular, easily scalable swarm conveyor designs. As fulfillment volumes keep rising, these economic incentives accelerate deployments across global logistics hubs. Edge-based coordination further eliminates the latency bottlenecks typical of cloud-centric control, strengthening the business case for the swarm intelligence market.

Growing deployment of UAV swarms for defense surveillance and disaster response

Military programmes such as the Czech-origin Interceptor autonomous kinetic drone illustrate how coordinated swarms neutralise hostile aerial targets under contested bandwidth. Disaster-relief research at the University of Sao Paulo shows drone collectives spotting wildfires and greenhouse-gas leaks faster than satellites while maintaining operations during communication blackouts. Government procurement drives edge-AI advances that later migrate into civil inspection and emergency-response use cases, broadening the addressable swarm intelligence market.

Shortage of cross-disciplinary swarm-algorithm engineers

Global supply of professionals fluent in biology, robotics, and distributed systems lags demand. Academic analysis in SAGE Open notes curricula seldom combine these domains, creating capability gaps for employers. Salary premiums that exceed 40% over conventional robotics roles still fail to close vacancies, leaving start-ups at a disadvantage against cash-rich incumbents. The talent constraint slows prototype-to-production cycles and limits scale-out speed in the swarm intelligence industry.

Other drivers and restraints analyzed in the detailed report include:

- Demand for decentralised optimisation in big-data IoT networks

- Collaborative AI platforms for large-scale brainstorming and decision-making

- Communication latency and reliability limits on real-time coordination

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ant colony optimisation retained the largest 37% share of the swarm intelligence market in 2024 as its probabilistic path-finding fits vehicle routing and warehouse picking needs. Bee colony methods are set for a 36.09% CAGR to 2030 because their decentralised resource allocation suits dynamic smart-city services. Particle swarm optimisation gains traction in financial services where model training achieved 98% accuracy for cryptocurrency price prediction. Hybrid frameworks now switch algorithms in real time to match context, as Texas A&M researchers showed in adaptive agricultural robots. This pivot toward configurable stacks broadens supplier opportunities while deepening software differentiation.

Growing experimentation with firefly, glow-worm, bacterial foraging, and artificial fish heuristics targets niche grids, sensor coverage, or energy-harvest optimisation. Early quantum-accelerated swarm prototypes promise exponential search-space pruning, hinting at disruptive future gains once hardware matures. As adopters pursue outcome-specific metrics rather than general benchmarks, vendors capable of integrating multi-algorithm libraries capture a larger slice of the swarm intelligence market.

Transportation and logistics held 28% share of the swarm intelligence market in 2024 due to immediate paybacks in parcel throughput and last-mile routing. Urban-mobility schemes, including coordinated eVTOL taxis and adaptive traffic grids, propel a 41.51% CAGR in smart-city adoption. Defense programmes remain pivotal for funding leading-edge swarm research that later transitions to civil infrastructure inspection. Health-care pilots apply distributed learning for diagnostics while safeguarding sensitive data. Agriculture and mining deploy ruggedised ground and aerial swarms in hazardous zones, raising worker safety and asset utilisation. Retail fulfilment centres extend use cases beyond conveyance to inventory auditing, and utilities employ cooperative agents for grid load-balancing, attesting to the cross-sector depth of the swarm intelligence market.

Swarm Intelligence Technology Market Report is Segmented by Algorithm Type (Ant Colony Optimisation (ACO), Particle Swarm Optimisation (PSO), and More), End-User Industry (Transportation and Logistics, Defense and Security, Agriculture and Mining, and More), Platform Type (UAV Swarms, UGV Swarms, USV Swarms, and More), Deployment Mode (Edge / On-Device, Cloud, and Hybrid), and Geography.

Geography Analysis

North America contributed 34% of the swarm intelligence market in 2024. Pentagon procurement, e-commerce warehouse automation, and USD 7.9 billion in CHIPS Act incentives spur early demand for neuromorphic processors. Venture capital concentration in Silicon Valley accelerates start-up formation, yet tight labour markets make it harder for smaller firms to secure cross-disciplinary talent. Regulatory sandboxes for autonomous vehicles further encourage field trials.

Asia Pacific delivers the steepest 36.98% CAGR to 2030 for the swarm intelligence market. China's comprehensive 2024 UAV safety rules create predictable certification pathways, and governmental city-cluster programmes unlock large-scale demonstration zones. Japan and South Korea pioneer molecular and service-robotics integration, while regional semiconductor fabs anchor supply for bespoke edge AI chips. Substantial corporate funding, such as SoftBank's USD 4 billion injection into Skild AI, underscores rising investor appetite.

Europe sustains growth through harmonised drone regulations under Implementing Regulation 2019/947 that enforce risk-based operational categories. The ROBOMINERS initiative illustrates how swarm ideas feed heavy-industry automation, and ethical-AI frameworks reassure stakeholders about liability and transparency. A deliberate but methodical approval process protects public trust, albeit at a slower deployment cadence than Asia Pacific.

- Swarm Technology

- Unanimous AI

- Hydromea SA

- Sentien Robotics

- Dobots

- Brainalyzed Insight

- ConvergentAI Inc.

- Kim Technologies

- Swarm Systems Ltd.

- Power-Blox AG

- DJI

- Hewlett Packard Enterprise (HPE)

- IBM

- Intel

- Valutico UK Ltd

- HexaDrone

- AeroVironment

- Kratos Defense and Security

- Bluefin Robotics

- Marine AI

- Thales Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of swarm robotics in logistics and warehouse automation

- 4.2.2 Growing deployment of UAV swarms for defense surveillance and disaster response

- 4.2.3 Demand for decentralized optimisation in big-data IoT networks

- 4.2.4 Collaborative AI platforms for large-scale brainstorming and decision-making

- 4.2.5 Venture funding for bio-inspired edge-AI chips improving energy efficiency

- 4.2.6 APAC BVLOS drone-swarm regulatory green-lights accelerating urban air mobility pilots

- 4.3 Market Restraints

- 4.3.1 Shortage of cross-disciplinary swarm-algorithm engineers

- 4.3.2 Communication-latency and reliability limits on real-time coordination

- 4.3.3 Algorithmic-liability concerns in autonomous financial-trading swarms

- 4.3.4 Silicon supply constraints for neuromorphic edge nodes

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Algorithm Type

- 5.1.1 Ant Colony Optimisation (ACO)

- 5.1.2 Particle Swarm Optimisation (PSO)

- 5.1.3 Bee Colony / Honey-Bee Algorithms

- 5.1.4 Firefly and Glow-worm Algorithms

- 5.1.5 Bacterial Foraging, Artificial Fish and Others

- 5.2 By End-user Industry

- 5.2.1 Transportation and Logistics

- 5.2.2 Defense and Security

- 5.2.3 Robotics and Industrial Automation

- 5.2.4 Healthcare and Life Sciences

- 5.2.5 Agriculture and Mining

- 5.2.6 BFSI and Financial Services

- 5.2.7 Smart Cities and Mobility

- 5.2.8 Retail and E-commerce

- 5.2.9 Energy and Utilities

- 5.3 By Platform Type

- 5.3.1 UAV Swarms

- 5.3.2 UGV Swarms

- 5.3.3 USV Swarms

- 5.3.4 UUV Swarms

- 5.3.5 Software-Only Multi-Agent Systems

- 5.4 By Deployment Mode

- 5.4.1 Edge / On-Device

- 5.4.2 Cloud

- 5.4.3 Hybrid

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Netherlands

- 5.5.3.7 Russia

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC (Saudi Arabia, UAE, Qatar, etc.)

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Swarm Technology

- 6.4.2 Unanimous AI

- 6.4.3 Hydromea SA

- 6.4.4 Sentien Robotics

- 6.4.5 Dobots

- 6.4.6 Brainalyzed Insight

- 6.4.7 ConvergentAI Inc.

- 6.4.8 Kim Technologies

- 6.4.9 Swarm Systems Ltd.

- 6.4.10 Power-Blox AG

- 6.4.11 DJI

- 6.4.12 Hewlett Packard Enterprise (HPE)

- 6.4.13 IBM

- 6.4.14 Intel

- 6.4.15 Valutico UK Ltd

- 6.4.16 HexaDrone

- 6.4.17 AeroVironment

- 6.4.18 Kratos Defense and Security

- 6.4.19 Bluefin Robotics

- 6.4.20 Marine AI

- 6.4.21 Thales Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment