PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1820813

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1820813

Global SHORAD Market 2025-2035

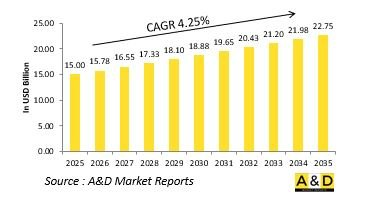

The Global SHORAD Market is estimated at USD 15.00 billion in 2025, projected to grow to USD 22.75 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 4.25% over the forecast period 2025-2035.

Introduction to SHORAD Market

The defense short-range air defense (SHORAD) market is a crucial segment of modern military capabilities, designed to provide rapid and reliable protection against low-altitude aerial threats such as unmanned aerial vehicles, helicopters, cruise missiles, and low-flying aircraft. SHORAD systems form the first line of defense in layered air defense architectures, safeguarding critical assets, mobile formations, and forward-deployed units. They are essential for maintaining air superiority in contested environments, particularly as the aerial threat landscape becomes increasingly diverse and complex. Modern conflicts often involve asymmetric tactics and saturation attacks, making rapid-reaction and highly mobile SHORAD solutions indispensable for frontline operations. These systems are deployed across various platforms - from ground vehicles and naval vessels to fixed installations - and are designed to operate in conjunction with medium- and long-range air defense assets. Their ability to detect, track, and neutralize threats in real time is critical for mission success and force protection. As the nature of warfare evolves toward agile, multi-domain operations, SHORAD capabilities are being prioritized by defense forces worldwide to ensure comprehensive air defense coverage, protect maneuvering troops, and secure vital infrastructure against a growing spectrum of aerial threats.

Technology Impact in SHORAD Market

Technological advancements are significantly enhancing the performance, agility, and effectiveness of SHORAD systems, enabling them to counter emerging and increasingly sophisticated aerial threats. The integration of advanced radar systems, electro-optical sensors, and passive detection technologies has improved target acquisition, tracking accuracy, and engagement speed. Modern SHORAD platforms now incorporate network-centric capabilities, allowing them to share data in real time with other air defense assets and command centers, enhancing situational awareness and coordinated response. The rise of multi-mission launchers capable of deploying different types of interceptors has increased operational flexibility, while advancements in seeker technology and guidance systems have improved interception precision against maneuvering and low-signature targets. The adoption of artificial intelligence and machine learning is enabling faster threat classification and automated decision-making, reducing reaction times during high-intensity engagements. Additionally, the integration of directed energy weapons and electronic warfare modules is expanding SHORAD's role beyond kinetic interception, offering new layers of defense against drone swarms and electronic threats. Modular and mobile designs are further improving deployment speed and adaptability. These technological innovations are transforming SHORAD systems into highly responsive, networked, and multi-layered defense solutions that remain effective across evolving battlefields and rapidly changing threat environments.

Key Drivers in SHORAD Market

The defense SHORAD market is driven by a convergence of strategic imperatives, evolving threat dynamics, and operational demands. The rapid proliferation of low-cost unmanned aerial systems and precision-guided munitions is compelling defense forces to strengthen their short-range air defense capabilities. Increasing reliance on agile, maneuverable ground and air assets in modern warfare has heightened the need for mobile protection solutions that can keep pace with deployed forces. Rising geopolitical tensions and the growing risk of hybrid warfare have further intensified demand for versatile air defense systems capable of countering diverse aerial threats. Additionally, the shift toward layered air defense strategies is positioning SHORAD as a vital component of integrated protection architectures. Defense modernization programs and the replacement of legacy systems are creating opportunities for advanced solutions with enhanced detection, response, and mobility capabilities. Collaborative development initiatives and partnerships between industry and defense agencies are also accelerating technological advancements and deployment. Moreover, the need to protect critical infrastructure, strategic installations, and population centers from evolving aerial threats is driving continued investment in SHORAD. These factors collectively underscore the system's strategic importance in ensuring force survivability, operational flexibility, and comprehensive air defense coverage in contemporary combat environments.

Regional Trends in SHORAD Market

Regional trends in the SHORAD market are shaped by distinct security challenges, defense strategies, and modernization priorities across different regions. North America continues to invest heavily in next-generation SHORAD systems to enhance homeland defense and support rapid-deployment forces in overseas missions. European nations are prioritizing the modernization of air defense capabilities to counter growing aerial threats near their borders, with particular emphasis on integrating SHORAD into multi-layered defense networks. The Asia-Pacific region is witnessing robust demand driven by rising territorial tensions, expanding aerial capabilities of neighboring states, and the increasing threat of drone incursions. Middle Eastern countries are accelerating SHORAD acquisitions to protect critical infrastructure, urban centers, and strategic assets from regional conflicts and asymmetric threats. In Latin America and Africa, investment is gradually increasing as nations seek to enhance border security and defend key installations against emerging aerial threats. Across all regions, there is a strong focus on mobility, modularity, and networked operations, with many countries pursuing joint development and procurement initiatives. This growing emphasis on agile and interoperable SHORAD solutions reflects their expanding role in national defense strategies, ensuring readiness against a broad spectrum of low-altitude threats in evolving global security environments.

Key SHORAD Program:

Romania's Ministry of National Defence has announced that Rafael Advanced Defense Systems of Israel has been selected to deliver the country's new Very Short- and Short-Range Air Defense (V/SHORAD) capability. The framework agreement, which is awaiting final signature, is valued at around €1.9 billion (approximately $2.2 billion) before VAT, marking the largest air defense acquisition in Romania's history. Originally approved by parliament in 2020 and launched in 2023, the V/SHORAD program is a key element of Romania's broader air defense modernization strategy. The initiative aims to strengthen the nation's layered defense architecture and bolster its ability to counter evolving low- and medium-altitude aerial threats.

Table of Contents

SHORAD Market Report Definition

SHORAD Market Segmentation

By Region

By Type

By Application

SHORAD Market Analysis for next 10 Years

The 10-year swarm drones market analysis would give a detailed overview of swarm drones market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of SHORAD Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global SHORAD Market Forecast

The 10-year swarm drones market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional SHORAD Market Trends & Forecast

The regional swarm drones market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of SHORAD Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for SHORAD Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on SHORAD Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global SHORAD Market Forecast, 2025-2035

- Figure 2: Global SHORAD Market Forecast, By Region, 2025-2035

- Figure 3: Global SHORAD Market Forecast, By Platform, 2025-2035

- Figure 4: Global SHORAD Market Forecast, By Type, 2025-2035

- Figure 5: North America, SHORAD Market, Market Forecast, 2025-2035

- Figure 6: Europe, SHORAD Market, Market Forecast, 2025-2035

- Figure 7: Middle East, SHORAD Market, Market Forecast, 2025-2035

- Figure 8: APAC, SHORAD Market, Market Forecast, 2025-2035

- Figure 9: South America, SHORAD Market, Market Forecast, 2025-2035

- Figure 10: United States, SHORAD Market, Technology Maturation, 2025-2035

- Figure 11: United States, SHORAD Market, Market Forecast, 2025-2035

- Figure 12: Canada, SHORAD Market, Technology Maturation, 2025-2035

- Figure 13: Canada, SHORAD Market, Market Forecast, 2025-2035

- Figure 14: Italy, SHORAD Market, Technology Maturation, 2025-2035

- Figure 15: Italy, SHORAD Market, Market Forecast, 2025-2035

- Figure 16: France, SHORAD Market, Technology Maturation, 2025-2035

- Figure 17: France, SHORAD Market, Market Forecast, 2025-2035

- Figure 18: Germany, SHORAD Market, Technology Maturation, 2025-2035

- Figure 19: Germany, SHORAD Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, SHORAD Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, SHORAD Market, Market Forecast, 2025-2035

- Figure 22: Belgium, SHORAD Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, SHORAD Market, Market Forecast, 2025-2035

- Figure 24: Spain, SHORAD Market, Technology Maturation, 2025-2035

- Figure 25: Spain, SHORAD Market, Market Forecast, 2025-2035

- Figure 26: Sweden, SHORAD Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, SHORAD Market, Market Forecast, 2025-2035

- Figure 28: Brazil, SHORAD Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, SHORAD Market, Market Forecast, 2025-2035

- Figure 30: Australia, SHORAD Market, Technology Maturation, 2025-2035

- Figure 31: Australia, SHORAD Market, Market Forecast, 2025-2035

- Figure 32: India, SHORAD Market, Technology Maturation, 2025-2035

- Figure 33: India, SHORAD Market, Market Forecast, 2025-2035

- Figure 34: China, SHORAD Market, Technology Maturation, 2025-2035

- Figure 35: China, SHORAD Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, SHORAD Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, SHORAD Market, Market Forecast, 2025-2035

- Figure 38: South Korea, SHORAD Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, SHORAD Market, Market Forecast, 2025-2035

- Figure 40: Japan, SHORAD Market, Technology Maturation, 2025-2035

- Figure 41: Japan, SHORAD Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, SHORAD Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, SHORAD Market, Market Forecast, 2025-2035

- Figure 44: Singapore, SHORAD Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, SHORAD Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, SHORAD Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, SHORAD Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, SHORAD Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, SHORAD Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, SHORAD Market, By Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, SHORAD Market, By Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, SHORAD Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, SHORAD Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, SHORAD Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, SHORAD Market, Global Market, 2025-2035

- Figure 56: Scenario 1, SHORAD Market, Total Market, 2025-2035

- Figure 57: Scenario 1, SHORAD Market, By Region, 2025-2035

- Figure 58: Scenario 1, SHORAD Market, By Platform, 2025-2035

- Figure 59: Scenario 1, SHORAD Market, By Type, 2025-2035

- Figure 60: Scenario 2, SHORAD Market, Total Market, 2025-2035

- Figure 61: Scenario 2, SHORAD Market, By Region, 2025-2035

- Figure 62: Scenario 2, SHORAD Market, By Platform, 2025-2035

- Figure 63: Scenario 2, SHORAD Market, By Type, 2025-2035

- Figure 64: Company Benchmark, SHORAD Market, 2025-2035