PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851089

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851089

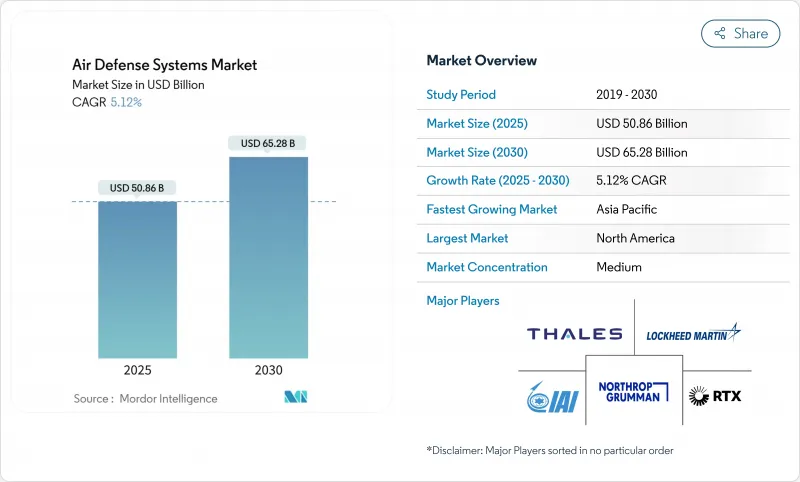

Air Defense Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The air defense systems market is valued at USD 50.86 billion in 2025 and is projected to climb to USD 65.28 billion by 2030, advancing at a 5.12% CAGR.

Demand pivots from aircraft-centric weapons to multilayer solutions that counter hypersonic glide vehicles, maneuvering ballistic missiles, and low-cost drone swarms. Defense ministries re-prioritize budgets toward integrated architectures, high-power microwave effectors, and AI-enabled command networks that shorten engagement cycles. North America remains the largest buyer, while Asia-Pacific records the fastest regional growth as territorial disputes accelerate procurement and indigenous production. Prime contractors sustain multi-year visibility through record backlogs, yet gaps in semiconductor supply chains and export-control regimes temper short-term deliveries.

Global Air Defense Systems Market Trends and Insights

Acceleration of Integrated Air and Missile Defense Procurement

Global militaries now treat sensor-to-shooter integration as critical, funding open-architecture command networks that fuse radars, electro-optical sensors, and effectors into a single fire-control ecosystem. The US Army's Integrated Battle Command System achieved initial operational capability in Poland, demonstrating real-time data exchange among Patriot, Sentinel, and THAAD batteries. In Europe, the 23-partner EISNET program led by Thales standardizes interfaces to cut command latency and widen supplier participation. Governments fund civilian-military links so air traffic regulators can coordinate with defense nodes during emergencies. Integration contracts often exceed the cost of individual launchers, as evidenced by Poland's USD 2.5 billion software package, which accompanies hardware orders. As a result, software engineering and cyber-secure networking capabilities increasingly decide tender outcomes.

Escalating Spectrum of Airborne Threats

Hypersonic glide vehicles compress engagement windows to seconds, forcing investment in space-based infrared satellites and nascent glide-phase interceptors under development by Northrop Grumman. Simultaneously, drone swarms costing under USD 1,000 per airframe threaten command posts and ammunition depots. Militaries now procure layered architectures that mate kinetic missiles with high-power microwave trucks and radio-frequency jammers to match cost with threat scale. The US Army nearly doubled its 2025 air and missile defense budget to USD 5.6 billion to speed deployment of such mixed-capability formations. Fiscal urgency is echoed in NATO supplemental budgets prioritizing interceptors, radar upgrades, and counter-UAS kits.

Supply-Chain Bottlenecks in GaN-Based Radar T/R Modules

Gallium nitride is indispensable for active electronically scanned array radars, yet Chinese export curbs on gallium compounds tightened supplies in 2024. The US Government Accountability Office warns that Western fabs cannot meet military demand without fresh capital investment, stretching lead times by 12-18 months. Defense primes now dual-source wafers and lobby for strategic stockpiles, but requalification of new fabs takes time and adds cost. Competition from 5G telecoms for the same substrates further inflates pricing and crowds military orders to the back of foundry queues.

Other drivers and restraints analyzed in the detailed report include:

- AI-Enabled Sensor Fusion Improving Track-Before-Detect Probability for Stealth Targets

- Emergence of Mobile Directed-Energy SHORAD for Base and Asset Protection

- Stringent ITAR and MTCR Export Controls Limiting System Sales to Emerging Nations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Missile defense systems accounted for 51.85% of 2024 revenues, anchoring the air defense systems market size at USD 26.4 billion. Demand stems from national strategic programs such as Patriot, THAAD, and S-400 that safeguard population centers and deterrent forces. Yet counter-UAS solutions register an 11.21% CAGR to 2030, mirroring the proliferation of small drones over urban and battlefield airspace. Militaries weigh the unsustainable cost of firing USD 3 million interceptors at USD 500 quadcopters, accelerating procurement of radio-frequency jammers, high-power microwave trailers, and kinetic Coyote interceptors. A layered mix reduces expenditure per engagement and preserves long-range interceptors for higher-value targets.

Counter-rocket, artillery, and mortar systems extend the same logic to indirect-fire threats, while anti-aircraft guns and surface-to-air missiles remain essential for medium-altitude aircraft. Buyers such as Qatar recently placed USD 1 billion orders for fully integrated counter-drone nodes that link acoustic, radar, and EO sensors to Coyote Block 2 effectors. This specialization diversifies supplier rosters, giving newer entrants leverage in a field once reserved for legacy missile houses. The rebalanced demand portfolio positions Counter-UAS as a critical growth engine within the broader air defense systems market.

Land-based launchers generated 42.90% of 2024 spending and anchor the air defense systems market share because fixed installations guard capitals, air bases, and industrial hubs. Nations continue to expand Patriot and S-400 sites, yet sea-based platforms are posting a 5.89% CAGR thanks to rising anti-ship ballistic missile threats. Modern Aegis destroyers carry revised software builds incorporating ballistic missile defense, and several navies add deck-mounted lasers for drone suppression. Littoral nations seek area denial around ports and offshore platforms, boosting demand for ship-integrated radars with cooperative engagement functions.

Aircraft-mounted systems supply expeditionary air coverage, often plugging gaps before land batteries arrive. Space-based sensors distribute early-warning data to every platform, acting as the backbone of global missile tracking. Because cross-domain cueing now defines survivability, navies specify open interfaces that accept real-time satellite feeds and ground radar tracks. This convergence blurs the historical boundary between maritime and terrestrial procurement cycles and further enlarges the opportunity within the air defense systems market.

The Air Defense Systems Market Report is Segmented by System (Missile Defense Systems, Anti-Aircraft Gun and SAM Systems, and More), Platform (Land-Based, Sea-Based, and More), Range (Short, Medium, and Long), Sub-System (Weapon System, Fire Control System, and More), Technology (Kinetic-Kill Effectors, and More ), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 37.90% of global revenue in 2024, buoyed by the United States' multi-layered homeland shield and robust foreign military sales pipeline. Combined Q1 2025 sales of RTX and Lockheed Martin surpassed USD 38 billion, providing a large domestic engineering base. Canada's NORAD modernization injects funds into over-the-horizon radar sites and Arctic satellite communications, while Mexico explores mobile SHORAD purchases for critical energy infrastructure. Space-based missile warning programs under the US Space Force amplify regional influence because their data feeds many allied intercept chains.

Asia-Pacific posts the fastest 7.90% CAGR to 2030. Japan fields Aegis Ashore derivatives, and contractors in South Korea exported the KM-SAM II to Gulf customers, demonstrating the region's shift from importer to net exporter. India accelerates its Integrated Air Defence Weapon System and negotiates co-production offsets for sensor packages. Australia funds Joint Project 9102 to add sovereign satellite communications that plug into Aegis afloat. Smaller players like the Philippines expand Spyder and FA-50 fleets, reflecting a desire for quick-reaction coverage of archipelagic terrain.

Europe increases investment under the European Sky Shield Initiative, bringing 21 nations into a common procure-organize-train model that aggregates demand. Germany champions IRIS-T SLM batteries, Poland fields IBCS-based Wisla battalions, and recent NATO entrant Sweden ordered TPY-4 surveillance radars from Lockheed Martin. EU funds focus on open-architecture command systems to ensure cross-border cueing.

The Middle East attracts a mix of US, European, and indigenous solutions as Gulf states harden refineries and airports against cruise missiles and drones. Saudi Arabia initiated domestic THAAD component assembly in 2025, reinforcing localization under Vision 2030. Israel continues to iterate on Iron Dome and multi-layer add-ons such as David's Sling, offering combat-proven benchmarks that shape tender specifications worldwide.

- RTX Corporation

- Lockheed Martin Corporation

- Israel Aerospace Industries Ltd.

- Northrop Grumman Corporation

- Thales Group

- Saab AB

- Rheinmetall AG

- Leonardo S.p.A.

- Kongsberg Gruppen ASA

- The Boeing Company

- ASELSAN Elektronik Sanayi ve Ticaret Anonim ?irketi

- Hanwha Systems Co., Ltd.

- Rafael Advanced Defense Systems Ltd.

- L3Harris Technologies, Inc.

- BAE Systems plc

- MBDA

- Diehl Group

- Elbit Systems Ltd.

- Bharat Dynamics Limited (BDL)

- China Aerospace Science and Technology Corporation

- MDA Ltd.

- China North Industries Group Corporation (Norinco)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Acceleration of integrated air and missile defense procurement

- 4.2.2 Escalating spectrum of airborne threats

- 4.2.3 AI-enabled sensor fusion for stealth detection

- 4.2.4 Mobile directed-energy SHORAD adoption

- 4.2.5 GaN-based AESA radar cost decline

- 4.2.6 Higher budgets for counter-UAS and point defense

- 4.3 Market Restraints

- 4.3.1 Supply-chain bottlenecks in GaN radar modules

- 4.3.2 Stringent ITAR and MTCR export controls limiting system sales to emerging nations

- 4.3.3 Technical and materials challenges in reliably intercepting maneuvering hypersonic targets, inflating R&D risk

- 4.3.4 Electromagnetic spectrum congestion raising inter-operability challenges

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By System

- 5.1.1 Missile Defense Systems

- 5.1.2 Anti-Aircraft Gun and SAM Systems

- 5.1.3 Counter-Unmanned Aerial Systems (C-UAS)

- 5.1.4 Counter-Rocket, Artillery and Mortar (C-RAM)

- 5.2 By Platform

- 5.2.1 Land-Based

- 5.2.2 Sea-Based

- 5.2.3 Air-Based

- 5.2.4 Space-Based Early-Warning Assets

- 5.3 By Range

- 5.3.1 Short Range

- 5.3.2 Medium Range

- 5.3.3 Long Range

- 5.4 By Sub-system

- 5.4.1 Weapon System

- 5.4.2 Fire Control System

- 5.4.3 Command and Control System

- 5.4.4 Others

- 5.5 By Technology

- 5.5.1 Kinetic-Kill Effectors

- 5.5.2 High-Energy Laser Systems

- 5.5.3 High-Power Microwave Systems

- 5.5.4 Electronic Warfare (EW) Soft-Kill Solutions

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Israel

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 RTX Corporation

- 6.4.2 Lockheed Martin Corporation

- 6.4.3 Israel Aerospace Industries Ltd.

- 6.4.4 Northrop Grumman Corporation

- 6.4.5 Thales Group

- 6.4.6 Saab AB

- 6.4.7 Rheinmetall AG

- 6.4.8 Leonardo S.p.A.

- 6.4.9 Kongsberg Gruppen ASA

- 6.4.10 The Boeing Company

- 6.4.11 ASELSAN Elektronik Sanayi ve Ticaret Anonim ?irketi

- 6.4.12 Hanwha Systems Co., Ltd.

- 6.4.13 Rafael Advanced Defense Systems Ltd.

- 6.4.14 L3Harris Technologies, Inc.

- 6.4.15 BAE Systems plc

- 6.4.16 MBDA

- 6.4.17 Diehl Group

- 6.4.18 Elbit Systems Ltd.

- 6.4.19 Bharat Dynamics Limited (BDL)

- 6.4.20 China Aerospace Science and Technology Corporation

- 6.4.21 MDA Ltd.

- 6.4.22 China North Industries Group Corporation (Norinco)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment