PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1831813

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1831813

Global Missile Propulsion Market 2025-2035

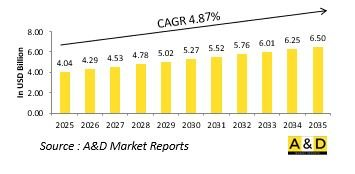

The Global MISSILE PROPULSION market is estimated at USD 4.04 billion in 2025, projected to grow to USD 6.50 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 4.87% over the forecast period 2025-2035.

Introduction to Global MISSILE PROPULSION market:

The defense missile propulsion market is a critical segment of the global defense industry, underpinning the performance, range, and effectiveness of modern missile systems. Propulsion technologies are the driving force that enable missiles to reach their targets with speed, precision, and reliability, making them vital for strategic deterrence, tactical operations, and homeland security. As threats evolve and nations focus on enhancing their offensive and defensive capabilities, the demand for advanced propulsion systems continues to grow. Modern militaries require missiles capable of striking targets across diverse ranges, from short-range tactical engagements to long-range strategic missions, which places significant emphasis on propulsion innovation. Additionally, the rise of hypersonic weapons, precision-guided munitions, and multi-domain operations is reshaping the propulsion landscape, pushing defense contractors and research agencies to develop lighter, more efficient, and highly adaptable propulsion systems. This market's evolution is closely tied to advancements in materials science, fuel chemistry, and aerodynamic design, as well as the increasing integration of propulsion technologies with guidance and control systems. As a result, the missile propulsion sector remains a cornerstone of national defense strategies, directly influencing the effectiveness and reach of a nation's deterrence and strike capabilities.

Technology Impact in MISSILE PROPULSION Market:

Technological advancements are profoundly transforming the defense missile propulsion landscape, driving improvements in range, maneuverability, fuel efficiency, and overall system performance. Innovations in solid, liquid, hybrid, and air-breathing propulsion systems are enabling missiles to achieve greater speeds, enhanced precision, and superior survivability in contested environments. Emerging technologies, such as scramjets and ramjets, are pushing the boundaries of hypersonic flight, allowing missiles to travel at extreme velocities while maintaining stability and control. Additionally, advances in composite materials and lightweight structures are reducing mass and improving fuel efficiency, thereby extending operational range without increasing payload weight. Developments in propulsion system miniaturization are also enabling the integration of advanced missile technologies into smaller platforms, supporting a broader range of tactical and strategic missions. Moreover, the integration of artificial intelligence and advanced modeling techniques is enhancing propulsion system design, testing, and performance prediction, significantly reducing development timelines. These technological breakthroughs are not only improving traditional missile capabilities but also facilitating the creation of next-generation systems designed for multi-domain operations, including space and cyber-enabled warfare. As nations invest in cutting-edge propulsion research, the technology's impact is redefining modern warfare dynamics and shaping future defense strategies.

Key Drivers in MISSILE PROPULSION Market:

Several factors are driving the sustained growth and innovation within the defense missile propulsion market. One of the primary drivers is the evolving nature of modern warfare, characterized by high-speed engagements, precision targeting, and long-range strike requirements. Nations are investing heavily in missile propulsion technologies to ensure their defense systems can effectively counter emerging threats, including hypersonic weapons, advanced air defenses, and evolving ballistic missile capabilities. Geopolitical tensions and regional conflicts are further accelerating the demand for enhanced missile performance, as countries seek to maintain technological superiority and strategic deterrence. Defense modernization programs and increased government spending on research and development are fueling innovation in propulsion systems, enabling the transition from traditional propulsion solutions to advanced, high-efficiency designs. Additionally, the growing focus on multi-domain operations, including space and near-space applications, is driving the development of versatile propulsion technologies that can operate across diverse environments. Collaboration between defense agencies, private industry, and research institutions is another key factor, promoting the rapid translation of scientific breakthroughs into deployable missile systems. Collectively, these drivers are shaping a highly competitive and rapidly evolving market that remains central to global defense capabilities.

Regional Trends in MISSILE PROPULSION Market:

The defense missile propulsion market is witnessing dynamic growth across various regions, each shaped by unique strategic priorities, security concerns, and industrial capabilities. In North America, strong investments in advanced propulsion technologies are driven by the need to maintain a technological edge and support a robust missile defense architecture. Europe is focusing on collaborative development initiatives, emphasizing interoperability and the modernization of missile systems to meet evolving security challenges. The Asia-Pacific region is emerging as a key growth center, with rapid advancements in indigenous missile programs and significant investments in hypersonic and long-range strike capabilities. Rising regional tensions and territorial disputes are fueling demand for advanced propulsion systems capable of supporting deterrence and rapid response strategies. In the Middle East, nations are prioritizing propulsion technologies to enhance missile-based deterrence amid regional instability and evolving threat landscapes. Meanwhile, emerging economies are investing in indigenous propulsion capabilities to achieve strategic autonomy and reduce reliance on foreign suppliers. Across all regions, the emphasis is shifting toward propulsion systems that offer greater efficiency, modularity, and adaptability, reflecting the broader evolution of defense strategies and the increasing importance of precision, speed, and reach in modern military operations.

Key MISSILE PROPULSION Program:

L3Harris Technologies has secured a contract worth up to $292 million to continue supplying propulsion systems for the Javelin weapon system. This marks the largest propulsion production award in the history of the Javelin program and extends manufacturing for an additional five years. The company is ramping up solid rocket motor production across multiple programs, including Javelin, supported by both its internal manufacturing investments and a $215.6 million cooperative agreement with the Department of War. As part of these efforts, L3Harris is implementing a fully digital production workflow for the Javelin line, enabling real-time data tracking, enhanced quality monitoring, and improved control over production efficiency. L3Harris remains the exclusive producer of Javelin solid rocket motors, while the Javelin weapon system itself is developed and produced by the Javelin Joint Venture - a collaboration between Lockheed Martin and Raytheon - for the U.S. Army, Marine Corps, and international customers.

Table of Contents

Missile Propulsion Market Table of Contents

Missile Propulsion Market Report Definition

Missile Propulsion Market Segmentation

By Engine

By Region

By Type

Missile Propulsion Market Analysis for next 10 Years

The 10-year missile propulsion market analysis would give a detailed overview of missile propulsion market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Missile Propulsion Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Missile Propulsion Market Forecast

The 10-year missile propulsion market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Missile Propulsion Market Trends & Forecast

The regional missile propulsion market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Missile Propulsion Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Missile Propulsion Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Missile Propulsion Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Engine, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Engine, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Missile Propulsion Market Forecast, 2025-2035

- Figure 2: Global Missile Propulsion Market Forecast, By Region, 2025-2035

- Figure 3: Global Missile Propulsion Market Forecast, By Engine, 2025-2035

- Figure 4: Global Missile Propulsion Market Forecast, By Type, 2025-2035

- Figure 5: North America, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 6: Europe, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 8: APAC, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 9: South America, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 10: United States, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 11: United States, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 12: Canada, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 14: Italy, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 16: France, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 17: France, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 18: Germany, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 24: Spain, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 30: Australia, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 32: India, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 33: India, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 34: China, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 35: China, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 40: Japan, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Missile Propulsion Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Missile Propulsion Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Missile Propulsion Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Missile Propulsion Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Missile Propulsion Market, By Engine (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Missile Propulsion Market, By Engine (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Missile Propulsion Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Missile Propulsion Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Missile Propulsion Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Missile Propulsion Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Missile Propulsion Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Missile Propulsion Market, By Region, 2025-2035

- Figure 58: Scenario 1, Missile Propulsion Market, By Engine, 2025-2035

- Figure 59: Scenario 1, Missile Propulsion Market, By Type, 2025-2035

- Figure 60: Scenario 2, Missile Propulsion Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Missile Propulsion Market, By Region, 2025-2035

- Figure 62: Scenario 2, Missile Propulsion Market, By Engine, 2025-2035

- Figure 63: Scenario 2, Missile Propulsion Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Missile Propulsion Market, 2025-2035