PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844306

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844306

Missile Propulsion Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

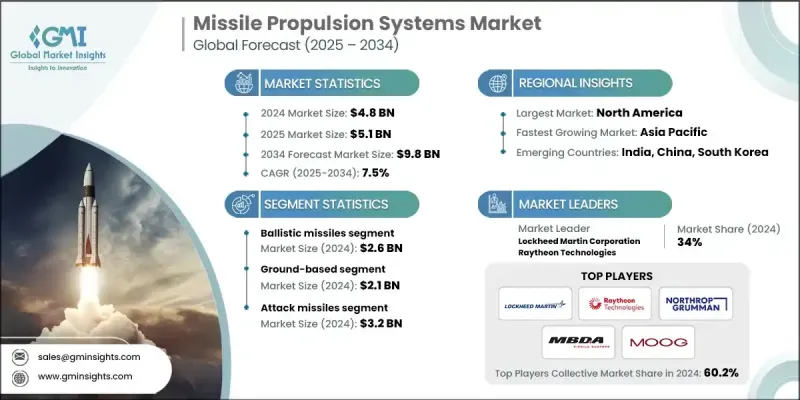

The Global Missile Propulsion Systems Market was valued at USD 4.8 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 9.8 billion by 2034.

Several factors are contributing to this expansion, including increased global defense spending, rising geopolitical tensions, and a push for strategic military modernization. Additionally, the growing space exploration industry, coupled with the surge in satellite launches, is driving demand for advanced propulsion systems. As military technology advances, so does the need for high-performance propulsion solutions, particularly those that enable hypersonic speeds and high maneuverability. The integration of artificial intelligence (AI) and smart targeting systems is also reshaping missile technology, with military forces increasingly relying on AI to enhance precision and flexibility in missile strikes. This trend is expected to peak between 2025 and 2030, revolutionizing modern warfare with more accurate and adaptable missiles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 7.5% |

The ballistic missile segment was valued at USD 2.6 billion in 2024. The segment benefits from the ongoing geopolitical instability, which increases the demand for long-range precision strike capabilities. Countries are investing heavily in upgrading their missile arsenals to ensure better speed, precision, and range. This calls for the development of advanced propulsion technologies that enhance fuel efficiency, modular flexibility, and precision strike capabilities.

The ground-based missile systems segment was valued at USD 2.1 billion in 2024, owing to the rising demand for mobile and deployable missile systems. With a greater focus on territorial defense and quick response capabilities, military forces are increasingly seeking advanced propulsion solutions to meet these needs. Manufacturers need to focus on enhancing mobility, improving propulsion efficiency, and creating advanced targeting systems to adapt to changing battlefield requirements.

U.S. Missile Propulsion Systems Market generated USD 1.5 billion in 2024 fueled by its substantial defense budget, which allows for significant investment in missile technology research and the development of hypersonic propulsion systems. The U.S. is also prioritizing the modernization of its military assets, which includes developing more advanced and efficient missile propulsion technologies. In line with this, manufacturers are working to accelerate innovations in hypersonic propulsion while forming strategic partnerships with defense agencies to address evolving technological demands.

Prominent companies in the Global Missile Propulsion Systems Industry include Lockheed Martin Corporation, Raytheon Technologies, Northrop Grumman, Rolls-Royce plc, Hanwha Aerospace, Kratos, Moog Inc., AVIO SPA, EDePRo, MBDA, IHI Corporation, Karman Space & Defense, Nammo AS, L3Harris Technologies, Inc., RAFAEL Advanced Defense Systems, Roxel, Vaya Space, and Walchandnagar Industries Limited. To maintain and strengthen their position in the missile propulsion systems market, companies are emphasizing cutting-edge technological advancements and strategic collaborations. Many are focusing on developing next-generation propulsion systems that incorporate hypersonic technology to meet military demands for speed and precision. Additionally, manufacturers are investing heavily in the integration of AI and smart systems to improve missile targeting and flexibility. Partnerships with defense agencies are also critical, allowing companies to remain closely aligned with military needs and benefit from government contracts.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Missile type trends

- 2.2.2 Propulsion type trends

- 2.2.3 Launch platform trends

- 2.2.4 Speed trends

- 2.2.5 Application trends

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Global Defense Spending

- 3.2.1.2 Geopolitical Tensions & Strategic Modernization

- 3.2.1.3 Expansion of Space Exploration and Satellite Launch Activity

- 3.2.1.4 Advancements in Hypersonic Technology

- 3.2.1.5 Commercial Space Industry Expansion

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Development and Procurement Costs

- 3.2.2.2 Stringent Export Regulations and Compliance Barriers

- 3.2.3 Market opportunities

- 3.2.3.1 Advancements in Green and Sustainable Propulsion Technologies

- 3.2.3.2 Emergence of Indigenous Defense Manufacturing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on Industry Growth

- 3.14.2 Defense Budgets by Country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market estimates and forecast, by Missile Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Ballistic missiles

- 5.2.1 Short range (<1,000 km)

- 5.2.2 Medium range (1,000-3,000 km)

- 5.2.3 Intermediate range (3,000-5,500 km)

- 5.2.4 Intercontinental range (>5,500 km)

- 5.3 Cruise missiles

- 5.3.1 Short range (<500 km)

- 5.3.2 Medium range (500-1,000 km)

- 5.3.3 Long range (1,000-3,000 km)

Chapter 6 Market estimates and forecast, by Propulsion Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Air-breathing

- 6.2.1 Gas turbine & jet engines

- 6.2.2 Ramjets & scramjets

- 6.3 Non-air-breathing

- 6.3.1 Solid propulsion

- 6.3.2 Liquid propulsion

- 6.3.3 Hybrid propulsion

- 6.3.4 Electric propulsion

Chapter 7 Market estimates and forecast, by Launch Platform, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Ground-based

- 7.3 Airborne

- 7.4 Naval

- 7.5 Space-enabled

Chapter 8 Market estimates and forecast, by Speed, 2021 - 2034 (USD Million)

- 8.1 Subsonic (< Mach 1)

- 8.2 Supersonic (Mach 1-5)

- 8.3 Hypersonic (> Mach 5)

Chapter 9 Market estimates and forecast, by Application, 2021 - 2034 (USD Million)

- 9.1 Attack Missiles

- 9.2 Defense Missiles

Chapter 10 Market estimates and forecast, by Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company profiles

- 11.1 Global Key Players

- 11.1.1 Lockheed Martin Corporation

- 11.1.2 Raytheon Technologies

- 11.1.3 Northrop Grumman

- 11.1.4 MBDA

- 11.1.5. L3 Harris Technologies, Inc.

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 Moog Inc.

- 11.2.1.2 Kratos

- 11.2.1.3 Karman Space & Defense .

- 11.2.2 Europe

- 11.2.2.1 AVIO SPA

- 11.2.2.2 Nammo AS

- 11.2.2.3 Roxel

- 11.2.2.4 Rolls-Royce plc

- 11.2.2.5 RAFAEL Advanced Defense Systems

- 11.2.2.6 EDePRo

- 11.2.3 Asia-Pacific

- 11.2.3.1 Hanwha Aerospace

- 11.2.3.2 IHI Corporation

- 11.2.3.3 Walchandnagar Industries Limited

- 11.2.1 North America

- 11.3 Disruptors / Niche Players

- 11.3.1 Vaya Space