PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1896740

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1896740

Global Fighter Aircraft Market 2026-2036

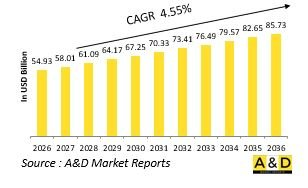

The Global Fighter Aircraft market is estimated at USD 54.93 billion in 2026, projected to grow to USD 85.73 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 4.55% over the forecast period 2026-2036.

Introduction to Fighter Aircraft Market:

The defense fighter aircraft market represents one of the most advanced and strategically significant segments of global military aviation. Fighter aircraft serve as the cornerstone of air dominance, ensuring territorial security, deterrence, and rapid response capabilities. These aircraft are designed for air superiority, ground attack, interception, and multirole missions, combining speed, agility, and advanced avionics to operate effectively in contested airspace. Modern defense strategies increasingly rely on next-generation fighters equipped with stealth technology, networked sensors, and precision-guided weapons to counter evolving threats. Nations are investing heavily in fleet modernization and joint development programs to maintain technological superiority and interoperability. As geopolitical tensions rise and defense alliances evolve, the fighter aircraft market continues to expand through both indigenous production and international collaborations aimed at building self-reliant and capable air forces.

Technology Impact in Fighter Aircraft Market:

Technological advancements are transforming the capabilities and strategic role of fighter aircraft. Stealth design reduces radar visibility, enabling aircraft to operate undetected in high-threat environments. Integration of artificial intelligence and machine learning enhances situational awareness, threat assessment, and automated decision support. Advanced avionics and sensor fusion provide pilots with a unified, real-time operational picture, improving mission precision. Fly-by-wire systems, digital flight controls, and adaptive engines enhance maneuverability and fuel efficiency. The use of composite materials and additive manufacturing reduces weight and maintenance requirements, extending operational life. Network-centric warfare capabilities allow fighters to act as nodes in broader defense ecosystems, sharing data across multiple platforms. These innovations collectively redefine air combat, allowing fighter aircraft to perform complex missions with greater accuracy, autonomy, and survivability.

Key Drivers in Fighter Aircraft Market:

The defense fighter aircraft market is propelled by the need for air superiority in increasingly contested and technologically complex battle environments. The emergence of advanced missile systems, unmanned aerial threats, and electronic warfare capabilities drives demand for next-generation fighters capable of countering multiple domains. Defense modernization initiatives emphasize replacing aging fleets with multirole platforms that integrate seamlessly into networked command and control systems. Increased defense spending and strategic alliances further support joint fighter development and technology transfer programs. Additionally, the growing focus on indigenous manufacturing and defense self-reliance motivates nations to invest in domestic fighter production capabilities. The demand for enhanced survivability, precision strike capabilities, and interoperability across allied forces continues to reinforce the strategic importance of modern fighter aircraft within national and coalition defense architectures.

Regional Trends in Fighter Aircraft Market:

Regional dynamics in the defense fighter aircraft market reflect shifting security priorities and technological ambitions. North America leads in the development and deployment of fifth-generation fighters, driven by advanced R&D infrastructure and robust defense budgets. Europe focuses on collaborative programs to develop next-generation platforms, emphasizing interoperability and shared technology development. The Asia-Pacific region is witnessing accelerated procurement and indigenous production to address regional security challenges and strengthen aerial deterrence. In the Middle East, rising geopolitical tensions have spurred investment in high-performance multirole fighters with advanced strike capabilities. Latin American and African nations are gradually modernizing their fleets through procurement partnerships and cost-effective upgrade programs. Across regions, defense planners increasingly emphasize adaptability, stealth, and digital connectivity, ensuring that fighter aircraft remain critical assets for maintaining strategic balance and operational readiness in modern air warfare.

Key Fighter Aircraft Program:

India has signed a 623.70-billion-rupee ($7 billion; €6 billion) agreement with Hindustan Aeronautics Limited (HAL) to upgrade its armed forces. The contract includes the procurement of 97 Tejas Mk-1A fighter jets to be domestically manufactured. The announcement came a day before the Indian Air Force conducted its final flight of 36 MiG-21 aircraft, marking the end of their decades-long service and reducing the predominantly Soviet-era fleet to 29 jets. Some Indian officials have expressed concerns over retiring the MiG fleet, particularly in view of recent tensions with Pakistan in May.

Table of Contents

Fighter Aircraft Market - Table of Contents

Fighter Aircraft Market Report Definition

Fighter Aircraft Market Segmentation

By Configuration

By Region

By Type

Fighter Aircraft Market Analysis for next 10 Years

The 10-year fighter aircraft market analysis would give a detailed overview of fighter aircraft market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Fighter Aircraft Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Fighter Aircraft Market Forecast

The 10-year fighter aircraft market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Fighter Aircraft Market Trends & Forecast

The regional fighter aircraft market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Fighter Aircraft Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Fighter Aircraft Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Fighter Aircraft Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Configuration, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Configuration, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Fighter Aircraft Market Forecast, 2025-2035

- Figure 2: Global Fighter Aircraft Market Forecast, By Region, 2025-2035

- Figure 3: Global Fighter Aircraft Market Forecast, By Configuration, 2025-2035

- Figure 4: Global Fighter Aircraft Market Forecast, By Type, 2025-2035

- Figure 5: North America, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 6: Europe, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 8: APAC, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 9: South America, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 10: United States, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 11: United States, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 12: Canada, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 14: Italy, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 16: France, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 17: France, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 18: Germany, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 24: Spain, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 30: Australia, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 32: India, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 33: India, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 34: China, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 35: China, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 40: Japan, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Fighter Aircraft Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Fighter Aircraft Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Fighter Aircraft Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Fighter Aircraft Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Fighter Aircraft Market, By Configuration (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Fighter Aircraft Market, By Configuration (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Fighter Aircraft Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Fighter Aircraft Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Fighter Aircraft Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Fighter Aircraft Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Fighter Aircraft Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Fighter Aircraft Market, By Region, 2025-2035

- Figure 58: Scenario 1, Fighter Aircraft Market, By Configuration, 2025-2035

- Figure 59: Scenario 1, Fighter Aircraft Market, By Type, 2025-2035

- Figure 60: Scenario 2, Fighter Aircraft Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Fighter Aircraft Market, By Region, 2025-2035

- Figure 62: Scenario 2, Fighter Aircraft Market, By Configuration, 2025-2035

- Figure 63: Scenario 2, Fighter Aircraft Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Fighter Aircraft Market, 2025-2035