PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1927667

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1927667

Global Civilian Ammunition Market 2026-2036

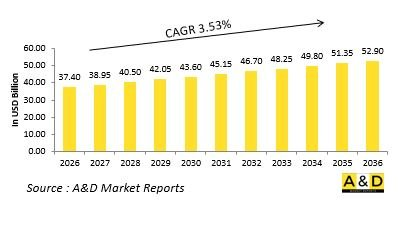

The Global Civilian Ammunition market is estimated at USD 37.40 billion in 2026, projected to grow to USD 52.90 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.53% over the forecast period 2026-2036.

Introduction to Global Civilian Ammunition

The civilian ammunition market encompasses cartridges and projectiles designed for recreational shooting, hunting, and personal defense. This market has grown alongside increasing interest in shooting sports, firearm ownership, and self-protection needs. Civilian ammunition is manufactured to provide reliability, accuracy, and safety under varied conditions. Modern designs incorporate advanced materials and precision engineering to improve ballistic performance and durability. Market demand is influenced by regional laws, licensing requirements, and firearm popularity, with preferences varying by caliber, type, and application. Manufacturers focus on environmentally sustainable options, improved propellants, and innovative designs to meet consumer expectations. Production processes emphasize quality control, material consistency, and safety standards. The rise of competitive shooting, hunting, and tactical training programs further stimulates market growth. Distribution networks, retail availability, and consumer education also shape adoption. Technological improvements in primers, casings, and projectile design contribute to performance optimization. Overall, civilian ammunition remains a critical segment supporting recreational, sporting, and defensive firearm use, with market trends driven by consumer preferences, regulatory policies, and innovation in materials and performance technologies.

Technology Impact in Global Civilian Ammunition

Technological advancements have transformed civilian ammunition, enhancing accuracy, reliability, and performance for recreational and defensive purposes. Innovations in propellants and primers improve consistency, muzzle velocity, and ballistic efficiency. Advances in projectile design, including specialized tips, controlled expansion, and aerodynamics, optimize accuracy and terminal performance. Materials engineering, including lightweight alloys, copper alloys, and polymer coatings, enhances durability, reduces barrel wear, and improves safety. Precision manufacturing techniques ensure uniformity and tight tolerances, reducing variability across batches. Environmentally friendly ammunition with reduced lead content responds to regulatory pressures and sustainability concerns. Integration of advanced testing and quality assurance systems ensures compliance with safety and performance standards. Specialty ammunition for competitive shooting, hunting, and self-defense continues to grow, with technological refinements supporting user-specific applications. Emerging trends also include enhanced traceability and identification features for security and regulatory compliance. Collectively, technology drives the evolution of civilian ammunition by improving performance, reliability, safety, and sustainability, meeting the needs of diverse users while supporting market expansion globally.

Key Drivers in Global Civilian Ammunition

The civilian ammunition market is propelled by several interrelated factors. Growing interest in recreational shooting, hunting, and sport competitions stimulates demand for precision and specialized ammunition. Rising firearm ownership, particularly for personal defense, increases the need for reliable, high-quality cartridges. Technological advancements in materials, projectile design, and propellants enhance performance, reliability, and safety, influencing consumer choice. Regulatory frameworks and safety compliance drive innovation while shaping production and distribution. Market expansion is supported by educational programs, firearm training initiatives, and competitive shooting leagues. Manufacturers are also responding to environmental sustainability trends through lead-free and low-impact ammunition. Global economic growth, increased disposable income, and access to retail networks further influence adoption. Trends toward personalized ammunition, tactical performance rounds, and specialty calibers cater to niche consumer segments. Collectively, these factors ensure consistent growth and innovation within the civilian ammunition sector, emphasizing safety, performance, and user-focused solutions across recreational, sporting, and defensive applications.

Regional Trends in Global Civilian Ammunition

Regional variations in civilian ammunition demand are influenced by legal frameworks, cultural practices, and recreational habits. North America represents a mature market with high firearm ownership, active shooting sports, and diverse product offerings catering to defense, hunting, and competitive applications. Europe focuses on regulated ammunition consumption with emphasis on safety, environmental standards, and sporting use. Asia-Pacific is experiencing emerging demand due to increasing interest in shooting sports, firearm licensing expansion, and industrial development supporting ammunition production. Middle Eastern markets emphasize defensive and security-related applications, while African and South American regions focus on hunting, recreational, and tactical applications adapted to local needs. Across regions, trends include adoption of environmentally friendly materials, precision engineering, and specialized cartridges for niche applications. Distribution networks, retail channels, and training programs influence regional market growth. Joint initiatives between manufacturers, regulators, and user communities drive innovation, quality standards, and safety awareness. Regional differences in legal frameworks, cultural practices, and recreational habits continue to shape civilian ammunition markets globally, reflecting both demand diversity and evolving technological adoption.

Key Civil Ammunition Program:

In India, the Ministry of Home Affairs has authorized state and Union Territory Home Guard organizations to procure equipment directly from the newly formed defence public sector undertakings, including entities such as Munitions India Limited, or alternatively through open competitive tendering. This procurement flexibility enables state and UT authorities to select suitable suppliers based on operational requirements, cost considerations, and delivery timelines. By allowing direct purchases from DPSUs, the policy supports domestic defence manufacturing and aligns with the government's Aatmanirbhar Bharat initiative. At the same time, the option of open tenders promotes transparency, competition, and value for money, ensuring that Home Guard forces are equipped efficiently to meet internal security and emergency response needs.

Table of Contents

Global Civilian Ammunition Market - Table of Contents

Global Civilian Ammunition Market Report Definition

Global Civilian Ammunition Market Segmentation

By Type

By Region

By Application

Global Civilian Ammunition Market Analysis for next 10 Years

The 10-year Global Civilian Ammunition Market analysis would give a detailed overview of Civilian Ammunition Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Civilian Ammunition Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Civilian Ammunition Market Forecast

The 10-year Civilian Ammunition Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Civilian Ammunition Market Trends & Forecast

The regional Global Civilian Ammunition Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Civilian Ammunition Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Civilian Ammunition Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Civilian Ammunition Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Type, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Application, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Type, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Application, 2026-2036

List of Figures

- Figure 1: Global Civilian Ammunition Market Forecast, 2026-2036

- Figure 2: Global Civilian Ammunition Market Forecast, By Region, 2026-2036

- Figure 3: Global Civilian Ammunition Market Forecast, By Type, 2026-2036

- Figure 4: Global Civilian Ammunition Market Forecast, By Application, 2026-2036

- Figure 5: North America, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 6: Europe, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 7: Middle East, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 8: APAC, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 9: South America, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 10: United States, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 11: United States, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 12: Canada, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 14: Italy, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 16: France, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 17: France, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 18: Germany, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 24: Spain, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 30: Australia, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 32: India, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 33: India, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 34: China, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 35: China, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 40: Japan, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Civilian Ammunition Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Civilian Ammunition Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Civilian Ammunition Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Civilian Ammunition Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Civilian Ammunition Market, By Type (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Civilian Ammunition Market, By Type (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Civilian Ammunition Market, By Application (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Civilian Ammunition Market, By Application (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Civilian Ammunition Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Civilian Ammunition Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Civilian Ammunition Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Civilian Ammunition Market, By Region, 2026-2036

- Figure 58: Scenario 1, Civilian Ammunition Market, By Type, 2026-2036

- Figure 59: Scenario 1, Civilian Ammunition Market, By Application, 2026-2036

- Figure 60: Scenario 2, Civilian Ammunition Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Civilian Ammunition Market, By Region, 2026-2036

- Figure 62: Scenario 2, Civilian Ammunition Market, By Type, 2026-2036

- Figure 63: Scenario 2, Civilian Ammunition Market, By Application, 2026-2036

- Figure 64: Company Benchmark, Civilian Ammunition Market, 2026-2036