PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936041

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936041

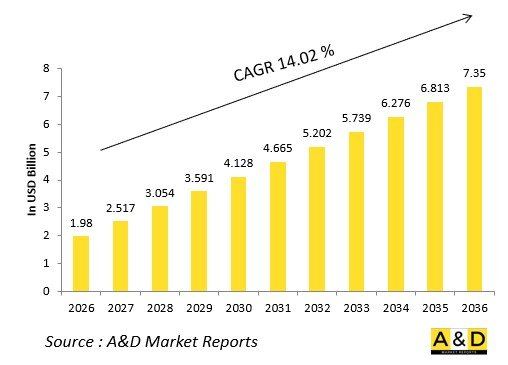

Global Aerostat Systems Market 2026-2036

The Global Aerostat Systems Market is estimated at USD 1.98 billion in 2026, projected to grow to USD 7.35 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 14.02% over the forecast period 2026-2036.

Introduction

The global Aerostat Systems market delivers cost-effective, long-endurance surveillance platforms, elevating sensors for wide-area coverage unattainable by ground systems. Tethered aerostats serve military ISR, border patrol, and critical infrastructure protection, carrying radars, electro-optical cameras, and communication nodes aloft for continuous monitoring.

Market expansion stems from heightened security needs, with aerostats filling gaps between drones and satellites. Hybrid helium envelopes with photovoltaic skins extend loiter times, while stabilized gimbals maintain sensor lock amid winds. Modular payloads swap seamlessly for missions from drug interdiction to electronic warfare support.

Geopolitical borders and urban threats drive deployments, integrated with UAV swarms and ground networks. Vendors like TCOM and Lockheed innovate tether management for mobile ops. Supply chains emphasize resilient materials against harsh environments. Competition favors rapid reconfigurability over fixed-wing alternatives.

Aerostats redefine persistent eyes in the sky.

Technology Impact in Aerostat Systems

Technological evolution empowers aerostat systems with unprecedented persistence and precision. Advanced envelope fabrics-kevlar laminates and nanocomposites-resist tears while minimizing helium leakage, enabling weeks-long stations. Autonomous tether winches deploy from trailers in minutes, supporting mobile forward ops.

Multi-spectral payloads fuse AESA radars, mid-wave IR, and hyperspectral imagers for day-night threat ID, detecting low-flying drones or vessels. AI algorithms process feeds onboard, cueing effectors via real-time downlink. Photovoltaic arrays and fuel cells power perpetual ops, reducing ground logistics.

Network integration meshes aerostats into kill webs, relaying data to fighters or missiles. Stabilized platforms counter turbulence up to gale forces, preserving gimbal accuracy. Predictive maintenance sensors forecast envelope stress, slashing downtime.

Hybrid tethers bundle power, data, and fiber optics, enabling high-bandwidth 5G relays. Swarm coordination links multiple aerostats for overlapping coverage. These strides amplify battlespace awareness, transforming aerostats into force multipliers for layered defense.

Key Drivers in Aerostat Systems

Escalating border threats propel aerostat adoption, offering economical persistent surveillance over vast frontiers versus manned patrols. ISR budget shifts favor low-operating-cost platforms filling near-space gaps.

Military doctrines demand 24/7 coverage for counter-UAS and maritime domain awareness, where aerostats excel in endurance. Homeland security expands roles in drug interdiction and infrastructure watch.

Technological maturity enables rapid payload swaps, adapting to evolving sensors without airframe requalification. Geopolitical tensions boost exports, with offsets spurring local production.

Integration with joint networks drives demand for communication buoys. Sustainability via helium recycling and solar power aligns with green mandates. Regulatory easing for commercial airspace eases deployments.

Cost advantages over satellites or helos sustain momentum. These drivers position aerostats as indispensable for asymmetric edges.

Regional Trends in Aerostat Systems

North America dominates with mature ISR programs, deploying tethered radars for continental defense and southern borders.

Europe integrates aerostats into NATO air pictures for eastern flanks and Mediterranean patrols.

Asia-Pacific accelerates amid territorial disputes, with India advancing Akashdeep for Himalayan vigilance and China scaling maritime sentinels.

Middle East leverages for desert frontiers and Gulf shipping lanes.

South America employs against narco-routes.

Africa adopts for peacekeeping perimeters.

Trends emphasize hybrid tethers and AI payloads, with Asia-Pacific emerging fastest via infrastructure spends.

Key Aerostat Systems Programs

US Army's Persistent Surveillance Systems-Tethered (PSS-T) modernizes aerostats for wide-area ISR, with Leidos, QinetiQ, and TCOM competing on sensor-laden tethers filling near-space voids.

India's Akashdeep, Nakshatra, and Chakshu develop indigenous aerostats for border radars.

JLENS trials balloon-borne fire-control radars cueing Patriot intercepts.

TCOM's LP-17 series equips forward bases with EO/IR relays.

Border Star systems patrol US-Mexico frontiers.

European Sky Shield incorporates aerostats for layered air defense.

Poland acquires PSS-T equivalents for eastern borders.

Maritime aerostats enhance littoral surveillance.

These initiatives blend legacy persistence with next-gen smarts.

Table of Contents

Aerostat Systems Market - Table of Contents

Aerostat Systems Market Report Definition

Aerostat Systems Market Segmentation

By Propulsion

By Region

By Type

Aerostat Systems Market Analysis for next 10 Years

The 10-year Aerostat Systems Market analysis would give a detailed overview of Aerostat Systems Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Aerostat Systems Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Aerostat Systems Market Forecast

The 10-year Aerostat Systems Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Aerostat Systems Market Trends & Forecast

The regional Aerostat Systems Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Aerostat Systems Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Aerostat Systems Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Aerostat Systems Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Range, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Application, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Range, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Application, 2026-2036

List of Figures

- Figure 1: Global Aerostat Systems Market Forecast, 2026-2036

- Figure 2: Global Aerostat Systems Market Forecast, By Region, 2026-2036

- Figure 3: Global Aerostat Systems Market Forecast, By Range, 2026-2036

- Figure 4: Global Aerostat Systems Market Forecast, By Application, 2026-2036

- Figure 5: North America, Aerostat Systems Market, Forecast, 2026-2036

- Figure 6: Europe, Aerostat Systems Market, Forecast, 2026-2036

- Figure 7: Middle East, Aerostat Systems Market, Forecast, 2026-2036

- Figure 8: APAC, Aerostat Systems Market, Forecast, 2026-2036

- Figure 9: South America, Aerostat Systems Market, Forecast, 2026-2036

- Figure 10: United States, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 11: United States, Aerostat Systems Market, Forecast, 2026-2036

- Figure 12: Canada, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Aerostat Systems Market, Forecast, 2026-2036

- Figure 14: Italy, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 16: France, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 17: France, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 18: Germany, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 24: Spain, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 30: Australia, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 32: India, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 33: India, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 34: China, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 35: China, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 40: Japan, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Aerostat Systems Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Aerostat Systems Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Aerostat Systems Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Aerostat Systems Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Aerostat Systems Market, By Range (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Aerostat Systems Market, By Range (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Aerostat Systems Market, By Application (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Aerostat Systems Market, By Application (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Aerostat Systems Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Aerostat Systems Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Aerostat Systems Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Aerostat Systems Market, By Region, 2026-2036

- Figure 58: Scenario 1, Aerostat Systems Market, By Range, 2026-2036

- Figure 59: Scenario 1, Aerostat Systems Market, By Application, 2026-2036

- Figure 60: Scenario 2, Aerostat Systems Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Aerostat Systems Market, By Region, 2026-2036

- Figure 62: Scenario 2, Aerostat Systems Market, By Range, 2026-2036

- Figure 63: Scenario 2, Aerostat Systems Market, By Application, 2026-2036

- Figure 64: Company Benchmark, Aerostat Systems Market, 2026-2036