PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936046

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936046

Global Defense Aircraft Turbines and Compressors Market 2026-2036

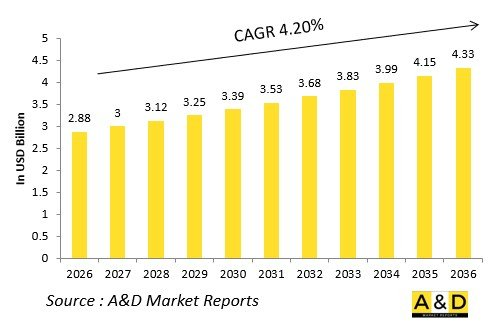

The Global Defense Aircraft Turbines and Compressors Market is estimated at USD 2.88 billion in 2026, projected to grow to USD 4.33 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 4.20% over the forecast period 2026-2036.

Introduction

The global Defense Aircraft Turbines and Compressors market drives propulsion superiority, delivering compressed air and extracted energy for thrust in military turbofans, turboprops, and turboshafts. Multi-stage high-pressure compressors feed combustors, while power turbines extract work for shaft-driven accessories and vectored nozzles.

Market evolution mirrors next-generation fighter demands, where variable geometry and blisks enhance compression efficiency under extreme thermal loads. Core technologies include swept fan blades, interstage bleed valves, and ceramic matrix coatings resisting oxidation in afterburning modes. Emphasis on low-observable exhausts integrates with infrared suppression.

Geopolitical air superiority races accelerate development, prioritizing modular cores for rapid upgrades across fleets. Open architectures enable technology insertion without full redesigns. Supply chains focus on refractory superalloys and precision forgings. Competition features Pratt & Whitney, GE, and Safran pioneering third-stream adaptive engines.

This market fuels aerial dominance through thermodynamic edges.

Technology Impact in Defense Aircraft Turbines and Compressors

Additive manufacturing crafts complex compressor blisks with internal cooling channels, slashing part counts while boosting aerodynamic efficiency. Variable stator vanes adjust incidence angles across flight envelopes, preventing surge in supercruise or loiter.

Ceramic matrix composites in high-pressure turbines withstand combustor temperatures, enabling higher overall pressure ratios without blade creep. Plasma-sprayed thermal barrier coatings extend hot-section lives under afterburner excursions. Digital twins simulate stall margins and bird-strike dynamics, accelerating certification.

Adaptive cycle compressors divert bypass air for thrust or efficiency, optimizing for air combat or penetration. Blended wing-body inlets demand distortion-tolerant stages. Electric boost compressors augment core flow for short takeoffs from carriers.

AI-optimized airfoil shapes via generative design maximize diffusion factors. Single-crystal turbine blades with ruthenium alloys resist oxidation. These innovations yield higher thrust-to-weight, reduced signatures, and extended ranges, redefining engine cycles for peer competition.

Key Drivers in Defense Aircraft Turbines and Compressors

Next-generation fighter programs demand high-thrust cores with supercruise capability, driving bladed disk innovations. Stealth mandates low-infrared turbine architectures with cooled exhaust paths.

Sustainment imperatives favor modular hot sections minimizing engine removals. Export offsets spur licensed production of compressor stages. Expeditionary ops require multi-fuel compatibility from desert to arctic.

Budget realignments prioritize thermodynamic efficiency over raw power. Supply chain resilience counters rare earth constraints via recycling. Interoperability standards enable common spares across alliances.

Urban close air support needs responsive compressors avoiding compressor stalls. These forces embed advanced cores as strategic assets.

Regional Trends in Defense Aircraft Turbines and Compressors

North America dominates with adaptive cycle prototypes for sixth-generation platforms, emphasizing variable geometry.

Europe collaborates on FCAS cores with contra-rotating turbines for efficiency.

Asia-Pacific accelerates indigenous development-India's Kaveri derivatives, China's WS-15-tailored to high-altitude intercepts.

Middle East pursues afterburning turbofans for regional deterrence.

Russia advances high-temperature materials for Su-57 sustainment.

South Korea integrates with KF-21 for export competitiveness.

Trends favor ceramic turbines; Asia-Pacific captures manufacturing growth.

Key Defense Aircraft Turbines and Compressors Program

F-35's F135 powers three variants with shaft-driven lift fans and adaptive afterburners.

NGAD adaptive engines feature third-stream compressors for thrust vectoring.

Eurofighter EJ200 upgrades incorporate blisks for enhanced dry thrust.

India's Kaveri dry variant equips Tejas with indigenous compressors.

RQ-170 drone turbines prioritize low-signature cooled blades.

B-21 Raider cores emphasize endurance over peak power.

Safran's M88 for Rafale integrates modular hot sections.

T-7A trainer engines drive high-cycle compressor testing.

Table of Contents

Defense Aircraft Turbines and Compressors Market - Table of Contents

Defense Aircraft Turbines and Compressors Market Report Definition

Defense Aircraft Turbines and Compressors Market Segmentation

-By Platform

-By Application

-By Technology

-By Material

Defense Aircraft Turbines and Compressors Market Analysis for next 10 Years

The 10-year Defense Aircraft Turbines and Compressors Market analysis would give a detailed overview of Defense Aircraft Turbines and Compressors Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Aircraft Turbines and Compressors Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Aircraft Turbines and Compressors Market Forecast

The 10-year Defense Aircraft Turbines and Compressors Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Aircraft Turbines and Compressors Market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Aircraft Turbines and Compressors Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Aircraft Turbines and Compressors Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Aircraft Turbines and Compressors Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Application , 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Application , 2026-2036

List of Figures

- Figure 1: Global Aircraft Turbines and Compressors Market Forecast, 2026-2036

- Figure 2: Global Aircraft Turbines and Compressors Market Forecast, By Region, 2026-2036

- Figure 3: Global Aircraft Turbines and Compressors Market Forecast, By Platform, 2026-2036

- Figure 4: Global Aircraft Turbines and Compressors Market Forecast, By Application , 2026-2036

- Figure 5: North America, Aircraft Turbines and Compressors Market , Forecast, 2026-2036

- Figure 6: Europe, Aircraft Turbines and Compressors Market , Forecast, 2026-2036

- Figure 7: Middle East, Aircraft Turbines and Compressors Market , Forecast, 2026-2036

- Figure 8: APAC, Aircraft Turbines and Compressors Market , Forecast, 2026-2036

- Figure 9: South America, Aircraft Turbines and Compressors Market , Forecast, 2026-2036

- Figure 10: United States, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 11: United States, Aircraft Turbines and Compressors Market , Forecast, 2026-2036

- Figure 12: Canada, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 13: Canada, Aircraft Turbines and Compressors Market , Forecast, 2026-2036

- Figure 14: Italy, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 15: Italy, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 16: France, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 17: France, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 18: Germany, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 19: Germany, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 20: Netherlands, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 21: Netherlands, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 22: Belgium, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 23: Belgium, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 24: Spain, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 25: Spain, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 26: Sweden, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 27: Sweden, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 28: Brazil, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 29: Brazil, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 30: Australia, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 31: Australia, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 32: India, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 33: India, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 34: China, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 35: China, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 38: South Korea, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 39: South Korea, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 40: Japan, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 41: Japan, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 42: Malaysia, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 43: Malaysia, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 44: Singapore, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 45: Singapore, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 46: United Kingdom, Aircraft Turbines and Compressors Market , Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Aircraft Turbines and Compressors Market , Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Aircraft Turbines and Compressors Market , By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Aircraft Turbines and Compressors Market , By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Aircraft Turbines and Compressors Market , By (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Aircraft Turbines and Compressors Market , By Platform(CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Aircraft Turbines and Compressors Market , By Application (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Aircraft Turbines and Compressors Market , By Application (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Aircraft Turbines and Compressors Market , Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Aircraft Turbines and Compressors Market , Global Market, 2026-2036

- Figure 56: Scenario 1, Aircraft Turbines and Compressors Market , Total Market, 2026-2036

- Figure 57: Scenario 1, Aircraft Turbines and Compressors Market , By Region, 2026-2036

- Figure 58: Scenario 1, Aircraft Turbines and Compressors Market , By Platform, 2026-2036

- Figure 59: Scenario 1, Aircraft Turbines and Compressors Market , By Application , 2026-2036

- Figure 60: Scenario 2, Aircraft Turbines and Compressors Market , Total Market, 2026-2036

- Figure 61: Scenario 2, Aircraft Turbines and Compressors Market , By Region, 2026-2036

- Figure 62: Scenario 2, Aircraft Turbines and Compressors Market , By Platform, 2026-2036

- Figure 63: Scenario 2, Aircraft Turbines and Compressors Market , By Application , 2026-2036

- Figure 64: Company Benchmark, Aircraft Turbines and Compressors Market , 2026-2036