PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936055

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936055

Global Defense Bleed Air Systems Market 2026-2036

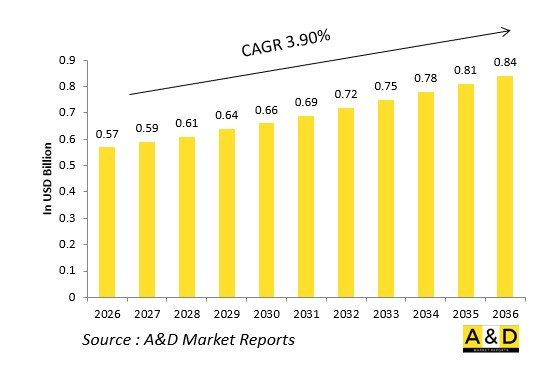

The Global Defense Bleed Air Systems Market is estimated at USD 0.57 billion in 2026, projected to grow to USD 0.84 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.90% over the forecast period 2026-2036.

Introduction

The global Defense Bleed Air Systems market taps turbine compressors to drive environmental controls, engine starts, and weapons bay actuation through precoolers, pressure regulators, and shutoff valves. High-pressure taps power hydraulic backups while low-pressure stages feed cabin suits and canopies.

Market evolution tracks more-electric aircraft replacing bleed extraction with electrically driven compressors, preserving thrust margins. Core technologies include variable-orifice precoolers, pneumatic relays, and contamination-resistant manifolds routing hot air to leading edges. Modular valve stacks enable rapid reconfiguration for mission profiles.

Geopolitical demands for sustained operations drive development, prioritizing systems compatible with adaptive cycle cores and directed-energy cooling. Open architectures support hybrid pneumatic-electric transitions. Supply chains focus on high-temperature ducting and shape memory alloy actuators. Competition features Honeywell, Collins Aerospace, and Safran pioneering bleedless variants.

Technology Impact in Defense Bleed Air Systems

Electric air compression replaces bleed taps entirely, driving cabin blowers and anti-ice mats via wing-embedded motors, eliminating efficiency-robbing extraction. Variable-speed electric boost compressors deliver pressurized air on-demand versus continuous bleed penalty.

Smart precooler bypass valves modulate fuel flow based on real-time heat exchanger delta-T, preventing overcooling during loiter. Shape memory alloy check valves auto-seal damaged ducts, maintaining pressure integrity. Embedded fiber-optic temp sensors trigger FADEC shutdowns before turbine overtemps.

Additively manufactured swirl precoolers optimize airflow mixing within inches-thick envelopes. Contamination-resistant manifolds with self-cleaning vortex generators prevent icing blockages. Hybrid architectures retain bleed for engine starts while electrifying secondary loads.

Digital twins validate bleed schedules against battle-damaged compressor maps. Ceramic-coated valves withstand synthetic fuel combustion byproducts. These innovations reclaim thrust while enabling all-electric subsystems.

Key Drivers in Defense Bleed Air Systems

More-electric architectures demand hybrid pneumatic-electric transitions, minimizing bleed extraction efficiency losses. Sixth-generation platforms prioritize variable-demand compression versus continuous taps.

Sustainment favors modular valve stacks enabling cartridge swaps. Export programs require synthetic compatibility across kerosene blends. Arctic deployments mandate reliable anti-icing without engine power diversion.

Budget pressures drive commercial bleedless derivatives with mil-spec hardening. Supply resilience counters titanium duct shortages. Interoperability enables common manifolds across coalition fleets.

Directed-energy cooling requires high-mass flow extraction. These position bleed air as transitional technology.

Regional Trends in Defense Bleed Air Systems

North America leads F-35 sustainment, pioneering electric compression for STOVL profiles.

Europe upgrades Rafale/Typhoon manifolds for dispersed basing with synthetic fuels.

Asia-Pacific surges with indigenous fighters-India's AMCA, China's J-35-prioritizing high-altitude extraction.

Middle East adapts precoolers for desert overtemps.

Russia hardens systems for Su-57 sustained afterburner.

South Korea integrates KF-21 with hybrid electric-pneumatic.

Trends favor electric replacement; Asia-Pacific captures growth.

Key Defense Bleed Air Systems Programs

F135 bleedless electric compression powers STOVL lift systems without core penalty.

NGAD variable extraction syncs with adaptive third-stream cycles.

EJ200 upgrades deliver supercruise bleed via optimized low-pressure taps.

AMCA equips indigenous electric boost for weapons bay actuation.

F119 systems enable stealth missions with minimized infrared extraction.

Rafale M88 integrates carrier catapult pneumatic assist.

Su-57 AL-41F1 powers 3D thrust vectoring hydraulics.

T-50 FADEC-controlled precooling prevents turbine overtemperature.

Table of Contents

Defense Bleed Air Systems Market - Table of Contents

Defense Bleed Air Systems Market Report Definition

Defense Bleed Air Systems Market Segmentation

By Platform

By Application

By Source

Defense Bleed Air Systems Market Analysis for next 10 Years

The 10-year Defense Bleed Air Systems market analysis would give a detailed overview of Defense Bleed Air Systems market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Bleed Air Systems Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Bleed Air Systems Market Forecast

The 10-year Defense Bleed Air Systems market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Bleed Air Systems Market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Bleed Air Systems Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Bleed Air Systems Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Bleed Air Systems Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Source, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Source, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Region, 2026-2036

List of Figures

- Figure 1: Global Defense Bleed Air Systems Market Forecast, 2026-2036

- Figure 2: Global Defense Bleed Air Systems Market Forecast, By Source, 2026-2036

- Figure 3: Global Defense Bleed Air Systems Market Forecast, By Platform, 2026-2036

- Figure 4: Global Defense Bleed Air Systems Market Forecast, By Region, 2026-2036

- Figure 5: North America, Defense Bleed Air Systems Market, Forecast, 2026-2036

- Figure 6: Europe, Defense Bleed Air Systems Market, Forecast, 2026-2036

- Figure 7: Middle East, Defense Bleed Air Systems Market, Forecast, 2026-2036

- Figure 8: APAC, Defense Bleed Air Systems Market, Forecast, 2026-2036

- Figure 9: South America, Defense Bleed Air Systems Market, Forecast, 2026-2036

- Figure 10: United States, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 11: United States, Defense Bleed Air Systems Market, Forecast, 2026-2036

- Figure 12: Canada, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Defense Bleed Air Systems Market, Forecast, 2026-2036

- Figure 14: Italy, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 16: France, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 17: France, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 18: Germany, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 24: Spain, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, , Market Forecast, 2026-2036

- Figure 28: Brazil, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 30: Australia, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 32: India, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 33: India, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 34: China, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 35: China, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 40: Japan, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Defense Bleed Air Systems Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Defense Bleed Air Systems Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Defense Bleed Air Systems Market, By Source (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Defense Bleed Air Systems Market, By Source (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Defense Bleed Air Systems Market, By (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Defense Bleed Air Systems Market, By Platform(CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Defense Bleed Air Systems Market, By Region (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Defense Bleed Air Systems Market, By Region (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Defense Bleed Air Systems Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Defense Bleed Air Systems Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Defense Bleed Air Systems Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Defense Bleed Air Systems Market, By Source, 2026-2036

- Figure 58: Scenario 1, Defense Bleed Air Systems Market, By Platform, 2026-2036

- Figure 59: Scenario 1, Defense Bleed Air Systems Market, By Region, 2026-2036

- Figure 60: Scenario 2, Defense Bleed Air Systems Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Defense Bleed Air Systems Market, By Source, 2026-2036

- Figure 62: Scenario 2, Defense Bleed Air Systems Market, By Platform, 2026-2036

- Figure 63: Scenario 2, Defense Bleed Air Systems Market, By Region, 2026-2036

- Figure 64: Company Benchmark, Defense Bleed Air Systems Market, 2026-2036