PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936052

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936052

Global Defense Engine Oil Cooling Systems Market 2026-2036

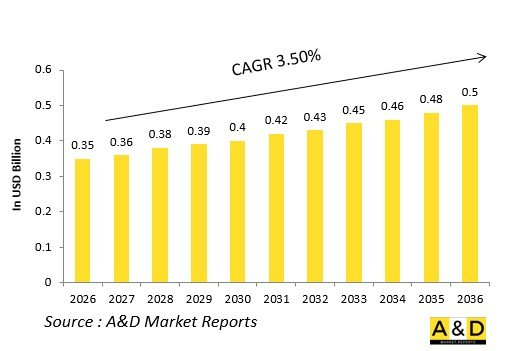

The Global Defense Engine Oil Cooling Systems Market is estimated at USD 0.35 billion in 2026, projected to grow to USD 0.5 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.50% over the forecast period 2026-2036.

Introduction

The global Defense Engine Oil Cooling Systems market regulates lubricant temperatures to protect bearings and gears under extreme thermal loads from combat maneuvers and weapons bay openings. Air-oil coolers exchange heat with bypass air, while fuel-oil exchangers leverage kerosene's capacity during cruise.

Market evolution tracks sixth-generation engines with ceramic turbines generating unprecedented sump temperatures. Core technologies include surface-air coolers, fuel-cooled oil coolers, and thermostatic bypass valves maintaining oil viscosity across flight envelopes. Modular heat exchanger cores enable rapid field swaps.

Geopolitical air superiority campaigns drive development, prioritizing systems compatible with directed-energy weapons and synthetic lubricants. Open architectures support technology insertion without engine redesigns. Supply chains focus on titanium brazing and corrosion-resistant coatings. Competition features Honeywell, Collins Aerospace, and Safran pioneering ram-air recovery designs.

Technology Impact in Defense Engine Oil Cooling Systems

Microchannel heat exchangers multiply surface area within existing envelopes, doubling heat rejection via laminar flow optimization. Phase-change materials in secondary loops absorb transient loads during afterburner lighting, stabilizing primary oil temperatures.

Electrochromic variable-geometry louvers modulate ram-air intake autonomously, maximizing recovery during climbs while minimizing drag in loiter. Fuel-cooled oil coolers with vortex generators enhance kerosene-side convection, rejecting heat without auxiliary blowers.

Embedded fiber-optic distributed temperature sensors feed FADEC closed-loop control, preempting coking during sustained max power. Additively manufactured lattice fins boost air-side effectiveness while slashing weight. Synthetic ester lubricants with doubled thermal capacity enable hotter sumps.

Predictive algorithms analyze delta-T signatures across cores, cueing filter swaps before bypass activation. Hybrid electric architectures demand dual-loop cooling for motor oils alongside turbine lubricants. Digital twins validate exchanger performance under battle-damaged inlet flows. These ensure continuous lubrication throughout mission profiles.

Key Drivers in Defense Engine Oil Cooling Systems

Adaptive cycle engines generate sump temperatures exceeding legacy limits, mandating advanced exchangers beyond current fuel-cooled capacity. Sixth-generation unmanned platforms require autonomous thermal management without pilot override.

Sustainment prioritizes core modularization eliminating scheduled engine removals. Export programs demand wide-cut fuel compatibility across kerosene blends. Supercruise-afterburner cycling stresses conventional coolers beyond margins.

Budget favors commercial derivatives with mil-spec hardening. Supply resilience counters titanium constraints via 3D-printed alternatives. Interoperability enables common cores across coalition engines.

Directed-energy extraction creates megawatt thermal loads requiring parallel cooling paths. These position oil cooling as thermodynamic enablers.

Regional Trends in Defense Engine Oil Cooling Systems

North America leads F-35 sustainment, pioneering fuel-cooled architectures for STOVL profiles.

Europe upgrades Rafale/Typhoon exchangers for synthetic lubricants in dispersed basing.

Asia-Pacific surges with indigenous programs-India's Kaveri, China's WS-15-prioritizing high-altitude heat rejection.

Middle East adapts coatings for sand-contaminated oils.

Russia hardens exchangers for Su-57 sustained afterburner.

South Korea integrates KF-21 exports with common cores.

Trends favor microchannel designs; Asia-Pacific captures manufacturing growth.

Key Defense Engine Oil Cooling Systems Programs

F135 fuel-oil cooler sustains STOVL transitions and afterburner via vortex-enhanced kerosene flow.

NGAD adaptive exchangers schedule cooling with third-stream modulation.

EJ200 upgrades reject supercruise heat through variable-geometry air-oil cores.

Kaveri equips Tejas with indigenous ram-air recovery.

F119 exchangers enable stealth missions with minimized drag louvers.

Rafale M88 integrates carrier catapult thermal surge protection.

Su-57 AL-41F1 handles thrust-vectoring oil heating.

T-50 FADEC-controlled bypass prevents sump overtemperature.

Table of Contents

Defense Engine Oil Cooling Systems Market - Table of Contents

Defense Engine Oil Cooling Systems Market Report Definition

Defense Engine Oil Cooling Systems Market Segmentation

By Platform

By Cooling Method

By System Integration

Defense Engine Oil Cooling Systems Market Analysis for next 10 Years

The 10-year Defense Engine Oil Cooling Systems market analysis would give a detailed overview of Defense Engine Oil Cooling Systems market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Engine Oil Cooling Systems Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Engine Oil Cooling Systems Market Forecast

The 10-year Defense Engine Oil Cooling Systems market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Engine Oil Cooling Systems Market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Engine Oil Cooling Systems Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Engine Oil Cooling Systems Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Engine Oil Cooling Systems Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By System Integration, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Cooling Method, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By System Integration, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Cooling Method, 2026-2036

List of Figures

- Figure 1: Global Defense Engine Oil Cooling Systems Market Forecast, 2026-2036

- Figure 2: Global Defense Engine Oil Cooling Systems Market Forecast, By System Integration, 2026-2036

- Figure 3: Global Defense Engine Oil Cooling Systems Market Forecast, By Platform, 2026-2036

- Figure 4: Global Defense Engine Oil Cooling Systems Market Forecast, By Cooling Method, 2026-2036

- Figure 5: North America, Defense Engine Oil Cooling Systems Market, Forecast, 2026-2036

- Figure 6: Europe, Defense Engine Oil Cooling Systems Market, Forecast, 2026-2036

- Figure 7: Middle East, Defense Engine Oil Cooling Systems Market, Forecast, 2026-2036

- Figure 8: APAC, Defense Engine Oil Cooling Systems Market, Forecast, 2026-2036

- Figure 9: South America, Defense Engine Oil Cooling Systems Market, Forecast, 2026-2036

- Figure 10: United States, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 11: United States, Defense Engine Oil Cooling Systems Market, Forecast, 2026-2036

- Figure 12: Canada, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Defense Engine Oil Cooling Systems Market, Forecast, 2026-2036

- Figure 14: Italy, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 16: France, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 17: France, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 18: Germany, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 24: Spain, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 30: Australia, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 32: India, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 33: India, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 34: China, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 35: China, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 40: Japan, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Defense Engine Oil Cooling Systems Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Defense Engine Oil Cooling Systems Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Defense Engine Oil Cooling Systems Market, By System Integration (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Defense Engine Oil Cooling Systems Market, By System Integration (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Defense Engine Oil Cooling Systems Market, By (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Defense Engine Oil Cooling Systems Market, By Platform(CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Defense Engine Oil Cooling Systems Market, By Cooling Method (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Defense Engine Oil Cooling Systems Market, By Cooling Method (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Defense Engine Oil Cooling Systems Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Defense Engine Oil Cooling Systems Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Defense Engine Oil Cooling Systems Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Defense Engine Oil Cooling Systems Market, By System Integration, 2026-2036

- Figure 58: Scenario 1, Defense Engine Oil Cooling Systems Market, By Platform, 2026-2036

- Figure 59: Scenario 1, Defense Engine Oil Cooling Systems Market, By Cooling Method, 2026-2036

- Figure 60: Scenario 2, Defense Engine Oil Cooling Systems Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Defense Engine Oil Cooling Systems Market, By System Integration, 2026-2036

- Figure 62: Scenario 2, Defense Engine Oil Cooling Systems Market, By Platform, 2026-2036

- Figure 63: Scenario 2, Defense Engine Oil Cooling Systems Market, By Cooling Method, 2026-2036

- Figure 64: Company Benchmark, Defense Engine Oil Cooling Systems Market, 2026-2036