PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936053

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1936053

Global Defense Jet Fuel Starters (JFS) Market 2026-2036

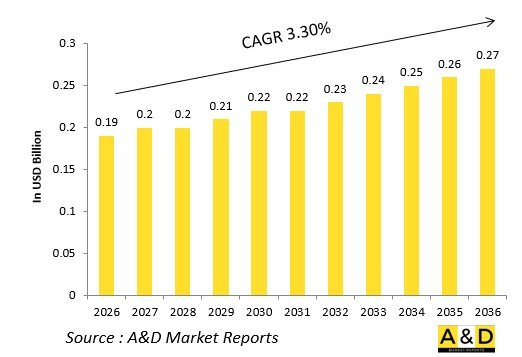

The Global Defense Jet Fuel Starters (JFS) Market is estimated at USD 0.19 billion in 2026, projected to grow to USD 0.27 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.30% over the forecast period 2026-2036.

Introduction

The global Defense Jet Fuel Starters (JFS) market powers main engine ignition via self-contained gas generators burning Jet-A through turbine-compressor assemblies. Single-shaft JFS accelerate cores from zero to self-sustaining RPM, then disengage via clutches for accessory drive.

Market evolution tracks more-electric architectures requiring lightweight starters compatible with hybrid propulsion. Core technologies include air-bearing turbines, variable inlet guide vanes, and FADEC-linked sequencing for seamless transitions. Modular overhauls enable field-level maintenance.

Geopolitical demands for scramble readiness drive development, prioritizing JFS tolerant of contaminated fuels and extreme climates. Open architectures support integration across engine families. Supply chains focus on high-temperature seals and single-crystal blades. Competition features Honeywell, Pratt & Whitney, and Safran pioneering electric-assist variants.

Technology Impact in Defense Jet Fuel Starters (JFS)

Electric boost JFS employ high-torque motors for initial spool-up, then transition to fuel combustion, slashing startup times during hot restarts. Variable geometry compressors prevent surge across ambient conditions from arctic to desert.

Ceramic bearings eliminate oil systems entirely, enabling dry motoring without scavenge pumps. Embedded health monitoring analyzes exhaust gas temps and vibration signatures, predicting turbine blade distress before failure. Additive manufactured impellers optimize airflow while minimizing inertia.

FADEC fusion sequences starter disengagement with main engine light-off, preventing hot gas reingestion. Hybrid designs integrate with integrated starter generators for seamless mode transitions. Single-shaft simplification reduces parts count versus twin-spool architectures.

Digital twins validate startup envelopes under battle-damaged inlet conditions. Fuel-atomizing can-annular combustors ignite reliably with synthetic blends. These advancements enable autonomous operations from forward strips.

Key Drivers in Defense Jet Fuel Starters (JFS)

More-electric engines demand integrated starter-generators replacing discrete JFS, driving hybrid designs. Sixth-generation unmanned platforms require air-start capability without ground support.

Sustainment prioritizes modular rotors enabling cartridge swaps. Export programs need wide-cut fuel tolerance across kerosene variants. Scramble readiness mandates sub-minute startups from cold soak.

Budget favors commercial derivatives with mil-spec hardening. Supply resilience counters turbine blade material constraints. Interoperability enables common drive pads across coalition engines.

Directed-energy weapons demand megawatt-class starter capacity. These position JFS as self-reliance enablers.

Regional Trends in Defense Jet Fuel Starters (JFS)

North America dominates F-35 sustainment, pioneering electric-hybrid starters for STOVL scrambles.

Europe upgrades Rafale/Typhoon JFS for dispersed basing with synthetic fuels.

Asia-Pacific surges with indigenous programs-India's Tejas, China's J-20-prioritizing high-altitude cold starts.

Middle East adapts fuel controls for sand-contaminated kerosene.

Russia hardens starters for Su-57 arctic deployments.

South Korea integrates KF-21 exports with common cartridges.

Trends favor electric integration; Asia-Pacific captures growth.

Key Defense Jet Fuel Starters (JFS) Programs

F135 JFS powers STOVL lift fan spin-up and main engine light-off sequencing.

NGAD hybrid starter integrates with variable cycle core transitions.

EJ200 upgrades enable rapid dry cranking for intercept missions.

Kaveri equips Tejas with indigenous air-bearing turbine.

F119 JFS sustains stealth missions from carrier catapults.

Rafale M88 starter handles STOBAR shipboard hot restarts.

Su-57 AL-41F1 integrates with 3D thrust vectoring spool-up.

T-50 FADEC-controlled startup prevents hot gas reingestion.

Table of Contents

Defense Jet Fuel Starters Market - Table of Contents

Defense Jet Fuel Starters Market Report Definition

Defense Jet Fuel Starters Market Segmentation

By Platform

By Starter Type

By Ignition

Defense Jet Fuel Starters Market Analysis for next 10 Years

The 10-year Defense Jet Fuel Starters market analysis would give a detailed overview of Defense Jet Fuel Starters market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Jet Fuel Starters Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Jet Fuel Starters Market Forecast

The 10-year Defense Jet Fuel Starters market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Jet Fuel Starters Market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Jet Fuel Starters Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Jet Fuel Starters Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Jet Fuel Starters Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Starter Type, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Ignition, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Starter Type, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Ignition, 2026-2036

List of Figures

- Figure 1: Global Defense Jet Fuel Starters Market Forecast, 2026-2036

- Figure 2: Global Defense Jet Fuel Starters Market Forecast, By Starter Type, 2026-2036

- Figure 3: Global Defense Jet Fuel Starters Market Forecast, By Platform, 2026-2036

- Figure 4: Global Defense Jet Fuel Starters Market Forecast, By Ignition, 2026-2036

- Figure 5: North America, Defense Jet Fuel Starters Market, Forecast, 2026-2036

- Figure 6: Europe, Defense Jet Fuel Starters Market, Forecast, 2026-2036

- Figure 7: Middle East, Defense Jet Fuel Starters Market, Forecast, 2026-2036

- Figure 8: APAC, Defense Jet Fuel Starters Market, Forecast, 2026-2036

- Figure 9: South America, Defense Jet Fuel Starters Market, Forecast, 2026-2036

- Figure 10: United States, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 11: United States, Defense Jet Fuel Starters Market, Forecast, 2026-2036

- Figure 12: Canada, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Defense Jet Fuel Starters Market, Forecast, 2026-2036

- Figure 14: Italy, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 16: France, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 17: France, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 18: Germany, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 24: Spain, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 30: Australia, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 32: India, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 33: India, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 34: China, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 35: China, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 40: Japan, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Defense Jet Fuel Starters Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Defense Jet Fuel Starters Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Defense Jet Fuel Starters Market, By Starter Type (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Defense Jet Fuel Starters Market, By Starter Type (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Defense Jet Fuel Starters Market, By (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Defense Jet Fuel Starters Market, By Platform(CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Defense Jet Fuel Starters Market, By Ignition (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Defense Jet Fuel Starters Market, By Ignition (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Defense Jet Fuel Starters Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Defense Jet Fuel Starters Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Defense Jet Fuel Starters Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Defense Jet Fuel Starters Market, By Starter Type, 2026-2036

- Figure 58: Scenario 1, Defense Jet Fuel Starters Market, By Platform, 2026-2036

- Figure 59: Scenario 1, Defense Jet Fuel Starters Market, By Ignition, 2026-2036

- Figure 60: Scenario 2, Defense Jet Fuel Starters Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Defense Jet Fuel Starters Market, By Starter Type, 2026-2036

- Figure 62: Scenario 2, Defense Jet Fuel Starters Market, By Platform, 2026-2036

- Figure 63: Scenario 2, Defense Jet Fuel Starters Market, By Ignition, 2026-2036

- Figure 64: Company Benchmark, Defense Jet Fuel Starters Market, 2026-2036