PUBLISHER: Bishop & Associates, Inc. | PRODUCT CODE: 1574326

PUBLISHER: Bishop & Associates, Inc. | PRODUCT CODE: 1574326

History of M & A in the Connector Industry (Shrinking Footprints: Connector Industry Consolidation 1950s - 2024)

For more than half a century, acquisitions and mergers have helped to reshape the landscape of the connector, cable, cable assembly market and electronic component industry.

- Which year or years accounted for the greatest number of acquisitions? For the least number of acquisitions? How does this correlate with the connector industry's overall performance during those years?

- How have acquisitions affected the overall ranking, market penetration, and product focus of connector manufacturers? Cable manufacturers and cable assembly manufacturers?

- Which manufacturers have made the greatest number of acquisitions?

- How have acquisitions changed the standing of the top 10 connector manufacturers? The top 50 or the top 100 connector manufacturers?

- What type of acquisitions; manufacturer, distributor, or private equity produced the greatest change in the market?

This research report, which looks at acquisitions by year, by acquiring type (manufacturer, distributor, or private equity firm), and by manufacturer, examines how mergers and acquisitions have changed the landscape of the connector, cable and cable assembly industry.

SAMPLE VIEW

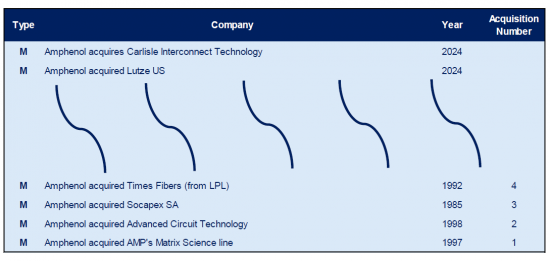

Amphenol Acquisitions by Year

Since their founding in 1985, Bishop & Associates has tracked acquisitions in the connector industry. These include acquisitions by manufacturers of connectors or cable and wire, manufacturers who produce cable assemblies or wire harnesses, distributors that focus on connectors as part of their product offering, and private equity companies. During this period, more than 850 acquisitions of these types have been recorded.

Since the beginning of the 21st century, many of these acquisitions, particularly those of traditional connector manufacturers, have ventured outside of the standard connector arena. Connector manufacturers over that time have acquired companies that focused on sensors, antennas, complex medical equipment, raw materials, software, and vehicle-to-vehicle and vehicle-to-infrastructure applications. Others have focused on specific product types, such as fiber optics or ruggedized connector and cable assemblies.

This report also looks at the history of individual acquirers. Of the more than 850 acquisitions recorded, over 600 or 77% were initiated by manufacturers. These acquisitions, which represent over 190 different manufacturers, include many companies who later become targets of acquisitions themselves. It also examines the individual acquisition history of these manufacturers, providing the total number of acquisitions during the period and how these totals compare with other manufacturers' acquisition habits.

Table of Contents

Chapter 1 - Merger and Acquisitions in the Connector

- Industry

- Introduction

- Top 100 Percent of Total Connector Market 1999 vs. 2023

- Top 50 Connector Manufacturers 1999 vs 2023

- Top Three Connector Manufacturer's Market Share 1999 vs. 2023

- Acquisition Type a Percent of Total Acquisitions

- Total Number of Acquisitions by Year and Type

- Acquisition by Type and Year 2000 through First Nine Months of 2024

- Total Number of Acquisitions by Year

- Total World Connector Year-Over-Year Percent Change

- Valuation: Purchase Price to Sales

- Purchase Price to Sales - 1987 through 2023

- Purchase Price to Sales by Decade 1987 - 2023

- Acquisition by Technology or Product Focus

Chapter 2 - Manufacturer Acquisitions by Year

- Introduction

- Manufacturer Acquisitions by Year 2000 through Nine Months 2024

- Manufacturer Acquisitions Through September 2024

- Manufacturer Acquisitions 2023

- Manufacturer Acquisitions 2022

- Manufacturer Acquisitions 2021

- Manufacturer Acquisitions 2020

- Manufacturer Acquisitions 2019

- Manufacturer Acquisitions 2018

- Manufacturer Acquisitions 2017

- Manufacturer Acquisitions 2016

- Manufacturer Acquisitions 2015

- Manufacturer Acquisitions 2014

- Manufacturer Acquisitions 2013

- Manufacturer Acquisitions 2012

- Manufacturer Acquisitions 2011

- Manufacturer Acquisitions 2010

- Manufacturer Acquisitions 2009

- Manufacturer Acquisitions 2008

- Manufacturer Acquisitions 2007

- Manufacturer Acquisitions 2006

- Manufacturer Acquisitions 2005

- Manufacturer Acquisitions 2004

- Manufacturer Acquisitions 2003

- Manufacturer Acquisitions 2002

- Manufacturer Acquisitions 2001

- Manufacturer Acquisitions 2000

- Manufacturer Acquisitions 1999 and Earlier

Chapter 3 - Distributor Acquisitions by Year

- Introduction

- Distributor Acquisitions by Year 2000 through 2024

- Distributor Acquisitions 2021 through 2024

- Distributor Acquisitions 2017 through 2020

- Distributor Acquisitions 2013 through 2016

- Distributor Acquisitions 2011 through 2012

- Distributor Acquisitions 2010 through 2000

- Distributor Acquisitions 1999 and Prior

Chapter 4 - Private Equity Acquisitions

- Introduction

- Private Equity Acquisition by Year

Chapter 5 - Manufacturer Acquisitions by Manufacturer

- Percent Top 10 Acquirers Represented of Manufacturers

- Total Acquisitions by Manufacturer

- Amphenol Acquisitions by Year

- Tyco/TE Connectivity Acquisitions by Year

- Molex Acquisitions by Year

- Winchester Acquisitions by Year

- Belden Acquisitions by Year

- FCI/Framatome Acquisitions by Year

- Carlisle Acquisitions by Year

- Smiths Acquisitions by Year

- Methode Acquisitions by Year

- Amp Acquisitions by Year

- Bel Acquisitions by Year

- ITT Cannon Acquisitions by Year

- Teledyne Acquisitions by Year

- Corning Acquisitions by Year

- HEICO Acquisitions by Year

- HUBER+SUHNER Acquisitions by Year

- Leoni Acquisitions by Year

- Luxshare Acquisitions by Year

- Phoenix Contact Acquisitions by Year

- PKC Group Acquisitions by Year

- Rosenberger Acquisitions by Year

- Berg Acquisitions by Year

- RF Industries Acquisitions by Year

- Samtec Acquisitions by Year

- Alcoa Fujikura Acquisitions by Year

- Delphi Acquisitions by Year

- Deutsch Acquisitions by Year

- ECI Acquisitions by Year

- Thomas Betts Acquisitions by Year

- AirBorn Acquisitions by Year

- AMETEK Acquisitions by Year

- Interconnect Systems Inc. Acquisitions by Year

- Radiall Acquisitions by Year

- Woodhead Industries Acquisitions by Year

- BizLink Holding Acquisitions by Year

- CommScope Acquisitions by Year

- Cooper Industries Acquisitions by Year

- Eaton Acquisitions by Year

- Emerson Acquisitions by Year

- ERNI Acquisitions by Year

- General Cable Acquisitions by Year

- Hubbell Acquisitions by Year

- Lapp Group Acquisitions by Year

- Lear Acquisitions by Year

Chapter 6 - All Acquisitions by Year and Type

- Total Acquisitions by Year 2000 through First Nine Months of 2024

- 2024 Acquisitions by Year and Type

- 2023 Acquisitions by Year and Type

- 2022 Acquisitions by Year and Type

- 2021 Acquisitions by Year and Type

- 2020 Acquisitions by Year and Type

- 2019 Acquisitions by Year and Type

- 2018 Acquisitions by Year and Type

- 2017 Acquisitions by Year and Type

- 2016 Acquisitions by Year and Type

- 2015 Acquisitions by Year and Type

- 2014 Acquisitions by Year and Type

- 2013 Acquisitions by Year and Type

- 2012 Acquisitions by Year and Type

- 2011 Acquisitions by Year and Type

- 2010 Acquisitions by Year and Type

- 2009 Acquisitions by Year and Type

- 2008 Acquisitions by Year and Type

- 2007 Acquisitions by Year and Type

- 2006 Acquisitions by Year and Type

- 2005 Acquisitions by Year and Type

- 2004 Acquisitions by Year and Type

- 2003 Acquisitions by Year and Type

- 2002 Acquisitions by Year and Type

- 2001 Acquisitions by Year and Type

- 2000 Acquisitions by Year and Type

- 1999 Acquisitions by Year and Type

- 1998 Acquisitions by Year and Type

- 1997 Acquisitions by Year and Type

- 1996 Acquisitions by Year and Type

- 1995 Acquisitions by Year and Type

- 1994 Acquisitions by Year and Type

- 1993 Acquisitions by Year and Type

- 1992 Acquisitions by Year and Type

- 1991 Acquisitions by Year and Type

- 1990 and Prior - Acquisitions by Year and Type