PUBLISHER: Bishop & Associates, Inc. | PRODUCT CODE: 1884177

PUBLISHER: Bishop & Associates, Inc. | PRODUCT CODE: 1884177

Connector Industry Forecast 2025

The 2025 "Connector Industry Forecast" report provides an in-depth, and detailed forecast of the worldwide connector industry. In addition to the detailed forecasts for each region of the world (North America, Europe, Japan, China, Asia Pacific, and ROW), an industry overview is included which provides current market trends, currency fluctuation effects, and industry sales performance, as well as an outlook narrative.

Worldwide and each regional forecast includes:

Computers & Peripherals

Automotive

|

Transportation (non-auto)

|

2025- Not the Year we Anticipated

What a year! I don't think when we made our initial forecast at the beginning of 2025, that anyone had anticipated 2025 to be as strong as it appears it will be. We had agreed it was going to be a year of growth for both bookings and billings, but it has been over four years (2021) since we have seen year-over-year bookings as strong as they were this summer and this last half of 2025. The same can be said about billings, with seven out of the last nine months showing double-digit year-over-year growth.

After growing +5.6% in 2024, we are predicting that the connector industry will have year-over-year growth of +12.5% in 2025, the strongest year-over-year growth we have seen since the industry made its strong comeback the year following the COVID shutdown. As is expected, not all regions are performing as well as others, with several regions showing double-digit growth, and others showing low single-digit year-over-year growth.

Unlike previous years, when the summer months reflected a period of factory shutdowns and employee vacations, in 2025, the summer months represented the beginning of double-digit year-over-year and year-to-date growth in bookings and billings. With such strong bookings, it was easy to anticipate the remainder of 2025 to experience positive growth.

Industry Sales Performance by Region

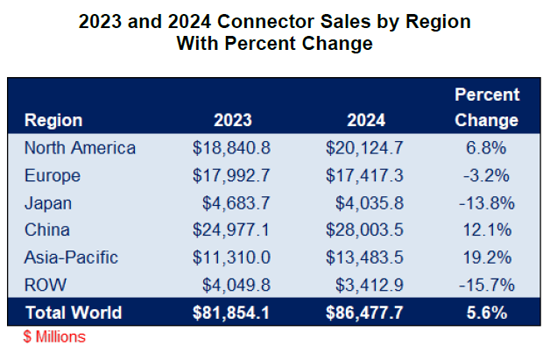

In 2024, as seen by the table below, growth and decline were not equal across all regions, nor will they be in 2025. The Asia Pacific region saw the greatest growth in 2024, growing +19.2%. With growth of +12.1%, the Chinese region followed Asia Pacific. The only other region showing an increase was North America, where sales increased +6.8%. All other regions declined in 2024, with the greatest decline in the ROW region, where sales in US dollars decreased -15.7%, followed by Japan with a decline of -13.8%. Europe, the only other region declining, showed a decrease of -3.2%.

Assessing predicted performance in 2025, Asia Pacific, who was ranked number two in 2024, is anticipated to move up to the number one spot in 2025.

The Asia Pacific region will be followed by China. All other regions are projected to grow in the single digits.

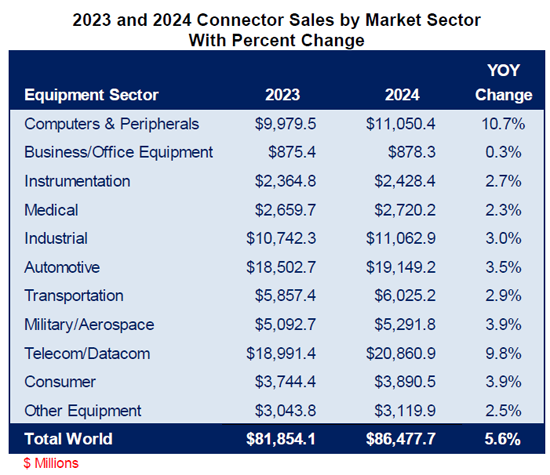

In addition to connector sales results varying by region in 2024, electronic connector sales also varied remarkably by market sector. As the table below shows, in 2024, the computer & peripherals equipment/market sector saw the greatest percentage growth, at +10.7%. It is interesting to note that this was the first time since 2006 that the computer & peripherals market sector outperformed all other sectors!

2025 and Beyond Outlook

With industry backlog remaining strong, Bishop is forecasting 2025 sales. We anticipate the greatest percentage increase will occur in the Asia Pacific region. When looking at growth in U.S. dollars, although not the greatest increase percentage wise, the largest increase in sales will be seen in the Chinese region.

Forecast Assumptions

During times of world economic and geopolitical uncertainty it is very difficult to project future business conditions. Increased volatility as well as the presence of unexpected and random events that are difficult to anticipate can greatly affect economic indicators like unemployment, trade policies, or inflation. Consider the following economic headwinds, political challenges, and uncertainties.

- Instability in the worldwide economy. As announced by the International Monetary Fund, "while the near-term forecast is revised up modestly, global growth remains subdue, as the newly introduced polices slowly come into focus." They continue by stating that "the overall environment remains volatile, and temporary factors that supported activity in the first half of 2025-such as front-loading-are fading. Similar sentiment is being dictated by the World Economic Forum, who states "the global economy is entering a period of weak growth and systemic disruption, and that "some 72% of surveyed chief economists expect the global economy to weaken over the next year, amid intensifying trade disruption, rising policy uncertainty and accelerating technological change." All fundamental changes that will play out in future trade, fiscal policy, and debt, and that could potentially spiral into areas like the financial markets and monetary policies. It was also noted "with global public debt levels mounting, the chief economists surveyed highlight that debt vulnerabilities, once largely associated with emerging economies, are increasingly centred in advanced ones - 80% expect risks in advanced economies to grow in the year ahead. Fiscal vulnerabilities are also more frequently identified among the top growth inhibitors in advanced economies (41%) compared to developing economies (12%)." It will be interesting to hear the outcome of the World Economic Forum's annual meeting in January 2026 taking place in Davos Switzerland.

- Although in the U.S., the Feds dropped interest rates by 0.25 percentage points in September and October of 2025, the lowest level in three years, many are still concerned if this will be enough to keep growth steady, in the face of continuing economic uncertainty. With the supposed plan of giving a boost to the economy, lower interest rates make it cheaper to borrow money and in turn, prompt businesses to take out loans to expand production and hire more people. There is also hope and speculation that the drop will correlate to a drop in mortgage rates, which have been hovering around 7% over the last couple of years. Unfortunately, because a drop in interest rates primarily affects the rates banks use to lend money to each other, it is not going to affect the "interest rate spread" or the interest rates paid by businesses and consumers in the same way. Thus, making it highly unlikely that mortgage interest rates are going to drop drastically in the next few months. Also, there is still some question as to how the drop in the U.S. will affect the global central banks. Many feel that these cuts are a definite sign of economic conditions worsening worldwide, prompting many other countries to also look at cutting interest rates. Note: there is still a good chance that the Feds will cut interest rates by an additional 0.25 percentage points one more time before the year is over.

In addition to these, other forecast assumptions will also be discussed, these will cover supply change issues, political tensions, labor issues, as well as tariffs, commodity prices, and cybersecurity to name a few.

There are also some interesting projections as to why we will see connector growth in 2026 and beyond, and what that growth will be. These include factors such as strong bookings, historical growth, and low unemployment coupled with strong consumer spending.

This report details the markets where Bishop anticipates growth, and which subsectors will drive that growth. This report provides projections for the period 2025F through 2030F, with year-over-year percent change and five-year CAGR by region, market sector, and sub-sector. Will the industry continue to grow, and which years may not be as strong as others? These answers and more are revealed in the December 2025 "Connector Industry Forecast".

Table of Contents

Chapter 1 -2025 - Not the Year we Anticipated

- Bookings Year-over-Year and Year-to-Date

- Billings Year-over-Year and Year-to-Date

- Industry Backlog Continues to Shrink

- Industry Backlog April 2024/2025

- Connector Industry Book-to-Bill

- Change in Backlog

- Industry Sales Performance by Region

- 2023 and 2024 Connector Sales by Region with Percent Change

- 2023 and 2024 Change in Sales Dollars by Region

- 2024 and 2025F Connector Sales by Region with Percent Change

- 2024 and 2025F Change in Sales Dollars by Region

- 2023 and 2024 Connector Sales by Market Sector with Percent Change

- 2024 and 2025F Connector Sales by Market Sector with Percent Change and USD Delta

- Change in Market Share

- Market Share by Region 2015 through 2025F

- Market Share by Region 1994 through 2025F

- Industry Sales Performance by Month

- Historical Sales Performance

- Connector Industry Business Cycles Growth Cycles Highlighted

- Historical Percentage Change in Connector Demand

- 2024 and 2025 YTD Currency Impact on Regional Industry Growth

- Local Currency to One USD April 2024 versus April 2025

- Industry Sales Performance April 2025 USD-vs-Local Currencies

- 2025 Sales Outlook Historical Analysis

- Range of Projected 205 Connector Sales with YOY Percentage Growth

- Range of Projected 2025 Connector Sales

- Forecast Assumptions

- Forecast Projections

- Five-Year Outlook (2025-2030)

- Five Year Forecast - Region Percent Year-Over-Year Change Sales

- Five Year Forecast - End-Use Equipment Sector Percent Year-Over-Year Change Sales

- Equipment/Market Sectors

Chapter 2 - World Connector Forecast

- World Connector Market Forecast - Year-to-Year Dollar Change

- World Connector Market Forecast - Year-to-Year Percent Change

- Top Six End-Use Equipment Categories

- World End-Use Equipment Forecast - Summary

- 2024-2025F Percent Change and 2025F-2030F Five-Year CAGR

- 2025F and 2030F Market Share by Equipment Sector

- World End-Use Equipment Forecast - Detail

- Computers & Peripherals

- Mobile Computers

- Desktops

- Servers

- Storage Equipment

- Input/Output Equipment

- Communication LAN Devices

- Other Computer Equipment

- Business/Office Equipment

- Retail/POS Equipment

- Imaging Systems

- Other Office Equipment

- Instrumentation

- Automatic Test Equipment

- Analytical & Scientific Instruments

- Other Instruments

- Medical

- Diagnostic & Imaging Equipment

- Therapeutic Equipment

- Other Medical Equipment

- Industrial

- Heavy Equipment

- Industrial Automation & Process Control

- Building & Civil Engineering

- Energy Markets

- Machine Tools, Machinery & Robotics

- Other Equipment

- Automotive

- Body Wiring & Power Distribution

- Powertrain

- Comfort, Convenience & Entertainment

- Navigation & Instrumentation

- Safety & Security

- Transportation

- Commercial Air

- Commercial Vehicles

- Rail

- Heavy Equipment

- Recreation

- Commercial Marine

- Military

- Telecom/Datacom

- Carrier Network

- Enterprise Network

- Mobile & Wireless

- Wireless Infrastructure

- Subscriber Equipment

- Cable-Equipment-Infrastructure

- Other Telecommunications

- Consumer

- Personal/Portable Consumer Electronics

- Consumer Entertainment Electronics

- Consumer White Goods

- Other Consumer

- Other Equipment

Chapter 3 - North American Connector Forecast

- North American Connector Market Forecast - Year-to-Year Dollar Change

- North American Connector Market Forecast - Year-to-Year Percent Change

- Top Six End-Use Equipment Categories

- North American End-Use Equipment Forecast - Summary

- 2023-2024F Percent Change and 2024F-2029F Five-Year CAGR

- 2024F and 2029F Market Share by Equipment Sector

- North American End-Use Equipment Forecast - Detail

- Computers & Peripherals

- Mobile Computers

- Desktops

- Servers

- Storage Equipment

- Input/Output Equipment

- Communication LAN Devices

- Other Computer Equipment

- Business/Office Equipment

- Retail/POS Equipment

- Imaging Systems

- Other Office Equipment

- Instrumentation

- Automatic Test Equipment

- Analytical & Scientific Instruments

- Other Instruments

- Medical

- Diagnostic & Imaging Equipment

- Therapeutic Equipment

- Other Medical Equipment

- Industrial

- Heavy Equipment

- Industrial Automation & Process Control

- Building & Civil Engineering

- Energy Markets

- Machine Tools, Machinery & Robotics

- Other Equipment

- Automotive

- Body Wiring & Power Distribution

- Powertrain

- Comfort, Convenience & Entertainment

- Navigation & Instrumentation

- Safety & Security

- Transportation

- Commercial Vehicles

- RV's & Power Sports

- Commercial Air

- Marine

- Rail

- Construction

- Farm & Garden

- Military

- Telecom/Datacom

- Carrier Network

- Enterprise Network

- Mobile & Wireless

- Wireless Infrastructure

- Subscriber Equipment

- Cable-Equipment-Infrastructure

- Other Telecommunications

- Consumer

- Personal/Portable Consumer Electronics

- Home Video Equipment

- Home Audio Equipment

- Consumer White Goods

- Other Consumer

- Other Equipment

Chapters 4 Thru 8 Provide the Same Detail Level as Chapter 3.

Chapter 4 - European Connector Forecast

Chapter 5 - Japanese Connector Forecast

Chapter 6 - Chinese Connector Forecast

Chapter 7 - Asia Pacific Connector Forecast

Chapter 8 - ROW Connector Forecast