PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1672699

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1672699

Peer to Peer Lending Market, By Investor, By Platform Type, By End User, By Geography

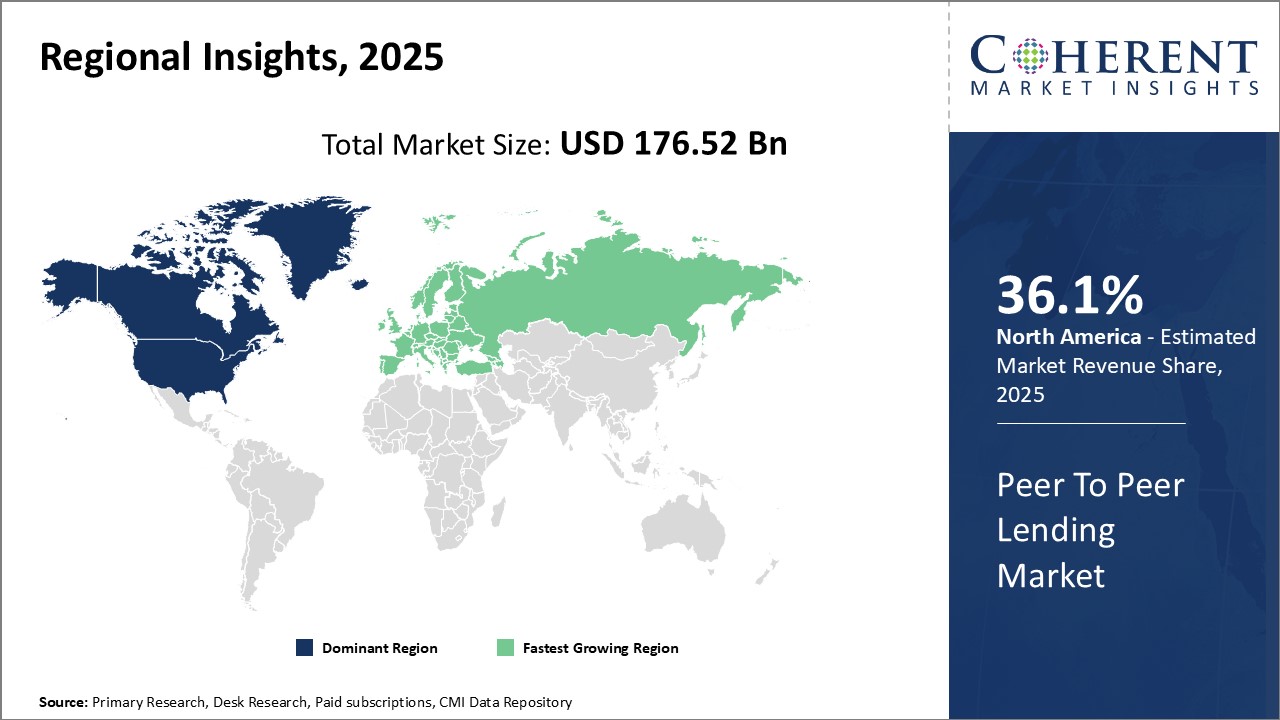

Global Peer To Peer Lending Market is estimated to be valued at USD 176.52 Bn in 2025 and is expected to reach USD 698.34 Bn by 2032, growing at a compound annual growth rate (CAGR) of 21.7% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 176.52 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 21.70% | 2032 Value Projection: | USD 698.34 Bn |

Peer to Peer Lending refers to the practice of lending money to individuals or businesses through online services that match lenders with borrowers. It allows individuals to borrow and lend money without going through a traditional banking institution. Over the past decade, Peer to Peer Lending has emerged as an innovative alternative model of financing that connects people who need money with those who want to invest funds. The growth of this industry has been propelled by the rise of financial technology or fintech firms that provide an online platform to facilitate direct transactions between peers. Key benefits include convenient access to financing at competitive interest rates for borrowers and attractive returns for investors.

Market Dynamics:

The global Peer to Peer Lending market has experienced strong growth driven by multiple factors. A major driver has been the wider availability of online financial services and emergence of several fintech companies offering convenient peer-to-peer platforms. Rising smartphone and internet penetration globally has facilitated connectivity between peers. The easy accessibility of financing through digital means has boosted adoption among borrowers and investors. Another key opportunity lies in catering to the credit needs of underbanked small businesses and individuals who have limited access to traditional loans. However, regulatory uncertainties regarding the legal framework of Peer to Peer Lending poses a restraint. Additionally, high dependency on investors raises liability risk in case of defaults.

Key features of the study:

This report provides in-depth analysis of the global Peer to Peer Lending market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global Peer to Peer Lending market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include Avant LLC, Beehive (UAE), Bondora, CircleBack Lending Inc., Estateguru, Faircent (India), Funding Circle Holdings plc, Kabbage Inc., LendBox, LendingClub Corporation, LendingTree, LLC, Lendwise, Max Crowdfund B.V., Modalku (Funding Societies, Indonesia), and Peerform, Inc.

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global Peer to Peer Lending market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global Peer to Peer Lending market.

Detailed Segmentation:

- Investor Insights (Revenue, USD Bn, 2020 - 2032)

- Individuals

- Institutional Investors

- Others (Wealth Management Firms, Family Offices, etc.)

- Platform Type Insights (Revenue, USD Bn, 2020 - 2032)

- Lending Platforms

- Equity-based Crowdfunding Platforms

- Invoice Trading Platforms

- Others (Donation-based, Reward-based, etc.)

- End User Insights (Revenue, USD Bn, 2020 - 2032)

- Retail Investors

- Small and Medium Enterprises (SMEs)

- Startups

- Others (Individuals, Large Enterprises, etc.)

- By Regional Insights (Revenue, USD Bn 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- Avant LLC

- Beehive (UAE)

- Bondora

- CircleBack Lending Inc.

- Estateguru

- Faircent (India)

- Funding Circle Holdings plc

- Kabbage Inc.

- LendBox

- LendingClub Corporation

- LendingTree, LLC

- Lendwise

- Max Crowdfund B.V.

- Modalku (Funding Societies, Indonesia)

- Peerform, Inc.

Table of Contents

1. RESEARCH OBJECTIVES AND ASSUMPTIONS

- Research Objectives

- Assumptions

- Abbreviations

2. MARKET PURVIEW

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Peer to Peer Lending Market, By Investor

- Global Peer to Peer Lending Market, By Platform Type

- Global Peer to Peer Lending Market, By End User

- Global Peer to Peer Lending Market, By Region

3. MARKET DYNAMICS, REGULATIONS, AND TRENDS ANALYSIS

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Global Peer to Peer Lending Market, By Investor, 2025-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Individuals

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Institutional Investors

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Others (Wealth Management Firms, Family Offices, etc.)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

5. Global Peer to Peer Lending Market, By Platform Type, 2025-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Lending Platforms

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Equity-based Crowdfunding Platforms

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Invoice Trading Platforms

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Others (Donation-based, Reward-based, etc.)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Peer to Peer Lending Market, By End User, 2025-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Retail Investors

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Small and Medium Enterprises (SMEs)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Startups

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Others (Individuals, Large Enterprises, etc.)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

7. Global Peer to Peer Lending Market, By Region, 2020 - 2032, Value (USD Bn)

- Introduction

- Market Share (%) Analysis, 2025,2028 & 2032, Value (USD Bn)

- Market Y-o-Y Growth Analysis (%), 2020 - 2032, Value (USD Bn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Investor, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Platform Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By End User , 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Investor, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Platform Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Investor, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Platform Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Investor, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Platform Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Investor, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Platform Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Investor, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Platform Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- South Africa

- North Africa

- Central Africa

8. COMPETITIVE LANDSCAPE

- Avant LLC

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Beehive (UAE)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Bondora

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- CircleBack Lending Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Estateguru

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Faircent (India)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Funding Circle Holdings plc

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Kabbage Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- LendBox

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- LendingClub Corporation

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- LendingTree, LLC

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Lendwise

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Max Crowdfund B.V.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Modalku (Funding Societies, Indonesia)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Peerform, Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

9. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

10. References and Research Methodology

- References

- Research Methodology

- About us