PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1462395

PUBLISHER: China Research and Intelligence | PRODUCT CODE: 1462395

Philippines Fertilizer Industry Research Report 2024-2033

The Philippines has a population of approximately 110 million, ranking second in ASEAN. Agriculture plays an important role in the Philippine economy. 70 % of the country's population is in rural areas, and a considerable number of rural people rely on agriculture to make a living. According to statistics, the agricultural industry employs 24% of the Philippines' workforce. Cultivated land and forestland account for 18.7 % of the total land area of the Philippines.

SAMPLE VIEW

The Philippines has limited fertilizer production capacity, so it needs to import large amounts of fertilizer every year. According to CRI's analysis, the Philippines' annual fertilizer imports have exceeded 2 million tons in recent years. The Philippines mainly imports fertilizers from China, Indonesia, Malaysia and other countries.

But the Philippines also exports fertilizers. The main types of chemical fertilizers exported by the Philippines are urea, ammonium sulfate, diamine phosphate, potassium fertilizer and compound fertilizer. Cambodia, Vietnam, Malaysia, Zambia, Bulgaria, etc. are the main export markets for fertilizers in the Philippines.

According to CRI's analysis, although COVID -19 has had a certain adverse impact on the Philippine fertilizer industry in 2020-2021, in 2022-2023, the Philippine fertilizer industry has shown a recovery trend.

Although the demand for fertilizers in the Philippines in 2020 was adversely affected by extreme weather conditions, in general, the operating conditions of enterprises are good, and the operating performance of leading enterprises has increased significantly.

According to CRI's analysis, the positive outlook for agriculture is a factor driving the growth of fertilizer consumption in the Philippines. The Philippines is one of the agricultural systems most vulnerable to monsoons and other extreme weather events, and these events are expected to create more uncertainty as climate change impacts the country.

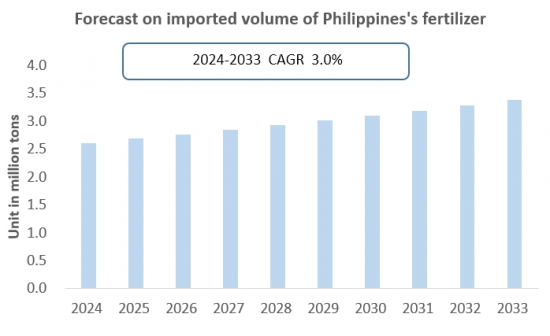

Overall, with the growth of the Philippine population and economic development, the demand for chemical fertilizers in the Philippine agriculture and planting industry will continue to rise. The Philippines' fertilizer imports are expected to continue to grow from 2024 to 2033. CRI predicts that by 2033, the Philippines' fertilizer imports will reach 3.39 million tons, with a compound annual growth rate of 3.0 % from 2024 to 2033.

For foreign-funded enterprises, the Philippine fertilizer industry is an area worthy of investment in the next few years.

Topics covered:

Philippine Fertilizer Industry Overview

Economic environment and policy environment for fertilizers in the Philippines

Philippine fertilizer market size from 2019 to 2023

Analysis of major Philippine fertilizer manufacturers

Key Drivers and Market Opportunities of the Philippine Fertilizer Industry during the 2024-2033 forecast period?

What is the expected revenue of the Philippine fertilizer market during the forecast period of 2024-2033?

What strategies are adopted by the key players in the market to increase their market share in the industry?

Which segment of the Philippines Fertilizer Market is expected to dominate the market in 2033?

Philippine fertilizer market forecast 2024-2033

What are the major headwinds facing the Philippine fertilizer industry?

Table of Contents

1 Philippines Overview

- 1.1 Geographical conditions

- 1.2 Demographic structure of the Philippines

- 1.3 Philippine Economy

- 1.4 Minimum wage standard in the Philippines 2014-2024

- 1.5 Impact of COVID -19 on Philippine Fertilizer Industry

2 Development environment of Philippine fertilizer industry

- 2.1 Economic environment

- 2.1.1 Development status of agriculture and planting industry in the Philippines

- 2.1.2 Analysis of fertilizer usage in the Philippine market

- 2.2 Technical environment

- 2.2.1 Main types of chemical fertilizers used in the Philippines

- 2.2.2 Technical level of Philippine fertilizer manufacturing industry

- 2.3 Policy environment for the Philippine fertilizer industry

- 2.3.1 Main government policies for the Philippine fertilizer industry

- 2.3.2 Foreign investment policies in the Philippine fertilizer industry

- 2.4 Analysis of operating costs of the Philippine fertilizer industry

- 2.4.1 Human resources cost

- 2.4.2 Electricity price

- 2.4.3 Factory rent

- 2.4.4 Other costs

3 Supply and demand status of Philippine fertilizer industry

- 3.1 Supply status of Philippine fertilizer industry

- 3.1.1 Total fertilizer production in the Philippines

- 3.1.2 Yield of different types of fertilizers

- 3.2 Demand status of Philippine fertilizer industry

- 3.2.1 Analysis of fertilizer consumption in the Philippines

- 3.2.2 Analysis of Philippine market demand for different types of fertilizers

- 3.2.3 Comprehensive forecast of Philippine fertilizer market

- 3.3 Philippine fertilizer market price analysis

4 Import and export status of Philippine fertilizer industry from 2019 to 2023

- 4.1 Import status of Philippine fertilizer industry

- 4.1.1 Philippine fertilizer import volume and import value

- 4.1.2 Main import sources of chemical fertilizers in the Philippines

- 4.2 Export status of Philippine fertilizer industry

- 4.2.1 Philippine fertilizer export volume and export value

- 4.2.2 Main export destinations of fertilizers in the Philippines

5 Market Competition Analysis of Philippine Fertilizer Industry

- 5.1 Barriers to entry in the Philippine fertilizer industry

- 5.1.1 Brand barriers

- 5.1.2 Quality barriers

- 5.1.3 Capital barriers

- 5.2 Competitive Structure of Philippine Fertilizer Industry

- 5.2.1 Bargaining power of fertilizer suppliers

- 5.2.2 Consumer bargaining power

- 5.2.3 Competition in Philippine Fertilizer Industry

- 5.2.4 Potential Entrants to the Fertilizer Industry

- 5.2.5 Alternatives to chemical fertilizers

6 Analysis of major fertilizer brands in the Philippines

- 6.1 Universal Harvester Incorporated ( UHI )

- 6.1.1 Development History of Universal Harvester Incorporated ( UHI )

- 6.1.2 Universal Harvester Incorporated ( UHI ) 's main products

- 6.1.3 Universal Harvester Incorporated ( UHI ) operating model

- 6.2 Hans

- 6.2.1 The development history of Hans

- 6.2.2 Hans ' main products

- 6.2.3 Hans ' operating model

- 6.3 Sagrex Corporation

- 6.3.1 Development History of Sagrex Corporation

- 6.3.2 Sagrex Corporation 's main products

- 6.3.3 Sagrex Corporation 's operating model

- 6.4 K & R Chemical Industries Inc.

- 6.4.1 Development History of K & R Chemical Industries Inc.

- 6.4.2 K & R Chemical Industries Inc.Main Products

- 6.4.3 Operating model of K & R Chemical Industries Inc.

- 6.5 Philippine Phosphate Fertilizer Corporation ( PHILPHOS )

- 6.5.1 Development History of Philippine Phosphate Fertilizer Corporation ( PHILPHOS )

- 6.5.2 Main Products of Philippine Phosphate Fertilizer Corporation ( PHILPHOS )

- 6.5.3 Philippine Phosphate Fertilizer Corporation ( PHILPHOS ) operating model

- 6.6 Atlas Fertilizer Corporation

- 6.7 Maxiplex International Philippines Corporation

- 6.8 Planters Products

- 6.9 AA Bio Tekh Enterprises Co.

- 6.10 Filipinas Agri-Planters Supply, Inc.

- 6.11 Agrichem Corporation

- 6.12 Manchem Marketing, Inc.

7 Philippine fertilizer industry outlook 2024-2033

- 7.1 Analysis of development factors of Philippine fertilizer industry

- 7.1.1 Driving forces and development opportunities of the Philippine fertilizer industry

- 7.1.2 Threats and challenges faced by the Philippine fertilizer industry

- 7.2 Philippine Fertilizer Industry Supply Forecast

- 7.3 Philippines Fertilizer Market Demand Forecast

- 7.4 Philippines Fertilizer Import and Export Forecast

Disclaimer

Service Guarantees

LIST OF CHARTS

- Chart Total population of the Philippines in 2013-2023

- Chart Philippine GDP per capita 2013-2023

- Chart Fertilizer industry-related policies issued by the Philippine government 2018-2024

- Chart Total fertilizer production in the Philippines 2019-2023

- Chart Nitrogen, phosphorus and potassium fertilizer production in the Philippines 2019-2023

- Chart 2019-2023 Domestic consumption of chemical fertilizers in the Philippines

- Chart Philippine fertilizer imports from 2019 to 2023

- Chart 2019-2023 Philippine fertilizer import amount

- Chart 2019-2023 Philippine fertilizer importing countries and import amounts

- Chart 2019-2023 Philippine fertilizer export volume

- Chart 2019-2023 Philippine fertilizer export value

- Chart Main export destinations of Philippine fertilizers from 2019 to 2023

- Chart Philippine fertilizer production forecast 2024-2033

- Chart Philippine domestic fertilizer market size forecast 2024-2033

- Chart Philippines fertilizer import forecast 2024-2033

- Chart Philippine fertilizer export forecast 2024-2033