PUBLISHER: CSIL Centre for Industrial Studies | PRODUCT CODE: 1365855

PUBLISHER: CSIL Centre for Industrial Studies | PRODUCT CODE: 1365855

The Upholstered Furniture Market in the United States

The CSIL research report “The Upholstered Furniture Market in the United States” analyses the upholstered furniture sector in North America (Canada, Mexico, and the United States) focusing on the US market, and providing data and trends for the upholstered furniture production and consumption, imports and exports (time series 2017-2022), the competitive landscape, market shares of the leading manufacturers, prices and the analysis of the distribution channels. Furthermore, it provides market forecasts for the closing of 2023 and 2024.

Country analysis. North America: The USA, Canada, Mexico.

For each considered country this study provides:

- Market value up to 2022 and market forecasts for 2023 and 2024.

- Analysis of the competitive landscape in terms of concentration, company dimension, and manufacturing locations.

- Production breakdown by covering material (leather, fabric and other)

- Sales and estimates on market shares of the leading upholstered furniture manufacturers, with short profiles of the top players.

- International trade of upholstered furniture by country and by geographical area of origin/destination

- Demand determinants and economic indicators.

Focus on the United States.

Together with figures included for each considered country (see above), for the US this study provides:

- Foreign companies and market shares

- Insights on the distribution channels of main foreign companies (Chinese and European) on the US market

- Retail upholstered furniture market (2017-2022) and breakdown by motion / Stationary

- Analysis of the distribution system

- Geographical areas and cities

- Upholstered furniture sales by State.

- Main distribution channels and short profiles of leading retailers.

- Brands price positioning

SELECTED COMPANIES

American Leather Holdings, Ashley Furniture, Ekornes, Ethan Allen, Flexsteel, Halo Asia, HHC (MotoMotion), HM Richards, HTL International , Jackson Furniture, Jason Furniture-Kuka, La-Z-Boy, Lexington Home Brands, Lovesac, Man Wah Holdings, Natuzzi, Roche Bobois, Shane Global Holding, Southern Furniture, Trayton Group.

Highlights:

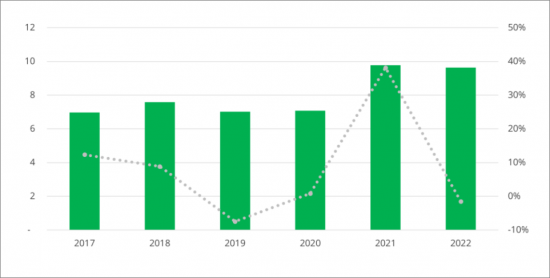

United States. Imports of upholstered furniture, 2017-2022,

US$ Billion and percentage changes

Source: CSIL processing of official data

According to CSIL, the United States is the largest market for upholstered furniture worldwide, with a market value of US$ 23.5 billion.

Approximately 40% of the consumption is met by imported products, which also makes the US the leading importer of upholstered furniture globally. Asia and the Pacific account for a remarkable share of total imports, with China being the primary contributor, although decreasing its share in favour of Vietnam and Mexico.

The latter has become an attractive destination of foreign manufacturing investments, mainly driven by the rapidly evolving US trade policies, together with the necessity to mitigate vulnerability to supply chains disruptions, and the need to reduce the time-to-market (nearshoring).

TABLE OF CONTENTS(ABSTRACT)

METHODOLOGY

- Research Tools, Geography, Exchange rates, Considered products, Terminology and methodological notes

EXECUTIVE SUMMARY

- Upholstered furniture sector in North America and the US market: CSIL assessments on the post-pandemic market evolution, the supply chain and logistics, the reshoring, nearshoring, and related competitive advantages, the economic uncertainty and decreasing consumer confidence.

1. OVERVIEW OF NORTH AMERICAN UPHOLSTERED FURNITURE MARKET

- 1.1. Market evolution and figures by country: Canada, Mexico and the United States

- Production, consumption, international trade and openness of the upholstered furniture market in North America and by Country

- 1.2. Trade balance and trading partners: Exports, imports, and trade balance by country

- 1.3. Production breakdown by covering material: leather, fabric and other

- 1.4. Competitive landscape: the leading manufacturers of upholstered furniture in North America by revenues and short profiles

- 1.5. Manufacturing presence:plants locations of leading upholstered furniture manufacturers

- 1.6. Leading companies in North America and their market share

- 1.7. Current trends and forecasts for 2023 and 2024: Upholstered furniture consumption, GDP and residential investments forecasts for 2023 and 2024 by country

2. UPHOLSTERED FURNITURE IN THE UNITED STATES

- 2.1. The upholstered furniture sector in the US: basic data. 2017-2022

- 2.2. Production breakdown by upholstered furniture covering material in the US: leather, fabric and other

- 2.3. Competition: the leading manufacturers of upholstered furniture in the US, Market shares, Foreign companies active in the United States

- International upholstered furniture companies exporting to the United States

- Distribution channels in selected international upholstered furniture companies exporting to the United States

- Short profiles of the leading Chinese manufacturers operating in the US market

- Insights on the distribution channels of leading European players in the US market

- 2.4. US Upholstered furniture Market

- The US Upholstered furniture market at retail prices

- Price segmentation and Price positioning

- The consumer preferences

- Recliner/Motion and stationary upholstered furniture. Market breakdown by product type and players

- 2.5. Distribution of upholstered furniture in the United States

- Geographical areas and cities

- Sales of upholstered furniture by state

- Market breakdown by distribution channel. Top furniture retailers sales and number of stores; Short profiles of leading furniture retailers

- 2.6. International trade. Exports and Imports of upholstered furniture from and to the US

- 2.7. Demand determinants: Economic indicators, Constructions.

APPENDIX 1:

- INTERNATIONAL TRADE STATISTICS

APPENDIX 2:

- LIST OF MENTIONED COMPANIES