PUBLISHER: CSIL Centre for Industrial Studies | PRODUCT CODE: 1756514

PUBLISHER: CSIL Centre for Industrial Studies | PRODUCT CODE: 1756514

The World Upholstered Furniture Industry

CSIL's Research Report "The world upholstered furniture industry" offers a comprehensive sector's picture through key statistics and basic data (production, consumption, and international trade of upholstered furniture 2015-2024), market forecasts for 2025 and 2026, detailed profiles of the leading manufacturers, and a focus on the Top 20 world's upholstered furniture countries.

International trade of upholstered furniture is in a state of unprecedented uncertainty as a consequence of the USA's tariff measures and countermeasures by its trading partners. Trade policy and tariff unpredictability may continue. CSIL is committed to constantly monitoring the international trade of upholstered furniture to provide data that reflects its in-depth knowledge of the markets and their ongoing evaluation.

INTRODUCTION AND EXECUTIVE SUMMARY

An executive summary introduces the analysis and outlines CSIL's assessments regarding the upholstered furniture market, including regional and country analysis, competitive landscape, globalization, nearshoring, trade tensions, and market scenario.

Additionally, the report presents key topics and manufacturers' strategies to address the recent market challenges based on CSIL's surveys and interviews conducted from March to June 2025, targeting the major global manufacturers in the upholstered furniture industry.

This part also analyses recent M&A transactions, examines corporate strategies, and reviews the Q1 2025 financial performance of publicly listed companies operating in the upholstered furniture market.

UPHOLSTERED FURNITURE: WORLD MARKET OUTLOOK

This part highlights the largest upholstered furniture markets, the growth and openness to imports, and the role of major exporting countries in the world marketplace.

The analysis of the global production of upholstered furniture outlines the major producing countries and provides a breakdown by covering material (leather, fabric, other).

Forecasts of the world trade of upholstered furniture and market scenarios 2025 and 2026 are based on CSIL analysis of industry dynamics and macroeconomic indicators.

World consumption and production of upholstered furniture are broken down by geographical area: European Union (27) + UK, Norway, Switzerland, and Iceland; Central and Eastern Europe outside the EU & Russia; Asia and Pacific; the Middle East and Africa; North America; South America.

The breakdown of upholstered furniture production by covering material (leather, fabric, and other covering) is provided by geographical area (European Union (27) + UK, Norway, Switzerland, North America, Asia, and Pacific) and for a selection of major producing countries.

KEY MARKETS AND COUNTRIES IN THE GLOBAL UPHOLSTERED FURNITURE SECTOR

The chapter focuses on the Top 20 world upholstered furniture countries (Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Lithuania, Mexico, Poland, Romania, South Korea, Spain, Sweden, Turkiye, United Kingdom, United States, Vietnam), providing:

- Upholstered furniture production, apparent consumption, exports, and imports for the years 2015-2024 and forecasts of yearly changes in upholstered furniture consumption in 2025 and 2026.

- Production of upholstered furniture in quantity: 2019-2024 for China, United States, Vietnam, Poland, Italy, India, United Kingdom, Germany, Mexico, Turkiye, Romania, Canada, Brazil, Spain, France, Lithuania, Sweden, and Japan.

- Breakdown of production value by covering material (leather, fabric, and other) for China, the United States, Vietnam, Poland, Italy, India, the United Kingdom, Germany, Mexico, Canada, Spain, France, and Lithuania.

- Competitive landscape: Major upholstered furniture manufacturers in the country, with short profiles (for a total of around 800 considered firms) providing Company name, Headquarters/Main Location, Telephone, Web, Email address, Activity,

- Product Portfolio, Total Turnover range, Employees range, Exports share on total turnover, Manufacturing plants, Upholstered furniture production of total revenues.

- Upholstered furniture exports by country of destination and imports by country of origin.

- Socio-economic indicators, including population (total and by age group), forecasts up to 2035.

Moreover, for the 70 most important countries for upholstery production, consumption, and trade, including the Top 20, the study provides summary tables including upholstered furniture production, consumption, imports and exports data (2015-2024), the openness of the sector to foreign trade, consumption growth (2025 and 2026 forecasts), origin of imports, destination of exports and country rankings to place all statistics in a broader worldwide context.

LEADING MANUFACTURERS IN THE WORLD UPHOLSTERED FURNITURE INDUSTRY

A special section offers detailed company profiles for the 30 leading upholstered furniture manufacturers worldwide: headquarters, activity and product portfolio, turnover (last available year), controlled companies and subsidiaries, brands, financial performance (last 3 years for total revenues and employees), recent M&A operations, export sales, production facilities.

CONSIDERED COUNTRIES:

|

|

|

What is the scope of the CSIL report "The World Upholstered Furniture Industry"?

This study aims to analyse the current state and future outlook of the sector by answering the following questions:

- What is the market size of the global upholstered furniture industry?

- What are the largest and fastest-growing upholstered furniture markets worldwide?

- What are the market forecasts for upholstered furniture for 2025 and 2026?

- What are the leading upholstered furniture manufacturers worldwide, and how are they performing?

- How is international trade in upholstered furniture evolving? How are companies responding to new trade policies?

- What are the main trends and challenges shaping the upholstered furniture sector?

Highlights:

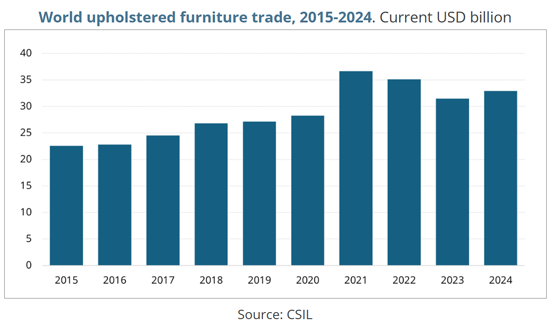

With over 35% of its production traded internationally, the upholstered furniture sector reflects a growing global dimension. International trade of upholstered furniture has increased, reaching nearly US$ 33 billion.

While the overall directions of trade flows between regions have remained largely unchanged, the specific partner countries involved have shifted. The US, the world's largest importer of upholstered furniture, has continued to be highly reliant on foreign supply. Since 2023, Vietnam has overtaken China as the United States' main supplier of upholstered furniture. In recent months of 2025, due to a new wave of tariffs, companies across the supply chain have been forced to rapidly reassess their sourcing models, production strategies, and investment plans.

TABLE OF CONTENTS (ABSTRACT)

INTRODUCTION

SCOPES AND STRUCTURE OF THE RESEARCH REPORT

EXECUTIVE SUMMARY:

- Market overview, Regional and country analysis, Competitive landscape, Globalization, nearshoring and trade tensions, Market Outlook

- Upholstered manufacturers' strategies.

- Overview of the competitive system in the upholstered furniture industry

- M&A deals and companies' strategies

- Publicly listed companies. Financial performance in Q1 2025

PART I. CONSUMPTION, PRODUCTION, AND INTERNATIONAL TRADE OF UPHOLSTERED FURNITURE 2015 - 2024

- 1.1. THE WORLD MARKET FOR UPHOLSTERED FURNITURE

- World consumption of upholstered furniture

- Imports and opening of the world upholstery market

- 1.2. WORLD PRODUCTION OF UPHOLSTERED FURNITURE

- World production of upholstered furniture

- Upholstered furniture exports and major exporting countries

- 1.3. THE OUTLOOK: prospects of the global upholstered furniture trade and consumption

- Trading partners, imports/consumption and exports/production ratios, and World upholstered furniture trade, 2015-2024

- Upholstered furniture consumption 2025-2026. Forecasts of yearly changes in real terms

PART II. UPHOLSTERED FURNITURE INDICATORS

- Overview of the world upholstered furniture sector

- The 70 Countries, alphabetical order, and rankings

- Opening Of Upholstered Furniture Markets. Growth of exports and imports

- Forecasts. Upholstered furniture consumption 2025-2026

PART III. TOP 20 COUNTRIES FOR THE UPHOLSTERED FURNITURE INDUSTRY

- A detailed analysis of the top 20 upholstered furniture consuming countries in the world (Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Lithuania, Mexico, Poland, Romania, South Korea, Spain, Sweden, Turkiye, United Kingdom, United States, Vietnam) including:

- Upholstered furniture production, apparent consumption, exports, imports for the years 2015-2024, and forecasts of yearly changes in upholstered furniture consumption in 2025 and 2026

- Production of upholstered furniture in quantity (when available)

- Breakdown of production value by covering material (leather, fabric, and other), when available

- Competitive landscape: Major upholstered furniture manufacturers in the country, with short profiles

- Upholstered furniture exports by country of destination and imports by country of origin

- Socio-economic indicators

PART IV. COMPETITION: TOP UPHOLSTERED FURNITURE MANUFACTURERS IN THE WORLD

- Detailed profiles of the Top 30 world's Manufacturers of upholstered furniture

PART V. COUNTRY TABLES

- Summary tables for 70 countries (Algeria, Argentina, Australia, Austria, Bahrain, Belgium, Bosnia-Herzegovina, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Ghana, Greece, Hong Kong (China), Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Kazakhstan, Kuwait, Latvia, Lebanon, Lithuania, Malaysia, Malta, Mexico, Morocco, Netherlands, New Zealand, Norway, Oman, Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan (China), Thailand, Turkey, Ukraine, United Arab Emirates, United Kingdom, United States, Vietnam) including:

- Upholstered furniture production, apparent consumption, exports, and imports for the years 2015-2024, and forecasts of yearly changes

- Major trading partners (countries of origin of imports and destination of exports of upholstered furniture).

APPENDIX

- Notes, presentation conventions, classification of countries