PUBLISHER: CSIL Centre for Industrial Studies | PRODUCT CODE: 1814238

PUBLISHER: CSIL Centre for Industrial Studies | PRODUCT CODE: 1814238

The Office Furniture Market in Asia and the Pacific

The CSIL Market Research Report 'The Office Furniture Market in Asia and the Pacific' offers a comprehensive overview with a focus on ten countries (Australia, China, India, Japan, Malaysia, Singapore, South Korea, Taiwan-China, Thailand, and Vietnam), including key trends, production and consumption figures, international trade data, and forecasts for the office furniture demand in 2025 and 2026. It also highlights the leading manufacturers and players and analyses the office furniture sector by sub-segment.

ASIA PACIFIC: OFFICE FURNITURE MARKET OVERVIEW

The first section offers basic data on production, consumption, and international trade of office furniture, in Asia and the Pacific and by country, highlighting trade dynamics, market openness and prices.

OFFICE FURNITURE MARKET TRENDS AND FORECASTS FOR 2025-2026

Looking ahead, the report outlines expected market developments according to CSIL, with forecasts for office furniture consumption in 2025 and 2026. Factors influencing the market include macroeconomic trends and workplace transformations.

LEADING GROUPS IN ASIA AND THE PACIFIC AND THEIR MARKET SHARES

The competitive environment and the leading office furniture manufacturers operating in the Asia-Pacific market are outlined through information on their performance, the market concentration and the latest M&A operations.

BUSINESS PERFORMANCE: OFFICE FURNITURE MARKET IN THE ASIA PACIFIC COUNTRIES

Production, consumption, international trade of office furniture for the years 2019-2024, macroeconomic indicators and office furniture market forecasts 2025-2026 for:

|

|

OFFICE FURNITURE TRADE DYNAMICS: EXPORTS AND IMPORTS

This section provides a deep look at key export and import flows, identifying the main importers and exporters of office furniture in the area, with trade partners.

OFFICE FURNITURE SUPPLY SYSTEM AND PRODUCT SEGMENTS

Production and consumption of office furniture in the Asia Pacific and for selected countries (Australia, China, India, Japan, and South Korea) are provided for the main sub-segments:

|

|

A special focus is provided for:

- Office seating: Breakdown of office seating production by type and by covering, and seating breakdown by type in a sample of companies. Production and consumption of office seating / office furniture excluding seating, are also provided by country.

- Office desking & Height-Adjustable Desks (HAT): Incidence of HAT on total desk production in the Asia Pacific, with incidence and production value also for Australia, China, India, Japan, and South Korea; Height Adjustable Tables by kind of mechanism; Breakdown of desking supply between fixed and HAT in a sample of companies

- Partitions, Acoustic Pods & Phone Booths: Production of partitions, acoustic pods, and phone booths in Asia Pacific, by segment, by kind; production of phone booths and acoustic pods for Australia, China, India, Japan, and South Korea and estimates of breakdown by type (single, double, multiple)

DISTRIBUTION OF OFFICE FURNITURE IN THE ASIA PACIFIC

The report analyses the structure of the distribution landscape in the Asia Pacific region through the evolution of distribution channels:

- Direct sales

- Indirect sales (specialist dealers, non-specialist dealers, e-commerce)

The incidence of the distribution channels is also provided for Australia, China, India, Japan, and South Korea.

COMPETITION IN THE ASIA PACIFIC OFFICE FURNITURE MARKET: LEADING MANUFACTURERS AND MARKET SHARES BY PRODUCT AND BY COUNTRY

In this section, the report analyses the key players in the office furniture market with an overview of market shares and data for office seating, desking, executive, storage, walls/partitions, acoustic pods/phone booths, and communal furniture.

Finally, the report outlines the office furniture market competitive landscape across the Asia Pacific region, exploring the largest players in Australia, China, India, Japan, Malaysia, Singapore, South Korea, Taiwan (China), Thailand, and Vietnam, with selected company profiles.

A list of around 165 of the most important players operating in the office furniture sector in the Asia Pacific completes the research.

THIS REPORT OFFERS AN IN-DEPTH ANALYSIS WHICH HELPS TO RESPOND TO THE FOLLOWING QUESTIONS:

- 1. What is the current size and structure of the office furniture market in Asia and the Pacific?

- 2. Which are the top and fastest-growing office furniture markets in the Asia-Pacific region?

- 3. What are the key trends driving the office furniture market in Asia and the Pacific?

- 4. What are the office furniture demand forecasts for 2025 and 2026 in Asia-Pacific countries?

- 5. Which are the leading office furniture manufacturers in Asia and the Pacific?

- 6. What are the main import and export flows of office furniture in the Asia-Pacific region?

- 7. What product segments make up the office furniture market in Asia-Pacific?

- 8. How is the distribution of office furniture structured in the Asia Pacific region?

Selected companies

Among the largest companies analysed in this study:

|

|

|

Highlights:

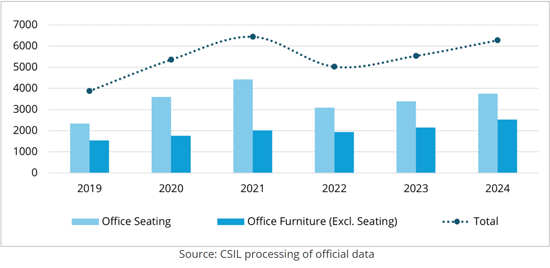

Asia-Pacific. Office Furniture Trade Balance.

Seating/Office furniture excluding seating.

2019-2024. US$ Million

According to CSIL, the office furniture trade balance in Asia-Pacific has continued to show a growing surplus despite international tensions and protectionist measures implemented in recent years. This growth is mainly supported by China and Vietnam, with varying trends corresponding to different product segments.

On the consumption side, the largest office furniture markets are China, India, and Japan. Among them, India is steadily emerging as one of the most dynamic ones in the area, projected to exceed the average forecasted growth for the whole region.

TABLE OF CONTENTS (ABSTRACT)

METHODOLOGY

- Research tools, geographical area, samples and notes

EXECUTIVE SUMMARY

- The office furniture market in Asia Pacific

1. SCENARIO

- 1.1. The Asia Pacific Office Furniture Market: Evolution and figures by country

- Office furniture basic data and market openness

- Producer prices for office furniture in the main countries

- Production, consumption, imports, and exports of office furniture by country

- 1.2. Office Furniture Market in Asia Pacific: Development and perspectives

- Macroeconomic indicators

- Office furniture consumption by country. Forecasts, 2025-2026

- 1.3. Leading groups in Asia-Pacific and their market shares

- Overview of the largest Office Furniture companies in the Asia Pacific

2. BUSINESS PERFORMANCE:

- Australia

- China

- India

- Japan

- Malaysia

- Singapore

- South Korea

- Taiwan (China)

- Thailand

- Vietnam

For each considered country:

- Production, consumption, international trade of office furniture, 2019-2024

- Macroeconomic indicators. Forecasts, 2025-2026 (except Taiwan)

3. INTERNATIONAL TRADE OF OFFICE FURNITURE

- 3.1. Trade balance by segment and by country

- 3.2. Asia Pacific. Exports of office furniture 2019-2024

- Top five exporters of office furniture in Asia Pacific

- Exports of office furniture by segment and by country

- Office furniture Exports by destination (Office seating and Office furniture excluding seating)

- 3.3. Imports of office furniture, 2019-2024

- Top five importers of office furniture in Asia Pacific

- Imports of office furniture by segment and by country

- Office furniture. Imports by origin (Office seating and Office furniture excluding seating)

4. THE SUPPLY STRUCTURE: OFFICE FURNITURE PRODUCT SEGMENTS AND TRENDS

- 4.1. Product segments (Office seating, Office desking, Executive furniture, Filing systems, Walls, partitions and acoustic, Phone booths and acoustic pods, Furniture for communal areas)

- Office furniture production in Asia Pacific by segment, 2019-2024

- Office seating and office furniture, excluding seating. Production and consumption by country

- Office furniture segments breakdown for selected countries (Australia, China, India, Japan, and South Korea)

Office seating

- Breakdown of office seating production by type and by covering

- Seating supply by type in a sample of companies

Office desking & Height-Adjustable Desks (HAT)

- Incidence of HAT on total desk production in the Asia Pacific and HAT production and incidence in selected countries (Australia, China, India, Japan, and South Korea)

- Height Adjustable Tables by kind of mechanism

- Breakdown of desking supply between fixed and HAT in a sample of companies

Partitions, Acoustic Products, and Phone Booths/Pods

- Production of partitions, acoustic products, phone booths/pods in the Asia Pacific

- Production of partitions, acoustic products by segment

- Phone booths and acoustic pods production in selected countries (Australia, China, India, Japan, and South Korea)

- Breakdown of phone booths and acoustic pods by kind

5. DISTRIBUTION OF OFFICE FURNITURE IN ASIA PACIFIC

- 5.1. Office Furniture Distribution Channels

- Evolution of distribution channels 2020-2024

- Incidence of the distribution channels in the major markets (Australia, China, India, Japan, and South Korea)

6. COMPANY MARKET SHARES BY PRODUCT

Total sales of office furniture by the largest office furniture companies in the Asia Pacific

Company sales and market shares by segment:

- Office seating

- Office desking

- Executive furniture

- Filing systems

- Walls, partitions and acoustic

- Phone booths and acoustic pods

- Furniture for communal areas

7. COMPANY MARKET SHARES BY COUNTRY

Competition by country:

- Australia

- China

- India

- Japan

- Malaysia

- Singapore

- South Korea

- Taiwan (China)

- Thailand

- Vietnam

APPENDIX 1: INTERNATIONAL TRADE TABLES

APPENDIX 2: LIST OF MENTIONED COMPANIES