PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858998

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858998

Vascular Closure Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

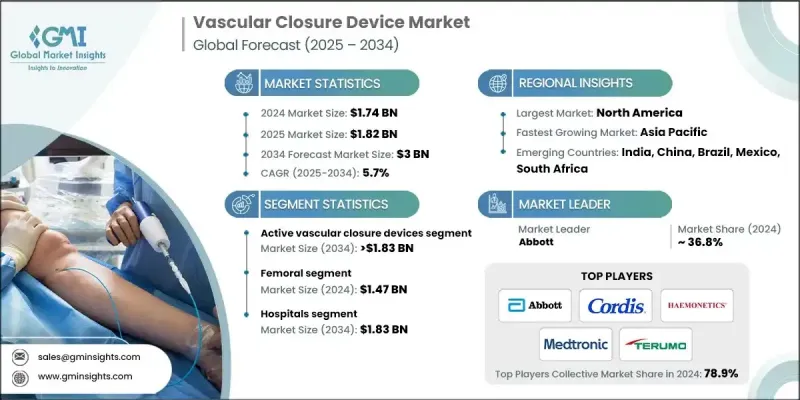

The Global Vascular Closure Device Market was valued at USD 1.74 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 3 billion by 2034.

This growth can be attributed to several factors, including the rising prevalence of cardiovascular diseases, the growth of interventional cardiology and radiology procedures, and the increasing demand for outpatient and same-day discharge procedures. Vascular closure devices are essential medical tools designed to seal arterial punctures after catheterization procedures, either using mechanical clips, sutures, or collagen plugs. These devices offer quicker and more efficient hemostasis compared to traditional methods like manual compression, reducing the time needed for bleeding cessation and minimizing patient downtime. As cardiovascular diseases like coronary artery disease and heart failure rise globally, more angiographies and interventional procedures are performed, further driving the demand for vascular closure devices. Additionally, innovations such as bioabsorbable closure devices and extravascular sealing systems have expanded the adoption of VCDs by addressing complications like bleeding and infection, which improves patient outcomes and accelerates market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.74 Billion |

| Forecast Value | $3 Billion |

| CAGR | 5.7% |

The active vascular closure devices segment held 59.3% share in 2024, owing to their superior efficacy, faster hemostasis times, and lower complication rates. Active VCDs, including suture-based and collagen-based devices, are increasingly preferred by physicians for their ability to close vascular access sites, enabling faster recovery and more efficient catheterization procedures. This segment is expected to maintain its leadership as it allows for improved cath lab performance and shorter operation times.

The radial artery segment will grow at a CAGR of 4.4% during 2025-2034. Radial access is becoming the preferred choice in interventional cardiology because it carries a lower risk of bleeding complications and allows for faster recovery compared to femoral access. The increasing number of radial artery procedures performed in healthcare settings is driving the demand for specialized closure devices in this area.

North America Vascular Closure Device Market held a 44.9% share in 2024. The presence of advanced healthcare infrastructure, cutting-edge catheterization labs, and highly skilled interventional cardiologists contributes to the widespread acceptance and use of advanced VCDs, such as suture-mediated and collagen-based devices. The trend towards minimally invasive cardiovascular procedures, designed to shorten recovery times and reduce healthcare costs, further boosts the demand for these devices.

Key players in the Global Vascular Closure Device Market include Medtronic, Teleflex, MERIT MEDICAL, Abbott, Rex Medical, Cordis, Ensite Vascular, Terumo, HAEMONETICS, Vivasure Medical, Transluminal Technologies, Vasorum, Tricol Biomedical, and Meril. To solidify their market position, companies in the Global Vascular Closure Device Market focus on enhancing product innovation and improving patient outcomes. Many companies are investing in the development of advanced, minimally invasive technologies that reduce complications and recovery times. Strategic partnerships and collaborations with healthcare providers and research institutions are also common to expand market reach and gain clinical validation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Device type trends

- 2.2.3 Access trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of patients suffering from cardiovascular diseases

- 3.2.1.2 Growing geriatric population

- 3.2.1.3 Technological advancements in vascular closure devices

- 3.2.1.4 Rising volume of interventional cardiology and radiology procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk associated with post-procedural complications

- 3.2.2.2 Stringent regulatory scenario

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Development of bioresorbable and next-generation closure devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Vascular closure device market, 2021-2034 (Units)

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 Middle East and Africa

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New device type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Active vascular closure devices

- 5.2.1 Collagen plug mediated device

- 5.2.2 Suture-mediated devices

- 5.2.3 Staple/clip-mediated VCD

- 5.3 Passive vascular closure devices

- 5.3.1 Haemostasis pads/patches

- 5.3.2 Compression devices

Chapter 6 Market Estimates and Forecast, By Access, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Femoral

- 6.3 Radial

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 Cordis

- 9.3 Ensite Vascular

- 9.4 HAEMONETICS

- 9.5 Medtronic

- 9.6 Meril

- 9.7 MERIT MEDICAL

- 9.8 Rex Medical

- 9.9 Teleflex

- 9.10 TERUMO

- 9.11 Transluminal Technologies

- 9.12 Tricol Biomedical

- 9.13 TZ Medical

- 9.14 Vasorum

- 9.15 Vivasure Medical