PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844357

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844357

Pet Dental Health Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

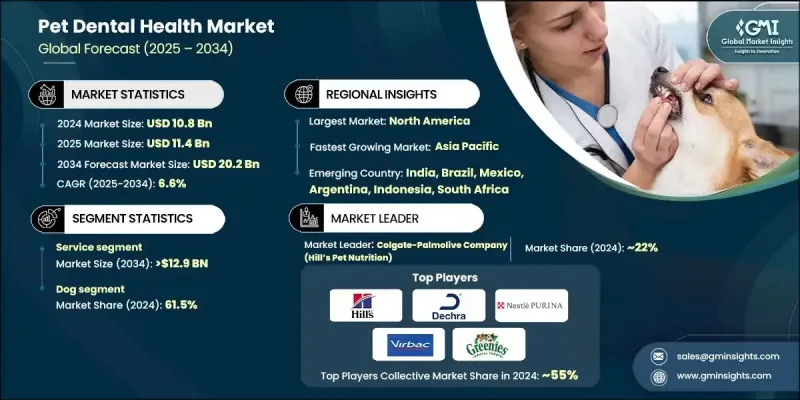

The Global Pet Dental Health Market was valued at USD 10.8 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 20.2 billion by 2034.

Market growth is driven by rising pet ownership, increasing awareness of animal oral health, and higher spending on veterinary care. Dental health is a critical component of overall pet wellness, with oral diseases among the most common health issues in companion animals, particularly dogs and cats. Growing recognition of the link between oral hygiene and systemic health has spurred demand for preventive and therapeutic dental care solutions, positioning the pet dental health industry as a vital segment of the global veterinary market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.8 Billion |

| Forecast Value | $20.2 Billion |

| CAGR | 6.6% |

The market's growth is further supported by the humanization of pets, where owners increasingly view animals as family members and invest in advanced healthcare solutions. Preventive care, including routine checkups, professional cleanings, and dental diets, has gained traction as pet parents seek to extend the longevity and quality of life of their animals. Additionally, veterinary associations and pet healthcare organizations are actively running awareness campaigns that highlight the importance of oral care in preventing pain, tooth loss, and secondary conditions such as heart and kidney disease. This has accelerated the adoption of pet dental products and services across developed and emerging markets alike.

The services segment generated USD 6.7 billion in 2024, encompassing professional dental cleanings, scaling, polishing, tooth extractions, and preventive oral checkups offered by veterinary clinics and hospitals. Pet owners recognized the importance of routine dental visits to prevent oral diseases and associated health complications. Veterinary dental services are increasingly in demand due to the rising prevalence of periodontal disease in pets, which affects nearly 70-80% of dogs and cats over the age of three.

In terms of animal type, the dogs segment held a 61.5% share in 2024. Dogs are more prone to dental issues compared to other companion animals, which has heightened demand for specialized oral care products and veterinary dental services. The growing emphasis on preventive oral care in canine health, supported by the availability of a wide range of chews, rinses, toothbrushes, and professional cleaning services, continues to drive this segment forward. Pet owners are increasingly proactive in addressing their dogs' dental health needs, aligning with the broader trend of rising expenditure on premium veterinary services.

North America Pet Dental Health Market held a 44.9% share in 2024, supported by high pet ownership rates, advanced veterinary infrastructure, and strong consumer awareness regarding preventive oral care. The United States, in particular, accounts for the bulk of regional demand, with pet insurance penetration and premium pet care spending fueling market growth.

Key players in the Global Pet Dental Health Market include Mars Petcare, Virbac, Nestle Purina PetCare, Hill's Pet Nutrition, Dechra Pharmaceuticals, PetIQ, TropiClean, and Vetoquinol. These companies are at the forefront of driving innovation and expanding their global footprint through new product launches, acquisitions, and partnerships with veterinary service providers. The competitive landscape of the pet dental health market is defined by strong investments in product innovation, partnerships with veterinary clinics, and targeted marketing strategies. Companies are focusing on expanding their product portfolios to include functional chews, enzymatic oral care solutions, and advanced dental cleaning services.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Animal type

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet adoption

- 3.2.1.2 Increasing cases of pet dental problems

- 3.2.1.3 Growing awareness of pet oral health

- 3.2.1.4 Increasing animal healthcare expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced dental procedures

- 3.2.2.2 Shortage of specialized veterinary dentists

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding technological advancements in pet dentistry

- 3.2.3.2 Natural and organic product demand

- 3.2.3.3 Growing focus on preventive dental

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Regulatory landscape

- 3.6 Pet population statistics 2024

- 3.7 Pricing analysis

- 3.8 Reimbursement scenario

- 3.9 Venture capitalist scenario in animal health industry

- 3.10 Future market trends

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Merger and acquisition

- 4.5.2 Partnership and collaboration

- 4.5.3 New product launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Service

- 5.2.1 By service type

- 5.2.1.1 Treatment

- 5.2.1.2 Diagnosis

- 5.2.2 By end use

- 5.2.2.1 Veterinary clinics

- 5.2.2.2 Veterinary hospitals

- 5.2.1 By service type

- 5.3 Product

- 5.3.1 By product type

- 5.3.1.1 Dental chews and treats

- 5.3.1.2 Oral care solutions

- 5.3.1.3 Toothpastes and brushes

- 5.3.1.4 Dental spray

- 5.3.1.5 Other product types

- 5.3.2 By distribution channel

- 5.3.2.1 Retail pharmacies

- 5.3.2.2 Online pharmacies

- 5.3.2.3 Pet stores

- 5.3.2.4 Other distribution channels

- 5.3.1 By product type

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Other animal types

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

Chapter 8 Company Profiles

- 8.1 Animalcare Group

- 8.2 BarkBox

- 8.3 Bo International

- 8.4 Boehringer Ingelheim

- 8.5 Ceva Sante Animale

- 8.6 Colgate-Palmolive Company (Hill’s Pet Nutrition)

- 8.7 H. von Gimborn

- 8.8 imRex

- 8.9 Ingenious Probiotics

- 8.10 Mars (GREENIES)

- 8.11 PetDine

- 8.12 Petsona

- 8.13 Petzlife Products

- 8.14 Purina PetCare (Nestle)

- 8.15 TropiClean Pet Products

- 8.16 Vetoquinol

- 8.17 Virbac