PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913351

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913351

Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

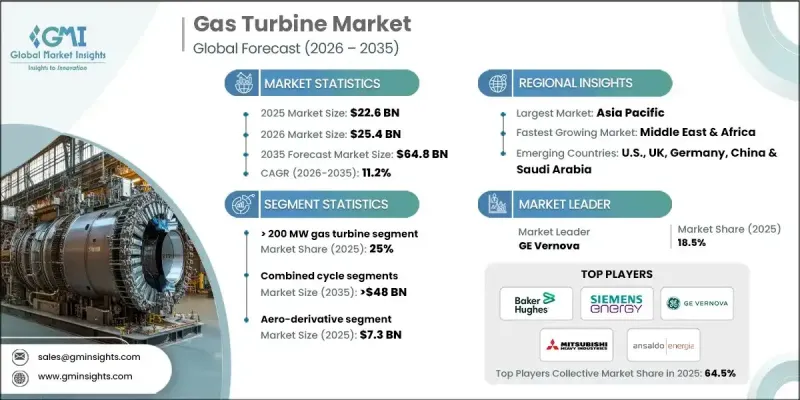

The Global Gas Turbine Market was valued at USD 22.6 billion in 2025 and is estimated to grow at a CAGR of 11.2% to reach USD 64.8 billion by 2035.

The market growth is driven by accelerated power plant modernization, rising demand for cleaner energy systems, and the global shift toward flexible, high-efficiency generation technologies. Gas turbines continue to gain prominence across both developed and emerging economies due to their capability to balance intermittent renewable energy and deliver fast-start, low-emission performance. Advancements in turbine materials, cooling technologies, and digital predictive maintenance have further strengthened the adoption of next-generation units optimized for long-duration operation and superior thermal efficiency.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $22.6 Billion |

| Forecast Value | $64.8 Billion |

| CAGR | 11.2% |

The increasing pressure on utilities to reduce carbon intensity has boosted investment in hybrid and hydrogen-ready gas turbines, enabling significant reductions in lifecycle emissions while enhancing grid stability. These innovations support utilities and industrial operators in transitioning from conventional coal-fired units. Upgrades and retrofits for existing turbine fleets also contribute substantially to market growth, as operators seek to extend equipment life, improve fuel flexibility, and enhance combined-cycle efficiency. With global electricity demand surging across manufacturing, data centers, and heavy industries, gas turbines continue to serve as a cornerstone technology for reliable baseload and peak-load power generation.

The 50 kW gas turbine market was valued at USD 1.4 billion in 2025, driven primarily by the growing demand for decentralized and localized power generation solutions. These compact turbines are increasingly utilized in industrial facilities, remote or off-grid locations, and specialized energy setups such as microgrids, where continuous reliability, high efficiency, and operational flexibility are paramount. Their ability to deliver consistent power output with minimal footprint makes them ideal for sectors requiring uninterrupted energy supply. Additionally, these turbines are favored for their low emissions, fuel versatility, and potential integration with renewable energy sources, which aligns with global trends toward cleaner and more resilient energy infrastructure.

The combined cycle segment is expected to reach USD 48 billion by 2035, driven by its superior efficiency and ability to generate more electricity using the same fuel input compared to conventional simple-cycle systems. Combined cycle power plants are increasingly preferred for large-scale utility projects due to their lower emissions profile, operational flexibility, and ability to support baseload as well as peak power requirements. Governments and utilities worldwide are prioritizing high-efficiency natural gas technologies to meet rising electricity demand while aligning with emission reduction goals, strengthening the demand for combined cycle gas turbines.

Asia Pacific Gas Turbine Market held 35% share in 2025 significantly outpacing all other regions in annual revenue. The region's dominance is attributed to rapid industrialization, extensive urban growth, and massive investments in gas-fired power generation infrastructure. Governments in China, India, Indonesia, and Southeast Asia are accelerating the shift from oil- and coal-based power generation to natural gas, driven by cleaner combustion characteristics and lower operating costs.

Major companies shaping the Global Gas Turbine Market include General Electric, Siemens Energy, Mitsubishi Power, Ansaldo Energia, Rolls-Royce, Solar Turbines, Doosan Enerbility, Harbin Electric, BHEL, and OPRA Turbines. These players focus on high-efficiency turbine development, hydrogen integration, service modernization, and OEM-utility partnerships to strengthen their market presence. Leading companies in the Gas Turbine Market are adopting several strategic initiatives to reinforce their global presence. A major focus is on developing hydrogen-capable and low-NOx turbines, enabling operators to transition toward cleaner fuels while future-proofing long-term asset investments. Firms are also expanding aftermarket service portfolios, offering digital monitoring, predictive maintenance, and full lifecycle management to secure recurring revenue streams. Collaborative R&D partnerships with utilities, governments, and material science companies accelerate innovation in high-temperature alloys and cooling technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Capacity trends

- 2.1.3 Product trends

- 2.1.4 Technology trends

- 2.1.5 Application trends

- 2.1.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of gas turbines

- 3.8 Price trend analysis (USD/MW)

- 3.8.1 By region

- 3.8.2 By capacity

- 3.9 Market dynamics & emerging trends

- 3.10 Smart technologies & industry 4.0 adoption

- 3.11 Green initiatives & ESG strategies

- 3.12 Qualitative analysis on gas transportation infrastructure

- 3.13 Electricity generation trends from natural gas

- 3.14 Industry overview on alternative energy sources in power generation

- 3.15 Detailed analysis on role of natural gas in coal-to-gas transition

- 3.16 Global gas utilization overview

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2022 - 2035 (USD Million & MW)

- 5.1 Key trends

- 5.2 ≤ 50 kW

- 5.3 > 50 kW to 500 kW

- 5.4 > 500 kW to 1 MW

- 5.5 > 1 MW to 30 MW

- 5.6 > 30 MW to 70 MW

- 5.7 > 70 MW to 200 MW

- 5.8 > 200 MW

Chapter 6 Market Size and Forecast, By Product, 2022 - 2035 (USD Million & MW)

- 6.1 Key trends

- 6.2 Aero-derivative

- 6.3 Heavy duty

Chapter 7 Market Size and Forecast, By Technology, 2022 - 2035 (USD Million & MW)

- 7.1 Key trends

- 7.2 Open cycle

- 7.3 Combined cycle

Chapter 8 Market Size and Forecast, By Application, 2022 - 2035 (USD Million & MW)

- 8.1 Key trends

- 8.2 Power plants

- 8.3 Oil & gas

- 8.4 Process plants

- 8.5 Aviation

- 8.6 Marine

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2022 - 2035 (USD Million & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Russia

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.3.7 Finland

- 9.3.8 Greece

- 9.3.9 Denmark

- 9.3.10 Romania

- 9.3.11 Poland

- 9.3.12 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 Japan

- 9.4.4 India

- 9.4.5 South Korea

- 9.4.6 Indonesia

- 9.4.7 Thailand

- 9.4.8 Malaysia

- 9.4.9 Bangladesh

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Qatar

- 9.5.4 Kuwait

- 9.5.5 Oman

- 9.5.6 Egypt

- 9.5.7 Turkey

- 9.5.8 Bahrain

- 9.5.9 Iraq

- 9.5.10 Jordan

- 9.5.11 Lebanon

- 9.5.12 South Africa

- 9.5.13 Nigeria

- 9.5.14 Algeria

- 9.5.15 Kenya

- 9.5.16 Ghana

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Peru

- 9.6.4 Chile

Chapter 10 Company Profiles

- 10.1 Ansaldo Energia

- 10.2 Baker Hughes

- 10.3 Bharat Heavy Electricals Limited

- 10.4 Capstone Green Energy

- 10.5 Destinus Energy

- 10.6 Doosan Enerbility

- 10.7 FlexEnergy Solutions

- 10.8 GE Vernova

- 10.9 Harbin Electric Corporation

- 10.10 IHI Corporation

- 10.11 Kawasaki Heavy Industries

- 10.12 MAN Energy Solutions

- 10.13 Mitsubishi Heavy Industries

- 10.14 Nanjing Steam Turbine Motor (Group)

- 10.15 Rolls-Royce

- 10.16 Shanghai Electric

- 10.17 Siemens Energy

- 10.18 Solar Turbines

- 10.19 Vericor

- 10.20 Wartsila