PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913330

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913330

Water Purifier Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

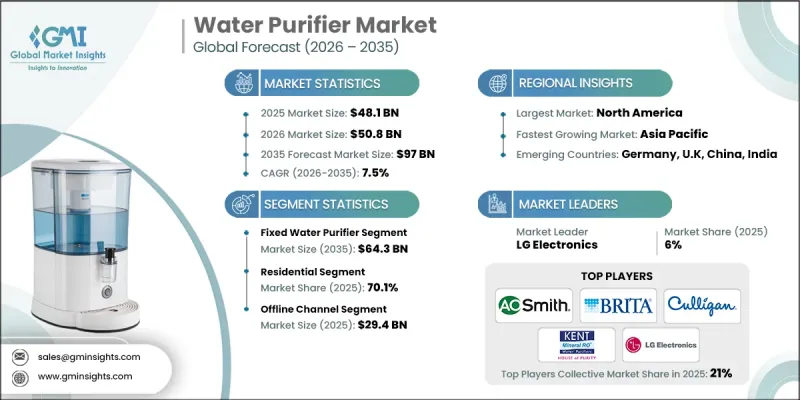

The Global Water Purifier Market was valued at USD 48.1 billion in 2025 and is estimated to grow at a CAGR of 7.5% to reach USD 97 billion by 2035.

Market growth is driven by continuous technological advancement and rapid digital transformation across household and commercial water treatment solutions. Innovation is playing a central role in reshaping product capabilities, with manufacturers increasingly focusing on intelligent, connected, and automated purification systems. Modern water purifiers are evolving into smart appliances capable of monitoring water quality parameters, tracking filter performance, and delivering consistent purification outcomes. Growing consumer awareness regarding water safety, rising urbanization, and increasing adoption of smart home technologies are supporting sustained demand. Advancements in adaptive and data-driven purification technologies are enabling personalized purification processes while ensuring the retention of essential minerals. The market is further supported by rising expectations for convenience, efficiency, and long-term reliability in water treatment devices. As concerns related to water contamination intensify and regulatory standards continue to tighten, demand for technologically advanced water purification solutions is expected to remain strong across residential and commercial applications worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $48.1 Billion |

| Forecast Value | $97 Billion |

| CAGR | 7.5% |

The fixed water purifier segment generated USD 32.4 billion in 2025 and is projected to reach USD 64.3 billion by 2035. Fixed systems continue to represent the largest portion of the market due to their widespread use across households, offices, healthcare facilities, educational institutions, and food service establishments. These systems are favored for their high filtration efficiency, consistent performance, and ability to deliver safe drinking water for daily consumption.

The offline distribution segment reached USD 29.4 billion in 2025. Physical retail continues to dominate as consumers prefer evaluating product build quality, performance features, and service support in person. Given the long-term nature of the investment, buyers often prioritize direct inspection and professional guidance before making purchasing decisions.

United States Water Purifier Market held 78.1% share in 2025. Strong market performance is attributed to heightened awareness of water quality issues, strict regulatory frameworks, and sustained government support aimed at improving water safety standards. Continued investment in residential and commercial water treatment solutions is reinforcing market growth across the country.

Key companies operating in the Global Water Purifier Market include Whirlpool Corporation, LG Electronics, Kent RO Systems Ltd., A.O. Smith Corporation, Unilever PLC, Panasonic Corporation, Pentair Plc., Culligan International Company, Brita LP, Honeywell International Inc., 3M Purification, Aquatech International LLC, Helen of Troy Limited, iSpring Water Systems LLC, and APEC Water Systems. Companies in the Global Water Purifier Market are strengthening their market position by prioritizing product innovation and expanding their technology portfolios to address evolving consumer needs. Manufacturers are investing in smart features, automation, and advanced filtration technologies to enhance performance and user experience. Strategic expansion of distribution networks, particularly through offline retail and service partnerships, is helping brands improve customer reach and trust. Many players are also focusing on after-sales service, maintenance programs, and warranty offerings to build long-term customer relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Technology

- 2.2.4 Capacity

- 2.2.5 Price

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising awareness about purified water

- 3.2.1.2 Increasing industrial activities

- 3.2.1.3 Rising concerns about contaminants and waterborne diseases

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High maintenance cost of filters

- 3.2.2.2 Lack of awareness in rural areas

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for smart & iot-enabled purifiers

- 3.2.3.2 Expansion in rural & semi-urban segments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By product type

- 3.6.2 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS Code-8421)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Consumer behaviour analysis

- 3.13.1 Purchasing patterns

- 3.13.2 Preference analysis

- 3.13.3 Regional variations in consumer behaviour

- 3.13.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Fixed

- 5.3 Portable

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 UV water purifiers

- 6.3 RO water purifiers

- 6.4 Gravity water purifiers

Chapter 7 Market Estimates & Forecast, By Capacity, 2022 - 2035 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Small (below 5l)

- 7.3 Medium (5l to 10l)

- 7.4 High (above 10l)

Chapter 8 Market Estimates & Forecast, By Price, 2022 - 2035 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Industrial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Offline

- 10.3 Online

Chapter 11 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 France

- 11.3.3 UK

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 A.O. Smith Corporation

- 12.2 APEC Water Systems

- 12.3 Aquatech International LLC

- 12.4 Brita LP

- 12.5 Culligan International Company

- 12.6 Helen of Troy Limited

- 12.7 Honeywell International Inc.

- 12.8 iSpring Water Systems LLC

- 12.9 Kent RO Systems Ltd.

- 12.10 LG Electronics

- 12.11 Panasonic Corporation

- 12.12 Pentair Plc.

- 12.13 Unilever PLC

- 12.14 Whirlpool Corporation

- 12.15. 3M Purification