PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913464

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913464

Employee Experience Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

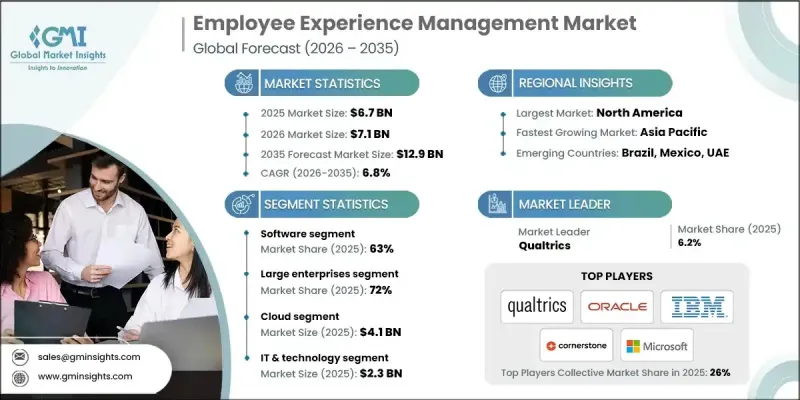

The Global Employee Experience Management Market was valued at USD 6.7 billion in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 12.9 billion by 2035.

Growth is supported by the rapid digitalization of human resource functions and the increasing complexity of managing modern work environments. Organizations are focusing more closely on employee satisfaction, retention, and performance alignment as key drivers of long-term success. Advanced employee experience management platforms are becoming integral to workforce strategies by enabling continuous engagement, structured feedback, and data-driven decision-making. Innovations such as intelligent analytics, automated feedback mechanisms, cloud-based experience platforms, and mobile-accessible tools are reshaping traditional people management models. These technologies offer visibility across the full employee journey while minimizing manual processes and improving insight accuracy. The continued expansion of remote and hybrid work arrangements, increased reliance on cloud-based HR systems, demand for actionable workforce intelligence, and stronger focus on inclusion and well-being initiatives are collectively reinforcing market growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.7 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 6.8% |

The software segment accounted for 63% share in 2025 and is expected to grow at a CAGR of 6% from 2026 to 2035. Software solutions dominate due to their ability to deliver real-time insights, measure engagement levels, and manage workforce experience across organizational structures. Scalable, analytics-driven platforms enable organizations to enhance performance and retention efficiently.

The large enterprises segment held 72% share in 2025 and is forecast to grow at a CAGR of 6.4% through 2035. Their leadership is driven by larger employee bases, higher technology investment capacity, and the need for unified experience management across multiple locations and departments.

United States Employee Experience Management Market held 78% share and generated USD 2 billion. Regional dominance is supported by strong adoption of digital HR tools, advanced analytics capabilities, and a mature enterprise technology ecosystem.

Key companies operating in the Global Employee Experience Management Market include SAP, Workday, Microsoft, Oracle, ServiceNow, Salesforce, Qualtrics, IBM, ADP, and Cornerstone OnDemand. Companies in the Employee Experience Management Market strengthen their position through continuous platform innovation and integrated digital solutions. Organizations invest in advanced analytics, automation, and intelligent feedback tools to improve engagement measurement and workforce insights. Expanding cloud-based offerings allows scalable deployment across diverse workforce models. Strategic partnerships with enterprise technology providers support seamless system integration. Firms also emphasize mobile accessibility and user-centric design to improve adoption rates.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Organization Size

- 2.2.4 Deployment Model

- 2.2.5 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Focus on Employee Engagement & Retention

- 3.2.1.2 Growth of Hybrid & Remote Work Models

- 3.2.1.3 Digital Transformation of HR Functions

- 3.2.1.4 Data-Driven Workforce Decision-Making

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data Privacy & Security Concerns

- 3.2.2.2 Integration & Change Management Challenges

- 3.2.3 Market opportunities

- 3.2.3.1 AI-Driven Personalization & Predictive Analytics

- 3.2.3.2 Growing Adoption Among SMEs & Emerging Markets

- 3.2.3.3 Cloud-Based and Mobile-First EXM Solutions

- 3.2.3.4 Integration with HR, Collaboration, and Productivity Tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. Department of Labor (DOL) & EEOC Guidelines

- 3.4.1.2 OSHA Standards

- 3.4.1.3 Canada Labour Code & Employment Standards

- 3.4.2 Europe

- 3.4.2.1 Germany BMAS Regulations

- 3.4.2.2 France CNIL & Ministry of Labour Guidelines

- 3.4.2.3 United Kingdom ACAS & GDPR Guidelines

- 3.4.2.4 Italy Ministry of Labour & Social Policies Compliance

- 3.4.3 Asia Pacific

- 3.4.3.1 China MOHRSS Guidelines

- 3.4.3.2 Japan MHLW Compliance

- 3.4.3.3 South Korea MOEL Regulations

- 3.4.3.4 India Ministry of Labour & Employment Guidelines

- 3.4.4 Latin America

- 3.4.4.1 Brazil MTE Guidelines

- 3.4.4.2 Mexico STPS Guidelines

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE Ministry of Human Resources & Emiratisation Guidelines

- 3.4.5.2 Saudi Arabia HRSD Regulations

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Employee engagement platforms

- 5.2.2 Learning & development tools

- 5.2.3 Performance management software

- 5.2.4 Employee feedback & surveys

- 5.2.5 Employee well-being solutions

- 5.2.6 Hr analytics & insights

- 5.2.7 Onboarding & offboarding solutions

- 5.2.8 Others

- 5.3 Service

- 5.3.1 Consulting & advisory services

- 5.3.2 Implementation & integration services

- 5.3.3 Training & support services

- 5.3.4 Managed services

Chapter 6 Market Estimates & Forecast, By Organization Size, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Large Enterprises

- 6.3 SMEs

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 On premises

- 7.3 Cloud

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 IT & Technology

- 8.3 BFSI

- 8.4 Healthcare

- 8.5 Manufacturing

- 8.6 Retail

- 8.7 Government & Public Sector

- 8.8 Hospitality

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 ADP

- 10.1.2 Cornerstone OnDemand

- 10.1.3 IBM

- 10.1.4 Microsoft

- 10.1.5 Oracle

- 10.1.6 Qualtrics

- 10.1.7 Salesforce

- 10.1.8 SAP

- 10.1.9 ServiceNow

- 10.1.10 Workday

- 10.2 Regional Player

- 10.2.1 Freshworks

- 10.2.2 Kenexa

- 10.2.3 Lumesse

- 10.2.4 Meta4

- 10.2.5 PeopleFluent

- 10.2.6 Ramco Systems

- 10.2.7 Saba Software

- 10.2.8 Softland

- 10.2.9 Talentsoft

- 10.2.10 ZingHR

- 10.3 Emerging Players

- 10.3.1 Culture Amp

- 10.3.2 Glint

- 10.3.3 Hyphen

- 10.3.4 Leapsome

- 10.3.5 Peakon