PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928900

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928900

Home Fragrance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

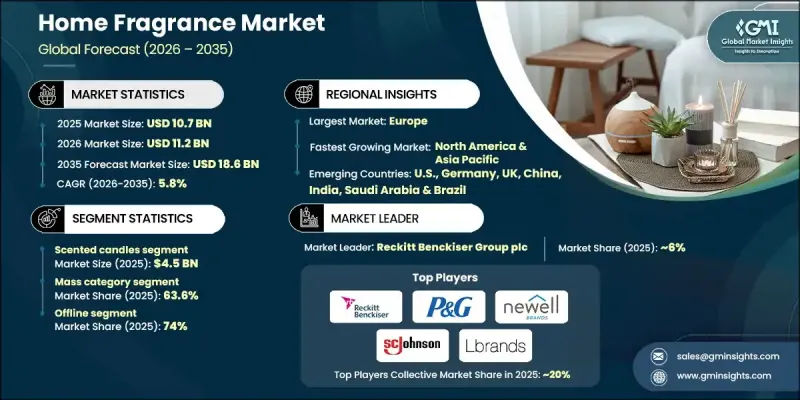

The Global Home Fragrance Market was valued at USD 10.7 billion in 2025 and is estimated to grow at a CAGR of 5.8% to reach USD 18.6 billion by 2035.

Growth is supported by shifting consumer preferences toward enhancing living spaces through sensory experiences. Home fragrance products are increasingly perceived as lifestyle and decor elements rather than purely functional items, contributing to their widespread adoption. Consumers are actively using fragrances to elevate ambiance, personalize interiors, and improve overall home comfort. Continuous product launches aligned with changing decor themes and seasonal preferences encourage repeat purchases and experimentation with different scent profiles. Urbanization and rising disposable income levels, particularly across developing economies, are further strengthening demand. As urban households expand and middle-income populations grow, spending on premium and aesthetically appealing home fragrance products continues to increase. Consumers are also prioritizing quality, design, and fragrance longevity, reinforcing the market's long-term growth potential. These factors position home fragrance products as essential components of modern home styling and everyday wellness routines.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $10.7 Billion |

| Forecast Value | $18.6 billion |

| CAGR | 5.8% |

The scented candles segment generated USD 4.5 billion in 2025 and is anticipated to grow at a CAGR of 5.7% from 2026 to 2035. Candles are widely valued for their ability to combine visual appeal with fragrance, creating relaxing and inviting environments. Demand is further supported by interest in wellness-oriented products and higher-quality formulations that emphasize clean performance and refined design.

The mass segment accounted for 63.6% share in 2025 and is projected to grow at a CAGR of 5.5% through 2035. This category appeals to cost-conscious consumers seeking everyday fragrance solutions that balance affordability with visual and functional benefits. Broad retail distribution and consistent promotional activity continue to support high-volume sales.

United States Home Fragrance Market reached USD 2.6 billion in 2025 and is expected to grow at a CAGR of 5.6% from 2026 to 2035. Strong consumer spending power and a well-established home decor culture drive consistent demand, while growing interest in wellness-focused and environmentally responsible products further supports market expansion.

Key companies operating in the Global Home Fragrance Market include S.C. Johnson & Son, Inc., Newell Brands, Reckitt Benckiser Group plc, L Brands, Henkel AG & Co. KGaA, Colgate-Palmolive Company, The Estee Lauder Companies Inc., Nest Fragrances, Blyth Inc., Lampe Berger, Candle-lite Company, Illume, Revlon, Inc., P&G Prestige, and Johnson & Johnson. Companies in the Global Home Fragrance Market strengthen their market position through continuous product innovation and portfolio diversification. Manufacturers focus on developing new scent profiles, improved formulations, and visually appealing packaging to attract a wide consumer base. Strategic branding and lifestyle-focused marketing help align products with evolving decor and wellness trends. Expanding omnichannel distribution, including strong online presence and retail partnerships, improves accessibility and market reach. Many companies emphasize sustainability through responsible sourcing, refillable formats, and cleaner ingredient profiles to meet rising consumer expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Fragrance type

- 2.2.4 Category

- 2.2.5 Price

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Home decor & ambiance trends

- 3.2.1.2 Increasing disposable income & urbanization

- 3.2.1.3 Personalization & modular scent experiences

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Environmental and sustainability concerns

- 3.2.2.2 Supply chain disruptions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter';s analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Scented candles

- 5.3 Sprays

- 5.4 Scented wax tablets

- 5.5 Essence oil

- 5.6 Incense sticks

- 5.7 Other (diffuser, scented cotton sack)

Chapter 6 Market Estimates & Forecast, By Fragrance Type, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Floral

- 6.3 Fresh / citrus

- 6.4 Woody

- 6.5 Oriental / spicy

- 6.6 Herbal

- 6.7 Other (fruity, oceanic)

Chapter 7 Market Estimates & Forecast, By Category, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Mass

- 7.3 Premium

Chapter 8 Market Estimates & Forecast, By Price, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce sites

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Mega retail stores

- 9.3.3 Others (departmental stores, individual stores)

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Blyth Inc.

- 11.2 Candle-lite Company

- 11.3 Colgate-Palmolive Company

- 11.4 Henkel AG & Co. KGaA

- 11.5 Illume

- 11.6 Johnson & Johnson

- 11.7 L Brands

- 11.8 Lampe Berger

- 11.9 Nest Fragrances

- 11.10 Newell Brands

- 11.11 P&G Prestige

- 11.12 Reckitt Benckiser Group plc

- 11.13 Revlon, Inc.

- 11.14 S.C. Johnson & Son, Inc

- 11.15 The Estee Lauder Companies Inc.